Inventory management is one of the most important components of business operations. Especially, the manufacturing units and retailers need to manage their inventory properly.

FIFO and LIFO are two common methods for managing inventory, assigning values to inventory items, and ensuring effective management. Most businesses use these two methods for their inventory management. However, some of them who sell large quantities of similar items also use the average cost method.

FIFO vs LIFO is a common topic of discussion, and professionals should always have clear information regarding the same. This is because it helps choose the right inventory method and positively affects business flow.

Fortunately, this article will present a clear overview of the same, along with real-life LIFO and FIFO examples. Explore their meaning, advantages, and disadvantages.

📌 Key Takeaways

- FIFO and LIFO are two important & common accounting methods for assigning inventory values.

- FIFO stands for First In First Out, and LIFO stands for Last In First Out.

- Both FIFO and LIFO provide different implications for financial reporting and inventory tracking.

- The key difference between LIFO and FIFO is that FIFO sells the oldest inventory items first, while LIFO sells the most recently purchased items first. The choice depends on the business type and accounting standards.

- In FIFO vs LIFO accounting methods, the choice depends on the business type and accounting standards.

💡Insider Info:

The AI market for inventory management is at its peak of adoption and is expected to grow to

$24.96 billion.

What Is FIFO? Defining FIFO Definition

FIFO stands for First In and First Out. In this inventory management process, the oldest inventory items are sold first, and the newest items remain in stock. It leads to higher net income, lower COGS, and higher ending inventory value during inflation.

The inventory method is often useful in industries that handle perishable goods. Such industries deal with medicines, food items, beverages, and cosmetics.

The FIFO method works best for these items because the oldest item must be sold before it expires. Also, inventory moves naturally in chronological order. FIFO results in lower COGS and higher net income. However, FIFO is not tax beneficial.

Advantages of FIFO

- FIFO always reflects the current market value of inventory.

- It is easier to implement compared to LIFO.

- FIFO is a globally accepted method and is suitable for international businesses.

- It always presents a clearer picture of profitability.

- Inventory waste is always minimal because the older stock is sold first.

Disadvantages of FIFO

- It leads to a higher taxable income/tax bill due to higher profits.

- FIFO doesn’t reflect the true cost of goods sold when the prices go high.

- It produces less consistent financial results when prices frequently change.

- FIFO doesn’t fit well for the durable goods industries.

- It brings higher tax liability.

Example of FIFO

Let’s understand FIFO with a single example.

Assuming a beverage company named ‘Blue Star Beverages’ purchased 200 units of bottles for $2 each in October, the total cost will be $400. Later, the company again purchased 400 bottles at $4 each in November.

Later, the company sold 200 units in the first batch and 250 in the second. The COGS will be as follows:

Sell 200 units in first batch – 200 x $2 = $400

Sell 250 units in the second batch – 250 x $4 = $1000

Calculating the total COGS, $400 + $1000 = $1400

Calculating the ending inventory yields the following output.

$400 – $250 = $150

$150 x $4 = $600

Thus, the total cost of goods sold is $1400, and the ending inventory is $600.

Gain Full Control of Your Inventory

Simplify your inventory computation with the #1 inventory management solution.

What Is LIFO? Defining LIFO Definition

LIFO stands for Last In First Out, which is the opposite of FIFO. It is an inventory valuation method used in accounting in which the most recently purchased or produced items are used or sold first.

LIFO is most commonly used when there is a higher pricing period. It aligns with current inventory sales and could result in tax savings. The LIFO method results in a lower cost of goods sold.

It is not allowable under International Financial Reporting Standards (IFRS), but it is permitted under US Generally Accepted Accounting Principles (GAAP).

Advantages of LIFO

- It improves cash flow planning by reducing taxable income during inflation.

- LIFO reduces the risk of overstated profits.

- It provides a more accurate picture of the current inventory costs.

- It is particularly suitable for businesses that handle non-perishable inventory.

- Given current market conditions, LIFO provides a more realistic view of the company’s profitability.

Disadvantages of LIFO

- LIFO is unsuitable for international businesses because it is not allowed under IFRS.

- It may be administratively challenging to track inventory layers and their costs.

- LIFO is quite complex to apply and prone to errors when the business has multiple products.

- It doesn’t reflect the actual flow of goods.

- The LIFO method doesn’t provide tax advantages.

Example of LIFO

We now understand the LIFO through an example.

Suppose a widget-selling company, ‘Wacky Widgets’, purchased 100 units of widgets at $2 each in October. Later on, purchased 250 units of widgets at $3 in November and 300 units of widgets at $2 in December.

As in LIFO, the last items are considered; we first calculate the units of December and November. The company sells the units in two different batches as follows:

Sell 300 units in batch 1 – 300 x $2 = $600

Sell 250 units in batch 2 – 250 x $3 = $750

Total Cost of Goods Sold (COGS) = $600 + $750 = $1350

The remaining inventory value will be 100 x $2 = $200, which was purchased in October.

💡Don’t forget to read:

Mastering Inventory Formula

Before we jump to LIFO vs FIFO, we need to get familiar with the inventory formula. Determining an inventory value is straightforward. Business professionals can easily utilize the following formula:

A typical inventory formula is as follows:

Ending Inventory = Beginning Inventory + Purchases – Cost of Goods Sold (COGS)

- Beginning inventory – An inventory value at the start of the period.

- Purchases – Cost of inventory purchased during the period.

- Cost of Goods Sold (COGS) – Cost of items sold during the period.

- Ending Inventory – The value of inventory that remains at the end of the period.

The cost of goods sold is also straightforward by using the COGS formula:

Cost of Goods Sold = Starting Inventory + Purchases – Ending Inventory

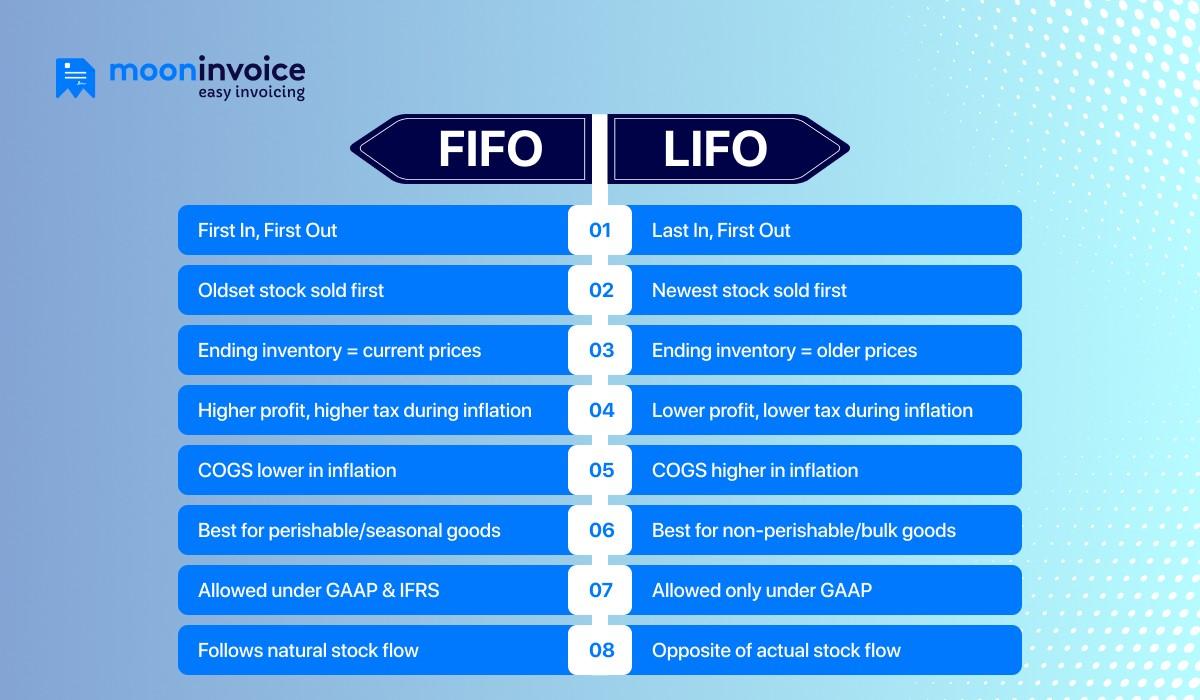

FIFO vs LIFO: Key Difference Between FIFO and LIFO

After determining and understanding what LIFO and FIFO are, we now come to their comparison.

FIFO and LIFO are two different inventory methods. Business professionals use them depending on their work type.

FIFO majorly focuses on the oldest inventory item, whereas LIFO focuses on the newest inventory item. Here are the major comparison points to understand the key difference between LIFO and FIFO.

| FIFO | LIFO |

|---|---|

| Stands for First In First Out | Stands for Last In First Out |

| The oldest inventory is sold first, while the newer inventory remains in the stock at the end of the accounting period. | The newest inventory is sold first, and the oldest inventory remains in the stock at the end of the accounting period. |

| The ending inventory reflects the current market price. | The ending inventory may understate the inventory value. |

| Higher taxes during inflation. | The tax impact is lower taxes due to inflation. |

| The COGS is higher in profit and lower in inflation. | The COGS is lower in profit and higher in inflation. |

| This inventory method is best for perishable items and other seasonal products. | This inventory method is best for non-perishable items and bulk items. |

| The accounting standards are GAAP & IFRS. | The accounting standard is limited only to GAAP. |

| The inventory flow is quite natural and in chronological order. | The inventory flow is the opposite of FIFO and does not match the actual physical flow. |

What Is the Impact of FIFO and LIFO on the Financial Statements?

After understanding LIFO vs FIFO, we now examine how they affect the company’s financial statements. Both FIFO and LIFO have different impacts on the balance sheet and income statement. The major effect is on profit, COGS, taxes & inventory valuation as follows:

- Cost of goods sold (COGS) is lower under FIFO but higher under LIFO.

- FIFO yields higher profit and net income, but both decline under LIFO.

- Taxable income is higher under FIFO but lower under LIFO.

- The ending inventory is close to market value under FIFO, but it is older under LIFO.

💡Also Read:

FIFO or LIFO: Let’s Find Out the Real Winner

So far, we have defined what FIFO and LIFO are. The next step is to choose the right method. It is, of course, necessary to justify which works better for the business inventory.

Choosing between FIFO and LIFO depends on several factors and the company’s nature. Market conditions, inventory costs, financial conditions & system complexity are other factors.

FIFO works best for perishable goods, while LIFO works best for non-perishable or bulk items such as metals and raw materials. For instance, if the business sells snacks, the FIFO inventory method is an ideal choice because it accounts for the cost of the most recent goods sold.

On the other hand, LIFO works better for businesses that sell crude oil, natural gas, or any non-perishable items, given the constantly fluctuating prices.

In short, FIFO is an ideal choice if the business goal is accurate inventory valuation and higher profits. In contrast, LIFO, as an inventory management system, is an ideal choice if the business goal is tax savings during inflationary periods.

Experience Smart Inventory Management With Automation

Level up your inventory management with Moon Invoice and keep your business operations running smoothly.

Bottom Line

FIFO and LIFO methods are poles apart and possess different concepts for inventory management. Business professionals need to choose the right method based on the type of business they handle and the products they sell. In the FIFO vs LIFO accounting debate, professionals need to consider financial goals and regulatory requirements.

Using online accounting software like Moon Invoice can streamline inventory management. It offers automation that saves time and delivers correct results. Are you curious to learn how it works and to find the right partner for your business journey?

Initiate your trial with a free sign-up!