TL;DR

Accrued revenue is the money the company earns before billing. Deferred revenue refers to the money the company earns in advance before delivering a service or product.

Revenue is the backbone of any business and a key contributor to its financial health. A steady & healthy cash flow helps the company cover expenses, pay employees, manage its balance sheet, & keep the other business operations on track.

In addition, recognizing accurate revenue is another important factor. Incorrect revenue recognition can paint an inaccurate picture of your company’s financial condition. Even more, it can lead to other issues, such as penalties and the loss of investors’ trust.

That’s why it is important to understand the distinction between accrued and deferred revenue that enhances the revenue recognition process. In the following content, you’ll find a clear guide to accrued vs. deferred revenue. So keep maintaining a visual focus!

📌 Key Takeaways

- Understanding deferred vs. accrued revenue is crucial for accurate revenue records and the company’s financial position.

- Accrued revenue is the opposite of deferred revenue and refers to the income that has not been billed or received.

- Deferred revenue, also called unearned revenue, refers to the income received before the product or service is delivered.

- Proper tracking of accrued & deferred revenue helps improve cash flow analysis and produce accurate financial statements.

🤔Are You Aware of It?

Companies may lose 20-30% of their annual revenue due to inefficiencies and errors in revenue-recognition processes.

(Source: Future CFO (2025) report )

What is Accrued Revenue?

Accrued revenue refers to the earnings or income for which the company has not received payment, even after successfully delivering the product or service. This kind of revenue also refers to unrealized payments under which the company has not received any cash.

Such revenues are recorded as an asset or accounts receivable on the balance sheet once the company receives payment.

A financial professional can get a clear scenario of the company’s financial performance when they perform timely recognition. Whether the payment is received or not, recognizing the revenue is crucial.

Accrued Revenue Example

Let’s understand accrued revenue through an example. Suppose an IT company, Moon Technolabs Pvt Ltd, provides the client with a web development service worth $5,000 in November. However, the client will pay the amount in December upon receipt of the invoice.

This $5,000 will be referred to as accrued revenue. This is because earnings and revenue have been recorded, but the payment is still pending.

The company will record it as a current asset in the balance sheet until the invoice is shared and the payment is received. Upon receipt of the payment, the company will record cash received in the balance sheet.

What is Deferred Revenue?

Deferred revenue, also called unearned revenue, is revenue the company receives before delivering a service or product. It reflects future obligations because it includes an upfront payment or cash received in advance. This type of revenue is recorded as a liability on the balance sheet.

It is the reverse of accrued revenue. So when you think over what is opposite to deferred revenue, it’s accrued.

It should be noted that deferred revenue gradually decreases when the company delivers the service or the product. It is because the same amount becomes the actual revenue. Deferred revenue is debited, and actual revenue is credited.

Deferred Revenue Example

Again, taking the above example of Moon Technolabs Pvt Ltd, we understand the deferred revenue. Suppose the company receives $1,000 from the client before delivering the app development service. The company received money in November but provided the service in December.

The $1,000 amount is recorded as a liability. Once the company delivers the project, it will become actual revenue and be recorded as a credit, while deferred revenue decreases.

Invoicing Is Now Simple With Moon Invoice

66+ customized templates, automation concept, and a complete invoicing solution for your business. Open the door & level up your invoicing!

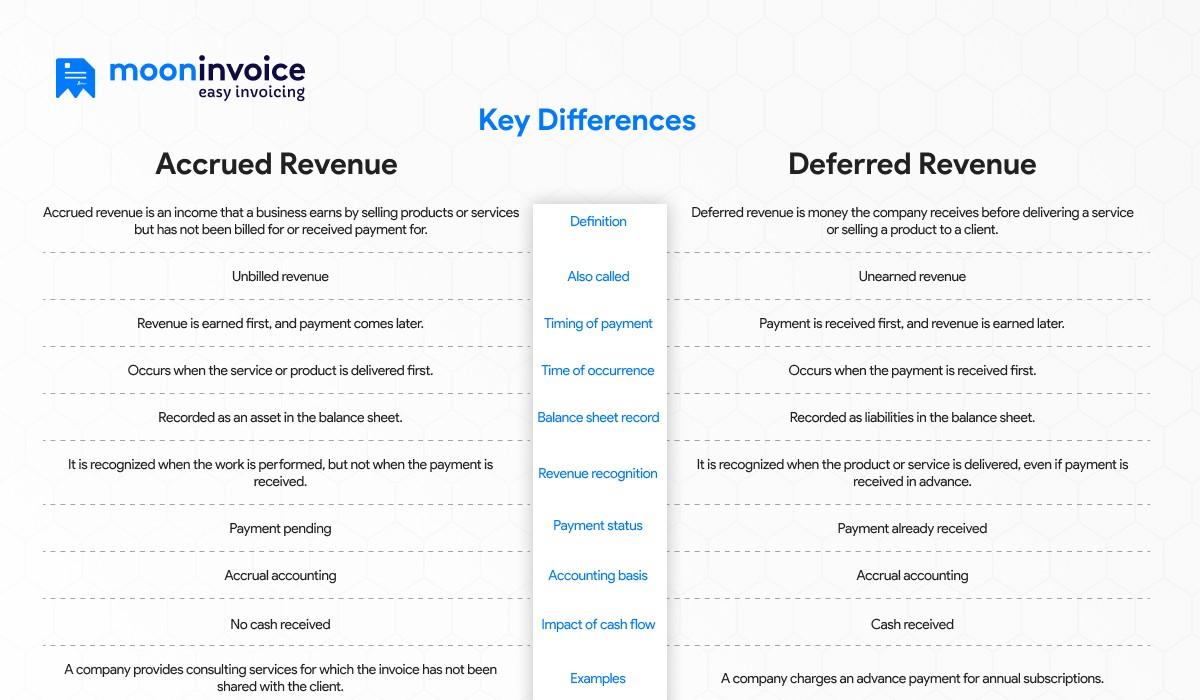

Key Differences Between Accrued and Deferred Revenue: Accrued vs. Deferred Revenue

Accrued and deferred revenue differ in many respects, and understanding the differences is essential to calculating revenue. Here is a tabular presentation of accrued revenue vs. deferred revenue.

| Comparing Features | Accrued Revenue | Deferred Revenue |

|---|---|---|

Accrued Expense vs. Deferred Expense

With defining accrued revenue vs. deferred revenue, we now define the differences between accrued expense and deferred revenue:

| Comparing Features | Accrued Expense | Deferred Expense |

|---|---|---|

💡Pro Tip:

Always pair and match revenue with its corresponding expense. Accrued revenue is matched with accrued expenses, and deferred revenue is matched with prepaid expenses.

Impact of Deferred & Accrued Revenue on the Financial Statements

With a deep understanding of the accrued revenue vs. deferred revenue, it is also important to understand how these terms influence the financial statements.

Any company’s balance sheet and financial reports include deferred and accrued revenue. Both affect the financial statements differently. Let’s see their impact here:

In the deferred revenue, cash is received first, and services and products are delivered later. It is recorded as a liability, not as an expense.

- In the balance sheet, there is no immediate effect on the equity until the revenue is earned. Once the revenue is received, liabilities increase, and cash also increases.

- In the income statement, deferred revenue is moved from the liabilities section to the revenue section. This is set to boost net income.

- In the cash flow statement, the received cash is recorded under operating activities. Therefore, there is a short-term boost to operational cash flows.

In the accrued revenue, the service or product is delivered before the payment. This revenue is earned but not yet collected or billed.

- In the balance sheet, professionals record accrued revenue as a current asset, under Accounts Receivable or Accrued Revenue.

- In the income statement, the revenue increases immediately & net income increases.

- In the cash flow statement, cash flow is reported under operating activities. The cash part increases once the customer makes payments.

Accounting Methods in Recognising Revenue: Accrual vs. Cash Accounting

There are two accounting methods for recognizing revenue:

1. Accrual Accounting

In an accrual accounting method, revenue is recorded when earned and expenses are recorded when incurred. It is regardless of the cash payment. It also follows the matching principle, which requires revenues to be matched with related expenses. Accrual accounting is ideal for larger businesses.

2. Cash Accounting

This cash basis accounting method only recognizes revenue & expenses when cash is exchanged. This kind of method is suitable for smaller businesses that prefer cash transactions. In this method, expenses are not recorded when they are incurred; instead, they are recorded when paid.

Best Practices to Follow for Managing the Revenue

Having the right knowledge of deferred vs. accrued revenue is crucial to recognizing revenue correctly. In addition, the following practices are important for managing revenue, helping maintain cash flow, and ensuring accurate financial reporting.

Defining Revenue Recognition Policies

Preparing and establishing proper revenue recognition policies is an important practice. These policies outline how & when to recognize revenue. Setting up policies helps minimize potential audit issues. However, experts must ensure that policies align with relevant accounting standards, such as ASC 606 and IFRS 15.

Reconciliation and Review

Reviewing recognition at regular intervals helps ensure the accuracy of financial data. One of the most effective ways is to compare recorded revenue with payment gateway records and bank statements. The process could be monthly or quarterly, as per the volume and complexity of the transaction.

Choosing the Best Accounting System

Utilizing an accounting system streamlines the process and helps manage revenue efficiently. However, you must ensure that the system offering advanced features aligns with your business’s complexity. Seamless integration, automation, AI-powered, and real-time analysis are key elements to look for when choosing a system. One can reduce manual work and improve many aspects, including the revenue schedule, through automation.

How to Manage Accrued and Deferred Revenue Using Moon Invoice?

Moon Invoice is the best online invoicing software, offering a one-to-one accounting solution. It helps businesses manage their revenue efficiently through digital invoicing, recurring billing, and real-time business & financial reports.

Managing Accrued Revenue

As with accrued revenue, services are delivered to the client, but the bill is still pending. Professionals can handle such revenues by creating & drafting a digital invoice. Once the invoice is generated, record it as revenue in your system. Once the customer makes the payment, record it.

Managing Deferred Revenue

Because deferred revenue includes an upfront payment, professionals can record it via the Add Payment option. Once you provide the service, issue an invoice.

Another key feature of Moon Invoice:

- Real-time Insights: Professionals can easily access real-time insights to evaluate data better.

- Recurring Invoices: It is simple to set up recurring invoices for ongoing services, such as a subscription under which services are rendered. This also eases the revenue recognition.

- AI-Powered: Moon Invoice is an AI-powered system that automatically extracts data from a receipt or invoice.

- Expense Management: Professionals can streamline their expense management with a comprehensive digital solution.

- Automate Recurring Billing: Professionals can easily automate recurring billing. This ensures correct & on-time billing, which also impacts revenue recognition.

- Project-Based Billing: Moon Invoice is a helpful platform for managing projects. Professionals can easily track their billable hours using the time tracker.

Take Control of Your Business Expenses

Choose Moon Invoice and elevate your expense management to the next level. Stay organized, stay profitable!

Wrapping Up

Understanding and correctly identifying accrued vs. deferred revenue is a crucial concept for professionals to ensure they are on the right track with revenue recognition. It represents a clear picture of current financial performance and helps make the right decisions about business expansion, pricing strategy & resource allocation. Additionally, accurate financial statements attract new investors and retain existing investors.

Streamlining your business finances is one of the key steps to advancing your profession. Want to experience it? Sign up for Moon Invoice now.