Managing a business is not that easy. It needs careful planning to identify future opportunities & success. The most useful financial tools for such practices are budgeting and forecasting activities.

Usually, these two terms are used interchangeably in the financial process. However, they are different in their way. Budgeting is the process of creating a financial plan, whereas forecasting is the process of predicting future financial outcomes.

This is just brief information. The detailed knowledge of the difference between forecast and budget is hidden in this guide. So read the words and enhance your understanding.

📌 Key Takeaways

- Budgeting aims to create a financial plan and help control spending.

- Professionals better understand cash flow through budgeting.

- Financial forecasting is useful for determining the company’s budget allocation approach.

- Budgeting and forecasting are both helpful for the business in performance evaluation, measurement, and strategic planning.

- The key components of budgets are debt reduction, fixed costs, and variable costs.

What Is Budgeting?

Budgeting is a systematic process through which a business or organization plans its finances. Thus, it outlines how the organization, business, or individual earns and spends over a specific period of time.

In short, it presents a clear structure of income and expenditure flow. This helps the business plan & control its expenditure, resource allocation & utilization to achieve its financial goals.

Setting up a budget requires historical financial data on sales and expenses. A typical budgeting process begins with setting financial goals. Once it is done, the next step is to collect historical data, followed by estimating income & expenses. The team then prepares a budget document, which is reviewed by higher authorities.

The budgeting process is performed once a year. However, the process varies from business to business due to different work nature and financial goals.

Budgeting Advantages

- Business leaders can easily make clear decisions for better financial management.

- It also ensures that the resource allocation is correct.

- Professionals can easily control their overspending and maintain financial discipline.

- Performance analysis becomes easy with the right budgeting.

😲Surprising Fact:

In the USA, many people have minimal savings. About 69% of Americans have less than $1,000 in total savings, and about 34% don’t save any money.

What Is Forecasting?

Forecasting is a process by which business professionals analyse the past and present metrics. This practice is useful in predicting their future performance in terms of demand, sales, and expenditure.

Unlike budgeting, a financial forecast can be short-term (2 or 3 months) or long-term (a full fiscal year). The primary purpose of budget forecasting is to provide a better estimate of what will happen in the future.

Business leaders can easily gain more accurate predictions by developing rolling forecasts that incorporate market trends and real-time data.

Cash flow data, income statements, and balance sheets are crucial for creating financial forecasts.

Forecasting Advantages

- Forecast in accounting helps make informed decisions.

- Business professionals identify the financial issues and challenges in advance.

- Aligning the financial projections with the long-term business strategies.

- Predicting future inflows and outflows helps professionals identify the right time to invest.

Is It Difficult to Handle Your Business Finance?

It’s time to simplify it with Moon Invoice! Digitalize your business estimates, expenses, and cross-check them.

Budgeting Vs. Forecasting: Differences Between Budgeting and Forecasting

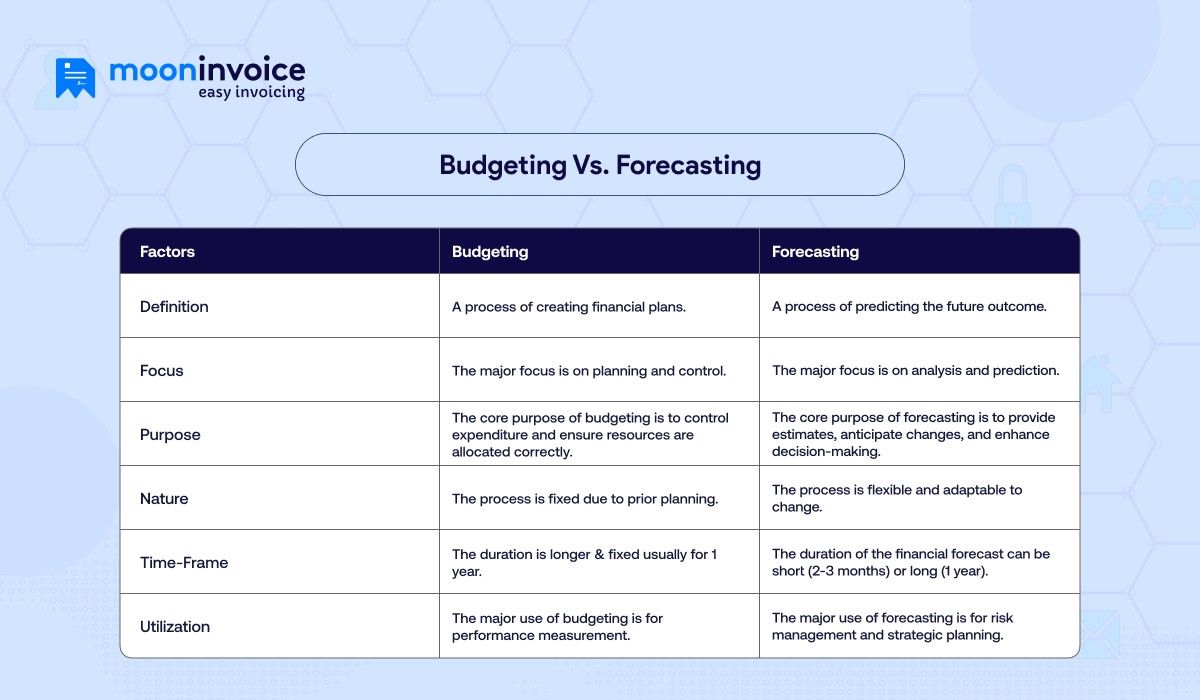

After a deep understanding of the meaning of budgeting and the forecasting process, we now come to our core topic: their comparison. The core factors that differentiate these two terms are purpose, nature, time frame, etc.

Here is the tabular form of budgeting vs forecasting, presenting the clear comparison on the various key points:

| Factors | Budgeting | Forecasting |

|---|---|---|

💡Pro Tip:

Business professionals and the finance team can boost the estimation process using the online estimate maker. Its digital concept also prioritizes accuracy and helps save a significant amount of time.

Common Challenges With Budgeting & Forecasting

You might encounter certain challenges while performing budgeting and forecasting. These issues are associated with data, process speed, and inefficient financial plans.

Here are the key challenges:

Information Gathering

Collecting data is a necessary part of forecasting and budgeting. However, in some cases, it takes a longer time due to the unavailability of a proper source. Hence, it affects the overall process and delays it.

Outdated & Inaccurate Data

It is a big challenge that adversely impacts the process. The major causes of expired data are human errors or incorrect sources. Yet it disrupts the entire cash flow process, slowing it down. An improper accounts payable process is also a major cause of inaccurate data.

Lack of Flexibility

Market conditions are subject to change. Businesses often face unexpected expenditures and new opportunities. However, when the business possesses rigid financial plans, it is difficult to adapt and align with these changes.

Lack of Automation & Tools

Automation is a core part of every industry, streamlining overall operations. The same applies to budgeting and forecasting. The lack of automation and online tools leads to errors in the process and prolongs it. Also, using fragmented tools causes issues.

Miscommunication

Inappropriate collaboration among team members also negatively affects budgeting & forecasting. The major consequences are poor decision-making, insufficient data, and inefficient resource allocation.

Best Practices for Budgeting and Forecasting

While incorporating the following practices, one can easily cope with the above issues:

Reviewing & Updating Regularly

Forecasting and budgeting are ongoing processes that must be reviewed and updated regularly. It might be monthly, quarterly, or even yearly. Regular reviews keep the process aligned with current market conditions, which is vital to the business’s financial performance.

Establish a Clear Communication

To prevent confusion and other issues, one should always establish clear communication. Professionals should establish a clear communication channel and hold regular meetings to keep all parties involved informed. Proper execution occurs when everyone understands the business plan and goals.

Always Focus & Use Up-to-Date Data

Information & data play the key role in budgeting & forecasting. Latest & up-to-date information cuts down the risk of underestimating expenses and overestimating revenue. Therefore, one should always focus on the accuracy of information.

Incorporate Technology and Automation

Using forecasting software and automation concepts reduces human errors and speeds up the process. It streamlines overall operations and enables professionals to gain real-time, accurate insights that further add value.

Example of Budgeting and Forecasting

After exploring the real meanings and differences between budgeting and forecasting, we now understand a real-life example.

Suppose a software company, Moon Technolabs Pvt Ltd, develops human resources management software and hotel management software.

The company creates the budget for the next fiscal year. Therefore, the company’s budget is as follows, covering revenue target, planned expenses, & profit goal.

Budget vs Forecast Example

Revenue target: $2,500,000

Expenses

- Salaries (development & support): $900,000

- Office & utilities: $15,000

- Marketing & sales: $200,000

- Software hosting & license: $180,000

- Miscellaneous: $60,000

Total: $1,355,000

Profit goal: $1,145,000

Once the above budgeting is prepared, the company now focuses on the budget forecast for the first quarter of the fiscal year. The company experienced a hike in the following expenses:

- Office & utilities: $20,000

- Marketing & sales: $250,000

Therefore, the revenue target, expenses, and profit goal will be as follows:

- Revenue target: $2,500,000

- Total expenses: $1,410,000

- Profit goal: $1,090,000

Why Are Budgeting and Forecasting Both Valuable for a Business?

Planning, budgeting, and forecasting are growth contributing factors for the business. The roles of both terms are quite different but vital for creating a financial planning roadmap, obtaining real-time insights, and measuring progress.

Budgeting helps establish financial goals and keeps spending under control. Additionally, it helps manage rapidly fluctuating market conditions. Business professionals get a clear picture of how to allocate resources efficiently to achieve goals more effectively.

Financial forecasting, on the other hand, is vital for predicting upcoming financial outcomes. Also, effective forecasting enables professionals to identify and manage risk early. It is also helpful in managing business progress and ensuring it is on the right track.

Both budgeting and forecasting affect the financial reporting process.

Automate Your Finances with Moon Invoice

Get 100% accuracy for informed decision-making. Ease your forecasting while eliminating financial guesswork!

Wrapping Up

A business financial baseline can only be strong when budgeting and forecasting go hand in hand. Therefore, one should always handle both processes wisely. Additionally, a better understanding of the difference between a forecast and a budget is crucial for professionals to manage effectively.

Using online tools like Moon Invoice can refine the overall process. It enables professionals to manage their expenses digitally, providing real-time insights and accuracy. Moreover, professionals can get a clear picture of incoming and outgoing payments.

Do you want to experience it? Free Sign Up available!