TL;DR

Invoices and quotes are the crucial financial documents. However, these two are confusing points for professionals. An invoice is a payment request, whereas a quote is a formal document that provides an estimate of the project’s cost.

Is a quote the same as an invoice? The straightforward answer is NO! But many people are confused about this question.

When you run and manage the business, you must be aware of the accounting documents related to it, such as quotes and invoices.

These are two important financial documents, but they vary as per their purposes and other factors. A clear understanding of the difference between a quote and an invoice is crucial. It’s because mishandling these documents can lead to financial and legal issues for businesses. Moreover, the client becomes confused, which disrupts the payment flow. Hence, business professionals must be aware of invoices and quotes.

If you are one, then you have landed on the right page. In this blog, we’ll provide guidance on the invoice vs quote. Our words will highlight the key differences among the documents, their meanings and purposes, and the appropriate actions to create them.

📌 Key Takeaways

- The quote always comes before the invoice when the project deal is finalized.

- Quotes become legally binding once the client accepts them.

- Invoices are not legally binding, but they include payment obligations.

- Quotes are flexible, whereas invoices are unlikely to change except under certain conditions.

- Using the right digital tool makes it easy to create and manage invoices and quotes, helping achieve financial success.

📊Key Insight:

The billing and invoicing software market is projected to reach approximately USD 6.57 billion by 2026, according to the Business Research Insight Report.

Invoice vs Quote: What is the Difference Between a Quote and an Invoice?

A quote shows the estimated cost, whereas an invoice shows the amount payable by the client. Here is the tabular form presenting more information on quote vs invoice:

| Features | Quote | Invoice |

|---|---|---|

| A quote is a formal document that presents a cost estimate for a project or the delivery of a product or service. | An invoice is a financial document that shows the amount the client owes the seller. | |

| Quote number, quote date, business details, customer details, and line-item details, including estimated/ projected costs. | Invoice number, invoice date, due date, business details, customer details, and line-item details, including final costs that the client pays. | |

| Flexible and can be modified before the client’s acceptance | Invoice documents can be modified only when they are not aligned with the PO and agreement. | |

| Before purchasing or beginning the project. | After purchasing or project completion. (can be sent in advance in case of partial payment) | |

| It is not a payment request. | It is a formal payment request. | |

| A formal quote becomes a legally binding document upon the customer’s acceptance. | Not a legally binding document, but it serves as evidence of payment. | |

| Not applicable | Mandatory to include if the PO document exists. | |

| Can approve or reject the price quotes. | Mandatory to make the payment. | |

| The quote is not recorded in the accounting book. | The invoice is recorded in the accounting book. | |

| Can be converted to an invoice. | It is not converted back to a quote. |

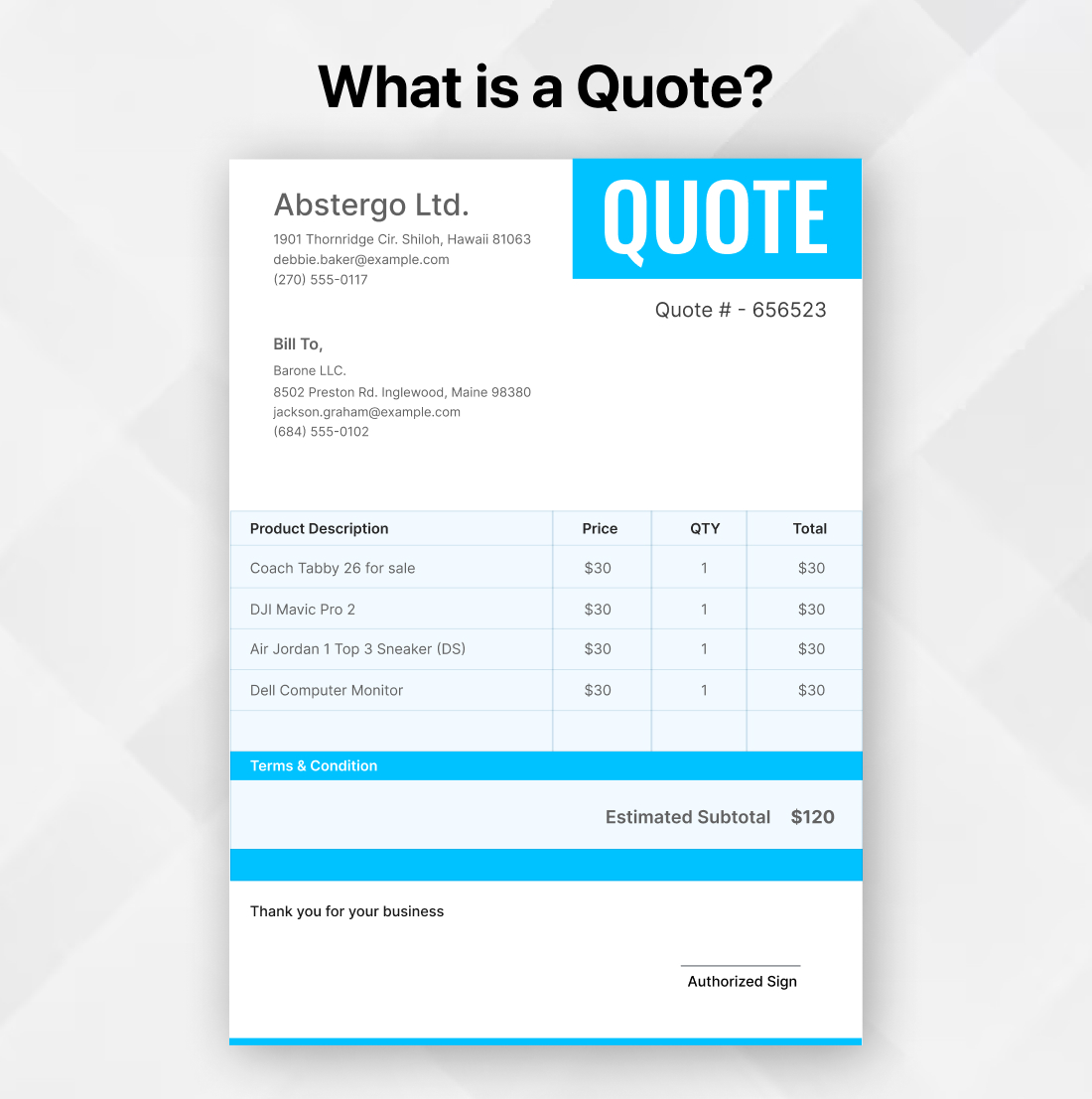

What is a Quote?

A quote is a formal document that outlines the estimated cost of a project. It is shared by the vendor with the customer prior to the project beginning or sale. A proper quote includes a brief description of the product or service with quantity, unit price & applicable tax/discount.

Quotes are crucial for businesses because they inform potential customers of the written estimate before purchase or the project begins. Thus, transparency is established between the seller and the customer through a trustworthy conversation. A quote’s meaning in business is simply presenting the estimated cost of the deal.

Key Details to Include in Quote

- Quote number

- Quote date

- Yours or your business details (name, address, & contact number)

- Client information (name, address & contact number)

- Detailed information on goods/ services agreed to deliver

- Pricing breakdown

- Applicable tax and discount

- Terms and conditions

- Estimated timeline

- Authorized signature

- Supporting documents

Types of Quotes

1. Product Quotes

A product quote is a well-written commercial document that clearly states the price of the product the seller offers to the client. Additionally, it includes the buyer’s and seller’s details, applicable tax, the terms and conditions, and the signature.

2. Service Quotes

A service quote is a document that indicates the estimated cost of the service that the seller agrees to deliver to the client. It includes the buyer’s and service provider’s details, terms and conditions, a service description with an estimated cost, and a signature.

3. Open Price Quote

An open price quote is widely accepted in the business world. These quotes vary based on the project scope or material costs. Thus, such a quote is useful for scaling projects or when the client is ready to negotiate.

4. Fixed Price Quotes

A fixed-price quote is a quote that includes a fixed price. The cost remains fixed regardless of changes to the project or services. This type of quote is useful when there are clear specifications, and the customer agrees to pay a fixed amount.

When to Use a Quote?

A quote helps sellers present an estimate to clients before selling products or services. This fosters transparency for the potential client regarding the investment. The client can either accept or reject the quote; upon acceptance, it becomes a legally binding contract.

Customers should always review the price quotes and other details before accepting a quote for payment. Once accepted, the terms cannot be changed. The seller offers the product or service at the agreed-upon price, and the client must pay it.

How to Make a Quote? Key Steps to Follow

You can create formal quotes manually or using a template to improve accuracy, speed, and organization. Templates provide ready-made fields in a well-structured format. Below is the key strategy for using the quote template.

1. Gathering the Client’s Requirements

The initial step is to gather the client’s needs. What products or services the client wants to buy, or what the client’s requirements are in the project. Hold a clear, open discussion with your client to clarify the situation. Additionally, you must be careful at this step, as any misunderstanding can lead to errors and incorrect quotes. Note down all the requirements carefully.

2. Choose the Right Template

Choosing the correct quote template is the next step. It helps in creating the perfect quote in a professional layout. Select the customized estimate template to create the quote that best fits your needs. Keeps the theme and colors consistent with your brand.

3. Fill in the Details

Finalized the template! Great! It’s time to fill in the details. Templates possess a standardized format, so you need to include the details accordingly. Here is the mandatory information you need to fill out:

- Quote details: Quote number, quote date, & currency.

- Your details: Yours or your business information, including name, address, & contact number.

- Client details: Mention your client’s information, including name, address & contact number.

- Line item detail: Detailed information on goods or services that you are about to provide. Includes unit price and quantity.

- Tax & discount: Mention the applicable tax and discount. However, these are included only if required.

- Terms and conditions: Provide the terms and conditions related to the deal, according to your business policies.

- Upload document: Upload the relevant and supporting document (if required).

- Authorized signature: Includes your signature or that of any other authorized person.

4. Review the Quote

Once the details are filled in the quote, professionals need to review it. It helps identify shortcomings and missing information. Cross-checking the quote is necessary before sending it to the client.

Follow up on your quote and be open to discussing any point with your client. This will clear the doubt and get the deal started on time.

Need a Quote Template that Fits Your Business?

Join Moon Invoice to get the right quote template & create a professional quote with 100% accuracy.

Best Practices to Follow During Quote Making

- Understand the client’s requirements well before making the quote.

- Visit the job site for on-site projects to gain a better understanding.

- Always mention the actual cost that aligns with the market condition.

- Make sure you mention accurate pricing.

- Include all the costs involved in the deal, including material and labor costs.

- Utilize the quote template to create a professional quote in just a few clicks.

- Choose a template that aligns with your brand’s theme and features a professional layout.

- Always specify the deliverables you can realistically deliver.

- Don’t forget to mention the terms in a clear and understandable language.

- Highlight all key terms to capture viewers’ attention.

- Showcase the cost in a proper breakdown format.

- Review the quote deeply before sharing it with the client.

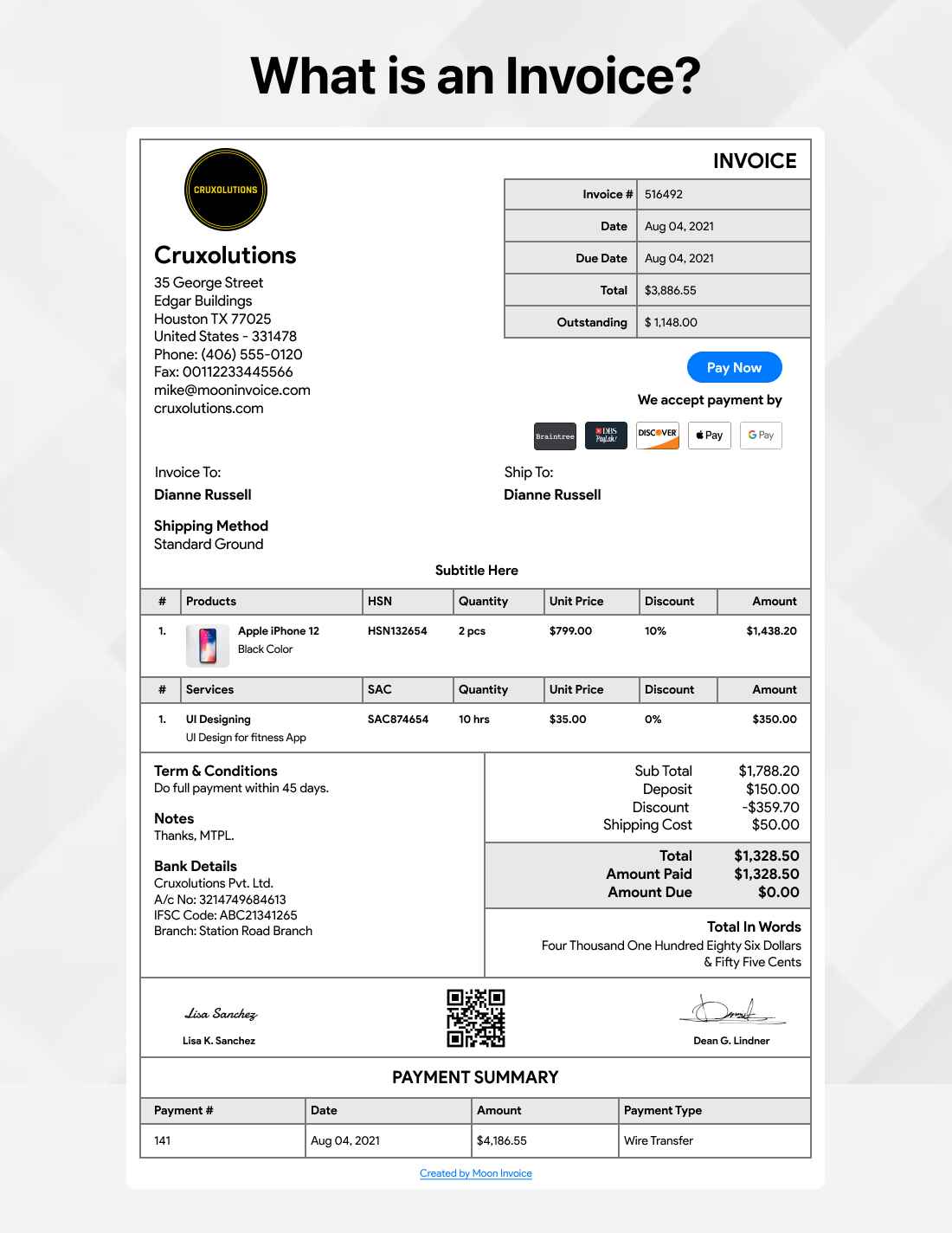

What is an Invoice?

An invoice is a payment request issued by the seller to the client. This document is shared after project completion or the sale of the product or service. The primary purpose of an invoice is to prompt the buyer to pay for the goods or services. In short, it is issued to request payment.

It is not a contract or any other legal document. However, it serves as important evidence of the financial transactions and acts as a payment reminder. Invoices are a helpful tool for maintaining steady business income by encouraging clients to make on-time payments.

Key Details to Include in an Invoice

- Invoice serial number

- Invoice date

- Due date

- Yours or your business details (name, address, & contact number)

- Client information (name, address & contact number)

- Detailed information on sold goods or services

- Pricing breakdown

- Applicable tax and discount

- Total cost to pay

- Terms and conditions

- Payment options/payment method

- Authorized signature

- Supporting documents

When Are Invoices Useful?

Invoices are useful when a business owner needs to collect the due payment from a client. Additionally, the document is highly useful for bookkeeping purposes. Sellers can easily track the incoming cash flow, and clients can easily track outgoing payments.

Whether it’s a one-time or recurring payment, invoices are useful in both cases. Invoices are also useful during taxation. It serves as proof of taxable sales and provides accurate information on the applicable tax. An incorrect sales invoice can negatively affect the taxation process, leading to penalties and other actions.

How to Make an Invoice? Key Steps to Follow

You can create an invoice in either paper or electronic format. However, it is better to opt for the digital option. Here are the key steps to create the perfect invoice.

1. Choose the Template

Firstly, choose the right invoice template that aligns with your brand. Invoicing tools like Moon Invoice offer more than 66 customizable invoice templates. Customize the template as per your needs.

2. Fill in the Details

Once the template is ready, the next step is to fill in the required details. Make sure you include your business details, the client’s details, and any other relevant information accurately.

- Invoice details: Invoice number, invoice date, currency, and due date.

- PO number: Mention the purchase order number if applicable.

- Your details: Yours or your business information, including name, address, & contact details.

- Client details: Mention your client’s information, including name, address & contact details.

- Line item detail: Detailed information on sold goods or services, including unit price and quantity.

- Tax & discount: Mention the applicable discounts and tax. (if applied)

- Terms and conditions: Provide the payment terms and other conditions as per your business policies.

- Payment options: The modes of payment the customer can use. (Make sure your business is open to accept them.)

- Upload document: Upload the relevant and supporting document (if required).

- Authorized signature: Includes your signature or that of any other authorized person.

3. Reviewing the Details

Cross-checking the fill-in details is mandatory. It helps you identify shortcomings or missing information and address them as early as possible. Thoroughly recheck the invoice, inspecting all details.

Best Practices to Follow During Invoicing

- Always add relevant and correct information.

- Utilize the correct invoice template that aligns with your brand.

- Highlight the due date and the total final cost to boost cash flow.

- Keeps payment terms language simple and easy to understand.

- Specify all accepted payment methods to ensure a smooth payment process.

- Please specify the correct tax applicable to your region (if applicable).

- Attach all supporting documents as required.

- Double-check invoicing details before sharing the final invoice with the client.

- Always issue sales invoices promptly to ensure timely payment.

- Keep a record of invoices for proper financial management.

Manage Your Quotes and Invoices With Moon Invoice

Moon Invoice, trusted by 1.7 million global users, helps business professionals manage their end-to-end billing tasks. Whether it’s a startup or a large corporation in any industry, the platform simplifies the billing and helps professionals save time.

You can streamline your quote and invoicing process with this platform. The invoicing software offers more than 66 free, customizable templates. Thus, you can easily generate professional quotes and invoices with accurate data. The ready-to-use samples save you time by enabling you to fill in the details.

Ensure accuracy and professionalism in every quote to help you secure the deal with quick approval. Convert your quote to an invoice in 1 minute to save time and reduce errors.

Mark the status of your quote or duplicate it as an invoice, estimate, Performa invoice, or PO. Perform all actions right on your screen with a few clicks. Monitor every single action performed through the activity log.

Similarly, you can streamline the overall invoice process with Moon Invoice. The tool supports 20+ payment options to make accepting payments simple. Its multi-currency and multi-lingual features enable you to accept payments globally.

You can also set automatic recurring billing for the subscription services. This keeps the billing cycle active, prevents missed invoices, and boosts cash flow.

Duplicate as an invoice, estimate, credit note, PO, and delivery challan in a few clicks. Verify every action performed in the activity log.

The platform is cloud-based, enabling you to store all your crucial documents securely. Also, its AI-powered concept offers a quick scan that extracts details from documents. Hence, leave no room for errors.

Facing Delays in Customer Payments?

Now create a professional invoice with Moon Invoice to drive 2x faster payments.

Before You Go

An invoice and a quote are two poles apart that serve different purposes. Whether you are a company owner or a professional accountant, clarity on the invoice vs quote is necessary. It helps you manage your finances more effectively, which is crucial to running a successful business. Additionally, adding automation to your strategy streamlines your workflow and elevates the process. Do you experience it practically?

Try Moon Invoice & see how it helps millions of professionals worldwide automate their billing.