TL;DR

PCI compliance is a security standard that companies must follow when handling clients’ debit and credit card data. An international standard, the Payment Card Industry Data Security Standard (PCI DSS), aims to protect cardholder data during transactions.

Does your business accept credit card payments or any other card payments? Then your company must be PCI compliant to prevent costly data breaches.

PCI DSS is a global security standard for the storage, processing, or transmission of cardholder data. Thus, it prevents fraud and data breaches while ensuring that sensitive information, such as card numbers, CVV codes, and expiration dates, is handled securely.

So you can think about how important it is for your company to be PCI compliant. But the question is: how do you become PCI compliant for your business? What requirements do you need? The answer is hidden in this article.

Additionally, you will learn about the advantages of PCI compliance and the associated challenges. So read our words carefully to dig out the useful information.

📌 Core Insights on PCI compliance

- The PCI compliance process is based on the PCI DSS (Payment Card Industry Data Security Standard).

- Non-compliance can lead to legal fines and higher transaction fees.

- PCI DSS certification is required for businesses that accept, process, store, or transmit credit or debit card information.

- Using invoicing software, POS systems, and secure payment gateways can simplify compliance.

- Proper PCI compliance with the payment gateway reduces the business’s exposure to financial losses.

- There is a need for ongoing monitoring, updates, and security maintenance in payment card industry compliance.

What is PCI Compliance?

PCI compliance means a business adopting the Payment Card Industry Data Security Standard (PCI DSS) when accepting card payments. These are international standards designed to protect the credit card and debit card information.

The core purpose of PCI compliance is to reduce card fraud and data breaches. For any business that accepts card payments, the PCI Data Security Standard must be followed. Apart from that, it is also important for an organization to store cardholder data, process card transactions, and transmit payment card data.

🧠Surprising Fact:

The card payments market is projected to grow to $12.5 trillion annually at a CAGR of 8.4% by the year 2027.

What Are the Requirements of Achieving PCI-Compliance?

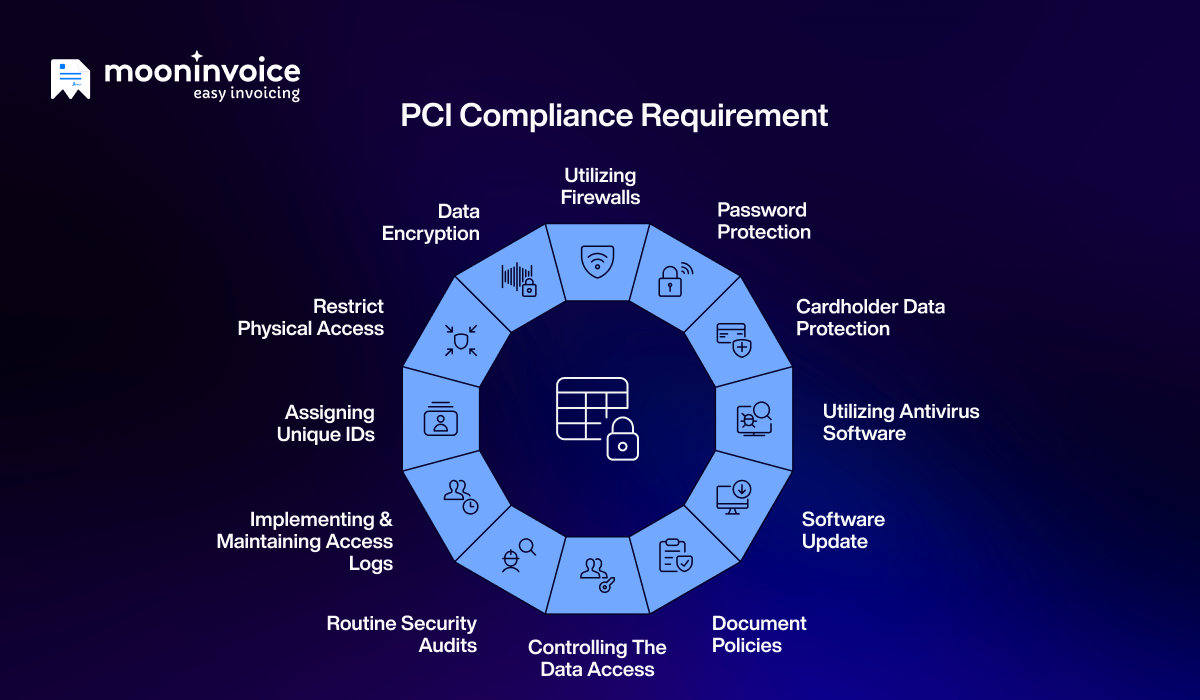

To achieve PCI compliance, your business must meet the security requirements. 12 key PCI compliance requirements come under this, which are as follows:

1. Utilizing Firewalls

Firewalls are essential to prevent unauthorized access to your internal network. It creates a barrier between your network and the external network, such as the internet, which can be risky and insecure. Therefore, it is essential to install and configure firewalls properly.

2. Password Protection

A very common and easy way to protect sensitive information is to use a password. One should use a strong password and change it frequently. Also, do not use the vendor-supplied defaults for the system passwords.

3. Cardholder Data Protection

Protecting the cardholder data is always important in PCI compliance. It includes storing cardholder information for the minimum time and disposing of unused cards to prevent fraudulent activity. It also includes measures to control unauthorized access.

4. Utilizing Antivirus Software

Installing antivirus and anti-malware software is one of the essential PCI compliance requirements. This software prevents malware, phishing, and other cyberattacks that can directly impact card data security. Thus, one should always use such software and keep it up to date.

5. Software Update

Keeping your software up to date is another important requirement for PCI compliance. Software updates include the security patches that fix vulnerabilities and bugs. Regular software helps protect the system against vulnerabilities.

6. Document Policies

Crafting security policies and implementing them in your work is another crucial part of PCI DSS certification. This encourages your team members to follow strict security measures and ensures that all work is done in a loop.

7. Controlling the Data Access

Data access should be limited to authorized persons rather than made open to everyone. The best possible solution is implementing strict access control measures. This significantly reduced the risk of accessing sensitive payment card data. Data access should be granted only to a known and genuine person.

8. Routine Security Audits

Just implementing security measures and building a security system is not enough. It is essential to audit and check security systems regularly. It includes intrusion detection systems and firewall testing. This ensures the security system is working properly and no shortcomings exist.

9. Implementing & Maintaining Access Logs

Creating and maintaining the access logs is another PCI compliance action. Under this, one can check the suspicious activity and prevent potential data breaches by accessing the logs. In this way, it helps protect all activities related to cardholder data.

10. Assigning Unique IDs

You must assign a unique ID to each person who accesses the card details. You can also assign individual login credentials for the same. This helps you easily track individual actions when accessing card details.

11. Restrict Physical Access

Physical security is also important, like digital security. Physical access to the data and the system should be restricted. Along with implementation, it should also be monitored closely to prevent unauthorized access or manipulation.

12. Data Encryption

Data encryption is crucial whenever you transmit payment card data over open networks. It’s because at that time, the data is more likely to be captured or stolen. It is important to encrypt data in transit.

How Do You Become PCI-Compliant? Complete PCI Compliance Checklist With Steps

Along with the question, what is PCI Compliance? You must also know how to become PCI-compliant. The simple meaning of becoming PCI-compliant is meeting the requirements of the PCI Data Security Standard. To get your business PCI-compliant, you need to achieve the following steps:

1. Determining the Compliance Level

Based on the number of debit and credit card payments you handle, you have a specific compliance level. The first step in PCI compliance is to identify the compliance level with your merchant and bank.

2. Identifying the Cardholder Data Environment

Where the card data is stored, how it flows, and who has access to it. Identifying the CDE involves mapping all systems. It includes networks, servers, and point-of-sale (POS) devices.

3. Choosing the Right Self Assessment Questionnaire

The SAQ is a tool that is used to validate PCI compliance. Usually, small and mid-sized businesses complete the self-assessment questionnaire. The primary purpose of PCI DSS compliance is to verify whether the business meets all 12 requirements.

4. Fill Out the Attestation of Compliance (AOC)

AOC is a signed, formal document that showcases the results of an organization’s PCI DSS assessment. The main purpose of this document is to ensure you complete all PCI DSS compliance steps. This document varies based on the business’s PCI compliance levels.

5. Conducting the Vulnerability Scan

You can conduct quarterly scans for security vulnerabilities. If required, you can hire approved scanning vendors (ASVs). This can help ensure you meet all the PCI DSS standards.

6. Submitting the Document

Depending on the level, you may need to submit the document. It covers completed SAQ, attestation of compliance (AOC), on-site audit, and quarterly scan results. The submission of documents is to credit card companies, banks, and similar institutions.

7. Monitoring

The security team is responsible for monitoring and responding to vulnerabilities and threats. The key components of this step are log management and File Integrity Monitoring (FIM). It refers to continuous tracking, logging, and analysis of access.

💡Pro Tip:

Avoid storing card data directly; use PCI-compliant invoicing software instead. It reduces the risk, saves time, and keeps the audit simple.

Why PCI Compliance Is Crucial for Businesses?

PCI compliance is not optional; it’s an essential requirement for any business that manages & process credit card payments. It acts as a shield, safeguarding the business from data breaches and other penalties and financial losses. Let’s understand its value for the business:

Prevents Data Breaches and Fraud

The major benefit of PCI DSS for businesses is that it helps prevent data breaches and fraud. It protects data sent over the internet by encrypting it and preventing it from being detected or stolen. Thus, it keeps the card’s sensitive information safe, benefiting both the business accepting the payment and the customer.

Sustaining the Customer Trust

Any client will trust the business that handles their payment card data carefully during credit card transactions. PCI DSS is a factor that helps establish trust between the business and the client in such cases. Handling and safeguarding clients’ data helps businesses earn their trust and confidence.

Saves Business Money

Data breaches and other fraud result in significant financial losses due to penalties. Businesses may need to compensate the client, pay for a credit card replacement, or bear the cost of the investigation. However, by incorporating PCI DSS certification, business owners can protect themselves from these losses.

What Are the Key Challenges of PCI Compliance?

Payment card industry compliance is crucial, but it still presents various challenges. The following are the major barriers:

- PCI comprises various technical security measures that are difficult to manage.

- Continuous monitoring and regularization are required, which adds a burden.

- Smaller businesses may not be able to bear the compliance cost.

- PCI DSS covers multiple security measures, so companies might not have a clear understanding of which ones apply.

- Human errors, shared login credentials, and phishing attacks can make the process quite difficult.

- Risk of involvement if the third-party software is not PCI-compliant.

- Failing to select the correct Self Assessment Questionnaire (SAQ) for the business-specific transaction.

- The PCI Security Standards Council continually updates the PCI DSS standard, making it hard for businesses to follow.

- Inadequate network segmentation increases the risk of unauthorized access to the card details.

What Are the Levels of PCI Compliance?

There are four levels of PCI compliance for merchants and two levels for service providers. The categorization is based on the number of transactions the business process annually has. Here are the PCI compliance levels for merchants and service providers.

For the Merchant

Level 1

A level 1 process more than 6 million Visa or Mastercard transactions per year. It needs third-party Quality Security Assessors (QSAs) to audit the merchant’s practices.

Level 2

A level 2 merchant processes more than 1 million but less than 6 million transactions per year. It doesn’t need a third-party auditor. Still, business professionals at this level must submit ROCs based on internal audits and respond to Self Assessment Questionnaires.

Level 3

A level 3 merchant processes more than 20,000 but fewer than 1 million transactions per annum. This level only needs completion of annual SAQs. Neither ROC nor external auditors are required.

Level 4

This level processes fewer than 20 thousand transactions per year. This compliance level requires merchants to complete the annual AOCs and SAQs.

For Service Providers

Level 1

A level 1 service provider processes and transmits over 3,00,000 credit card transactions per year. The company strictly adheres to PCI DSS and undergoes annual audits by a Qualified Security Assessor (QSA).

Level 2

It processes fewer than 300,000 transactions per year. The major cards processed are Visa, Mastercard, and other major brands. It is based on the transactions processed on behalf of other businesses.

Is Accepting Payment So Tough?

Ease your payment acceptance with us. Discover 20+ payment gateways of Moon Invoice.

Is PCI Compliance Legally Required?

There is no specific federal law in the USA that mandates PCI compliance. However, card brands such as American Express, Visa, and MasterCard enforce PCI DSS compliance through contractual agreements.

It means non-compliance can result in penalties, high fees, and service termination. In this way, they compel companies to adopt PCI standards as an integral part of their workflows. In short, it is not directly linked to state law but rather to state regulations or a payment processing agreement. So it is mandatory to adopt to ensure a secure transaction.

Closing Words

As a business owner, you cannot be selective about PCI compliance. It is a way to protect your company’s reputation and customers’ trust. You can reduce the legal risk and prevent heavy penalties. It is better to consider it a responsibility rather than just a mandatory requirement in this digital era.

Additionally, adopting reputable invoicing software like Moon Invoice. It supports popular payment gateways to ensure a high level of transaction security. Do you want to experience? Hit the 7 Day Free Trial Now!