No business is complete without understanding and learning about debit vs credit. Because money matters to everyone. And Also, maintaining a cash, asset, or expense account is daunting for the business.

To preserve accurate financial records, businesses rely on debits and credits. Accounts with liabilities, revenues, or equity decline, whereas accounts with assets grow when debits are applied. Debits cancel out credits. An equal and opposite credit entry must balance each debit item in a transaction’s journal.

Double-entry accounting relies heavily on debits and credits, even when you use a bank account, cash account, revenue account, equity accounts, or liability account for each transaction.

Transactions are the entries in a company’s general ledger that document the receipt, disbursement, and transfer of funds.

Let us start by exploring what debits are, a cash account, an expense account and how accounting software helps manage debit vs credit. Remember, that credit increases and debit increases are two different phenomena, and it is subject to the point of view of whose accounting transactions you are looking at.

What are Debits?

To begin, we will discuss debit, which is an accounting entry that increases an asset or cost account or decreases a liability or equity account.

While credit is an accounting item that enhances an equity or liability account, you will find it to the left when it is included in an accounting entry. It is mainly showing financial activities in the business.

Unlike using a debit card, which deducts funds from an account, a debit (DR) in accounting often reflects an amount of value entering an asset or bank account.

When using double-entry bookkeeping procedures, debits are entries made on the left side of T-accounts. Debits are believed to be the reverse of accounting credits.

Example of Debits

When as a business, you purchase an asset for your business – the cash account gets debited, and the asset account gets credited. So the debit amount will be equal to the purchase price of the asset. And Asset accounts will be increased by the same value.

You can have the same example for the loans payable account – where you have taken a loan hence your credit transactions are increased. Still, in liability accounts or loan payable accounts, the amount is equally negative on the debit side. (The same case goes in the case of bank loan).

Company owners or bookkeepers must always know the debit entry in any financial transaction.

What are Credits?

Credits are accounting entries that increase the value of a liability or equity account or decrease the value of an asset or expense account.

In contrast, a credit (CR) often records a quantity of value flowing from an asset account. This is compared to getting credit as a loan or return, which involves money flowing into an account.

It is common practice to record debits and credits as monetary units; however, these units do not always represent cash and may contain profits, losses, and depreciation. Because of this, we talk about them in terms of their “value.”

Example of Credits?

Similarly, the asset which you bought by debiting the cash account – the asset account gets into the credit side.

How do Debits and Credits Work?

In this section, let us understand how debit vs credit works. When Any transaction occurs in the business, two accounts will be affected by each given accounting activity. A certain amount will be debited from the bank account and credited to someone else’s account.

If that transaction is related to some business expense, it will be reflected in the expense accounts. It is 100% clear that there must be a minimum of 2 accounts for a transaction to happen.

The most important part of the process is the sum of the debits, and the total sum of the credits will always be equal.

And here comes the use of accounting software to maintain the records of debits and credits.

If a transaction did not result in a net positive amount, it would be impossible to generate financial statements.

Therefore, using debits and credits within a format for transaction recording consisting of two columns is the control over accounting correctness considered the most significant.

There is a good chance you are unclear on the fundamental difference between a debit and a credit. For instance, if you deduct money from a cash account, this indicates that there is now more cash available than there was before.

On the other hand, taking money out of an accounts payable account indicates that the total amount of money owed to creditors will be reduced.

What is the Difference Between a Debit and a Credit?

Until now, you have known that in bookkeeping or accounting, whether for personal or business, the entries, known as debits and credits, work together to create a sense of equilibrium.

Every transaction affects at least two accounts when using a form of accounting called double-entry. If you make a payment out of one account, you must pay into another account (or accounts) on your chart of accounts.

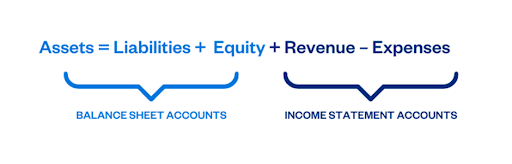

The fundamental difference between debits and credits may be summed up by the accounting equation, which is as follows:

| Debits (DR) | Credits (CR) |

|---|---|

| Recorded on the left side of the ledger. | Recorded on the right side of the ledger. |

| Increase asset and expense accounts and decrease liability, revenue, or equity accounts. | Increase liability, revenue, or equity accounts and decrease asset and expense accounts. |

| Example: You receive cash from a client, which debits (increases or adds to) the asset account. | Example: You make a business purchase, which credits (decreases or removes from) the asset account. |

How to Record Debits and Credits?

A general ledger is a kind of accounting record that comprehensively records all financial transactions over a certain period.

Journal entries are made in the general ledger whenever there is a change to any aspect of the company’s financial situation, including its assets, liabilities, equity, revenues, or costs.

Most modern bookkeepers and company owners use some accounting software to keep track of debits and credits. When individuals utilized to keep their financial records in paper ledgers, however, they would write down transactions and always place debits on the left and recognition on the right.

T Accounts are a useful tool for visually representing debits and credits. T accounts are only graphical representations of an account kept in a ledger.

In the later part of the blog we have shown how you can create T charts for each transaction.

How Important Debits and Credits are in Business Accounting?

Ensuring that debits and credits are used correctly is paramount regarding fundamental accounting principles. This will be an excellent opportunity for you to further your career in accounting if you possess sufficient knowledge and the capacity to put these things into practice.

Therefore, if you do not have a solid understanding of these ideas, you will have difficulty moving through the several levels of a career as an accountant. As you can see, the application of the approaches is extremely significant; hence, I have chosen to assist you in understanding how to utilize them so that you may increase your level of expertise.

A company’s books are said to be balanced when they include both debits and credits.

How are Debits and Credits Used?

Let us recall debit vs credit in simple terms: the movement of money coming in and going out of the company. Accounting is a business language. They are complementary in that they are equal yet opposed.

Regardless of the number of accounts or line items involved, the overall value of debits will always balance out to the total amount of credits.

The impact that debits and credits have on the following kinds of accounts:

An asset account records the worth of a business’s resources, which the firm owns and for which it anticipates future economic gain. Examples include cash on hand, outstanding account balances, inventory, and property.

An organization’s general ledger will account for all the categories: cost, liabilities, profits, assets, equity, income and losses. These accounts will also show on the firm’s different financial statements.

A company’s total amount of debt is shown in its liability statement. Accounts and balances for credit cards are one example, as are loans, taxes, and other payables such as accounts due and notes payable.

The charges that a corporation bears to operate its business and bring in income are shown in what is known as an expense account.

A shareholder’s equity account represents the shareholder’s stake in the firm’s assets. Financial assets include stocks, distributions, capital contributions, dividends, and retained profits.

A gain account records a rise in value achieved via endeavours unrelated to the primary company. Profits may come from various sources, such as money obtained through a lawsuit or an increase in value resulting from the sale of an asset or commercial property.

When you create a revenue account, you can see how much money was made from operational and nonoperating activities. Examples of activities that are under “operating” include sales and consulting services. In contrast, examples of activities that fall under “nonoperating” include interest and investment income.

A loss account is the reverse of a gain account. It reflects a value reduction due to circumstances unrelated to the principal company. Examples of this loss include monetary compensation for defeating a legal claim or claim and a decrease in value resulting from the sale of an asset or commercial property.

Debits and Credits T-Chart

A “T Chart” is a tool to organize and track changes made to specific general ledger accounts within an organization’s financial records.

It is named a T chart because its format consists of two columns. It is similar to the letter T in terms of representation.

In this T Chart, debit expenses are listed on one side, generally on the left side, and the credit is listed on the other, which is the right side.

Now this entry is reflected under the relevant account (e.g., cash, inventory, or accounts payable). Businesses nowadays use credit note software to manage everything.

To understand the working of the T chart – here is an example of it.

Consider that you just started going well in your business and decided to buy a Mac PC for your office desk as a business owner. And that would cost you around 2000$. Now, when you pay 2000$ to the Apple store, your cash account will decrease by $2,000$, and Apple’s cash account will increase by the same amount. But if we talk about your business transactions only, you purchased an asset for your business; hence it will increase your asset account by the same account.

Take another example of accounts payable and accounts receivable accounts. Let us say you lend 1000$ to John in advance for some personal work, then your accounts payable account will be debited by the 1000$, and the same amount will increase your account receivable.

In summary, the T Chart helps keep track of alterations made to different general ledger accounts, making it easier to monitor a company’s financial position and ensure accurate record keeping.

Credit note software would also help here to manage your financial accounts.

Conclusion

A company’s financial records are used to gauge its health, worth, and profitability. Thus, both ends of the ledger must add up to zero. That’s it from our end for debit vs credit entry. Be very accurate for your bookkeeping entries.

While accountants and bookkeepers may have no trouble grasping the principles of debits and credits, company owners who are more familiar with the language of plastic money may need some time to adjust.

Every monetary exchange affects two or more accounts in double-entry accounting. One account from where credit entry happens means money leaving the business and another where debit entry happens where the money coming in.