Manufacturing businesses usually have hidden costs that pop up on your income statement out of nowhere. These small yet forgotten expenses quietly pile up and sometimes even drain your bank account. Therefore, you have no choice but to reduce them in order to reclaim financial control.

Here, we will throw light on the meaning and example of manufacturing overhead. Plus, we will also break down how to calculate manufacturing overhead, along with the right manufacturing overhead formula.

Alright, let’s delve deeper.

What Is Manufacturing Overhead?

Manufacturing overhead (MOH) is the umbrella term for all costs linked to the production that can’t be pinned to a single unit. They are indirectly connected to your production, but very instrumental to the entire manufacturing facility.

Factory utilities, equipment depreciation, supervision labor, maintenance, and facility rent are among the manufacturing-overhead items that rarely come to light.

What Is Included in Manufacturing Overhead?

Here’s a rundown of the costs that usually sit outside the production process but still cost you money.

1. Indirect Labor

Costs related to indirect labor, such as workers’ salaries, fall under the manufacturing overhead. It involves everyone working at the manufacturing hub, including cleaners, security guards, and supervisors. You might need to log their hours to learn how much time they spend on jobs.

2. Indirect Materials

Gloves, tape, lubricants, light bulbs, repairs, general supplies, and chemicals are indirect materials, which also come under manufacturing overhead. These small costs are difficult to track, but they still drive your production. It’s already piling up while you read this, agree?

3. Factory Utilities

The utilities cost of your manufacturing unit, such as gas, internet, electricity, and water, belongs to manufacturing overhead. They often fluctuate, and that’s why it is difficult to calculate in comparison to more or less of a product’s demand. So, you must pay them anyhow.

4. Depreciation of Equipment

The decrease in the value of equipment over time is also related to manufacturing overhead. Since the equipment is something that benefits multiple products, its cost is not only associated with one unit. Therefore, depreciation of equipment is added as manufacturing overhead.

Stop Losing Money to Hidden Costs

Still bleeding money from untracked overheads? Moon Invoice gives you full visibility into manufacturing costs and keeps every expense under control.

How to Calculate Manufacturing Overhead?

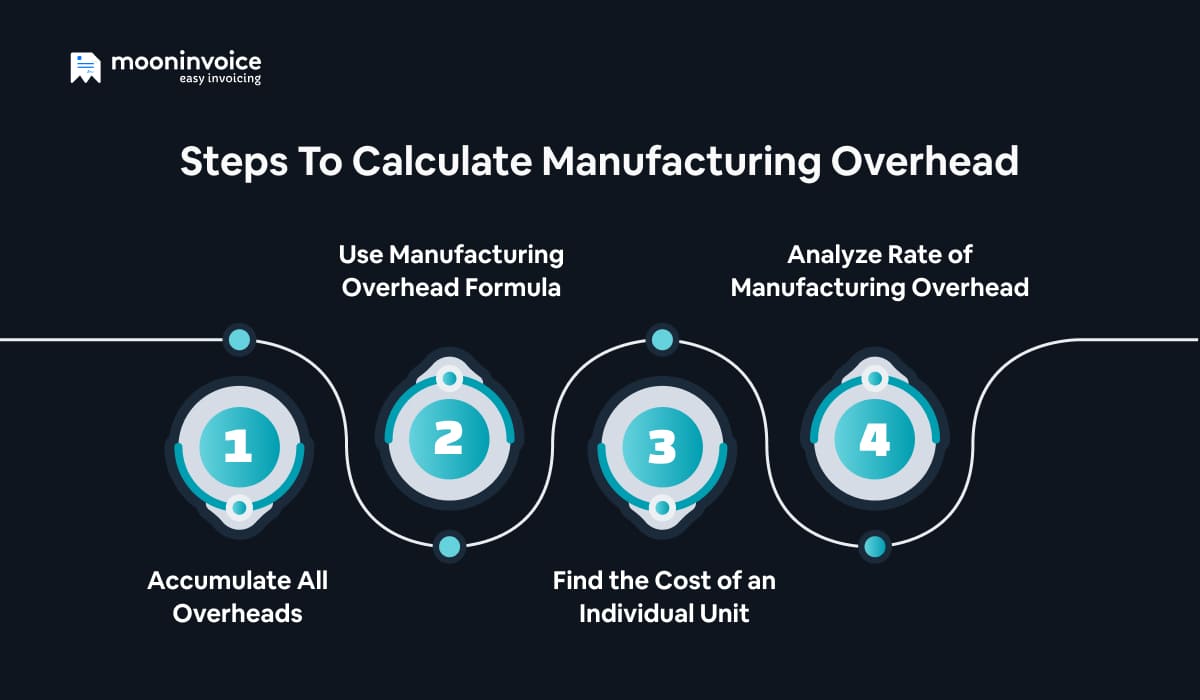

A few steps are what you need to compute the manufacturing overhead. Let us show you how to calculate total manufacturing overhead in detail.

1. Accumulate All Overheads

First, think of overhead costs like it’s an iceberg. What you see is only a tiny part compared to what’s beneath the surface. Missing them will lead to inflated margins and tax bills on phantom profits. Therefore, you must hunt down every cost that keeps your factory humming, but is never the physical part of the goods or products.

At this stage, what you need to do is look at the general ledger, export the last year’s accounting data, and then trace each line to its invoice. Then compile a list of the numbers you found from the ledger and the cost for each month and year. Keep doing it until you have scooped up all hidden costs like rent, equipment depreciation, and others, leaving nothing underwater.

2. Use Manufacturing Overhead Formula

Once you are ready with the list of sneaky costs, it’s time to plug the numbers into the formula of manufacturing overhead. But, hang on. What’s the manufacturing overhead formula? Here you go:

So, when you use the formula and do the sum of whatever indirect costs you found earlier, you can see how much is the total amount of manufacturing overhead. Once calculated,

3. Find the Cost of an Individual Unit

Now you must have an idea of total manufacturing overhead, but your job isn’t fully done. You need to determine what’s the cost of a product unit. Following this practice will aid you in estimating how much money you spend on manufacturing a single unit accurately.

Alright, use this formula to find the cost per unit:

For example, you figured out the year’s overhead is $120,000, and in that period you produced a total of 60,000 phone cases, then $2.00 is what the overhead per unit. This will further aid you in setting up the selling price in a way that you accumulate the maximum profit.

4. Analyze Rate of Manufacturing Overhead

Now, start assessing the manufacturing overhead rate by converting the big number into a

per-unit rate to see if your factory is really getting more expensive to operate. This process will assist you in assessing and allocating the costs to the goods.

Here, if the rate of manufacturing overhead is low, it means that you are using every resource efficiently. In other words, it’s a sign that equipment, space, and labor are being used wisely. But, in case the rate is higher, it indicates an alarming situation by quietly stacking extra costs onto each unit and eating into your profits.

Examples of Manufacturing Overhead Costs

Let’s take a couple of examples to understand how calculating MOH can help you capture those sneaky costs and protect your margins.

Manufacturing Overhead Calculation Example: Fixed Manufacturing Overhead

Suppose your company signs a three-year lease that keeps the 50,000 ft² plant open for $80,000 a year. Insurance on the building and equipment adds another $28,000, and depreciation on the CNC centres, calculated on a straight-line basis, is $92,000. Together, these costs lock in at $200,000 of fixed overhead for the year, regardless of your unit volume.

Manufacturing Overhead Calculation Example: Variable Manufacturing Overhead

To understand this, let us take a small bakery, where the oven uses $0.10 of electricity per loaf. One loaf needs $0.20 parchment sheet, which means $0.30 per loaf. So, when you bake 1,000 loaves of bread, the cost settles for $300, but when you bake 2,000 loaves, it will rise to $600. That’s how variable manufacturing overhead becomes more or less with a tray that slides onto the rack.

Why Is Manufacturing Overhead Important?

When you are in the manufacturing business, calculating MOH is so crucial for keeping your primary operations up and running. Let us explain it to you in detail.

1. Smart Pricing

MOH unravels how much is the true cost of every product, allowing you to set the price that covers overall expenses. Without it, you may underprice the product cost, which may lead to financial loss. That’s how MOH will aid you in setting prices that eventually protect your margin.

2. Analyzing Profits

Businesses need MOH to spot hidden costs and identify if products carry a fair share of power, maintenance, and other costs. Considering such things, you can clearly see which SKUs are making money and which are surviving on the overhead. Analyzing it, you can take the required steps to grow profits.

3. Uncover Cost Reduction Areas

MOH precisely breaks down into items that are metered kilowatts, setup hours, and indirect labor minutes, each tagged to a work center. This means businesses can delve deeper and explore the areas where they can reduce unnecessary costs without increasing production volume.

4. Boosting Efficiency

Since MOH plays a role in converting indirect dollars into measurable drivers, it enables your business to level up efficiency in production. It unearths machines or employees’ shifts that burn most indirect time and money to let businesses quickly optimize their production efficiency.

Tips for Reducing Manufacturing Overhead

The list of valuable tips that will surely help in minimizing the manufacturing overhead.

- Make sure you put every utility bill to tender, at least once a year.

- Encourage workers at the production facility to save energy and water usage.

- Whether it’s maintenance, energy, or consumables, always cap each cost bucket.

- Spot the source of material wastage and address it with better production planning.

- Schedule regular overhead reconciliation sessions with your finance team.

Conclusion

In conclusion, manufacturing overhead is something that may hide in electricity meters, internet routers, or even in a supervisor’s salaries. However, it is crucial to track and determine indirect costs, which state whether you are earning or burning money at the production facility. To do so, you now know what are the steps and formulas to measure the manufacturing overhead, right?

To simplify the process further, we recommend utilizing automation software like Moon Invoice to manage and calculate MOH in a fraction of a second. Besides overhead costs, there are plenty of things that you, as a business owner, will enjoy managing from one centralized platform. Go for a free trial and explore more.