A company’s accounting department may issue either a debit or credit note, each of which has its unique function and audience. Therefore, having a firm grasp of the differences between Debit note Vs Credit notes is essential in any organization that regularly works with either situation. In addition, the Seller’s and the buyer’s interpretations of the terms may differ.

These are not the same as invoices, but they are used for the same purpose: to inform buyers and sellers of the balance owing by purchasers and the remaining credit available to sellers. In addition, they’re crucial for keeping tabs on overdue payments and deliveries.

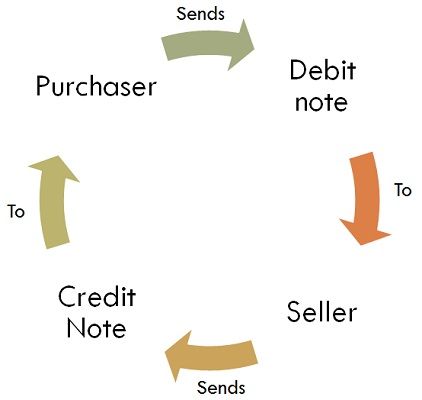

A debit note and credit note are frequently provided when consumers return products to sellers or providers of the goods above.

So, let’s begin with the exclusive read to know the difference between a Debit note Vs Credit Note.

What is Debit Note?

A debit note, sometimes known as a voucher, is a document one party sends to another indicating that the recipient’s account has been debited in the issuer’s books.

The Buyer will compile and send the Seller with a debit note and a debit note reflects the sum debited from the company account and the reasons for the same. The document alerts the Seller that a payment has been deducted from his account in the purchaser’s ledger.

Why is Debit Note Issued?

The businesses generate debit note using a quick invoice generator for the following reasons:

- Seller also gives debit notice upon receipt of returned products.

- It is customary for the customer to notify the Seller through debit notice of any overcharges made to his account.

- When a customer undercharges a seller’s account, the result is a debit notice from the buyer.

The Seller sends the purchaser a credit note as payment for the Debit Note. A blue pen is generally used to pen it down. As a result, receivables often decrease when a Debit note is issued.

Take the case of the business “Amazing LLC,” which purchases vendor “Mega LLC.” After receiving the materials, Amazing LLC discovers that the shipment contains faulty items worth Rs. 50,000. As a result, unique LLC must now reduce the liability on its balance sheet as payment due to creditor Mega LLC. Amazing LLC thus sends Mega LLC a debit notice for Rs. 50,000, indicating that he debited Mega LLC’s account in their records.

Credit Note Definition

A credit note is a kind of notification used by sellers to inform buyers that they have been awarded credit. The term “credit memo” may be used interchangeably with this term. A seller may provide a credit note in the event that they need to reject an invoice in whole or in part.

It is not a form of payment in and of itself but may be used to reduce the amount owed on a previously issued invoice.

What is a Credit Note Used For?

Credit notes are given for the following reasons using a credit note template:

- Buyer provides credit note when he overcharges Seller’s account.

- A credit note is also provided when the supplier receives the products he originally supplied to the customer.

- If the Seller undercharged the buyer, he might also request a credit note by sending one.

- The issuance of a credit note shows the reduction in account payables. In most cases, a negative value is displayed.

If you are using credit note management software or invoicing software online following image would make things easier for you.

Generate Quick Credit Notes Online

Start filling out the readymade credit note template and issue it online!

To What Extent Should a Credit Or Debit Note be Kept?

There is a 72-month retention period beginning on the day the annual return for the year in question is due. This includes both credit and debit note information.

Where such records are stored manually, copies should be retained at each location listed on the registration certificate. Likewise, electronic documents should be accessible from each site listed on the registration certificate.

When you use invoicing software online, these records are kept permanently until you delete them.

Difference Between Debit Note Vs Credit Note

Credit notes are used to keep track of money owed to you by a customer due to a downward revision in an invoice. In contrast, debit notes are used to keep track of money owed to you by a client due to an upward revision in an invoice.

A debit note is created and applied to accounts receivable when goods are returned for a refund after purchase. In contrast, a credit note is developed and applied to accounts payable.

There is no time restriction on issuing a Debit Note or Credit Note. However, the issuance of a Debit Note or Credit Note must also be reported in the GST returns submitted for the same calendar month.

In addition, there is a deadline by which information must be included in the GST return.

| Particulars | Debit Note | Credit Note |

|---|---|---|

| In general meaning | Customers who are dissatisfied with the purchased item may request a refund by issuing a debit note to the Seller. The cause for the merchandise return is detailed on a debit note. | The supplier of goods provides a credit note to certify that the purchased return is acknowledged. |

| How it impacts the accounting books? | Sellers’ account receivables are reduced as a result. Debit in Supplier Account & Credit in Purchase return Account |

It lowers the buyer’s accounts payables. Debit in Sales return account and Credit in Customer Account |

| Who can issue them? | The buyer of the products issues it. | The vendor of the products issues it. |

| Colour Coding in accounting language | They are issued using blue ink. | They are issued using red ink. |

| Issued in exchange of | A debit note is issued in return for a credit note. | A credit note is given in return when a debit note is presented. |

| Reflects | A debit note represents a positive sum. | While the credit note represents a negative sum. |

| Form | It’s a different kind of money-back guarantee on purchases. | It’s a different sort of sales return. |

Debit note vs credit note distinctions are as follows:

- A Debit Notation is a note indicating that a debit has already been issued to the Company account in the purchaser’s records.

Credit notes are commercial documents issued from one business to another to notify the recipient of a credit being made to the recipient’s account in the Seller’s books. - It’s common practice to use blue ink for Debit Notes and red ink for Credit Notes.

- As a means of doing business, the Credit Note is settled by means of a Debit Note.

- When a credit note is issued, the amount is negative, but when a debit note is issued, the amount is positive.

- Accounts receivable are lowered due to the use of a Debit Note. Instead, payables are reduced by a Credit Note.

- The purchase return book is updated based on the new information provided by the Debit Note. In addition, credit Notes are used to make adjustments to the sales return book.

How to Generate a Credit Note From Moon Invoice?

It would help if you had online billing software, such as Moon Invoice, to be able to issue a credit note online. The software may automate many aspects of your business’s accounting processes. For example, moon Invoice enables your organization to write a credit note online with the credit note function.

Please find below a brief tutorial on how to issue credit notes using our web-based billing system.

- Login to Moon Invoice App or Software or Website

- You may access Credit Notes by selecting it from the categories menu.

- To add a credit note, click the plus symbol to load the Credit note template.

- Complete the fields with the appropriate information, including the customer’s name, credit note number (automatic), currencies, date, address, products or product details, job and rate details, total amount, and notes.

- Click on save.

Why Us When It Comes to Credit Notes?

Credit notes may be issued and sent quickly with the aid of Moon Invoice. In addition, its sophisticated billing and accounting options are ideal for any organization.

Nevertheless, Moon Invoice allows companies to issue, generate, transmit, browse, download, email, and print credit notes to their clients with a single click! In addition, the program offers an innovative function that lets firms know if credit notes are utilized or unused.

Visit the Moon Invoice website for additional information on how your firm may issue a credit note online. Then, please take advantage of our no-risk seven-day trial to provide credit notes to your clients.