Credit cards play a massive role in our daily lives, whether for business or personal expenses. It allows us to pay fast and securely without any difficulty. Every transaction we make leaves a trail that requires careful tracking, which makes reconciling credit card statements non-negotiable.

For businesses, credit card reconciliation is more than just routine bookkeeping. It is the process that ensures transactions listed on the credit card statements match your company’s internal financial records. A business deals with numerous transactions every month, and a systematic credit card reconciliation process helps keep accurate financial data of your business.

In this blog, we will explore everything about credit card reconciliation, from what it is to its types, how to reconcile, the challenges it presents, and its importance.

Let’s get started..

📌 Key Takeaways

- Credit card reconciliation means cross-verifying your credit card statement with your company’s internal financial statements.

- Credit card reconciliation plays a massive role in ensuring that all of your financial data is accurate and that no discrepancies are overlooked.

- In the event of any discrepancies found during the reconciliation process, the finance team investigates the matter until it is resolved.

- Incomplete records management and unauthorized payment approvals are among the primary reasons for these discrepancies.

- The credit card reconciliation process can be more efficient when performed using software instead of manual data entry.

What is Credit Card Reconciliation?

Credit card reconciliation is the process of comparing your company’s internal financial records, such as expense reports, receipts, accounting entries, etc, with the transactions listed on your credit card statement.

Here, the primary goal is to get clarity that every price, payment, and refund on the credit card matches your business records without discrepancies.

Think of it as a financial “cross-check.” Businesses reconcile their bank accounts to ensure accuracy; similarly, credit card reconciliation means validating that all credit card activities are recorded correctly.

Credit card reconciliation is necessary for every business as it minimizes the chances of forgery, duplicate payments, or incorrect pricing and simplifies tax reporting.

Credit card reconciliation is carried out at the end of each month, quarter, or financial year. It ensures records stay accurate and aligned with financial reporting.

Struggling With Error-Prone Bank Reconciliation?

Manual matching wastes hours and increases the risk of mistakes. Moon Invoice automates reconciliation and helps you maintain accurate financial records.

Types of Credit Card Reconciliation

There are two types of credit card reconciliation:

- Credit Card Statement Reconciliation

- Credit Card Merchant Services Reconciliation

Let’s explore these two in detail.

1. Credit Card Statement Reconciliation

It is the reconciliation process businesses perform to match their outstanding balances on corporate or personal credit cards with the credit card company’s monthly statement. It primarily concerns outgoing expenses, which include employee charges, subscriptions, corporate purchases, refunds, and fees that create liabilities the company must pay.

Here, the primary records to check are: card statements and expense reports (outgoing).

2. Credit Card Merchant Services Reconciliation

Merchants and e-commerce businesses use this reconciliation to ensure that credit card sales processed via payment gateways or merchant accounts (including incoming cash) reconcile with the deposits actually received in the bank. It is more like a revenue settlement reconciliation, i.e., comparing gross sales with processor fees, refunds, and net deposits.

Here, the primary records to check are: payment processor/gateway reports, POS sales, and bank deposits (merchant).

💡Also Read:

Why Credit Card Reconciliation Needs Your Attention?

The general ledger of your company needs to be accurate and error-free to determine the financial health of your business. The reconciliation process solidifies the accuracy of these ledgers by cross-checking their entries with credit card statements, bank statements, receipts, etc.

Below are the primary reasons why the reconciliation of credit cards matters:

- Fraud Detection: Easy to spot unauthorized or suspicious charges on company credit cards before getting trapped in financial losses.

- Improved Cash Flow Management: Outgoing expenses are tracked, which provides better control over the cash flow of the business.

- No Duplicate or Missed Entries: Prevents double-charging or missed entries that could distort budgets.

- Easier Audits and Tax Preparation: A well-reconciled credit card record helps you reduce stress during audits and simplifies tax filings.

- Accuracy in Financial Reporting: After a thorough reconciliation, your financial statements reflect true and verified expenses, which prevents compliance issues.

- Enhanced Vendor Trust: Demonstrates financial discipline, which helps in making timely settlements and smoother operations.

Did You Know?

In 2024, there were about 739 reported cases of credit card and other financial fraud.

How To Do Credit Card Reconciliation?

Credit card reconciliation is a process designed to reduce discrepancies in your financial records. In this process, every transaction on the credit card statement is matched with the business’s internal accounting records.

Here’s how the reconciliation process can be done:

1. Collect Your Documents

You need to collect the monthly credit card statement from your provider with all the internal documentation, such as receipts, invoices, purchase orders, expense reports, etc.

2. Compare Transactions

Every transaction listed on the statement is reviewed and matched against internal records. In this step, key details, such as merchant name, amount, and transaction date, are carefully checked.

3. Verify Every Payment

Every payment you have made needs to be accurately recorded and deducted in both the credit card statement and internal records. You should also check your bank statement to confirm that the payment was sent.

4. Identify Discrepancies

While checking, if you find any discrepancies, note them to investigate further. It can be an incorrect amount, a duplicate entry, an unrecorded purchase, or a missing receipt.

5. Investigate Variances

After noting down discrepancies, in this step, you need to dig deeper. You need to discuss with employees, review purchase approvals, contact the merchant, or reach out to the credit card company to clarify errors or incorrect charges.

6. Record Changes in Accounting Books

Once issues are resolved, you need to adjust all changes in the accounting system. This can be anything from correcting expense categories to adding missing entries or even recording merchant fees and refunds properly.

7. Finalize Reconciliation Report

The reconciliation process will be completed once each transaction is matched and verified. In businesses, this step includes preparing a reconciliation report and getting approval from managers to ensure accuracy.

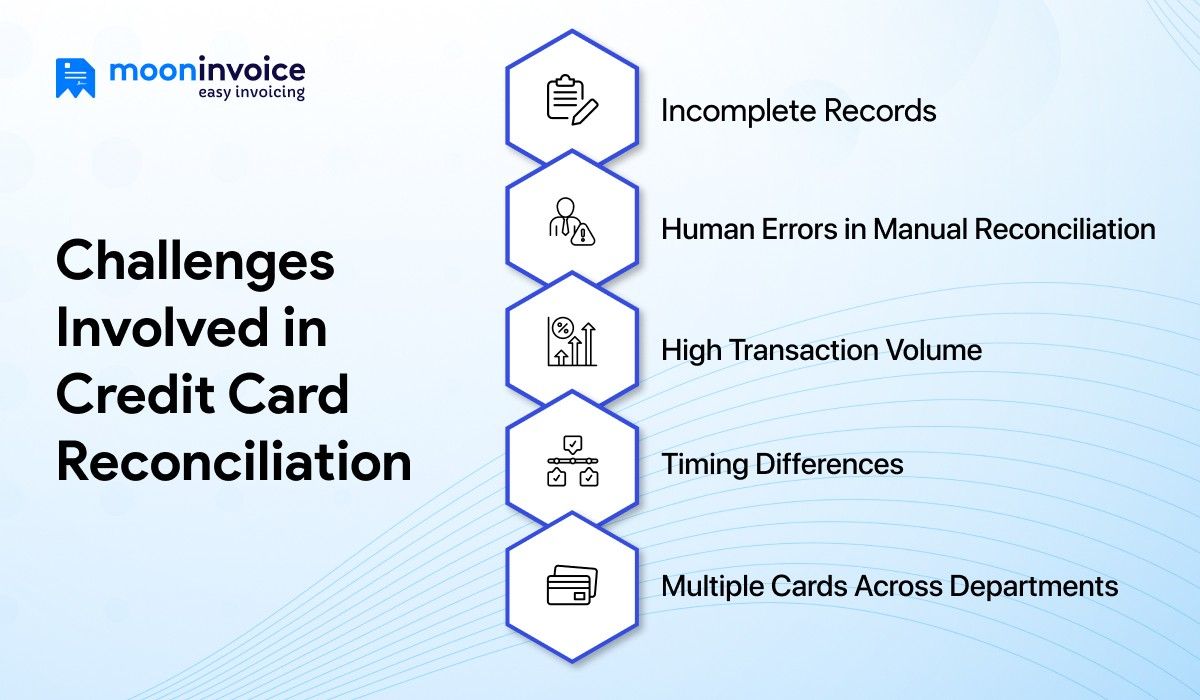

Challenges Involved in Credit Card Reconciliation

Accurate financial reporting can only be achieved when each detail is thoroughly checked. And that’s where it becomes more challenging. Let’s explore common challenges you may face while reconciling credit cards.

1. Incomplete Records

Lack of supporting documentation is the most common issue in reconciliation. Lost receipts, poor expense management, and missing entries for certain prices in the accounting system make it difficult to cross-check credit card transactions.

2. Human Errors in Manual Reconciliation

Mistakes in manual reconciliation are very common. Mistakes, such as incorrect data entry, skipped transactions, or overlooked documents, can prove costly and lead to compliance risks.

3. High Transaction Volume

When dealing with high-volume transactions, it becomes challenging to reconcile them within a short timeframe. These transactions require careful attention, as a single mistake could alter the entire transaction amount and create confusion in the financial cycle.

4. Timing Differences

Generally, credit card providers also count pending transactions and show them on the statement that don’t appear in internal records. Likewise, refunds and chargebacks could also be recorded in the books, which have yet to be reflected on the statement. These timing gaps require careful review to prevent confusion.

5. Multiple Cards Across Departments

For larger businesses, the corporate credit card reconciliation process can be complicated if multiple cards are used for different departments, rather than using a single card. Different users will likely have different sending patterns and approval workflows, which makes the verification more difficult.

6. Detecting Fraudulent or Unauthorized Charges

A business that handles high transaction volumes may incur fraudulent charges, which can be difficult to distinguish from legitimate business expenses. If the reconciliation process is not done appropriately, these charges can go unnoticed.

The credit card reconciliation process can be more efficient and reliable if the aforementioned challenges are addressed.

How Moon Invoice Speeds Up The Reconciliation Process?

Credit card reconciliation can be a quick and simple process if you use Moon Invoice in your workplace. Reconciliation, when done using Moon Invoice, helps you identify many discrepancies in your records.

Moon Invoice can be a reliable solution for your business, as it can compare all your financial data, including invoices, purchase orders, expenses, sales receipts, credit notes, and debit notes.

Instead of switching tabs or different applications, Moon Invoice allows you to cross-check everything in one place.

Here is how it can speed up your reconciliation process:

- Bank Reconciliation: Easily compare all your internal financial records with the bank statements to identify discrepancies, errors, or incorrect charges.

- Centralized Financial Records: All of the invoices, receipts, and payment reports are stored in one place, no need to juggle between multiple files.

- Customer Management: Saves customer history so you don’t have to fill in every detail again while creating an invoice.

- Customizable Reports: Generates detailed reports that make it easier to validate expenses, simplify audits, and maintain accurate financial records.

- Time-Tracking: Log billable hours with the help of the built-in time tracker and convert timesheets directly into invoices.

Conclusion

Credit card reconciliation keeps your business finances accurate and transparent. You can identify discrepancies before they impact your business. However, reconciliation can be a time-consuming process for your accounting team, especially when reconciling credit card statements involves hundreds of transactions and is done manually.

So, are you still unsure about how to do credit card reconciliation?

Don’t be! To have all-around access, apart from just credit card reconciliation, consider using an invoicing solution like Moon Invoice. It helps you reconcile credit cards as well as offers bank reconciliation and smarter invoice management.

Explore more about Moon Invoice and get started today!