Invoice Letter Definition

An invoice letter is a formal written document sent along with an invoice. It clarifies the purpose of the invoice, the payable amount, the due date, and any associated payment terms to encourage timely payment.

No business hasn’t dealt with late payment woes. No matter how many billing terms you include, some delinquent clients will never take it seriously, delaying the payment for days or even weeks.

Such late payment struggles are common for small businesses. If not addressed properly, they might turn into bad debts, something you probably don’t want as a business owner. In such cases, the invoice letter acts as a rescuer. It not only helps prevent bad debts but also improves cash flow by recovering outstanding payments.

Hence, it’s no surprise that you have found your way to this blog. In this ultimate guide, we will walk you through the meaning of an invoice cover letter, provide examples, and show you how to write an invoice letter for payouts correctly.

Ready? Let’s begin.

📌 Key Takeaways

- An invoice letter is a polite payment reminder sent by businesses to clients for overdue payments.

- A perfect invoice cover letter contains a short explanation of why you’re writing, the invoice number, payment terms, and a friendly closing note.

- Using an invoice letter template, professionals can easily create an invoice notice.

- Professionals can send invoice letters when the payment is due or has passed.

- A polite, well-written invoice letter sample builds trust between the business and the client.

💡Surprising Fact:

About 86% of businesses experience overdue accounts for up to 30% of monthly invoice sales.

What Is an Invoice Letter?

An invoice letter refers to a formal letter that accompanies an invoice. Business professionals send this letter to remind you of unpaid invoices. It explains what an invoice is and includes key details such as the due amount, due date, terms & conditions, and other required information.

In other words, an invoice notice is a polite message businesses send to their customers to encourage on-time payment. It helps companies collect payments promptly.

Make Accurate Invoices & Get Rid of Payment Delays

Use Moon Invoice to generate professional invoices that encourage clients to pay their dues instantly.

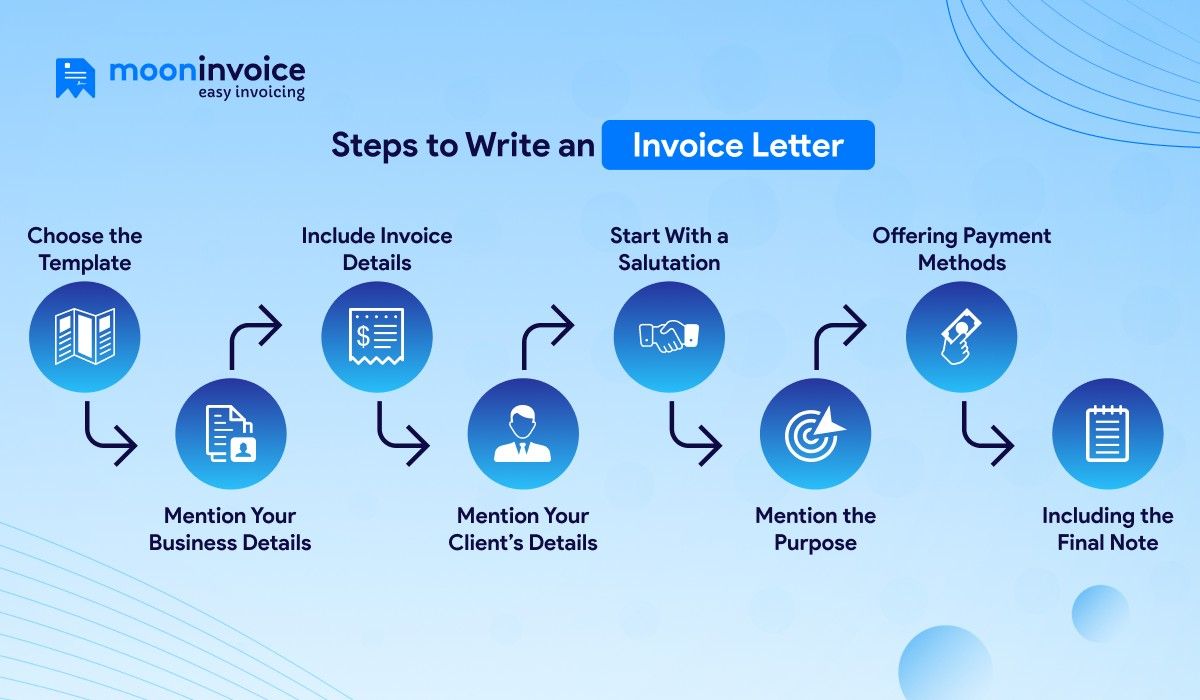

How to Write an Invoice Letter?

You need to be careful when writing an invoice notice. Make sure you include the key details & maintain a professional layout to keep an impressive image. Here is the key information to include when you think over how to write an invoice letter for payment:

1. Choose the Template

Generating a billing letter becomes easier with a ready-made invoice letter template. You can leverage the predefined fields that help professionals fill in the details quickly. Not only this, but templates also help maintain a professional layout, which is the most important aspect.

Using an online tool is better than using generic documents like MS Office. It is because tools provide advanced features to manage payment request letters effectively, along with customized invoice letter templates.

2. Mention Your Business Details

At the top of the due payment letter, it is better to include your business details. Mention your company name, address & contact details. Mention the complete address along with the ZIP code. Include your business email address and phone number as well.

3. Include Invoice Details

Next come the invoice details, such as the invoice number and due date. You must also mention the date on which you issue the invoice letter.

4. Mention Your Client’s Details

Just like your company details, you must mention the client’s details, like the client’s name, the client’s company name, the address, and contact details. The address should include the PIN. Also include contact details, such as a phone number and email address.

5. Start With a Salutation

Always begin the invoice letter with a polite salutation. Address the recipient by name in a professional tone, using “Hello” or “Hi”. For example, you can start with “Hello, Mark👋” or “Dear Enna Robinson” whenever you start writing a new invoice notice.

6. Mention the Purpose

This is the most important part. One should mention the purpose of sharing an invoice letter. Clearly states what the invoice is all about and what it expects. Keep the language polite, professional, and to the point.

7. Offering Payment Methods

Mention the payment methods that you accept. It’s convenient for your client to understand how he could make the payment. Also, include all relevant details that could help your client make the payment as simply as possible. For instance, if it is about a bank transfer, mention your bank account name, the bank’s routing number (ABA number), or the SWIFT code or BIC code for an international transfer.

8. Including the Final Note

This is the termination of your letter. Always end your invoice letter with an ending section, written in a professional tone. Also include a thank-you note to convey your appreciation for your client.

Below is an invoice letter example that shows how you can politely request that your client pay their dues as soon as possible.

Example of Invoice Letter

New World Tech Solutions

32 Innovation Drive

New York, NY 10001

solutions@newworld.com | +1 665-874-500

March 5, 2026

Unique Enterprises

5678 Business Ave

Los Angeles, CA 90012

Subject: Invoice Letter – MVH-2026-0034

Dear Mark Duckett,

I hope this letter finds you well. I am writing to follow up on my previous invoice #MVH-2026-0034, dated February 20, 2026, for services we provided to your company. As per our agreed terms, the payment was due on March 1, 2026, and we have not yet received it.

Below are the invoice details for your reference:

- Invoice Number: MVH-2026-0034

- Invoice Date: February 20, 2026

- Due Date: March 1, 2026

- Total Amount Due: $2,500.00

- Payment Method: Bank Transfer

Please process the payment as soon as possible to avoid any late fees. If the payment has already been made, kindly disregard this notice and share the transaction details for our records.

For any questions or concerns, feel free to contact us at solutions@newworld.com or call +1 665-874-500.

We appreciate your prompt attention to this matter.

Thank you for your understanding!

Best regards,

Ruby Carter

Accounts Receivable Manager | New World Tech Solutions

Timing and Conditions for Sending an Invoice Letter

Now, you unlock the true answer to how to write an invoice letter. That’s great! The next most important thing is knowing the best time and favorable conditions to send it. Let’s reveal the same here:

After Product or Service Sale

Business professionals can send a sample invoice letter after the product or service is delivered. It should be sent along with an invoice. This triggers on-time payment collection and lets your business maintain a smooth cash flow.

Before the Due Date

Not necessary to send an invoice reminder letter after the due date. It even works when you share it near the payment deadline. This reminds your customer about the payout and helps to receive payment smoothly.

Requesting Upfront Payment

Often, companies need advance payments before delivering services or products. In such situations, sending an invoice letter is very effective. However, you must clearly state the amount of the advanced payment and any other applicable conditions.

During the Late Payment

Sending an invoice notice is also effective when you haven’t received the due payment on time. The letter serves as a payment reminder and encourages your client to make the payment on time after the last date.

Achieving the Milestone

You can send an invoice letter when handling a large-scale project that includes milestones. Once you achieve a milestone, dispatch the payment reminder letter to the client. This maintains proper cash flow across all milestones and prevents financial crises.

💡Pro Tip:

Utilize online invoicing software to streamline your billing process – it provides an all-in-one solution to manage invoices effectively and ensures a smoother billing journey.

How to Avoid Late Payments?

Late payments are a major cause of poor financial performance for any business. Such a situation also causes operational stress and delays the project timeline. So, how to avoid late payment excuses? Here are the key solutions:

Provide Multiple Payment Options

You and your customer may not use the same payment method. Additionally, cash payment is not the only payment option left in this digital world. Therefore, offering multiple payment options boosts clients’ convenience.

Early Payment Discounts (EPDs)

Introduce Early Payment Discounts (EPDs) to incentivize early payments made within the first few days. For example, you can include 1/10 net 30 or 2/10 net 30 on an invoice to prompt early payment from customers. It means customers will receive a 1% or 2% discount if they pay within 10 days.

Sending Reminders

Professionals can also prevent late payment by sending payment reminders. You must ensure that you send the reminders at a systematic time interval. For instance, you can send the reminder before the due date, on the due date, or after the due date.

Use of Online Tools

This is the most effective way to prevent late payment. Using invoicing tools like Moon Invoice, one can easily streamline the invoicing & payment process. The platform helps to create a professional business invoice through a free invoice template. Apart from this, professionals can set the recurring invoicing for the ongoing projects. It also automates the payment reminders and saves your time.

Are You Tired of Invoice Follow-Ups?

Worry not – streamline payment follow-ups effortlessly with our automated invoicing software.

Final Words

To sum it up, the invoice letter serves as a gentle nudge for the buyer to take the necessary steps and complete payment. It is an ideal way to remind your buyers of their payment responsibilities and to keep your cash flow active. The condition is that you must follow the right roadmap to create it and share it with the client at the right time.