Times Interest Earned Ratio Definition

The times interest earned ratio is a financial metric that shows a company’s ability to meet its debt obligations relative to its outstanding debt.

Measuring the company’s financial health is crucial, and one way to do so is to calculate the times interest earned ratio.

A useful financial metric that many investors use to predict the company’s economic strength and make better investment decisions. A major focus of the TIE ratio is on debt sustainability and the company’s ability to pay interest. Thus, it is one of the most important terms in the business world.

This guide will open up the right answer to what times interest earned is. Additionally, you’ll learn how to calculate it and what limitations it poses.

📌 Key Takeaways

- The times interest earned ratio is also known as the interest coverage ratio (ICR).

- Like the current ratio, the TIE ratio measures a company’s ability to meet its obligations.

- A higher times-interest-earned ratio indicates stronger financial health and lower credit risk.

- A lower TIE ratio indicates higher financial risk.

- The times interest earned formula is EBIT divided by Interest Expense.

- Quarterly, monthly, or annual financial data are useful in calculating the TIE.

💡A Little-Known Fact:

The debt-to-net-worth (market value) ratio among non-financial corporate sectors in the United States was 40.92% according to the Trending Economics report.

What is the Times Interest Earned Ratio?

The times interest earned ratio, also known as the interest coverage ratio, is a metric that indicates a company’s ability to pay its interest obligations. It is part of the solvency ratios. It is determined by dividing the earnings before interest and taxes (EBIT) by the company’s total interest expense.

The TIE ratio helps investors evaluate a company’s creditworthiness. When they find a good ratio, it clearly indicates that the company is wisely managing its debt and has stable profitability. Thus, it helps the company to attract investors by gaining their trust and confidence.

Get the Total Expense Management Solution

From tracking to report generation, handle everything at your fingertips. Save time & cut costs!

What is the Times Interest Earned Formula?

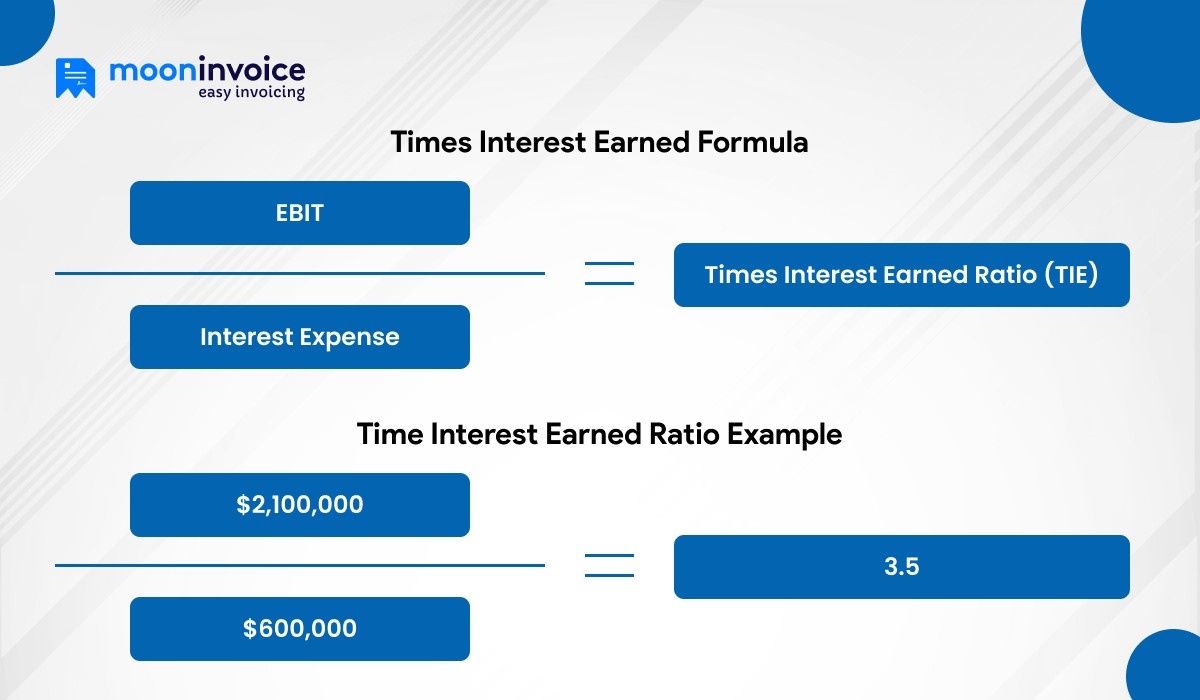

A typical TIE ratio formula includes Earnings Before Interest and Tax (EBIT) as the numerator and interest expense as the denominator. So, justifying the statement, we get the following formula:

TIE = EBIT / Interest Expense

Here,

EBIT = Total Revenue – Cost of Goods Sold (COGS) – Operating Expenses

or

EBIT = Net Income + Interest + Taxes

Interest expense – Total annual interest expense on the debt obligation.

The above formula is straightforward, and professionals can easily use it to determine the TIE.

How to Calculate Times Interest Earned Ratio?

Calculating the time-interest-earned ratio is quite straightforward. Professionals can easily compute it using the above times-interest-earned ratio formula.

However, before utilizing the above formula, you must get your EBIT and interest expense values ready. These are the key metrics used to determine the times interest-earned ratio.

The best approach to finding EBIT and interest expense is to use a multi-step income statement or a general ledger. These represent the clear and structured form of each profit stage. Once you locate the values, enter them directly into the TIER formula.

Times Interest Earned = EBIT / Interest Expense

Time Interest Earned Ratio Example

To better understand how to calculate times interest earned, we present a real-life example. Suppose a manufacturing company, Elite Bearings, possesses the following financial data:

Net income: $800,000

Interest expense: $600,000

Income tax expense: $700,000

EBIT = Net income + interest expense + income tax expense

$800,000 + $600,000 + $700,000 = $2,100,000

Calculating the times interest earned ratio as –

Times Interest Earned = EBIT / Interest Expense

TIER = $2,100,000 / $600,000 = 3.5

Thus, the company has a healthy financial condition, and its operating earnings are 3.5 times its annual interest expense.

What is a Good Times Interest Earned Ratio? (Interpreting Values)

Well, a good times-interest-earned ratio depends on the business’s size and industry. The different ratios, along with their interpretation, are as follows:

- Below 1.5 (High Risk) – The weakest times interest earned ratio, indicating the company struggles to pay interest.

- 1.5 to 2.5 (Moderate Risk) – A moderate ratio suggesting the company can pay interest but may face income fluctuations.

- 2.5 to 5.0 (Acceptable Ratio) – A good range showing stable ability to meet interest obligations.

- Above 5.0 (High Ratio) – An excellent ratio indicating strong debt-servicing capacity and minimal financial risk.

💡Read Next:

Times Interest Earned Ratio Limitations

There are several limitations to the times-interest-earned ratio. The major restrictions are as follows:

Lacking Cash Flow

EBIT does not reflect or cover the actual cash that the company holds. A high TIER ratio does not necessarily indicate that the company has sufficient cash. Thus, professionals lack a clear understanding of the company’s cash flow.

Industry-dependent

A TIE ratio is highly industry-specific. It means it varies from industry to industry. For instance, manufacturing units have more debt and a lower TIE ratio. On the other hand, service-based or tech industries tend to have a higher TIE ratio because they borrow less.

Seasonal-oriented

The times interest earned ratio can be distorted for seasonal and cyclical businesses, which are sensitive to economic fluctuations. Thus, the TIE ratio fluctuates according to the business season.

Excluding the Principal Repayments

The TIE ratio doesn’t include the principal amount of debt and mainly focuses on the ability to pay interest. Thus, this ratio should be used alongside other ratios, such as the Debt Service Coverage Ratio (DSCR).

What Are the Ways to Improve the Times Interest Earned Ratio?

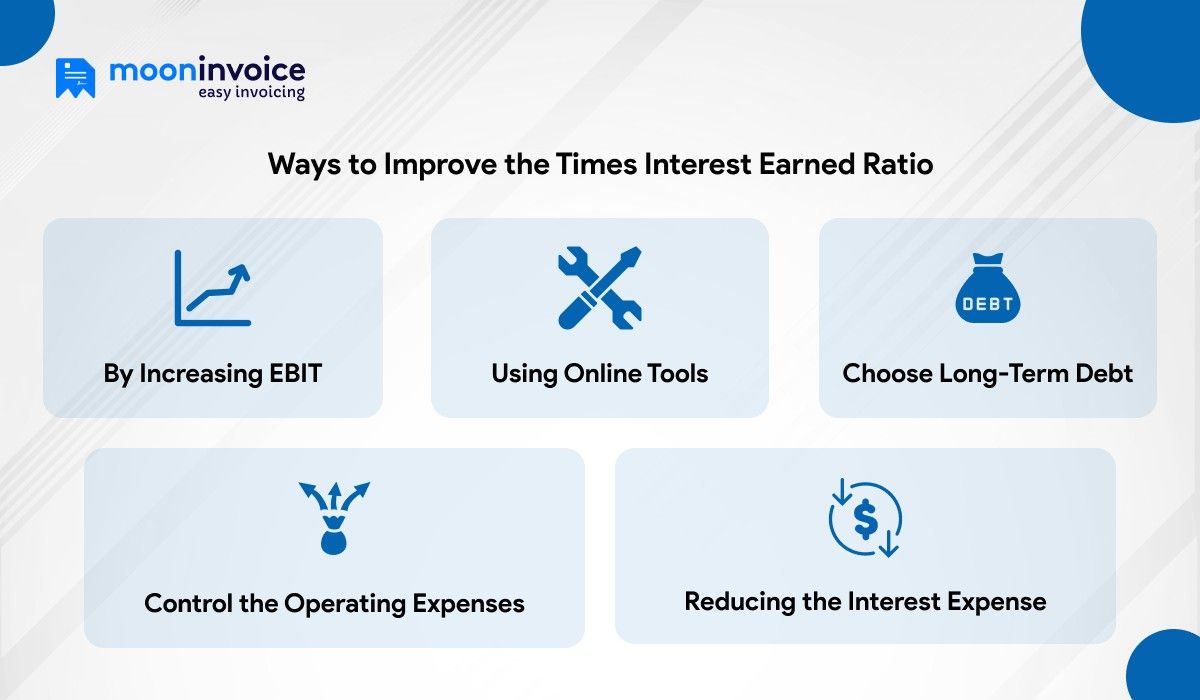

A general question can be in your mind: Can I improve the TIE ratio? The answer is Yes! Business leaders can easily refine the TIE ratio in the following ways:

1. By Increasing EBIT

A higher EBIT leads to higher income statements and TIER figures. Business professionals can easily increase EBIT by boosting sales. The key strategies are the launch of new products and services, market demand-focused initiatives, and price restructuring.

2. Using Online Tools

It is another way to enhance the TIE ratio. Professionals can achieve better financial control, accurate reporting, and cost efficiency with real-time expense-tracking software. Also, it streamlines the process, saving time and reducing costs, which are often associated with manual processes.

3. Reducing the Interest Expense

One way to improve the TIE ratio is to reduce interest expense. The best approach is to look for lenders providing lower interest rates. Additionally, paying the debt on time also reduces the total interest burden.

4. Control the Operating Expenses

Companies can improve their times interest earned ratio by controlling operating expenses. It is because, with low operating expenses, the company’s overall profitability increases. The key approach is to use strategies to reduce marketing, logistics, and administrative costs.

5. Choose Long-Term Debt

Long-term debt always has a longer repayment schedule and lower interest rates. Thus, the company takes advantage of the relaxation while reducing financial pressure. It allows a company to manage its cash flow efficiently.

💡Check Out:

Other Related Coverage Ratios

Let’s have a look at other commonly used coverage ratios by the financial experts and investors.

EBITDA Coverage Ratio

The EBITDA coverage ratio indicates the company’s ability to pay interest based on cash flow from operations.

EBITDA Coverage Ratio = EBITDA ÷ Interest Expense

Debt Service Coverage Ratio (DSCR)

Like interest earned, DSCR is also useful in determining the company’s debt-paying ability. Instead of earnings, the core focus of DSCR is on the cash flow:

DSCR = Operating Cash Flow ÷ Total Debt Service

Here,

Total Debt Service – Including both interest and principal payments

Fixed Charge Coverage Ratio

A fixed-charge coverage ratio is useful for measuring the company’s ability to cover all fixed obligations. It covers preferred dividends, lease payments, and scheduled principal repayments. The primary purpose of the fixed charge coverage ratio is to provide a more comprehensive assessment of the company’s capacity to meet all its fixed financial obligations fully.

Fixed Charge Coverage Ratio = (EBIT + Fixed Charges) ÷ (Interest Expense + Fixed Charges)

Automate Your Financial Reports for Better Decisions

Moon Invoice helps to generate accurate & customized reports on sales, expenditure, and inventory. Quick review, faster processing!

Last Remarks

The times interest earned ratio is an essential term in financial management. Therefore, the company’s leaders and financial experts must understand its core concept to support analysis and better decision-making regarding debt. However, one should know the correct way to calculate it.

Additionally, using reputable softwares like Moon Invoice, one can streamline the process. Its accurate financial data, expense categorization, and real-time reports enhance your business’s financial management.

You can avail free trial here!