TL;DR

Consolidated invoicing is the process of combining multiple transactions into a single invoice. It is commonly useful when the business offers bundled services to the same client. The major aim of this approach is systemize the billing process for both the business and the client.

Often, your single customer can make multiple purchases and subscribe to multiple services. It sounds good because your business’s sales are increasing. However, it also imposes an additional burden.

Why? Because you may need to create a separate invoice with different billing dates for each purchase order or subscription. Instead, opting for consolidated billing is a great approach.

Consolidated invoicing is the process of creating and sharing a single unified invoice for various transactions. In this way, it systemizes the invoicing & billing process.

In this article, you’ll learn the consolidated invoice meaning, its working & benefits to the business. Additionally, you will know how to create this invoice and what best practices to follow when dealing with it.

So, reading our words will be quite informative if you have no idea what consolidated invoicing is.

📌 Key Takeaways

- Consolidated invoicing is the process of combining multiple invoices into a single invoice.

- It eliminates the complex strategy of managing several invoices.

- It improves cash flow management and financial reporting while reducing administrative overhead.

- Consolidated billing is ideal for recurring clients and long-term projects.

- The billing error is minimal because charges are centralized into a single invoice.

- It is ideal for high-frequency transactions and recurring bulk.

What is a Consolidated Invoice?

A consolidated invoice is a single invoice that combines multiple invoices. It means that instead of sending multiple invoices for each purchase order, a single invoice is issued for the same customer. This type of invoice is sent weekly, monthly, or quarterly.

This kind of invoicing approach is widely used by SaaS companies, freelancers, bulk shipments, and multi-vendor purchasing. It is quite different from standard invoicing, where each purchase is handled separately.

How Consolidated Invoicing Works?

A consolidated invoice combines various transactions into a single comprehensive bill. Here are the four steps to follow:

1. Usage Tracking and Grouping

The vendor keeps on recording every single due payment against new purchases, subscriptions, or product deliveries. In this way, the vendor keeps adding transactions during the billing cycle.

There is no fixed set of rules for grouping transactions. The grouping of transactions is as per the agreement between the seller and buyer.

2. Itemization

Itemization involves a detailed breakdown of each transaction of a different purchase order. Every transaction includes its own line item details, unit price, applicable tax, and quantity. The details are combined into one document. A clear breakdown of each individual transaction is shown in the itemization.

3. Aggregation

Next comes the aggregation. It combines charges from multiple purchases or accounts into a single invoice for the specified period. It streamlines billing by consolidating various transactions, orders, or services.

4. Invoice Generation

At last, the invoice is created in a proper format and sent to the customer. It covers the grand total of all invoices with a listing of each service and product. In this way, customers receive a single invoice in a systematic manner.

Create an Invoice That is Easy to Read and Pay

Utilize our 66+ customized invoice templates to enhance your payment flow with a clear invoice.

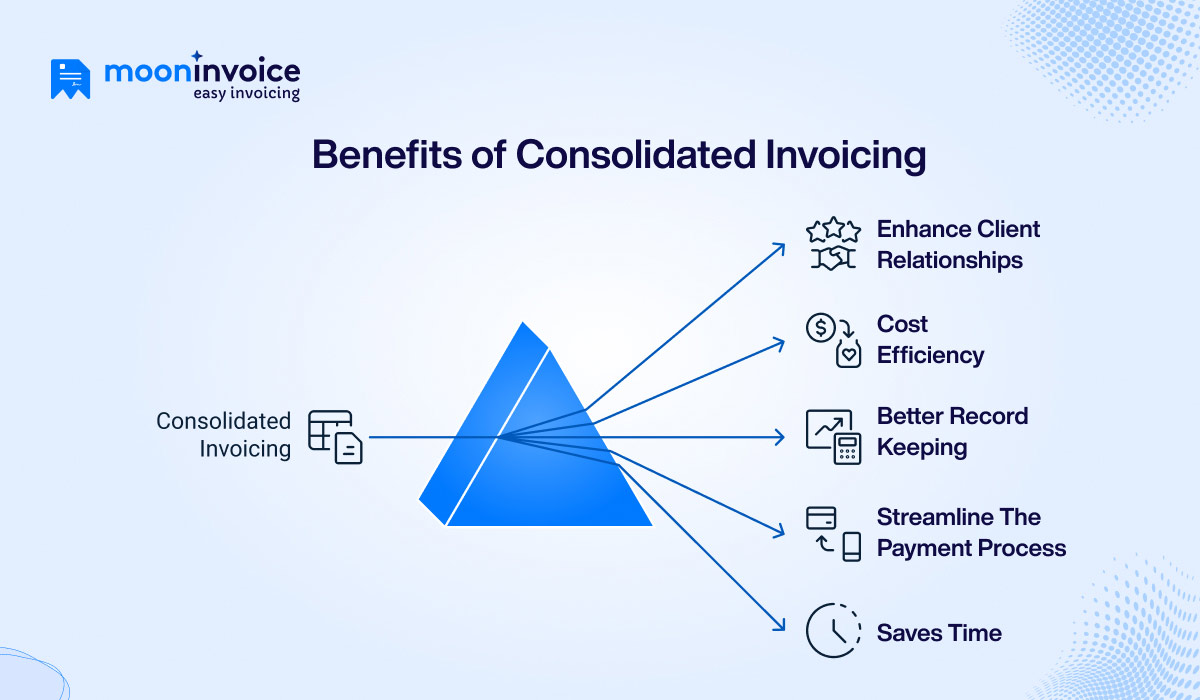

What Are the Benefits of Consolidated Invoicing?

Consolidated invoicing contributes to refining the cash flow, record keeping, and customer relationships. Let’s have a brief understanding of each point here:

Enhance Client Relationships

Consolidated billing is a single invoice that combines various transactions. It includes clear details for a single payable amount and a single due date, rather than multiple due dates. This enables the client to get a clear understanding of the overall billing. The customer pays a single payment rather than making multiple payments. In this way, it enhances the client’s business relationship. You can avail of high customer retention with this approach.

Cost Efficiency

Certain expenditures are associated with invoice handling. The payment processing fee, systems plan, and staff time, including labor costs, are some of the expenditures involved in managing the invoice. Thus, when you create a single consolidated invoice, the approach reduces all these costs.

Better Record Keeping

It is hard to track spending for separate invoices. A consolidated bill is one single document that eliminates it. Thus, it is easy for the professionals and clients to manage. Because transactions are centralized, it is quite easy for customers and professionals to review past activities. The financial records are in good order, facilitating straightforward audits and enabling smooth business operations.

Streamline the Payment Process

Business professionals can easily streamline revenue processes by issuing one invoice. As the document carries all the details in one centralized format, it makes it easy for the client to make the due payment. It reduces the financial team’s administrative burden of managing separate invoices. Additionally, it also prevents late payments excuses.

Saves Time

With consolidated billing, one can save time on documentation. As it involves a single invoice, it eliminates the need to handle multiple documents. It also streamlines the reconciliation process, which is the most time-consuming task in accounting.

How to Create a Consolidated Invoice?

Creating a consolidated invoice involves a systematic process. You need to group transactions for the same customers into a single, clear & accurate bill.

Determining the Billing Cycle

The first step in the consolidated bill is justifying the billing cycle. As mentioned earlier, the billing cycle can be weekly, monthly, quarterly, or any other. So, clearly defines when you’ll send the invoice to your customer with proper communication.

Implement the Tracking System

A consolidated invoice depends on maintaining the proper transaction details. It must include a clear breakdown of the relevant details, such as date, line item description, quantity, and unit price for each service.

Create the Format

Next, create an invoice that clearly details the multiple transactions. You need to decide on the right format that looks professional and clear. The best approach is to use the invoice template from a reputable invoicing software like Moon Invoice. The built-in fields let you fill in the details and create an invoice quickly.

Review the Invoice

Cross-check your invoice properly once it is ready. Verify the date, transaction amount, line item details, and other information, and ensure accuracy.

Send it to the Client

Once the invoice is ready, share it with the customer. The traditional method is sending the hard copy of the invoice to the customer. However, using invoicing software like Moon Invoice, you can send invoices directly via WhatsApp or email.

What Are the Common Challenges With Consolidated Invoices?

Professionals can face certain challenges when handling the consolidated invoices. These challenges are mainly related to taxation, timing, and complexity.

Complexity

A consolidated invoice includes too much information, including transaction volume and applicable tax. This can significantly enhance the complexity in handling the data and understanding the invoice for the client as well.

Timing Delays

Payments may be delayed when multiple transactions are combined into a single invoice. The major reasons could be more internal approval, technical complexities, & need for different payment methods.

Tax Complexity

Adding & handling the tax can be difficult in consolidated billing. The tax rates keep changing, which complicates tax calculations for the various transactions.

Data Inconsistency

Inconsistency may arise in a consolidated invoice when multiple finance teams enter the details differently. The formats can also vary across the system, which can further add to issues.

What Are the Best Practices for Consolidated Invoicing?

Offer Multiple Payment Options

Whenever you share an invoice, always provide multiple payment options to the client. It provides high convenience to the user. The final invoice should include wire transfer, credit card, & online payment options.

Keeps the Language Simple

Always keep the language simple and easy to understand, especially for payment terms. A complex language can confuse your client and ultimately lead to a dispute or slow down the process.

Careful With the Timing

One should always be careful with the right time to send an invoice. Neither should it be too early nor too late. The perfect time is immediately after the service is completed, or as specified in the payment terms. The right time to send the invoice determines your business’s cash flow.

Automate Where Possible

Always opt for automation by choosing the right invoicing software. Concepts like auto-calculation & integration with ERP help in streamlining the process. This saves time, reduces errors, and enhances productivity.

Streamlining Your Invoicing With Moon Invoice

Billing can be simple and efficient when using an invoicing system like Moon Invoice. Trusted by over 1.7M business professionals, the system simplifies the invoicing process through automation and digital tools.

You can effortlessly create an invoice through the 66+ customized templates in any format, including Word, Excel, Docs, Sheets, and PDF. The templates let you create a professional invoice with accurate information, thanks to their auto-calculation feature.

It also eases the consolidated invoicing process by automatically collecting all the billable entries. Thus, it automatically groups the transactions to streamline the process. You can leverage the quick scan feature, which lets you extract information from hard copies using the system’s AI. Thus, it reduces manual effort, saves you time, and enhances overall productivity.

Moon Invoice provides a centralized system for storing all important documents in one place. It provides easy & quick access to data whenever required. You can track every single transaction with clear financial reports.

The system also provides a simple approach to sending an invoice. Business professionals can easily send invoices directly via WhatsApp or email.

Turn Your Invoicing Headache into a Game of a Minute

Create your custom invoice in 60 seconds with Moon Invoice. Trusted by 1.7M+ global users.

At the Last

Consolidated invoicing is not just a billing approach but also a way to streamline your billing & keep your clients retained. You must adopt it if you provide subscription services, regular purchasing, or any other service that involves repetitive transactions. It might be challenging at first, but with the right software adoption, it becomes easy.