Double entry bookkeeping, or better known as double entry accounting, has been the key pillar of modern-day bookkeeping. Without it, businesses would have faced difficulties in keeping track of their finances. Although it’s been around for years, it still works well with modern accounting tools.

Since more and more businesses are heading towards AI-powered tools in a bid to create accurate and audit-ready financial reports, the accounting market is currently undergoing major shifts. A report by Research and Markets suggests that it would hit $735.94 billion by 2025. Mainly, due to businesses showing interest in enhancing their accounting practices.

Despite the technological shift, the double entry bookkeeping system is aiding businesses to monitor their finances and make sure they don’t lose a single penny.

Now, let’s unravel what is double entry accounting meaning and how it works, including a double entry bookkeeping example.

📌 Key Takeaways

- Double entry bookkeeping aims to offer a crystal clear financial picture as every transaction has two or more entries.

- Early error detection, simplified reporting, and improved decisions are perks of double entry bookkeeping.

- The double-entry bookkeeping system works on two important rules that should not be overlooked.

- Moon Invoice, an advanced accounting software, can help you in commencing the double bookkeeping process.

What is Double Entry Accounting?

Double entry bookkeeping is a part of accounting practices in which a transaction is registered at least twice (or more) through debits or credits. One account records a debit entry, while another records a credit entry in such a way that the transactions remain balanced.

This double entry bookkeeping system aids you in keeping an eye on your business finances and eventually allows you to make informed decisions.

Types of Accounts

Here are some account types where transactions are recorded as part of the double entry bookkeeping process.

-

- Asset accounts (cash or the company’s equipment)

- Liability accounts (Loans or funds you owe to others)

- Income accounts (product sales or interest income)

- Expense accounts (utility bills or shop rent)

- Equity accounts (investments or retained earnings)

How Does It Work?

Double entry bookkeeping works on the basis of the dual aspect concept. This means the company’s ledger must include one debit entry as well as one credit entry. So, there should be a corresponding credit entry for every debit entry registered in the ledger. If not, something is wrong in the ledger.

The double entry bookkeeping system relies on the following accounting equation, which should be maintained in balance between transactions.

Accounting Equation: Assets = Liabilities + Equity

Here’s how the process of double entry bookkeeping takes place, at a glance.

-

- The company creates a chart of accounts by listing all accounts, such as liabilities, equity, assets, revenue, and expenses.

- Then, it makes debit and credit entries in equal numbers to record transactions in the ledger.

- Later, verify whether the transaction is recorded on both sides, i.e., on a debit and credit.

- Prepare financial statements from the double-entry accounting system when closing the books.

Fed Up With Manual Bookkeeping?

Now is the time to automate your bookkeeping process with Moon Invoice and alleviate the pain of performing manual entries.

Double Entry Bookkeeping Example

Let’s understand double-entry accounting examples to know how such accounting practices are performed.

Use Case 1: Purchasing New Equipment

Let’s say your company needs new equipment to continue running your core operations. You purchase it for $3,500 on credit. Here, you add $3,500 to the Equipment (asset) account, and concurrently, you record $3,500 in the accounts payable (liability) account because you haven’t paid yet. This is how transactions remain balanced because both an asset and a liability increase equally as per the accounting equation.

Use Case 2: Making an Investment

Suppose you made an investment of $25,000 into your own company in a bid to commence the early operations. This move will increase your cash (asset) account by $25,000. Simultaneously, the equity account will also see a rise of $25,000.

As a result, the transaction remains balanced as both accounts show an equal increase. In a similar manner, a debit entry is made in the cash account and a credit entry is made in the equity account.

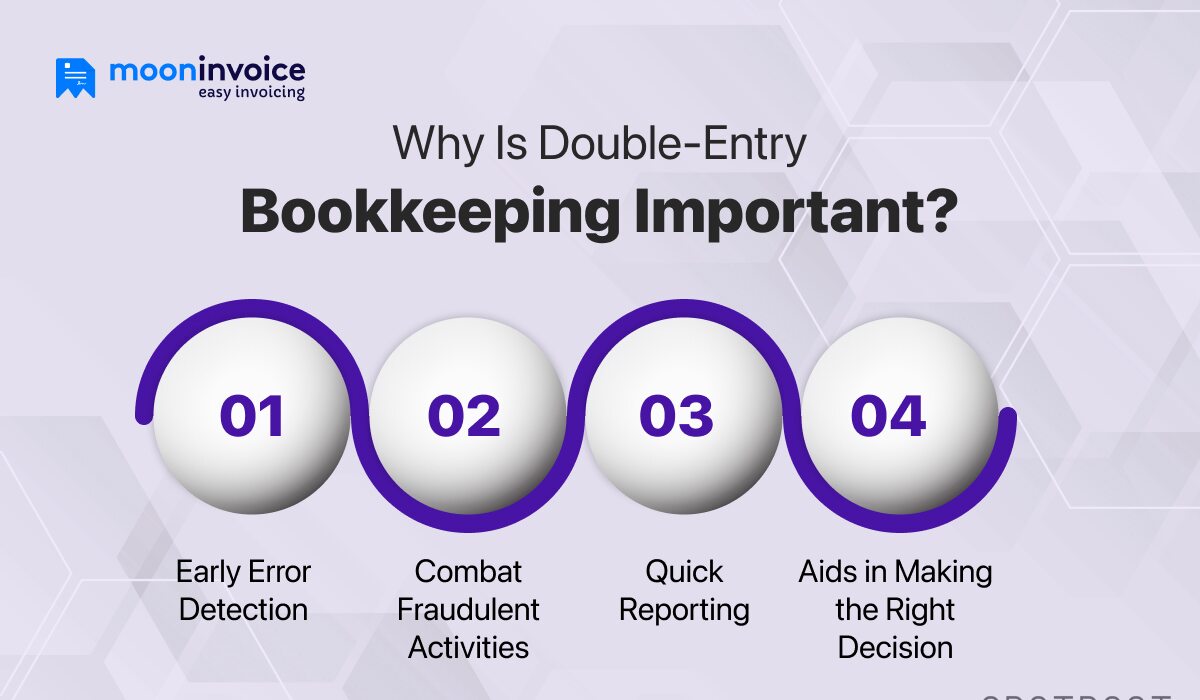

Why Is Double-Entry Bookkeeping Important? (Benefits)

Double entry bookkeeping is no longer a choice for modern businesses as it provides numerous perks. So, if you are mulling over switching to the double-entry bookkeeping system, here are the benefits you must check out.

1. Early Error Detection

Double entry bookkeeping provides a magnified view of your business finances, which helps in capturing errors quite easily. Even if the wrong amount is entered by mistake, it causes an imbalance, which immediately comes to light while vetting account totals. So, you can catch the early warning signs and take whatever steps are required to get rid of unwanted errors.

2. Combat Fraudulent Activities

The double-entry bookkeeping system keeps the fraudsters at bay as it offers unparalleled transparency. Say, for example, if somebody attempts to misreport income, the imbalance is quickly visible, raising red flags about the misadventure. Hence, in such scenarios, double entry bookkeeping has an edge over traditional accounting practices.

3. Quick Reporting

Another perk you get with the double entry bookkeeping system is simplified financial reporting. This is because the transactions are recorded in a structured way, which further alleviates your reporting process. You can pull the accurate financial data and create a comprehensive report in less time.

4. Aids in Making the Right Decision

Since double entry bookkeeping ensures you have up-to-date information available in your hands, you can decide on whatever is right for your business. Consequently, you no longer rely on guesswork and make informed decisions. Be it cutting down the cost or investing in assets, you can decide what’s ideal for your business.

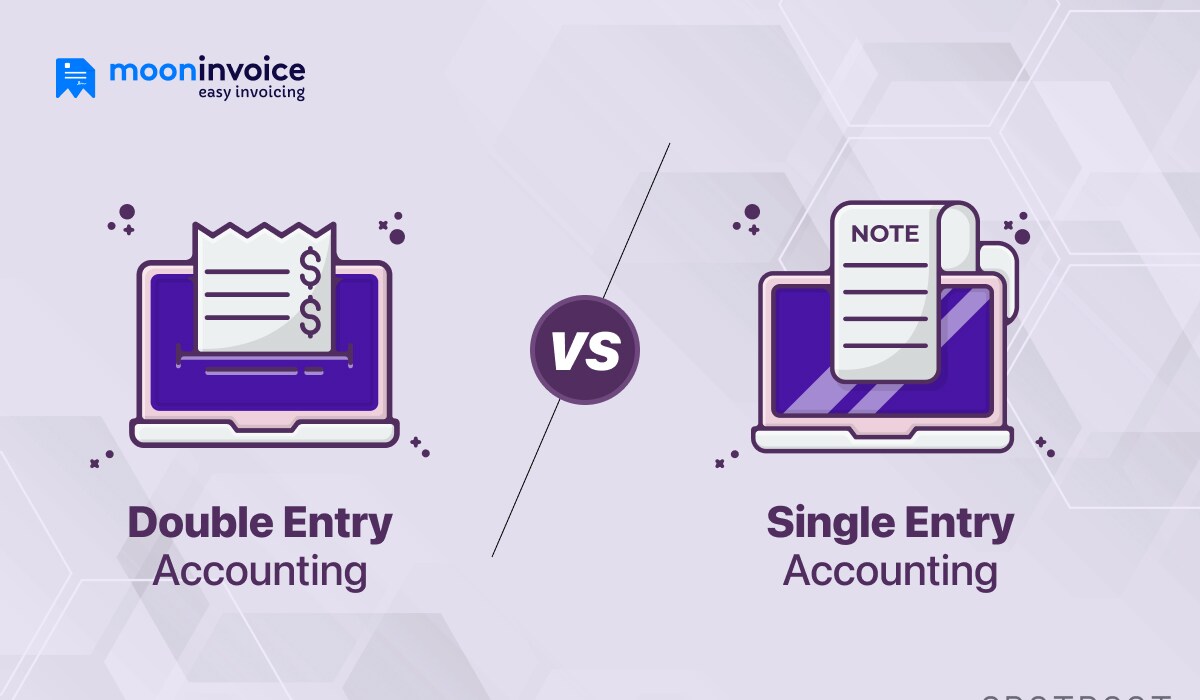

Double Entry Accounting Vs. Single Entry Accounting

Double entry accounting is one thing, and single entry accounting is a whole other thing. Let’s discover what really sets them apart.

| Differences | Double Entry Accounting | Single Entry Accounting |

|---|---|---|

| Basic meaning | A double entry accounting requires recording of transactions from two different angles. | A single entry accounting is where you record a transaction not more than once. |

| Accounts involved | The process revolves around five key accounts; assets, liabilities, equity, revenue, and expenses. | This process involves mainly two accounts, revenue and expenses. |

| Best practices | A double entry accounting practice is carried out using online accounting software. | It is a traditional method that involves making a one-time entry in the spreadsheet. |

| Perks | Double entry accounting gives you a comprehensive view of the financial picture. | Unlike double-entry accounting, single-entry accounting is limited to basic financial tracking and preparing profit and loss (P&L) reports. |

| Ideal for | Double entry accounting is a great choice for small or mid-size business owners. |

Single entry accounting is a smart choice for beginner freelancers or sole proprietors. |

What are the Rules of Double Entry Bookkeeping in Accounting?

Under Generally Accepted Accounting Principles (GAAP), a double ledger accounting hinges on two important rules that your accounting team should follow.

#1 Every transaction impacts at least two accounts

Rule no. 1 is that every small or large transaction should impact two or more accounts whenever it’s recorded in the books. The financial event must have a dual effect, i.e., when one account is debited, another one should be credited with the same amount.

Say, if you received cash by selling your company’s assets, a debit entry and a credit entry should be made in the asset and revenue accounts, respectively.

#2 Debits should be equivalent to credits

Secondly, the total debits you recorded should match the total of credits you entered in the books. So, no matter how many debit or credit entries you make, the accounting equation should stay balanced. For example, one day you bought office supplies worth $440. Now, you need to debit the expense account and simultaneously, credit the cash account.

Best Double Entry Bookkeeping System

When it comes to choosing the best double entry bookkeeping system, Moon Invoice stands out with its cutting-edge accounting features. Moon Invoice, a sophisticated accounting software, eliminates the need for manual dependencies. You no longer need to make debit or credit entries manually in the books.

When you started the business, the idea wasn’t only to become a bookkeeper, right? That’s where automation tools like Moon Invoice come in. It handles your bookkeeping duties so well that you can focus on what’s truly important for your business.

Bringing in automation in the bookkeeping process, you not only save time but also consistently monitor the cash flow. You can check high-quality reports in Moon Invoice on the fly.

How to Commence Double-Entry Bookkeeping Using Moon Invoice?

If manual bookkeeping feels tedious or you are on a hunt for an accountant due to a lack of experience, rest assured, Moon Invoice can do it all. How? Let us show you the simple steps.

-

- Firstly, prepare a chart of accounts and link your bank account with Moon Invoice to further import and categorize the transactions.

- Now, the transaction will be recorded in Moon Invoice in order to maintain your accounting books.

- Track sales, expenses, purchases, and even payments in real time through Moon Invoice’s dashboard.

- Generate must-have reports like the profit and loss, balance sheet, or any other.

- Next, add your team members so that they can review books and keep everyone informed.

Stress-free & Effortless Bookkeeping Now at $0

Absolutely! Try our 7-day free trial to perform your bookkeeping duties without draining your time and effort.

Final Thoughts on Double-Entry Bookkeeping

Double entry bookkeeping is all about maintaining your books well-organized. If you make a debit entry in one account, you should make a credit entry in another account to align with the accounting equation. If double-entry bookkeeping is taking up more of your time, we recommend hiring an accounting professional or utilizing software, especially if you are running a bookkeeping business and want to manage multiple clients efficiently.

Prioritizing software like Moon Invoice over manual bookkeeping can not only minimize your workload but also perform accounting practices accurately. Want to try it out by yourself? Start a 7-day free trial now.