If you want your business to thrive, it’s paramount that you monitor its finances. Revenue is the lifeblood of any business, it’s the income generated from your core operations before any costs or expenses are deducted. In simple terms, it’s what your business earns from selling products or providing services.

Revenue isn’t just a number on a financial statement, it reflects your company’s ability to generate sales and sustain growth. It’s a key performance indicator used by investors, stakeholders, and financial analysts to evaluate a business’s success and potential for future expansion.

However, many business owners and even some professionals get confused between revenue, profit, and income. While they’re all related, they are not the same:

- Revenue is the total amount earned from business operations.

- Profit (also known as net income) is what’s left after all expenses are subtracted from revenue.

- Income is a broader term that may refer to revenue or profit, depending on the context.

This blog will explore the different types of revenue, specifically total revenue and net revenue, and walk you through the step-by-step process of calculating revenue.

So, let’s get started…

📌 Key Takeaways

- Revenue is the total income a business generates from selling goods or services before any expenses, discounts, or returns are deducted. It reflects a company’s overall earning power.

- Net revenue is the actual income retained after subtracting returns, discounts, and allowances from total revenue. It gives a more accurate view of a company’s real financial performance.

- Total revenue is calculated by multiplying the unit price by the quantity sold. This provides a raw measure of sales performance across products or services.

- Revenue calculation varies by business type, product-based, service-based, SaaS, and others, each with its own structure for measuring income and growth.

- Confusing revenue with profit, ignoring returns, or misclassifying non-operating income can lead to incorrect financial reporting and poor decision-making.

- Using smart tools like Moon Invoice can automate revenue tracking, generate insightful reports, and improve financial management accuracy across any business size or model.

What is Revenue?

Revenue is the total income a business earns from its normal operations, mostly through the sale of goods or services. It represents the top line of a company’s income statement and serves as a key indicator of business performance. Revenue is calculated before any expenses, taxes, or costs are deducted.

It can come from various sources, including product sales, service fees, subscriptions, or commissions. Accurately tracking revenue is essential for assessing profitability, setting budgets, and making informed financial decisions in any business.

Are You Struggling To Manage Revenue Records?

Try Moon Invoice, an easy-to-use invoicing and accounting solution that helps you track total and net revenue effortlessly.

What is Total Revenue?

Total revenue is the sum of all sales receipts or income from a company’s primary operations. It represents the gross income generated solely from a company’s core sales activities, without any deductions. It reflects the raw earnings from all units sold or services rendered, calculated before factoring in any business-related costs like returns, discounts, or operating expenses.

In other words, total revenue answers the question:

“How much money did we bring in from sales alone?”

Formula:

- Total Revenue = Price per Unit × Number of Units Sold

This formula applies whether you’re selling physical products, offering services, or running a digital subscription model. The key is to multiply the amount you charge (price) by the number of units you sell.

Example:

Imagine a business that sells handmade candles. If each candle sells for $15 and the company sells 1,000 candles in a month, the total revenue for that month is:

- $15 × 1,000 = $15,000

This $15,000 is the total revenue before subtracting any costs like materials, shipping, or marketing expenses.

Why Does Total Revenue Matter?

- It’s undiluted: Total revenue doesn’t subtract anything, it’s the pure sales figure.

- Easy sales analysis: It’s the starting point for deeper financial analysis, such as calculating net revenue, gross profit, and net income.

- It focuses only on sales: It excludes secondary income sources like interest, investments, or licensing fees.

What is Net Revenue?

Net revenue is the amount of money a business actually retains from sales after subtracting certain deductions such as returns, discounts, allowances, and rebates. Unlike total revenue, which gives a raw snapshot of sales activity, net revenue reflects the real income generated, the money you can count on once all sales-related adjustments have been accounted for.

Formula:

- Net Revenue = Total Revenue − Returns − Discounts − Allowances

Where:

- Returns = Products or services refunded by customers

- Discounts = Price reductions offered to customers at the time of sale

- Allowances = Post-sale adjustments due to product defects or issues

Example:

Let’s say an online electronics store made $50,000 in total sales for the month. However:

- $2,000 worth of items were returned,

- $1,500 in promotional discounts were applied,

- $500 in allowances were granted for damaged packaging.

Calculation:

Net Revenue = $50,000 − $2,000 − $1,500 − $500 = $46,000

So, while the total revenue was $50,000, the net revenue, the income retained from those sales, was $46,000.

Why Does Net Revenue Matter?

- Reflects true earnings from operations

- Helps assess product quality and customer satisfaction (e.g., high returns may be a red flag)

- Gives investors and managers a more accurate view of financial health

- Used in calculating profitability metrics like gross margin and net income

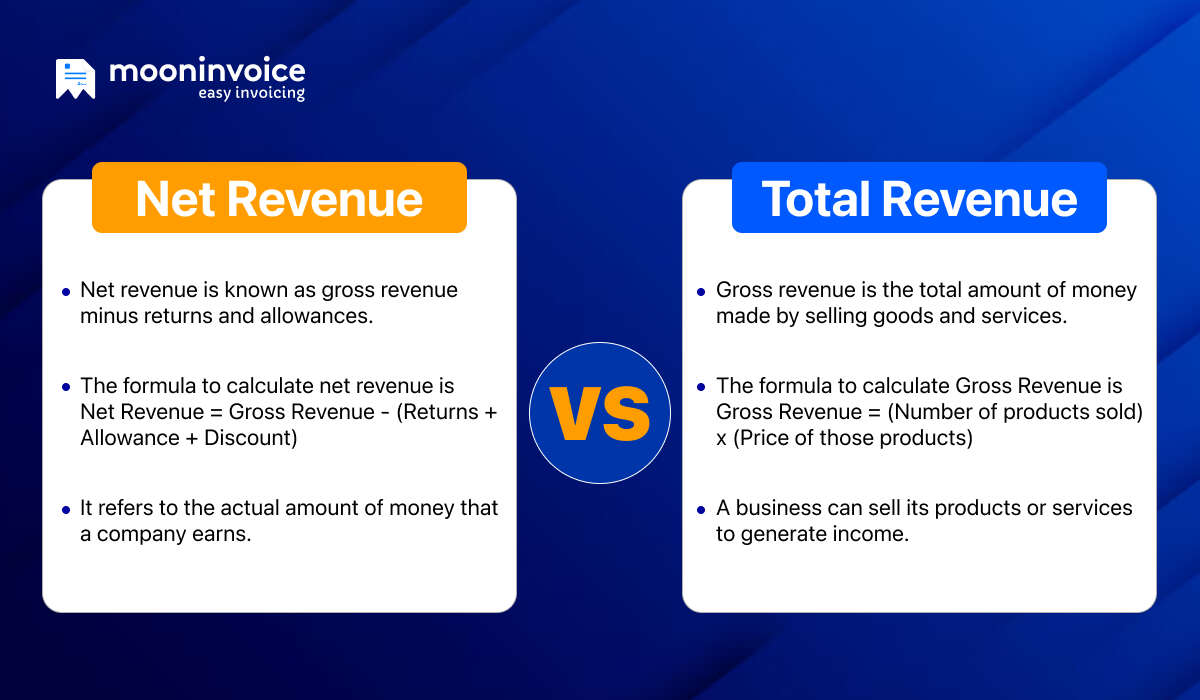

Net Revenue vs. Total Revenue

All revenues are not equal. Professionals often don’t have a clear picture of net revenue and gross revenue, which could significantly affect the company’s income tax. Let’s understand the difference between net revenue and gross revenue here.

| Net Revenue | Gross Revenue |

|---|---|

| Net revenue is known as gross revenue minus returns and allowances. | Gross revenue is the total amount of money made by selling goods and services. |

| The formula to calculate net revenue is

Net Revenue = Gross Revenue – (Returns + Allowance + Discount) |

The formula to calculate Gross Revenue is

Gross Revenue = (Number of products sold) x (Price of those products) |

| It refers to the actual amount of money that a company earns. | A business can sell its products or services to generate income. |

💡Pro Tip:

Always align your revenue tracking with your business model and reporting periods. Use tools like Moon Invoice to automate recurring revenue entries, minimize manual errors, and ensure your company’s financial statements reflect true performance in real time.

How to Calculate the Revenue of Your Business?

Whether you’re running a retail store, freelancing, or managing a SaaS platform, calculating revenue accurately is critical for understanding your financial health. Here’s a step-by-step guide to help you calculate both total revenue and net revenue effectively.

Step 1: Identify All Income Streams

Begin by listing all the ways your business earns money. This could include:

- Product sales (e.g., clothing, electronics)

- Service fees (e.g., consulting, design)

- Subscriptions or memberships

- Advertising or affiliate income

- Licensing or royalties

Why it matters: Not all revenue comes from selling a product. Recognizing every source ensures a complete picture of your earnings.

Step 2: Determine the Unit Price or Rate

For each income stream, identify how much you’re charging:

- Price per product

- Hourly rate for services

- Monthly/annual subscription fee

If your pricing varies (e.g., discounts or packages), take an average or segment them accordingly.

Step 3: Calculate Quantity Sold or Hours Worked

Track how much was sold or delivered:

- Number of items sold

- Billable hours

- Number of active subscribers

- Number of ad impressions or clicks (for digital businesses)

Use accurate sales records, invoices, or platform analytics to get this data.

Step 4: Calculate Total Revenue

Use the basic formula:

- Total Revenue = Price per Unit × Number of Units Sold

Repeat this for each revenue stream and sum them to get your total revenue.

Example:

- Price per unit: $250

- Number of units sold: 20

- Total Revenue = $250 × 20 = $5,000

Step 5: Subtract Returns, Discounts, and Allowances

Now, calculate your net revenue by subtracting:

- Returns: Items customers sent back

- Discounts: Promotional price reductions

- Allowances: Post-sale credits for damaged goods or service issues

Calculation:

Net Revenue = Total Revenue − Returns − Discounts − Allowances

Example:

- Total Revenue: $11,500

- Returns: $500

- Discounts: $300

- Net Revenue = $11,500 – $500 – $300 = $10,700

Step 6: Review and Validate Your Data

Double-check your inputs using:

- Invoicing or sales reports

- POS (Point of Sale) systems

- Accounting software like Moon Invoice

Tip: Automating this process with financial tools reduces human error and improves reporting accuracy.

How to Calculate Revenue for Different Business Models?

Revenue isn’t a one-size-fits-all metric. Depending on your business model, how you calculate gross revenue, recognize sales revenue, and report income on your company’s financial statements can vary significantly. Understanding these nuances is key to accurately assessing your company’s financial health, planning for revenue growth, and ultimately improving your company’s net income.

Below is a breakdown of how to calculate revenue across common business models, with examples and relevant revenue types.

1. Product-Based Businesses

Common in: Retail, E-commerce, Manufacturing

How to calculate revenue:

Sales Revenue = Selling Price per Unit × Units Sold

Example:

If an online apparel store sells 1,200 jackets at $60 each:

- 1,200 × 60 = $72,000 (Gross Revenue)

Considerations:

- Account for returns and shipping discounts when calculating net revenue

- This revenue is classified under operating revenue in the company’s financial statements

2. Service-Based Businesses

Common in: Consulting, Freelancing, Education, and Maintenance

How to calculate revenue:

- Sales Revenue = Hourly Rate or Package Fee × Hours Worked or Projects Completed

Example:

A freelance graphic designer charges $50/hour and works 80 hours a month:

- 80 × 50 = $4,000 (Gross Revenue)

Considerations:

- Unused billable hours = lost revenue opportunities

- Monitor repeat clients and upselling for revenue growth

3. Subscription-Based Businesses

Common in: SaaS, Streaming services, Membership sites

How to calculate revenue:

- Monthly Recurring Revenue (MRR) = Number of Subscribers × Subscription Fee

Example:

A SaaS platform with 500 subscribers paying $30/month:

- 500 × 30 = $15,000 MRR = $180,000 Annual Gross Revenue

Considerations:

- Adjust for churn, upgrades/downgrades

- Subscription revenue typically forms a major portion of operating revenue, but some may also include non-operating revenue like interest or referral bonuses.

4. Freemium or Ad-Supported Models

Common in: Mobile apps, Media websites, Digital games

How to calculate revenue:

- Total Revenue = Ad Revenue + Premium Purchases + In-App Transactions

Example:

- $10,000 from ads

- $5,000 from in-app purchases

- Gross Revenue = $15,000

Considerations:

- Ads are often classified as non-operating revenue in certain industries

- User engagement directly influences revenue growth

5. Commission-Based or Affiliate Models

Common in: Real estate, Marketplaces, and Affiliate marketing

How to calculate revenue:

- Commission Revenue = Total Sales × Commission Rate

Example:

An affiliate earns 10% on $25,000 worth of product sales:

- 25,000 × 0.10 = $2,500 (Gross Revenue)

Considerations:

- High variability in income

- Often reported separately in a company’s financial statements

Best Software to Help Calculate Revenue

Tracking and calculating revenue manually can be time-consuming and error-prone, especially as your business grows. That’s where accounting and invoicing software can make a big difference. One of the best tools available is Moon Invoice, an all-in-one invoicing and accounting solution designed for businesses of all sizes, whether small or large-scale enterprises, freelancers, or startups.

Moon Invoice allows you to generate professional invoices, track payments, record expenses, and automatically calculate both total and net revenue with ease. It also provides detailed financial reports to monitor your revenue growth and evaluate your company’s financial health. With mobile and desktop access, Moon Invoice ensures you’re always in control of your finances, anytime, anywhere.

Other promising tools apart from Moon Invoice to calculate revenue are QuickBooks, Xero, and myBillBook.

Common Mistakes to Avoid

Accurately calculating revenue is essential for assessing your company’s financial health, forecasting growth, and making informed decisions. However, many businesses, especially small or fast-growing ones, fall into traps that can distort their sales revenue, misrepresent their gross revenue, or lead to incorrect conclusions about net income.

Here are some of the most common mistakes to watch out for:

- Confusing Revenue with Profit: A frequent error is treating revenue as profit. Revenue is the income before expenses, while profit (or net income) is what remains after subtracting costs. Misunderstanding this difference can result in poor budgeting and overestimating your company’s actual earnings.

- Ignoring Returns, Discounts, and Allowances: Failing to deduct customer returns, promotional discounts, or product allowances leads to overstated revenue. Always calculate net revenue by subtracting these adjustments from your gross revenue to reflect what you truly earned.

- Double-Counting Income Streams: Businesses with multiple revenue sources (e.g., product sales and subscriptions) may mistakenly record the same revenue twice. This inflates earnings on your company’s financial statements and skews performance metrics.

- Not Separating Operating and Non-Operating Revenue: Combining operating revenue (from core business activities) with non-operating revenue (from investments or asset sales) without distinction can mislead stakeholders and distort analysis of your business’s core performance.

- Using Inconsistent Time Periods: Mixing revenue data from different time frames, monthly vs. quarterly, for instance, can lead to inaccurate revenue growth analysis. Always use consistent time periods for comparison and reporting.

- Relying on Manual Calculations: Manual revenue tracking using spreadsheets is prone to errors, especially as your business scales. Using reliable accounting software like Moon Invoice helps automate calculations and reduce human error.

- Excluding Deferred Revenue in Subscription Models: In subscription-based models, recognizing the entire payment upfront rather than spreading it over the service period can distort the company’s net income and future financial planning. Follow correct revenue recognition practices.

Ready to Boost Your Financial Clarity?

Don’t let revenue miscalculations hold your business back. Use Moon Invoice to automate invoicing, manage expenses, and generate real-time financial reports — all in one place.

Wrapping Up!

As a business owner, you must understand the difference between revenue and net revenue to maintain your company’s financial health. Keeping an eye on revenue not only helps you track performance but also supports smarter decision-making and long-term revenue growth. If you analyze your revenue metrics regularly, you will be prepared for upcoming challenges and can easily tackle mishaps.

To simplify your revenue estimation hassles, consider software tools like Moon Invoice. This powerful invoicing and accounting tool is designed to help you calculate revenue accurately, generate reports, and manage your finances easily.

Stay on top of your numbers, and your business will stay on top of its league.

Try Moon Invoice Today!