ACH withdrawal is playing a significant role in making our lives easier in terms of fund transfer. The ACH payment method also has lower processing fees in comparison to credit or debit cards. That’s why modern businesses love ACH withdrawal over other traditional payment methods.

If you are running your own business and are soon planning to accept ACH payments, then you should be aware of the ACH withdrawal meaning, benefits, as well as pitfalls. Here, we will discuss what is an ACH Withdrawal, the process, pros, cons, and everything you need to know.

What is an ACH Withdrawal?

An ACH withdrawal or ACH debit is a process of transferring funds from one bank account to another electronically.

Here, the ACH stands for Automated Clearing House, which works as a mediator to send or receive money from a bank account without any paperwork.

So, basically, it’s an electronic withdrawal method governed by NACHA (National Automated Clearing House Association) in the US.

Individuals and small businesses prefer ACH withdrawal (ACH debit & ACH credit) when it comes to accepting payments from their clients. ACH withdrawal is also widely popular in making recurring payments like employees’ payroll, utility bills, and others.

Now, after learning what is an ACH withdrawal from a bank, let’s unwind the ACH withdrawal process.

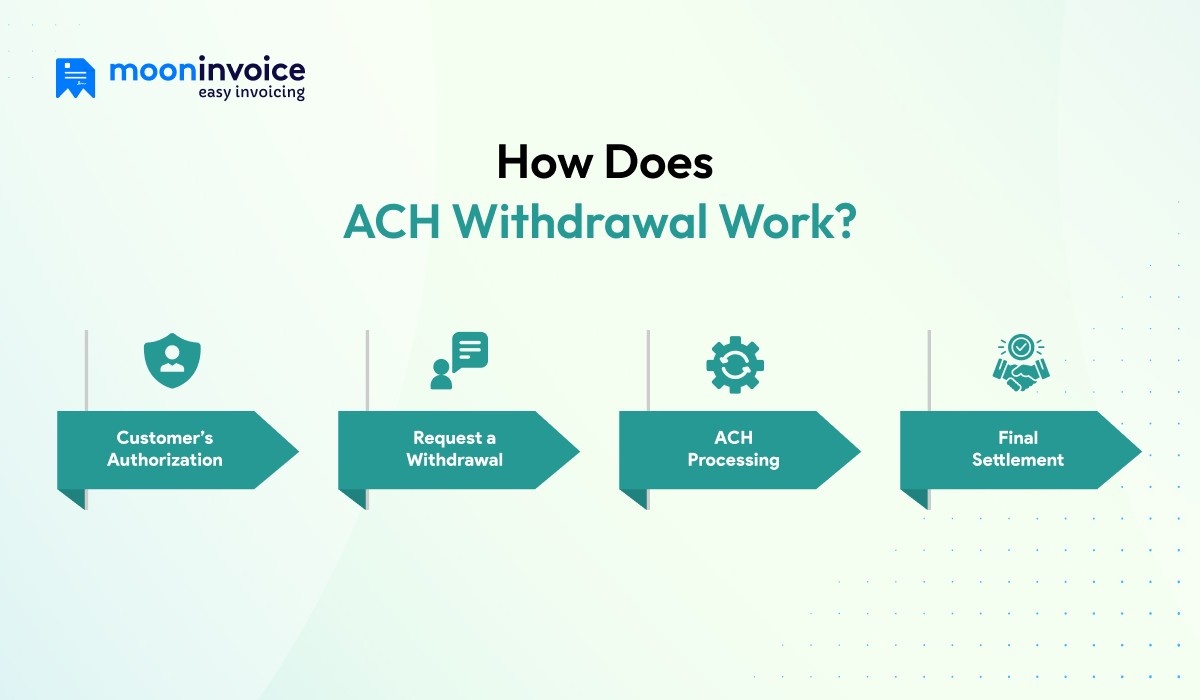

How Does ACH Withdrawal Work?

From authorizing the transaction to final settlement, ACH withdrawals typically follow a 4-step process. Let us check it out in detail.

1. Customer’s Authorization

The first step involves authorization from the customer, where they give permission for funds to be withdrawn from their account. They need to submit the details like bank account number, routing number, amount, and payment schedule in a signed form. This is much like a customer giving their consent to withdraw the funds.

Once authorized, the details are kept for the business’s internal records to address disputes that may arise in the future. The same details may also be requested by the bank for in-depth verification.

2. Request a Withdrawal

Since the customer has already authorized the transaction, you can initiate the withdrawal process. Submit the ACH details, like account information and withdrawal amount, to the respective bank via a payment processor, and in a way that complies with NACHA operating guidelines.

As soon as your ACH file reaches the bank, they verify if it is authorized and later pass it on to the ACH network for quick processing.

3. ACH Processing

At this stage, the ACH network takes over the matter and adds the ACH withdrawal to its queue. Later, the transactions in the queue are then processed on working days only. This means if a withdrawal is made on late Friday, then it is likely to get processed on Monday morning.

The processing may take around 2-3 days. But, in case you want same-day ACH processing, you need to pay an additional fee. Upon receiving the nod from the ACH operator, the bank takes the necessary steps to debit the amount from the customer’s account.

4. Final Settlement

Lastly, the settlement is done by moving the funds from the customer’s bank account to your bank account on the final settlement date. Customers will get notified about the funds withdrawal and reflect the same on their bank statement. Once the funds are transferred into your account, you will also receive a notification from the financial institution.

However, if there are insufficient funds in the customer’s account, you wouldn’t receive the money, and the sender’s bank may take necessary action in the form of a penalty.

ACH Withdrawal: Pros and Cons

Now, let’s first understand what an ACH withdrawal means for your business by looking at its pros and cons.

Pros

- User convenience: It offers unmatched convenience to the account holder, who wants to send to another party. They can send or receive money electronically without stepping out of their house.

- Cost: ACH transfers have lower processing fees, making them a cheaper option for individuals or businesses to accept payment. The sender or receiver isn’t required to spend hefty fees like wire transfers.

- Better security: Since ACH debit transactions rely on the secure ACH network, there are very less chances of fraudulent activities. This makes it a reliable payment option over checks and cash payments.

- No paperwork: There isn’t any paperwork involved in ACH processing, offering respite from the tedious manual entries. This means the sender’s account details are more accurate, and they can transfer the money with peace of mind.

- Safety-first approach: While it may take some days to settle your funds, you get an opportunity to quickly check and confirm that there is no involvement of fraudsters. In case you have concerns, you can reverse the funds as well.

Cons

- Longer processing times: ACH transactions will take around 2-3 days to complete the funds transfer process, which might be frustrating for merchants and may lead to cash flow issues. For same-day processing, they will charge an extra fee.

- Insufficient fund risks: It carries a risk of insufficient funds, which could further delay the payment. If the account holder fails to maintain a sufficient balance, they might have to pay penalties. So, it’s a big risk factor associated with this payment method.

- Domestic-only: The main drawback of ACH payments is that they work only within the US and are not suitable for international transfers. You may have to look for other options, like international wire transfers, when making cross-border payments.

- No immediate confirmation: An ACH operator doesn’t usually provide quick confirmation to debit the funds from the customer’s account. So, if you need an instant payment to resolve cash flow issues, this might not be a suitable payment method.

How to Make an ACH Withdrawal

So, you are ready to make an ACH withdrawal for the first time? Alright, let us help you out.

- Enable withdrawals: Register with an ACH service provider or use invoicing software that adapts to your payment needs.

- Obtain customer consent: Approach your customers and get their written authorization to withdraw funds directly from their accounts.

- Enter account details: Add ACH routing number, account holder name, bank name, and other required details into the ACH payment processing tool.

- Process the request: Initiate the withdrawal request for either a one-time payment or recurring payments, based on the agreed-upon terms.

Once you have processed the request, the bank and the ACH network will start the vetting process. The amount will then be deposited into your account, and you will be notified about the same.

Are ACH Withdrawals Safe?

The short answer is yes, ACH Withdrawals are slightly safer than other popular payment methods.

The real concern is that there are also chances of scammers trying to take advantage of this convenient payment method. Some fraudsters may trick people into pulling out their accounting details and obtain the funds without the account holder’s consent. And that’s what keeps us wondering if ACH withdrawals are really safe.

But ACH processing relies on the highly secure ACH network, which is responsible for fraud monitoring and providing a safety net for customers and merchants.

In addition to that, NACHA also imposes stiffer operating rules that should be followed by everyone involved in the process. Such rules and regulations help them keep the scammers at bay. Still, one can’t say confidently how safe ACH payments are.

Automate ACH Payments With Moon Invoice

In case your existing ACH system steals your time in processing payments, you can consider automating ACH payments with a sophisticated invoicing tool, Moon Invoice.

Designed to empower businesses like yours, Moon Invoice is your go-to invoicing and payment solution. Create invoices with AI-powered features and attach any online payment method of your choice, including ACH transfers. As a result, you get paid on time and keep operating your business normally.

With 20+ payment integrations, Moon Invoice frees you up from lengthy paperwork and helps you stay on top of the payments.

Moon Invoice has every feature your businesses need to amplify growth. Take a look.

- Customizable invoice templates

- Estimates and proforma invoices

- AI-powered receipt scanner

- Cashless payments

- Credit notes

- Expense management

- 15+ business reports

- Bank reconciliation

- Cloud storage and more

Get Paid Without Lifting a Finger

Try Moon Invoice, which works as hard as you do and ensures on-time payments so you don’t have to face cash flow problems.

Conclusion

Although ACH on demand payments offer zero paperwork and lower processing fees, foolproof security is still a concern for many users. On top of that, ACH withdrawal times are longer than usual, which means you aren’t getting paid instantly.

This could be a real trouble for merchants facing constant cash flow challenges. Therefore, looking for a secure and reliable payment solution is no longer optional but has become a necessity for every growth-oriented business. Adopt one powerful tool to centralize your important data and fulfill your invoicing and payment requirements.