At first, a big purchase order may feel like a jackpot, but only until the buyer waves the due diligence flag and starts slicing the price you have offered. And just like that, every handshake becomes an emotional coin-toss because there is no anchor to future cash flow, doesn’t it?

Discounted cash flow gives that anchor. How? By turning next year’s invoices, renewals, and even equipment savings into present-day dollars, which signifies whether the buyer is handing you a gift or quietly pick-pocketing your retirement. And then, you can complete the whole check before your coffee finishes dripping.

Here, we walk you through what is a DCF, the DCF formula, and a 10-minute DCF hack so you can stop praying and start pricing as quickly as possible.

What is Discounted Cash Flow?

The discounted cash flow meaning is simply the method to estimate what the present value of money a business, project, or asset is expected to make in the future. It is basically like turning tomorrow’s dollars into what could be today’s price tag.

Every invoice you dispatch, or every subscription you expect to renew, is discounted back to present value, revealing exactly what those future dollars are worth today.

For example, let’s say you expect $11,300 from a loyal client in one year. Discounting at 10% means today’s value is $10,273. And therefore, offering $10,800 upfront is far better than waiting for a year or more.

Manage Cash Flow with Peace of Mind

Start managing your business’s finances with state-of-the-art invoicing software, Moon Invoice, and secure tomorrow’s cash.

Discounted Cash Flow Formula

The DCF formula brings together each year’s projected cash flow, but discounts every future dollar by what’s your chosen rate. It’s like the longer you wait, the smaller that dollar becomes today.

Here’s the discounted cash flow formula:

DCF = (CF/(1+r)^1) + (CF/(1+r)^2)……..+ (CF/(1+r)^n)

Check out what different parameters of the DCF formula mean:

| Parameters | Meaning |

|---|---|

How Does Discounted Cash Flow (DCF) Work?

We have cleared up the DCF formula. Now, let’s understand the working process (how to calculate discounted cash flow).

1. Forecast the Cash

Launch your invoicing software and export the financial reports to filter out money that has actually been deposited into your bank account. Upon identifying the cash flow of the last 3 years, take off the outflows like rent, equipment purchase, or taxes.

Now, determine the net figure on a yearly basis. Then, pick a growth rate that is one-third lower than the historical average in a bid to gain a realistic cash forecast.

2. Finalize Discount Rate

Right after that, choose a discount rate you require to beat, leaving the money in a high-yield savings account. For a debt-free small business, the discount rate would be ideally between 10% and 12%. If you carry a bank loan, tack on an extra 1% or 2% to cover the added risk before locking that single figure into the model.

3. Add Up Today’s Total Value

Since you have already taken all the future cash you expect to earn, lower them to today’s value, and add them together. If you expect the business to keep running even after your forecast ends, then add a terminal value and adjust that to today’s value. The final number you see is what the entire future cash flow is worth right now.

4. Compare & Decide

At last, the ball is in your court. So, compare and calculate PV(present value) with the buyer’s bid. Accept offers if more than 15% or start negotiating if less than 5%. This means if you fail to push it above 15%, then choose to exit in a polite way.

10-Minute DCF Cheat That Spits Out a Fair Price

Here’s our 10-minute DCF hack to ensure you leave each meeting with a number you can prove, defend, and bank – no degree, no plugins required (we promise).

| No. | Steps | Actions Required | Time |

|---|---|---|---|

What’s the Purpose of Discounted Cash Flow?

Calculating discounted cash flow determines the risk-adjusted value of future cash streams, giving you a clear idea of whether to buy, sell, or invest. Let’s discuss more about this.

1. Stock Valuation

DCF strips away market hype and tells you what a company’s future dividends or free cash are really worth today. If your calculated value is higher than the share price, the stock is on sale; if it’s lower, you will end up paying more than what the future is actually worth. In this scenario, you need to be mindful or just walk away.

2. M&A Bids

A DCF plays a pivotal role in figuring out what a company is truly worth before making a takeover bid. It indicates how much cash the business is expecting in the near future. This is to avoid overpaying during an acquisition. That way, discounted cash flow assists in making informed decisions.

3. Evaluating New Projects

Discounted cash flow analysis provides deeper insight into the value a new project will deliver for the money invested. This means you know how much extra money or risk the new project will bring in. Based on that, you can approve projects that truly benefit you and drop the ones that are likely to drain cash.

What are the Advantages and Disadvantages of DCF?

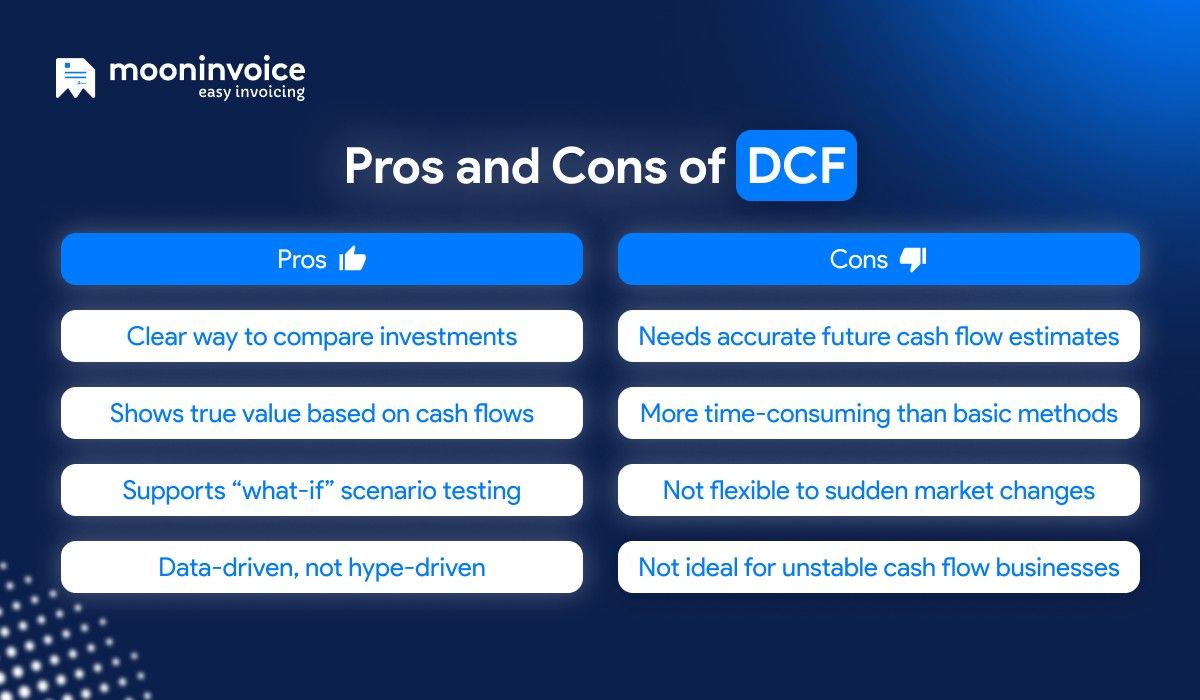

DCF Advantages

- It lets you compare very different opportunities using one metric, i.e., net present value.

- Underscores what’s the true value of an investment without hinging on competitor comparisons.

- Businesses can test multiple what-if scenarios to observe how returns change.

- Encourages you to make decisions based on true numbers, and not just hype.

DCF Disadvantages

- It is useful only when a business can reasonably estimate its future cash flows.

- DCF is time-consuming for sure. You need more time than with simpler valuation methods.

- It doesn’t adapt to sudden market changes or any comparative threats.

- DCF is not ideal for companies with unsteady or unpredictable cash flows.

Make Smart Valuations With Zero Stress

Create comprehensive reports with Moon Invoice and make smart valuations based on accurate data, not gut feeling.

Wrapping Up

For businesses, creating a DCF model requires time, attention, and accurate data. Had you done it before, you would know how demanding the process can get and how quickly it can burn out your accounting team as they continue chasing scattered information.

And therefore, generating and exporting the automated reports using the right tools makes sense. Especially when you want to build a DCF model with reliable data. Moon Invoice, an AI-ready accounting and invoicing software, can assist your team in extracting and monitoring business data.

It only takes a minute or less to create financial reports, which can be exported in PDF or HTML format, reducing the time taken for gathering information. Go for a free trial and find out how it can aid in DCF analysis.