There are no tasks in the world that one can say are easy to accomplish. However, we bet you will rarely see a task as complicated as the accounts payable process.

In business, managing finances effectively is essential for long-term sustainability and growth. Among the many financial processes that companies rely on, Accounts Payable (AP) is one of those.

According to The Business Research Company, automated accounts payable processes are more likely to grow in the coming years. It is projected to rise by approximately USD 11.8 billion by 2029, with a CAGR of 21.4%.

This means that businesses are slowly but steadily adopting automation as the new normal. An automated accounts payable process will speed up the accounting work and help you get paid on time.

In this blog, we will explore what the accounts payable process means, its importance, key components, common challenges, and how an automated accounts payable process helps businesses grow.

So, let’s get started!

📌 Key Takeaways

- The accounts payable process ensures timely, accurate payments while maintaining proper financial records.

- A well-structured accounts payable system helps avoid late fees, supports cash flow planning, and builds trust with suppliers.

- Issues like manual data entry, lost invoices, and approval delays can be fixed with automation.

- Standardizing processes, automating tasks, and monitoring performance can transform the accounts payable process.

- Tools like Moon Invoice simplify your accounts payable process, helping your business scale with ease.

What is the Full Cycle Accounts Payable Process?

The accounts payable process is the method by which a company pays what it owes to the vendor or supplier. It starts with a company receiving a bill or invoice for goods or services and concludes when payment is made and recorded in the accounting system.

This process requires a number of important procedures to be followed through, such as validating the invoice, comparing it with purchase orders and delivery receipts (a process more commonly referred to as a three-way matching), obtaining approvals, and scheduling payments, keeping financial records in order, etc.

The goal is to pay vendors accurately, timely, and in accordance with internal policies and external regulations.

The AP process includes:

-

- Purchase Order Creation

- Receipt of Goods and Services

- Invoice Receipt and Verification

- Three-Way Matching

- Approval Workflow

- Payment Processing

- Recording the Transaction

We will understand all of these processes in detail in the section “Components of the Accounts Payable Process”.

Still Managing a Slow and Inefficient Payment Processing?

Say goodbye to manual headaches and late payments. Try Moon Invoice and experience faster approvals, smarter tracking, and seamless vendor payments.

Difference Between Accounts Payable and Other Similar Terms

To understand the accounts payable process clearly, it’s important to differentiate it from similar financial terms:

1. Accounts Payable vs. Accounts Receivable:

Accounts Payable and Accounts Receivable may sound similar, but have different use cases in the finance of a business. The Accounts Payable (AP) indicates the money a business will pay to its vendors. On the other hand, Accounts Receivable (AR) means the money customers will pay to the business for receiving goods and services.

2. Accounts Payable vs. Trade Payables:

Now, another term similar to accounts payable is “trade payables.”

In finance, trade payables come under accounts payable and directly refer to amounts owed for inventory-related purchases (i.e., raw materials, finished goods, etc.). Accounts payable, on the other hand, can include other purchases such as office supplies or utilities.

3. Accounts Payable vs. Accrued Expenses:

Some businesses consider accrued expenses similar to accounts payable; however, in reality, they are distinct.

Accounts payable are recorded once the invoice is generated. However, accrued expenses are recorded if the company incurs an expense without receiving an invoice.

Understanding these distinctions is crucial for accurate financial reporting and analysis. The AP process does more than ensure bills are paid on time. It directly impacts a company’s reputation, financial stability, and operational efficiency.

Components of the Accounts Payable Process

The accounts payable (AP) is an end-to-end process that guides a business on how to pay its suppliers in a manner that will be both efficient and beneficial.

Every component of the AP process is essential to maintain financial integrity and operational continuity. By the end of a financial year, you also need to perform accounts payable reconciliation strategies to ensure there are no mishaps in the accounts department.

Here are the steps in the AP process, each done in order:

1. Purchase Order (PO) Creation

The accounts payable procedure begins when a department or a business requires goods or services.

A purchase order (PO) is created and sent to the vendor. This document includes key details such as:

-

- Description and quantity of the items

- Agreed-upon prices

- Delivery date

- Payment terms

The PO serves as a formal agreement and internal record for the transaction.

2. Receipt of Goods or Services

The receiving department checks the goods or services are being received after receiving the goods or services from the supplier.

A receiving report or proof of delivery is generated to confirm:

-

- Quantity received

- Condition of items

- Any discrepancies from the PO

This step ensures that the organization only pays for what was actually received.

💡Pro Tip:

Set up automated payment reminders and approval alerts within your AP software. So, what are you waiting for? Create your first receipt with the free online receipt generator now!

3. Invoice Receipt and Verification

The vendor submits an invoice to request payment.

The invoice should include:

-

- Vendor information

- Invoice number and date

- PO reference

- Itemized charges

- Total amount due and due date

When received, the AP department enters the invoice into the system and prepares it for verification in the next step.

4. Three-Way Matching

-

- Three-way matching is a critical internal control step that compares three documents:

-

- The purchase order

- The receiving report

- The vendor invoice

-

- The intention is to check quantity, price, and terms before you sign it off.

- If discrepancies are discovered (overcharge, missing items), the AP team needs to address them before further processing.

- Three-way matching is a critical internal control step that compares three documents:

5. Approval Workflow

-

- If the three-way match is verified successfully, the invoice proceeds through the approval chain.

- You may need various approval levels depending on the organization’s policies, such as:

-

- Invoice amount

- Type of purchase

- Departmental budget

-

- Modern AP systems can route invoices automatically to the right approvers.

6. Payment Processing

-

- Now, in this step, the invoice is queued for payment based on the due date if it is approved.

- There are various methods that can be considered to make a payment, such as:

-

- Bank transfer (ACH)

- Checks

- Digital Payments/UPI

- Credit cards or digital wallets

-

- The AP team ensures that payments are processed securely, recorded accurately, and completed within the agreed terms.

7. Recording the Transaction

-

- Upon payment, the transaction is posted to the company’s general ledger.

- This includes updating:

-

- The accounts payable account (decreasing liability)

- The cash/bank account (reducing the company’s cash balance)

-

- A reliable and consistent record-keeping helps in financial reports, audits, and decision-making.

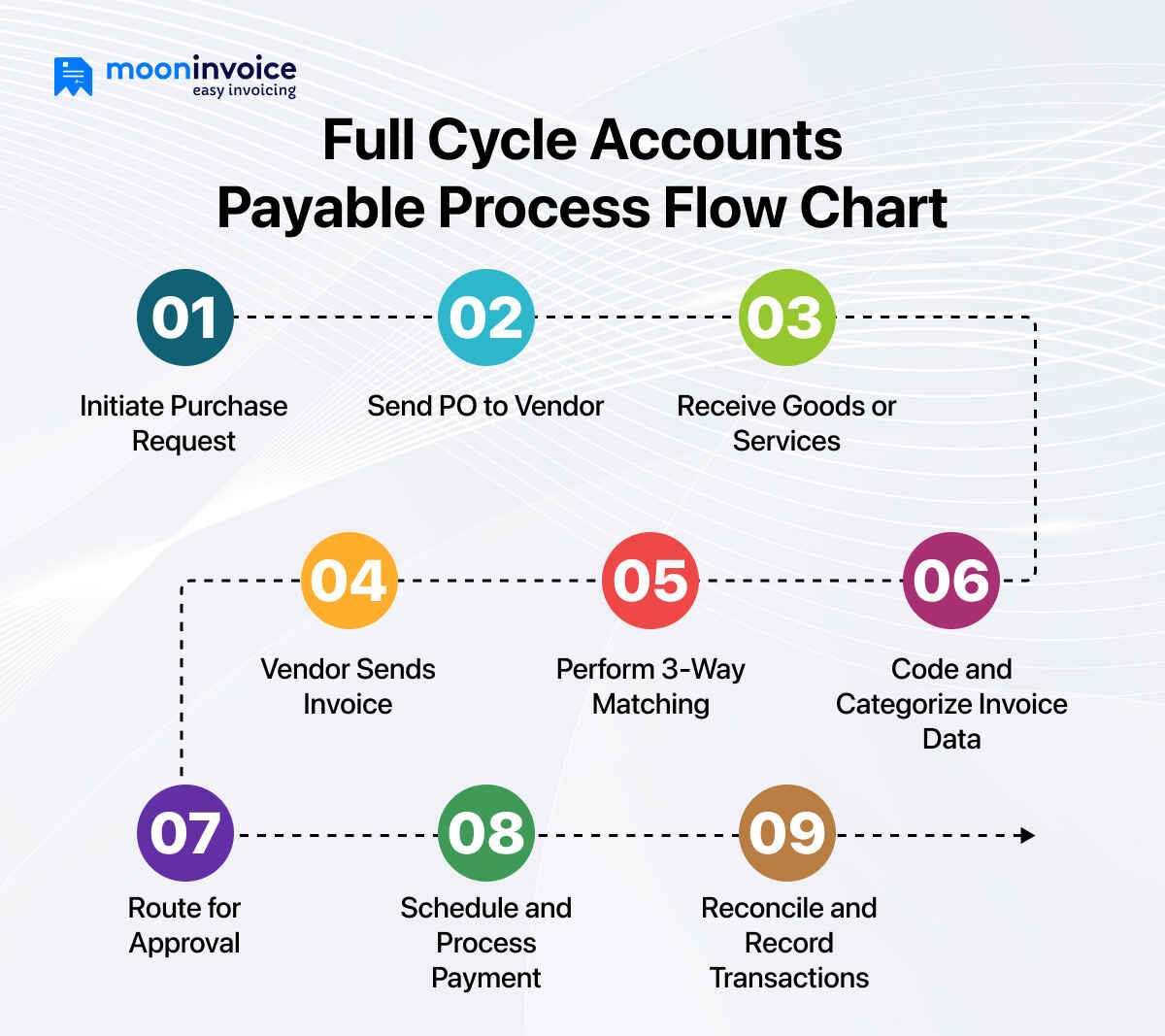

Full Cycle Accounts Payable Process Flow Chart

The accounts payable process flow chart includes 9 steps. It starts with “initiating a purchase request” and ends with “reconcile and record transactions.”

Let’s understand the full cycle accounts payable process flow chart here.

Importance of Accounts Payable Process

Consider your accounts payable process the invisible engine that powers your business. And it’s not just about paying the bills. It’s about keeping suppliers happy, managing cash wisely, and positioning the company for long-term success.

Let’s explore the importance of the accounts payable process to run a successful business.

1. Keeps Payments On Time and Accurate

Those late fees (or unhappy vendors) can be frustrating. An efficient AP process means that your suppliers have paid the correct amount on time, every time. In fact, with the right accounts payable automation software, you can automate the tracking of due dates, your approval processes, and even payment scheduling. Less stress, fewer mistakes.

2. Builds Trust With Your Vendors

Your vendors act as more than just providers; they’re your partners. Consistent, timely payments build trust, reinforce your reputation, and the relationship you have with the supplier. It can even have side benefits like improved payment terms or VIP-level treatment. Having a trustworthy AP system allows you to avoid the awkward errors or delays in payments that can damage the buyer-vendor relationship.

3. Helps You Stay on Top of Cash Flow

Poor cash flow management could end your business in no time. Between best-tier AP practices and invoice processing, your finance team has the necessary visibility and control over what’s going out when. That means you can strategically plan your payments, forecast future expenses, and maintain a healthy working capital.

4. Cuts Down on Errors and Red Flags

Manual workflows can introduce errors like double payments or forgotten invoices. Worst, there are fewer chances of fraud detection. A robust AP system adds layers of protection to your finance workflow. From approval rules to three-way matching, it ensures you catch issues before they turn into making your payment.

5. Makes Reporting and Compliance a Breeze

If your AP process is strong, every transaction is accurately documented within your system. That makes your reports more trustworthy and your audits a whole lot easier. Lots of tools connect directly to your online accounting software for more efficiency and less compliance stress.

6. Scales With Your Business

As your business expands, your AP volume will also grow as well. Automating the accounts payable process not only cuts down on day-to-day work but also sets your team free for more strategic tasks, such as negotiating with vendors or adding cash flow strategies. Manual processes make your business slow.

6 Common Challenges in the AP Process

The accounts payable process may sound simple enough: a company receives a bill, approves it, and pays it, but in reality, it is more complex than it sounds.

Many organizations, particularly those that still rely on manual procedures, face a lot of problems that slow down productivity or result in costly errors.

To avoid minor mistakes, you can check key accounts payable metrics and address the areas of concern.

Here are some common pitfalls that can impact even the best accounts payable team:

1. Manual Data Entry and Human Error

Manual data entry is one of the biggest challenges of the accounts payable process flow. Think about typing every date, number, amount, and vendor information by yourself; isn’t it time-consuming?

One error can spell disaster, especially if it is about the amount. Plus, time delays don’t help in having a good relationship with the vendor, either.

No matter how good your accounts payable team is, depending on manual tasks results in an error-prone workflow.

2. Lost or Misplaced Invoices

Invoices can arrive via multiple channels, such as email, mail, or occasionally hand-delivered, and there is a high chance that they can get lost in the shuffle. If there isn’t a system that is tracking the status of invoices, it becomes a guessing game. The risk of missing payments or entering a duplicate invoice becomes higher.

3. Bottlenecks in the Approval Process

There are countless businesses that experience delays in their approval process for the sole reason that they have to wait for invoices to be approved by several people, and not everyone is there all the time. When someone is out of the office or unsure of their role, the invoice can languish for days or weeks.

That visibility and accountability void slows your accounts payable cycle and may result in late payment penalties or lost early-payment discounts.

4. Fraud and Security Risks

The AP process, unfortunately, can easily catch fraud activity if not managed properly. Fake invoices, vendor impersonation, or unauthorized payments can sneak past without being noticed. A business without a centralized system in place could lead to financial loss and reputation damage.

5. Poor Vendor Communication

If vendors/suppliers are not paid on time, they may refuse to provide goods or services, charge late fees, or escalate the matter. Most of the time, these headaches can be prevented if their payment status and queries are resolved.

6. Lack of Reporting and Insights

Without the right tools in place, it’s challenging to determine where your money is going – or how efficient your accounts payable process truly is. Are we getting paid fast enough? Are there too many that are exceptional or rejected? Which bottlenecks loom largest? Without automated reporting capabilities, it isn’t easy to optimize or expand your operations.

The challenges in AP are very real, but they are not insurmountable. Once you have the right systems in place and a strong accounts payable team, running operations smoothly can be a breeze.

💡Pro Tip:

Set up automated payment reminders and approval alerts within your AP software. This simple step can drastically reduce late payments, keep your team on track, and help you take advantage of early payment discounts.

How to Simplify AP using Automation Software?

When the right tools are available in the market, don’t be afraid to run your business manually. Accounts payable systems or tools like Moon Invoice help you speed up approvals, remove long spreadsheets filling, and keep you on top of vendor payments without any hassle.

Here’s how Moon Invoice can help you manage your accounts payable process:

-

- AI-enabled Invoicing: Reduces invoicing overhead and helps you invoice 2x faster

- One-Click Approvals: Set up custom approval workflows to avoid delays and reduce paperwork.

- Real-Time Payment Tracking: What’s paid, pending, overdue – check everything at a glance.

- Seamless Integration: Sync with accounting software, bank accounts for smooth record keeping

- Custom Alerts and Reminders: Get notified about due payments, low cash flow, or missed approvals

- Cloud-Based & Mobile-Friendly: Manage your AP process on the go, anytime, anywhere.

Your entire AP process can be simplified once you use Moon Invoice in your workflow.

Control Your Business Finances Your Way!

Managing payables doesn’t have to be complicated. Automate your accounts payable process with Moon Invoice and keep your cash flow, vendors, and books in perfect sync.

In Short!

Effectively managing accounts payable forms the foundation of good cash flow, strong vendor relationships, and avoids expensive mistakes.

When you understand the steps, issues, and best practices, you can optimize your company’s accounts payable process seamlessly. You can use automation to accelerate and enrich financial decision-making.

Moving to an automated system for handling accounts payable increases efficiency and gives more time to do some strategic work.

So, are you ready to streamline your AP operation and empower your cash flow?

Check out Moon Invoice — your one-stop solution offering a 7-day free trial for new users.