TL;DR

The financial consulting profession is a good option for those with deep expertise in capital management and investment. To start a financial advisory business, one needs to choose a niche, develop a business plan, register, and set up financial advisory services. Also, establishing the pricing structure and conducting marketing are necessary.

Managing business capital and investment plans is not child’s play. Deep knowledge & financial skills are required to ensure the action’s success.

That’s why many company professionals hire a financial advisor to help steer their business in the right direction of financial planning. From startups to established enterprises, the demand for such experts is high. This encourages many young entrepreneurs to pursue careers as financial experts.

Of course, it is a good option to earn handsome money while working as your own boss. But how do you start a financial advisory business? This question is enough to pause you from taking action. Many aspiring business professionals are unaware of the roadmap for launching and establishing a business.

Here, we’ll guide you through the right steps to start your financial advisor business. Additionally, you’ll learn how much it costs to start and what strategies you can follow for growing your business well.

📌 Key Takeaways

- Starting a financial advisory business involves choosing the right niche & other business planning.

- Choosing the right automation and technology improves the efficiency of a financial planning firm.

- Opt for legal registration and other licenses to build long-term credibility.

- Securing business insurance is necessary to cover losses in the event of an incident.

- Outlining operations, setup, and pricing structure is a necessary part of this profession.

💡Don’t Miss to Know:

The global advisory market is expected to reach 166.63 billion by the year 2035, according to the Business Research Insight report.

What is the Role of a Financial Advisor?

A financial advisor’s role in financial consulting is broad. This wealth coach plays a vital role in the business, guiding financial planning. Business owners receive the right advice on capital management aligned with their goals and needs.

Furthermore, financial advisors help business owners make the right investment decisions. These professionals have strong knowledge of investment strategies that can deliver satisfactory returns. Thus, these financial consultants provide sound investment advice to business owners.

Financial advisors also help business owners manage financial risk across investments and other budgeting. The professionals also help streamline tax compliance for businesses. They guide better during the tax session and help minimize tax liabilities and maximize tax preparation through planning.

How to Start a Financial Advisor Business? Right Steps to Follow

Like any other business, a financial consulting business needs proper strategies to get started. Here are the steps to follow when starting this profession.

1. Defining Your Niche and Business Objectives

Initialize your step with a clear definition of the niche & business objective. It is better to target customers who best align with your expertise. You must be clear on whether you can address the financial needs of salaried professionals or retirees.

Additionally, defining your business objectives is essential. Set the clarity on the types of services you’ll offer, business operations, and the marketing plan. This kind of outlining helps establish the right vision and mission for your financial business.

2. Obtain Certification and License

Your business plan is all set! Next, obtain the required certifications and licenses, which are very important. It’s because strict legal and ethical standards underpin the financial consulting business. You need to pass the Series 65 (Uniform Investment Advisor Law) exam if you give investment guidance. Similarly, professionals can earn a Certified Financial Planner (CFP) credential.

3. Choose the Name

Choosing an appropriate name for your business is another important step. Choose the right name that helps your financial planning firm stand out from the crowd. Ensure it directly reflects your business’s core operations and is not copied from anyone. Always prefer a unique name that is not already registered as a trademark or copyright.

4. Set the Business Structure

Multiple business structures are available for a financial advisory firm. The various structures are as follows:

- Sole Proprietorship: The simplest structure and best suited for a startup financial advisor.

- Limited Liability Company (LLC): An LLC offers personal asset protection and is well-suited for a business with one or two owners.

- Partnership: Two or more partners share ownership.

- C-corporation: A C-corporation separates the business and personal taxes.

- S-corporation: An S-corporation offers liability protection and passes income through to shareholders.

5. Registering Your Business

Without a registration process, it is not possible to manage your business as a financial advisor. It is mandatory to register with the federal Securities and Exchange Commission (SEC) if your firm manages over $110 million in Assets Under Management (AUM). Financial advisors with less than $100 million in assets under management must register at the state level.

6. Insurance

Consider insurance to protect your business against prudential downturns. General Liability, E&O Insurance, Cyber Liability, Commercial Property Insurance, etc., are common insurance coverages. Ensure the coverage policy aligns with your investment plan.

7. Choose the Location & Set up Office

Identify the location to establish your own financial planning firm’s office. The location should be within the client’s proximity for easy access. Also, choose a commercial building or an area to set up your office. This contributes to your professional image & helps to gain clients’ trust. Obtain all the office essentials you need to operate your business. This includes an office desk, chair, laptop, printer, and other office supplies.

8. Developing the Service Offered

List out all the financial advisor services that you will offer to your client. Justify whether you will offer investment guidance, tax advice, retirement planning, or general financial planning. It should be aligned with your expertise and knowledge. It means offering only those services in which you are sufficiently expert to guide. This matters for you and your clients when they hire a financial advisor for business.

9. Pricing Structure

Set up the right pricing strategy for your services to attract customers & gain profit. In the financial advisory business, there are various pricing strategies, such as:

- Assets Under Management (AUM) Fees: You can charge as per the percentage of clients’ assets you manage.

- Hourly Fees: Professionals charge as per the time spent advising the client.

- Fixed or Flat Fees: Charging a constant fee for the financial advisory service.

- Performance-Based Fees: Client pays based on the returns they receive from the financial experts.

- Hybrid Models: They combine different models for greater flexibility. For example, combining the hourly fees model and the flat fees model.

10. Invest in the Right Software

In today’s technology landscape, it is necessary to purchase software that streamlines your day-to-day accounting operations, such as billing.

By choosing the right billing and invoicing software, such as Moon Invoice, you can speed up these processes. The software is ideal for businesses of all sizes, from startups to enterprises. Financial advisors can simplify their billing & get on-time payment for the financial services they offer.

The platform offers 66+ free & customized invoice templates to help you create invoices quickly. The templates support auto-calculation to ensure accurate data. Using the financial advisor invoice template, you can quickly create a professional & accurate invoice.

Ready for the Journey from Invoice to Income?

Streamline your financial advising billing with Moon Invoice. 4.9 Star Rating by the worldwide customers.

11. Market Your Business

Next, promote your financial planning business with a comprehensive marketing strategy. You must leverage both online and offline marketing channels.

For online promotion, showcase your business services on social media platforms such as Facebook & Twitter. Additionally, create your own website and include all relevant information. Hiring a digital marketing expert is worth it for achieving success & reaching the right audience in such a marketing strategy.

For offline marketing, consider newspaper ads, brochures, and flyers. This type of advertisement should always highlight your services with an appropriate layout.

12. Building the Client Base

Undoubtedly, marketing your business is a good way to generate leads. However, building a client network is crucial to succeed in a competitive market. But how to build a network for a startup financial advisor?

There are various ways to perform it. Attained the financial seminars, events & industry conferences. The other method is to use social media platforms, such as LinkedIn, to connect with many business leaders who are seeking the right financial consultants.

13. Stay Updated, Grow & Expand

You need to plan for the expansion of your financial planning consultancy once you achieve the milestone. Instead of remaining in the same position, you need to continue expanding your business scope. Also, stay up to date on the latest regulations to scale compliantly.

How Much Does it Cost to Start a Financial Advisory Firm?

Along with learning how to start a financial advisory business, it is important to understand the associated costs. Any business requires investment, which varies based on various factors. The average cost to set up a financial advisory firm ranges from $10,000 to $60,000+, depending on firm size.

Here are the other expenses for the financial advisory firm:

Office Set up & Rent

Plenty of expenses you need to bear when you set up your office. It also includes rent expenditure that depends on the location you choose. A high-cost-of-living city or posh area will be more expensive. The cost ranges from $1,500 to $5,500 per month.

Marketing & Advertising

The expected expenditure on promotion and advertising is from $500 to $20,000+. The cost is variable and depends on various factors. It includes website development, SEO, content marketing, social media management & ads, and email marketing.

License & Registration

Financial advisors need to register their business as per the Assets Under Management value. The typical cost may range from $1,500 to $3,500. It includes state or SEC filings, as well as exams such as Series 65/66.

Technology & Software

Business owners need to invest in technologies and software that can cost $5,500 to $15,000 or more annually, depending on the tool’s features. The cost may increase as your financial planning firm expands.

Insurance

This is another unavoidable expense for the firms to protect against legal, regulatory, and other operational risks. Insurance premiums range from $1,000 to $3,000+ per year for the new and small advisory firms.

💡Pro Tip:

Always monitor your client acquisition cost and retention rate, revenue per client, and operating expenses from the initial stage. Also, keep a sufficient reserve to cover future expenses.

Tips for Growing Your Financial Advisory Business

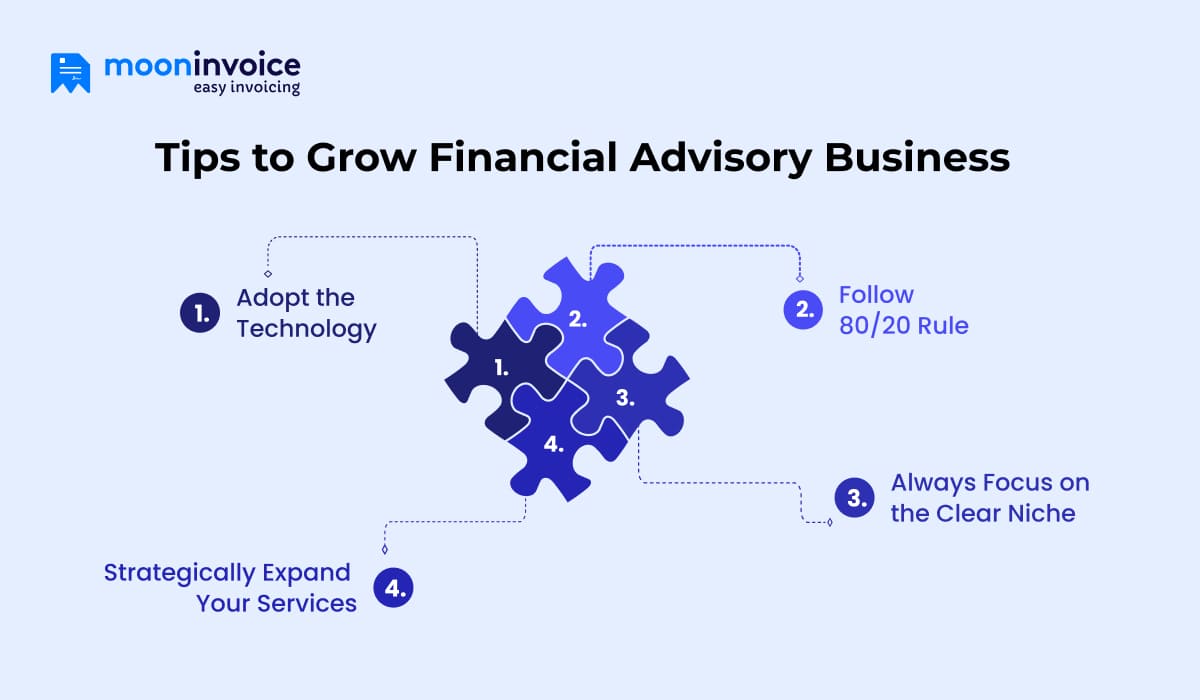

The financial advisory profession is an ongoing journey, and professionals must pursue continuous growth. Incorporating these tips helps to grow your business as a financial advisor.

Adopt the Technology

Incorporating the technology where possible is a good strategy for your business. It simplifies the work and accelerates the process. Thus, saves significant time, enabling professionals to focus on their core operations and other critical tasks.

Follow 80/20 Rule

According to this rule, focus on the 20% of clients who generate the highest revenue. This refines the profitability and time management. In simple terms, always focus on highly valuable customers who contribute to good income when you own a financial planning firm, even if they are in limited quantities.

Always Focus on the Clear Niche

As a financial advisor, it is not possible to serve everyone. You must specialize in one field and work on it. This helps you better understand your client’s problem. Ultimately, you offer the most relevant guidance to your client.

Strategically Expand Your Services

Of course, every service provider expands its service offerings. This is crucial to business growth because expanding the service scope also increases the client base. It becomes easier to retain existing clients when you expand your services.

Last Remarks

When you think about how to start a financial advisor business, it might seem complex. However, with the right strategy, you can win the business battle. Prepare a solid business plan, comply with the laws, and use the right technology & tools to attract new clients. Take a small step, but keep following the right guide for a profitable and sustainable business.