Late payments could be the sole reason your business fails. If your business is facing consistent cash flow issues, address them as soon as possible, or your growth plans may be shelved indefinitely. Chasing payment dries up your funds, and your business is stuck in the middle of nowhere.

According to an article, more than half (50%) of all B2B invoiced sales in the U.S. are currently overdue, and nearly 73% of SMBs are negatively affected by late payments.

These reports illustrate how common late payments have become, and they can cripple SMBs if not addressed on time. In this blog, we will explore the step-by-step process for chasing payment and the best solution to get rid of late payments.

Let’s dive in…

📌 Key Takeaways

- In a B2B business, chasing payment means following up with clients for overdue payments.

- Sending a polite payment reminder via email (with date mentioned) is the first step of chasing payment.

- After two emails, if the payment is still outstanding, it is recommended to have a friendly call with the client.

- After multiple calls and formal notices, taking legal action such as filing a lawsuit or contacting a debt collection agency is appropriate.

- Cash flow problems on the client side and disorganized internal processes are among the major reasons clients delay payments.

What Does “Chasing Payment” Mean for Businesses?

For a business, “chasing payment” means they are following up with clients who haven’t cleared their dues on time. It can include unpaid invoices, overdue payments, or forgotten invoices from the client side. Chasing payments is more than sending a message; it is a repetitive effort to recover money that’s already earned. For some companies, chasing invoices becomes a burden and affects the entire business.

Until the payment is settled, businesses must track outstanding invoices, send timely follow-ups, and communicate frequently with the client. If payment is continuously delayed even after sending payment reminders, further strict actions are taken.

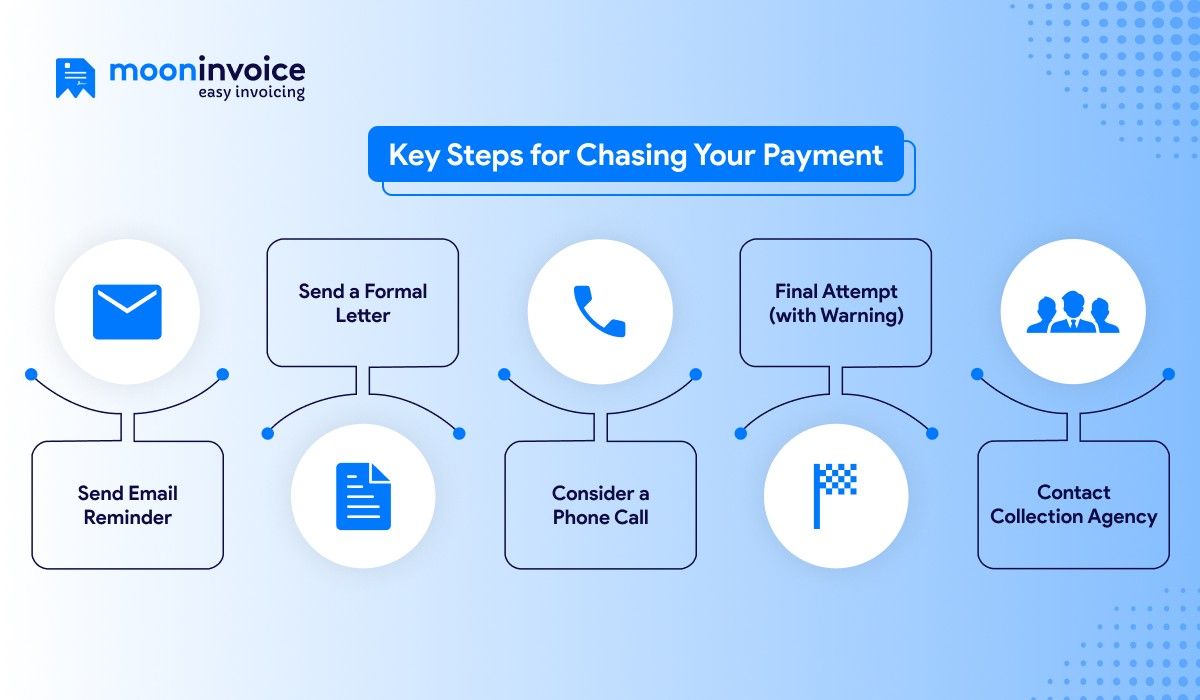

5 Steps to Chase Payments Without Hurting Client Relationships

Always confirm with your client that there are no misunderstandings about the invoice details or payment terms. If your payment remains pending despite the clarity of the invoice and terms, it’s time to follow up.

Below are the steps to recover your outstanding payments:

Step 1: Send Email Reminder

Wait for at least 2-3 days after the payment due date. If the payment is not received, you can send a polite email reminder stating that they have crossed the due date of the invoice and that payment is pending. Make sure you are sending this email to the right person. The first email will be a polite reminder.

After sending the first email reminder, wait for 7-8 days, and if you haven’t received the payment, send one more invoice overdue email. In this email, you will mention that the invoice hasn’t been paid and ask the reason for the delay. The second email will be a friendly reminder.

Stop Spending Hours Chasing Overdue Invoices!

Still following up manually on overdue invoices? Let Moon Invoice automate reminders, streamline billing, and help you get paid on time—every time.

Step 2: Send a Formal Letter

Wait for 24 to 48 hours after sending the second email, and if you haven’t been paid yet, it is time to send a formal letter to the client. Here, you will add a copy (or screenshot) of the previous invoice overdue email, along with the late fees that will be applied from now on.

Adding late fees to the invoice might encourage clients to pay as quickly as possible.

Step 3: Consider a Phone Call

Wait for 7 days after sending the formal notice, and if you haven’t been paid yet, call the client. Keep your tone professional and ask them if they have received the payment reminders, and why the payment is still due. Also, ask them when you can expect payment.

After ending the call, summarize the entire conversation and send it to the client via email.

Consider a second phone call after one week, if not paid yet, and make sure the whole conversation is reasonable. Once the call ends, again send a summary of the call via email to the client.

Stuck with Limited Payment Options?

Process payments faster with multiple payment options and make it easier for clients to pay you on time.

Step 4: Final Attempt (with Warning)

Wait for another 14 days after making the second phone call. If the client still hasn’t taken any steps to make the payment, it is time for you to make one final request for payment before sending a solicitor’s warning.

You can consider a discounted price (if paid within a certain timeframe), or list out payment options within the email to get paid. In the same email, clearly state that if the client does not complete payment within the next 7 days, you can consider legal action, e.g., commencing court proceedings or issuing a statutory demand.

Step 5: Contact Collection Agency

This scenario rarely arises in business transactions, but when it does, you should be prepared. To recover your debt, there are two ways you can do it. You can file a lawsuit or hire a collection agency.

Filing a lawsuit could turn out to be an expensive and time-consuming option, so carefully consider this option before finalizing it. On the other hand, professional debt collection agencies offer a more viable option to recover debts.

Examples of Chasing Payment Email Templates

The format for chasing payment depends on your business relationship with the client. If you know the client for a long time, delays won’t raise a concern, whereas a new client or one with strained relations is a bit concerning.

Here are a few examples of payment reminder templates you must know:

Template 1 (Invoice Due Date)

Subject: Upcoming Invoice Due Date For Invoice “#7878784”

Dear (Client Name),

We hope you are doing well. We are reaching out as a gentle reminder that Invoice #7878784 is approaching its due date on MM-DD-YYYY.

If your team has already initiated the payment process, please feel free to share any details or a transaction timeline so we can update our records accordingly. If there’s anything required from our side or if you foresee any delays, we’re more than happy to assist and help things move smoothly.

Thank you for your attention, and we appreciate your timely coordination.

Best Regards,

Signature

Template 2 (Overdue Invoice)

Subject: Overdue Invoice Reminder – Invoice “#0000000”

Dear (Client Name),

We hope you’re doing well. This email is regarding a follow-up on

Invoice #0000000, which became overdue on

MM-DD-YYYY. We wanted to check if there have been any updates regarding the payment status.

If the payment has already been processed, could you please share the transaction details so our team can update our records accordingly?

If it hasn’t, please let us know if there are any challenges or delays on your end — we are happy to assist in resolving anything that may be holding things up.

Best Regards,

Signature

Template 3 (Unpaid Invoice Negotiation)

Subject: Final Notice – Action Required on Unpaid Invoice “#ABC000”

Dear (Client Name),

We hope you’re doing well. This email is regarding a follow-up to

Invoice #ABC000, which remains unpaid despite previous reminders. As of today, the outstanding amount is significantly overdue, and we haven’t received any update regarding the payment status.

If the payment has already been made, please share the transaction details so we can update our records. However, if the invoice is still pending, we kindly request that you either process the payment immediately or provide a firm timeline for settlement.

Please note that if we do not receive payment or a clear response by the Final Deadline Date (MM-DD-YYYY), we may need to proceed with further actions, which could include initiating legal steps or involving a collection agency. We prefer to avoid this and hope we can resolve the issue directly and professionally.

Here is the re-attached invoice for your reference.

Thank you for your prompt attention.

Best regards,

Your Signature

Why Clients Delay Payments?

There are numerous reasons for a client to delay payments. They could be facing administrative hassles or not communicating properly about deliverables. Though there are some clients who deliberately delay by putting common late payment excuses, it is not true all the time. As a business owner, you must understand the root cause before jumping to a conclusion.

Here are some of the major reasons behind payment delays:

1. Cash Flow Problems

This is a major concern for a client. When the invoice arrives, they may not have enough funds to pay. They could be juggling multiple expenses at once. This issue doesn’t justify the delay but shows poor financial workflow.

2. Disorganized Internal Processes

In many businesses, especially businesses that are well-established, they manage invoices in multiple layers. The payment approval process might involve procurement, accounts, and management. A small interruption or mistake can delay your invoice for weeks or even months.

3. Miscommunication About Deliverables

Confusion is the major reason behind this type of delay. When clients see that the work they are receiving is not meeting expectations, they silently pause payment. Some clients just don’t communicate their dissatisfaction properly and hold off payment until things are clear.

4. Administrative Delays

There is a chance that your invoice is stuck under dozens of other invoices. The accountant might be processing payments on one specific day of the week. Sometimes it is not an excuse; it is just so messy that it goes unnoticed. This delay can also occur if the business relies on manual processes rather than invoicing software in its workflow.

5. Intentional Delay Tactics

Not all clients, but some intentionally delay payments to address cash flow issues. These are the type of clients who wait for repeated reminders or wait until late fees are imposed.

How Moon Invoice Helps You Get Paid Faster?

Checking records, switching tabs, emailing the client for the follow-up, all of this could take lots of time when you chase payments from your clients. To save time and get paid faster, you should consider using software such as Moon Invoice. The software comes with an AI-powered quick scan feature, also known as a receipt scanner, which is rare and very useful for growing businesses.

Another feature is its smart notification. The moment your client opens the email or clicks the “Pay Now” button, you will be notified. It gives you complete visibility into your client’s actions and helps you follow up more effectively.

Key features of Moon Invoice:

- Customizable Invoice Templates: Over 66+ customizable templates to create a professional invoice.

- Proforma Invoice: Allows you to create professional-looking proforma invoices.

- Purchase Order: Create and manage purchase orders in one platform.

- Expense Tracking: Smartly manage business expenses by attaching documents or receipts to expense entries.

- Time Tracking: Log billable hours with the help of the built-in time tracker and convert timesheets directly into invoices.

- Financial Reports: Create error-free financial reports and export them in PDF or HTML.

- Recurring Billing: Manage your repeat clients easily by setting up recurring billing.

In Short!

Chasing payment is never a good sign for a business. As a business owner, you should think of getting paid faster rather than chasing payments. The 7 steps mentioned above are the standard procedure to address or chase late payments. However, one thing you must keep in mind is having an automated system to follow up regularly. Manual methods just delay everything, even if you follow every step.

So, the question here is: are there any software solutions that support automated payment reminders and invoice tracking? The answer is yes, it is available.

With Moon Invoice, you can set up automated payment reminders and track whether the client has viewed the invoice or not. Start your free trial today!