EFT Definition

EFT (Electronic Fund Transfer) refers to a strategy of transferring funds through an electronic mode through one bank account to another account.

It’s a digital era, and most work is dependent on digital concepts, especially when it comes to payment. Using cash and checks to make payments is a thing of the past. Electronic payments are now part of daily life, and almost every business owner is adopting them.

According to Statista, the total transaction value in the Digital Payment market is expected to be US$3,073 billion in 2024.

Regardless of the amount and payment scope, electronic payments are capable of transferring the amount. However, it’s still a general question – what is EFT?

This blog is about the EFT (Electronic Funds Transfer) story, and the journey will cover the foremost guide to the electronic fund transfer concept. So, unlock everything from scratch and take a deep dive into crucial points of EFT meaning, its types, and its working.

What Is an EFT?

EFT stands for Electronic Fund Transfer, which transfers the amount from one bank to another bank account or within the two accounts of the same bank. Apart from banks, it also transfers amounts between financial institutions and individuals. EFT is also known as electronic bank transfer, electronic payments, and e-checks. So, the actual EFT means transferring the amount through a digital mode.

Where Is EFT Utilized?

Electronic funds Transfers have a broad scope of utilization. People can use EFT regardless of the purpose of payment transactions and the amount. One can use EFT for multiple purposes, such as.

-

- Direct deposit payment

- Payment of bills

- Refund of tax and payments

- Donation and charity funds

- Fund transfer between two people

- Direct deposit payments

- Investment account contribution

Looking for the Right Solution to Enhance On-Time Payment?

Switch to Moon Invoice for the best invoicing solution. Craft unlimited and accurate professional invoices in 60 seconds.

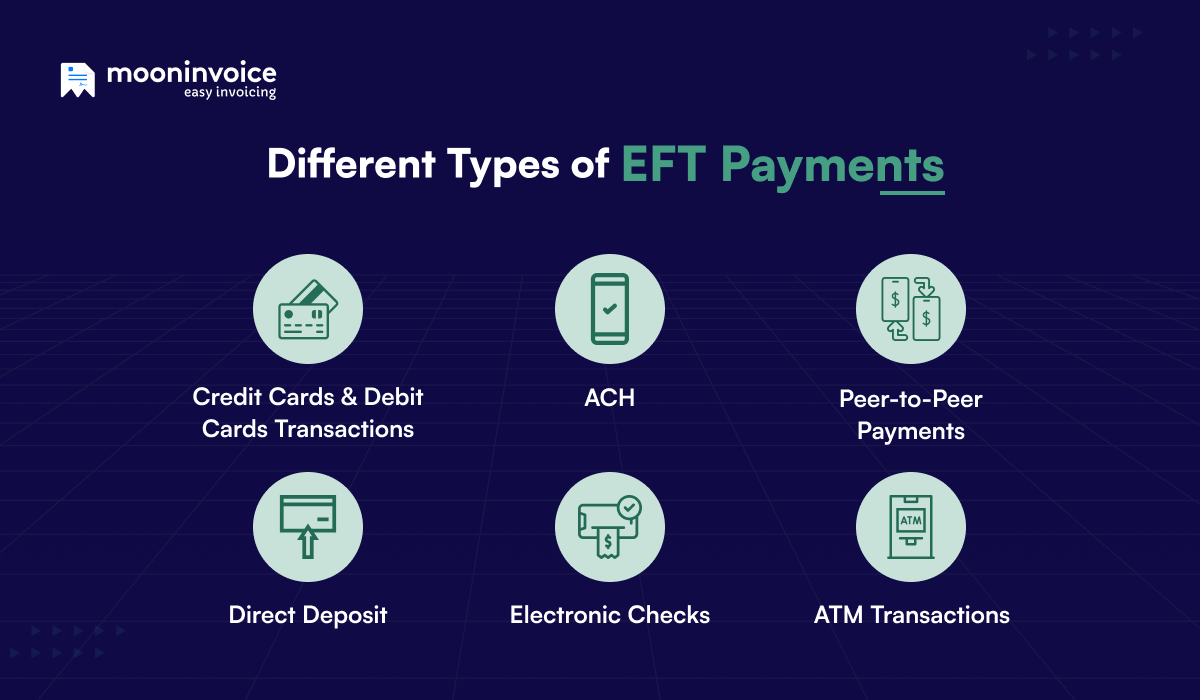

Types of EFT Payments

There are multiple EFT payment types. Each type has a different purpose, but fast and accurate payment transactions are common attributes. Let’s dive into each EFT payment type one by one –

1. ATM Transactions

ATM transactions are common throughout the world. This is most commonly used when a person needs cash. The ATM is useful for dispensing cash by using a debit card. Once the user inserts a debit card, the information is transmitted to the bank and processed further to dispense the money.

2. Internet Transactions

Internet transactions involve card insertion or tapping on a POS machine. The system captures the card details automatically and proceeds with the payment. This enables fast processing, and a security concept is also applicable in this context.

3. Phone Payments

This type of transaction is conducted using a mobile device. It is very common for utility payments. There are multiple applications available for making payments via phone. It involves QR code scanning and entering a phone number to complete the payment.

4. Direct Deposit

The funds are deposited automatically into the receiver’s account. This is a popular method in the corporate and industrial areas where employers transfer salaries into employees’ accounts.

5. Credit Card & Debit Card

Credit and debit card payments are also forms of Electronic funds transfers. The card swiping and tapping make the payment transaction fast and accurate. Credit cards and debit cards are useful for making electronic bill payments.

6. Wire Transfer

Wire transfers are useful for transactions involving large amounts of money. The money transaction can be between a person and a business. The receiver receives the money directly into the bank account.

EFT Payment Example

Let us understand EFT’s meaning with examples. We can provide three examples of electronic fund transfers.

Recurring Bill Payments Directly from the Bank Account

Suppose your monthly subscription is billed through a recurring method by ACH transactions. In this case, your bank will deduct the amount and make the payment from your checking account. Similarly, consumers pay their utility bills through recurring payments and electronic payments.

Wire Transfers

These are another example of EFT (Electronic Funds Transfer) that uses SWIFT or Fedwire to transfer funds. There are some charges applicable to international and domestic wire transfers. Some banks charge fees for domestic wire transfers. On the other hand, an international wire transfer involves multiple charges applicable to the sender’s bank, the receiver’s bank, and the intermediary bank.

Direct Amount Crediting

Companies and other employers directly deposit salaries into employees’ accounts. This is also an example of an EFT that uses ACH, where direct payment is done.

How Does EFT Banking Work?

After learning about EFT (Electronic Funds Transfer), let’s explore how electronic funds transfers work. In EFT, two parties (sender and receiver) are essential to initiating the process. On initiating the transaction from the sender’s end, funds are transferred to the receiver’s account. The bank’s approval and authorization process is also applicable. This is the basic EFT banking definition, and it’s working.

The sender can be anyone, an individual, a business party, or an employer. Likewise, a receiver can be an employee who receives a salary or vendors who receive payments for selling goods or services.

In the USA, an Automated Clearing House is a transfer system that unites entire banks, financial institutions, and credit unions. Banks handle EFT payments by utilizing the Automated Clearing House (ACH) network.

The following information is necessary to fill in when initiating EFT banking –

-

- Account type

- Recipient’s bank name

- Recipient’s account number

- Recipient’s routing number

What Is the Difference Between EFT and Wire Transfers?

The relationship between wire transfers and EFT is similar to that between ACH transfers and electronic fund transfers. However, the difference lies in their administration. The Federal Reserve controls wire transfers, and transactions occur on the Fedwire (Federal Reserve Wire Network). The National Automated Clearing House Association controls the ACH network.

What Is the Difference Between EFT and ACH Transfer?

ACH stands for Automated Clearing House (ACH). It is a type of transfer process that utilizes the ACH network and occurs between two financial institutions. It is a type of EFT, but the entire EFT is not considered an ACH transfer. To understand the difference between ACH and EFT, it’s important to note that ACH is a specific type of electronic transfer within the broader EFT system.

This clearly states that the ACH-oriented transfer will be referred to as an ACH transfer, whereas the general electronic bank transfer will be referred to as a bank transfer or EFT.

Benefits of EFT for Businesses

Electronic Fund Transfer (EFT) is now an integral part of daily business life. Professionals utilize EFT for accurate and efficient transactions, streamlining the process. There are various merits associated with EFT.

1. Security

EFT has refined its security structure and now features numerous new advancements to prevent fraudulent actions. For instance, in the past, there was little to no encryption, and card numbers were transmitted directly to the card reader via magnetic stripes. However, EMV chips and NFC payments now always send encrypted codes. This keeps the fraud attempts at bay.

2. Affordability

There are different fees for different EFTs that depend on the network. The EFT fees are low. Another reason electronic fund transfers are cost-effective is the elimination of paper checks. Ultimately, there is no chance of checks being returned or lost. It reduces the cost associated with the traditional payment method.

3. Speed

EFT commits to offering fast fund transfers for sending and receiving purposes. Transactions related to debit cards, credit cards, and mobile payments offer instant transactions. The net banking transaction, however, takes 1 day to transfer the funds.

4. Accuracy

Electronic Fund Transfer always commits accuracy with minimal chances of errors. It operates on a digital concept with minimal manual processing. Thus, it is less prone to mistakes. EFT also helps maintain accurate records.

Are There Any Challenges Involved In EFT?

EFT is not a 100% free concept. Some challenges in Electronic Fund Transfer are listed below –

-

- Electronic fund transfer offers a secure transaction, but it cannot prevent hacking attacks.

- EFT generally offers high accuracy, but that doesn’t mean it can correct the mistakes. Wrong information entered can lead to heavy loss.

- Most banks have a transaction limit, which blocks transactions exceeding that limit.

Simply Manage your Invoicing and Expenses with One Platform

Speed up your payment by sending professional invoices to clients and increasing your business cash flow.

Wrap Up

We are now conveying our final thoughts on EFT. Electronic Fund Transfer offers a fast and convenient way to transfer funds. Along with it, secured payment is also a crucial part.

However, users must be aware when performing a digital transfer. They should recheck the details before hitting the pay button. A small mistake on the user’s side can give rise to a significant issue. Users must protect passwords and use trusted applications to prevent fraud and theft.