Optical Character Recognition (OCR) is not a new term; in fact, it is a technology that is used in modern accounts payable processes. The technical advancements in our daily lives have ensured that automating the accounts payable workflow remains seamless and efficient.

New tech-driven accounts payable solutions come with features such as electronic funds transfer, tax form processing, and, of course, OCR invoice processing.

According to Grand View Research, it is projected that the global OCR market size will reach USD 32.90 billion with a CAGR of 14.8% from 2024 to 2030.

It is clearly visible how crucial OCR will be in the coming days, and this is why having a proper understanding of it is key for your business.

So, let’s explore what OCR is and its significant role in invoice processing.

What is Invoice OCR?

OCR invoice processing refers to a technology, Optical Character Recognition, which automatically extracts data from photocopies or digital invoices. Here, you don’t need to fill in the details of each invoice, such as invoice number, date, vendor name, vendor email, items, or total amount.

With the use of optical character recognition technology, it will directly read text from scanned paper invoices or image/PDF formats and convert them into editable invoice data.

OCR is designed in such a way that it can recognize and interpret printed characters and translate them into machine-readable text. OCR simplifies invoice processing and transforms your manual workflow into an automated one. It makes the accounts payable process quick and error-free.

Generally, OCR invoice scanning involves reading data fields such as:

- Vendor details

- Invoice number

- Invoice date

- Purchase order number

- Item description + quantities

- Tax rates and totals

Once the invoice scanning and capturing process is complete, the data can be validated (and modified if necessary) and then transferred into an accounting or ERP system for further processing.

How Does OCR Work for Invoice Processing?

The invoice OCR processing follows a method where unstructured invoice documents, like scanned images or PDFs, are converted into actionable data.

The following is a step-by-step process that explains how it works.

1. Document Capture

The user can import or scan the invoice. These raw documents can come in different invoice formats, such as images (JPEG/PNG), PDFs, or even manual paper. Currently, almost every OCR tool supports multiple uploads and automatically detects invoice types.

2. Preprocessing

The first thing OCR does before extracting data is check the readability. It may:

- Enhance blurry images

- Adjust alignment

- Improve contrast and brightness

The above steps help increase the accuracy of text recognition.

3. Text Recognition

Now, in this step, the OCR algorithm comes into play. It analyzes the entire document and detects if it is printed or handwritten. By using pattern recognition, it identifies letters, numbers, and symbols and converts them to digital text.

4. Data Extraction

The digitized text is then shown in relevant fields such as:

- Invoice number

- Date

- Vendor name

- Line items and amounts

- Tax and total

5. Data Validation and Cleanup

After extracting texts, the OCR invoice processing system will check the captured data for missing fields, errors, or mismatches. Some tools even cross-verify with purchase orders to ensure accuracy.

Are You Spending Money on Expensive OCR Solutions?

No more! Discover a smarter, AI-powered alternative software that centralizes, automates, and simplifies everything, from scan to send.

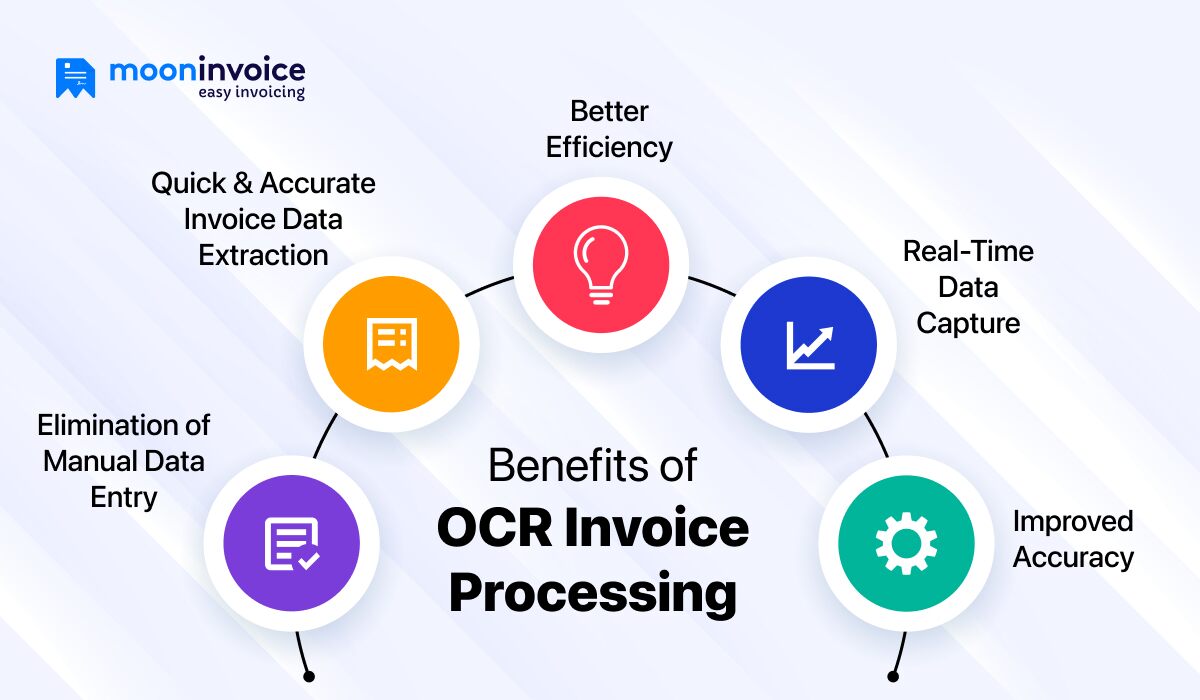

Benefits of OCR Invoice Processing

Time-consuming manual methods to automated invoice processing; times have changed, and there are more advantages, as you save time with the help of OCR technology.

Time-consuming manual methods to automated invoice processing; times have changed, and there are more advantages, as you save time with the help of OCR technology.

Let’s look at the benefits of OCR invoice processing:

1. Elimination of Manual Data Entry

With OCR invoice processing in place, there are more chances of creating error-free invoices, plus it saves your time and resources. There is no need to fill in each detail while creating an invoice; OCR does it all and speeds up the entire process.

2. Quick & Accurate Invoice Data Extraction

OCR automatically extracts major fields like invoice number, vendor name, vendor email, date, and amount. This invoice data extraction process is accurate and consistent. Way faster than manual work.

3. Better Efficiency

New tech-driven OCR invoice processing tools offer seamless integration with accounting systems, ensuring that extracted invoice data is directly compatible with finance software. It simplifies reconciliation, approvals, payments, and provides better efficiency.

4. Real-Time Data Capture

The data capture is real-time and fast from both digital and scanned invoices. Within a fraction of a second, you will have all your key fields filled, which is excellent for businesses. Scanning invoices using OCR is crucial for large-scale enterprises, as they manage multiple financial operations.

5. Improved Accuracy

OCR makes sure critical information (text data) from the photo is extracted with better accuracy, which reduces discrepancies. It helps you gain more insight into your business’s current cash flow.

Challenges of OCR Technology

There’s no doubt that OCR processing has taken invoice management to a new level, but there are still some challenges you should be aware of. Even with all these astounding benefits, you must understand the limitations that can arise during OCR implementation and usage.

There’s no doubt that OCR processing has taken invoice management to a new level, but there are still some challenges you should be aware of. Even with all these astounding benefits, you must understand the limitations that can arise during OCR implementation and usage.

1. Inconsistent Formats

We all know invoices come in countless designs and structures from different types of vendors. For traditional invoices, OCR extracts data easily, but for complex invoices with lots of unknown fields, it gets tricky even for modern OCR software.

2. Poor Scan Quality

The document you scan or the image you upload needs to be of good quality. Blurred scans, handwritten notes, or low-resolution images could reduce data accuracy and may need manual correction.

3. Errors in Field Detection

Some OCR systems may fail to identify fields for invoices that come with packed data. If there are multi-line entries or involve embedded tables, then OCR may pass incorrect information into financial systems.

4. Misplaced Data Extraction

There are times when OCR misreads data or misplaces data in the right field; in such cases, manual data entry is required. It fails the automation process.

5. Cost and Complexity of Integration

For small businesses, implementing a high-quality OCR invoice processing solution can be an expensive addition, especially if they are willing to integrate it into platforms like ERP.

6. Complications in Data Export

Some OCR systems provide limited data export capabilities that don’t support customization. This can reduce the overall efficiency of the business if data export is not managed properly.

Are You Spending Money on Expensive OCR Solutions?

No more! Discover a smarter, AI-powered alternative software that centralizes, automates, and simplifies everything, from scan to send.

Best Practices for Implementing Invoice OCR

OCR invoice software performs optimally when implemented strategically. Here is how you can do it, explained with examples:

1. Evaluate Your Business Needs

Don’t select an OCR tool without a thorough evaluation of your business needs. Review your invoice volume, identify existing pain points, and assess the time-consuming aspects of processing an invoice. Once you answer all these questions, you will be able to find an OCR invoice processing software that fits your needs and workflow.

2. Invest in the Right Software

When selecting an OCR invoice software, it is essential to verify that the software has a good track record, supports multiple invoice formats, can handle various invoice designs, and addresses all other relevant aspects. The OCR invoice processing software that supports a customizable interface is key.

3. Set up Clear Invoice Format

Meet with vendors and request that they adhere to a single invoice layout, as this helps the OCR system’s recognition ability. Consistent formats make it easier to extract invoice data for mapping. Failing to address this might lead to complexities and duplicate invoices.

Are There Any Alternatives to OCR Invoice Processing?

In the world of vast automated workflows, almost every business is seeking an OCR software that eases their workload. However, what if we tell you there are many alternatives to OCR as well? Some businesses don’t even require OCR in the initial stages, but still go on to purchase expensive software, which results in a waste of money.

To avoid this, you can select Moon Invoice as your invoice processing software. It is simple, efficient, and of course not expensive.

Moon Invoice: An Efficient Alternative to OCR

Moon Invoice could be one of the best alternatives to OCR invoice processing if generating invoices is a priority for your business. The list of features includes customizable templates, multiple payment gateways, cross-platform availability, recurring invoices, and modern-day smart features such as AI-powered Quick Scan.

Here’s a brief look at the features of Moon Invoice:

- AI-Powered Quick Scan: Drop the document, and it will auto-extract key data like vendor name, email, total, date, taxes, etc.

- Customizable Templates: Over 60+ professional invoice templates to choose from with customizable logo, currency, language, and tax setting options.

- Expense Tracking & More: Beyond invoices, you can track your expenses, track time, manage credit notes, delivery challans, and purchase orders too, all in one place.

- Multiple Payment Gateways: Integrates more than 20+ payment gateways (Stripe, PayPal, Square, UPI) so that you can accept payments directly.

- Enhanced Reporting: More than 15+ business reports, such as sales, expenses, profit/loss, etc, that help organizations to make decisions and forecast finances.

In Short

OCR for invoice processing is gradually becoming the new standard, with organizations opting to automate their workflows. However, new businesses normally don’t require OCR; they can opt for alternatives like Moon Invoice, which offers a quick scan feature that allows users to scan and extract data from documents to create invoices.

If you are also looking for invoicing software that offers a complete invoice solution and doesn’t want to miss out on cutting-edge industry-first features, you can consider Moon Invoice.

Book a free demo now and enhance your invoicing journey with ease.