DEFINITION:

A credit note is a formal document issued by a seller to a buyer to acknowledge a return, refund, or adjustment on a previously issued invoice. It reduces the amount owed and can be used to offset future purchases or correct accounting records.

If you’ve ever run a business — or even just managed your invoices — you’ve probably come across a situation where something on a bill needed to be corrected. Maybe a customer returned a product, or perhaps you accidentally overcharged them. That’s where a credit note comes in.

A credit note is essentially a way to say, “Oops, let’s fix that.” It’s a formal document used to correct or cancel part (or all) of a previously issued invoice. In simple terms, it tells the customer that they no longer owe the full amount, and it updates your books accordingly.

For small businesses and freelancers, understanding credit notes isn’t just about paperwork — it’s about maintaining trust and professionalism. It ensures transparency in transactions and helps avoid future confusion for both you and your clients.

In this blog, we’ll explore what a credit note is, when you might need one, and how to create and record it correctly. Whether you’re new to invoicing or need a refresher, this guide will help you stay organized and financially sound.

Key Takeaways

📌 Key Takeaways

- A credit note is a vital document used to correct billing errors, handle returns, or adjust invoices without modifying the original invoice.

- Issuing credit notes promptly ensures smoother customer relationships, accurate financial records, and better tax compliance.

- Essential components of a credit note include customer details, original invoice reference, item descriptions, and the credited amount.

- Recording credit notes properly helps maintain clean books by adjusting accounts payable and offsetting future purchases.

- Using tools like Moon Invoice can simplify the creation and tracking of credit notes, saving time and reducing errors.

What is a Credit Note?

A credit note (also known as a credit memo) is a document issued by a seller to a buyer, letting them know that they’ve been credited a certain amount on their account. Think of it as the reverse of an invoice — it reduces the amount the buyer owes.

Let’s say you sent a customer an invoice for $500, but later realized you overcharged them by $50. Instead of sending a revised invoice, you issue a credit note for $50. This tells the customer, “Hey, we owe you $50 back,” either to be refunded or applied to future purchases.

Credit notes are commonly used in situations like:

- A customer returns goods due to damage or dissatisfaction.

- You offered a discount after the invoice had been sent.

- There was an error in the original invoice — maybe you billed for one item too many.

- Services weren’t rendered as expected, and you want to adjust the final amount.

In bookkeeping terms, a credit note helps correct or reduce an invoice without deleting or altering the original document. This is important for transparency and for staying compliant with accounting or tax regulations.

Also, credit notes are not just about being nice to your customers — they help keep your financial records clean and accurate. Instead of adjusting past invoices (which can confuse audits), credit notes provide a clear, trackable way to fix things.

Tired of Creating Credit Notes Manually?

Try Moon Invoice to generate professional credit notes in just a few clicks — fast, accurate, and hassle-free.

Why Are Credit Notes Important?

At first glance, a credit note might seem like a bit of admin work — one more document to deal with. But in reality, it plays a much bigger role in keeping your business running smoothly, professionally, and legally.

Here’s why credit notes really matter:

- Credit Notes Keep Your Financial Records Accurate: Business transactions aren’t always perfect. Items get returned, services fall short, and sometimes we make simple billing mistakes. When that happens, a credit note helps you correct the amount owed without messing with the original invoice. This means your accounting records stay clean, traceable, and audit-friendly.

- It Helps Maintain Good Customer Relationships: Nothing builds trust like honesty and transparency. When you issue a credit note, you’re showing your customers that you take their concerns seriously — and that you’re willing to correct mistakes or adjust pricing fairly. It’s a small gesture that can go a long way in customer satisfaction and long-term loyalty.

- Credit Notes Are Essential for Tax Compliance: Depending on where you operate, tax authorities often require a paper trail for every adjustment to your revenue or customer billing. A credit note serves as an official document that shows why an invoice was reduced. This keeps you compliant with tax laws and ready for audits, without needing to go back and alter issued invoices (which is generally a big no-no).

- It Supports Better Business Decisions: Properly issuing and recording credit notes gives you a more accurate view of your actual income. This helps you analyze customer behavior (like frequent returns), manage cash flow, and make informed decisions. Over time, patterns in credit notes can reveal areas where your pricing, product quality, or customer communication could improve.

- Credit Notes Help Avoid Confusion or Disputes: Without a credit note, misunderstandings can easily arise. A customer might believe they’re owed a full refund, partial refund, or discount, but there’s no clear documentation to prove it. With a credit note, everything is on record. Both sides know exactly what was adjusted, when, and why.

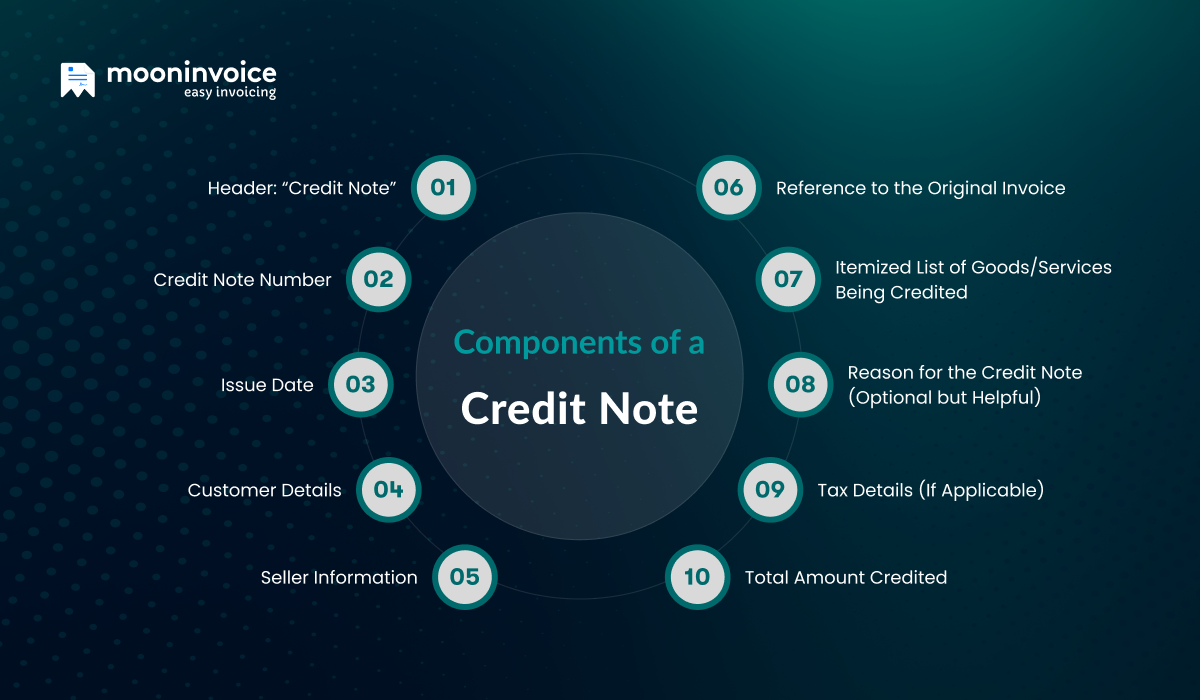

Components of a Credit Note

If you’re going to issue a credit note, it needs to be clear, professional, and include all the essential information, just like an invoice. Whether you’re using accounting software or creating one manually, here are the key components every credit note should have:

1. Header: “Credit Note”

It might sound obvious, but clearly labeling the document as a Credit Note (not an invoice or receipt) is important. This helps the customer, your accounting team, and tax authorities instantly understand the nature of the document.

2. Credit Note Number

Just like invoices, credit notes need to have a unique number for tracking and record-keeping. It can follow your existing invoice numbering system, like “CN-001” or “2025-CN-04.” This helps you (and your auditor) find and reference the credit note later on.

3. Issue Date

The date the credit note is created and sent should be clearly stated. This is important for accounting, especially if you’re adjusting revenue or taxes in a specific period.

4. Customer Details

Include the same customer details that appeared on the original invoice:

- Name or company name

- Billing address

- Contact information

This ties the credit note back to the correct account and avoids confusion if you’re dealing with multiple clients.

5. Seller Information

Include your business name, address, and contact information. If applicable, add your tax identification number or business registration number.

6. Reference to the Original Invoice

Always state which invoice the credit note is related to. This usually means including:

- The invoice number

- The invoice date. This makes it easy to track which transaction is being adjusted.

7. Itemized List of Goods/Services Being Credited

Clearly list the products or services that are being credited. For each line item, include:

- Description (e.g., “Product return: Wireless Mouse”)

- Quantity (e.g., 2 items)

- Unit price

- Total amount credited

This mirrors the format of the original invoice and keeps things clear.

8. Reason for the Credit Note (Optional but Helpful)

Though not always required, it’s helpful to include a brief note explaining why the credit is being issued. For example:

- “Customer returned damaged items.”

- “Applied 10% goodwill discount post-sale.” This adds transparency and reduces customer questions.

9. Tax Details (If Applicable)

If VAT or sales tax was applied to the original invoice, the credit note should reflect that. Ensure the tax amount is adjusted proportionately, and include the correct tax rates.

10. Total Amount Credited

At the bottom, clearly show the total value being credited, including tax if relevant. This is the amount that will either be refunded or applied as a balance on the customer’s account.

Optional Add-ons:

- Payment Terms for Adjustment: If the credit is being applied to a future invoice, you should note that.

- Signature or Approval: You should include a signature or authorized stamp for internal or external validation.

A well-prepared credit note is more than just a form — it reflects your professionalism and attention to detail. Getting the components right ensures both clarity and compliance.

💡Pro Tip:

Always include a reason for issuing a credit note — this avoids confusion, adds transparency, and helps track recurring issues for better business decisions.

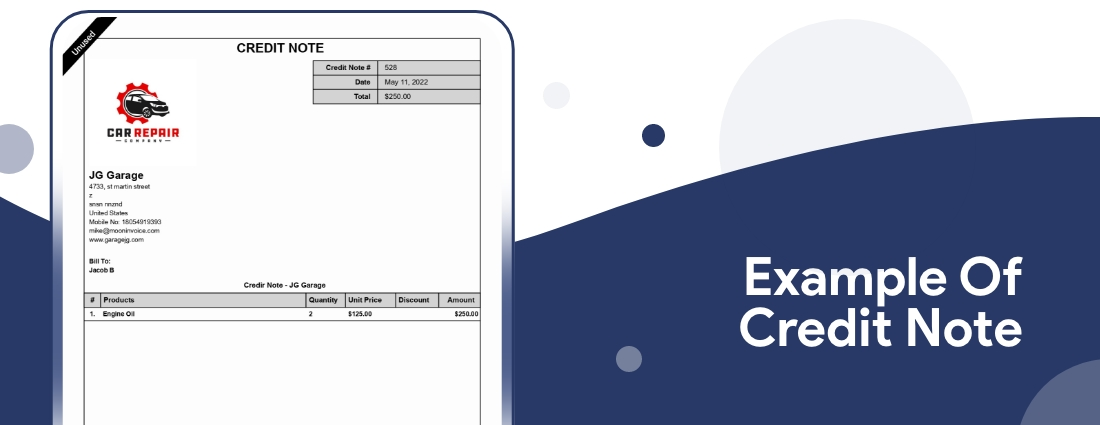

Example of a Credit Note

How to Create and Record a Credit Note?

Issuing a credit note might sound like a technical task, but it’s not as complex if you understand the process. Whether you’re running a small business or freelancing, knowing how to create and record a credit note correctly helps you stay organized, accurate, and professional.

Let’s walk through both parts: creating the credit note and then recording it properly in your books.

Part 1: How to Create a Credit Note?

Here’s a simple step-by-step guide to creating a credit note:

Step 1: Identify the Reason

Before you start drafting anything, figure out why you’re issuing the credit note. Common reasons include:

- Returned goods

- Overbilling

- Discounts applied after the invoice was sent

- Canceled services

- Being clear on this helps ensure the credit note reflects the correct adjustments.

Step 2: Gather Invoice Information

Locate the original invoice to which the credit note will be linked. You’ll need:

- Invoice number

- Invoice date

- Billed items/services

- Amount due

This ensures your credit note is directly referenced and corrects the transaction.

Step 3: Use a Template or Accounting Software

You can either:

- Use a credit note template (many free options online)

- Or, generate one using an accounting software like Moon Invoice.

Most accounting platforms let you create a credit note with just a few clicks, which simplifies the credit adjustment process, especially if it’s tied to an existing invoice.

Step 4: Fill Out the Credit Note

Include all the essential components (as we covered earlier), such as:

- Credit note number and date

- Customer and business details

- Reference to the original invoice

- Description of items/services being credited

- Total amount to be credited (with taxes, if applicable)

- Optional: Reason for issuing the credit

Step 5: Send It to the Customer

Once the credit note is complete, email or send it to the customer through your invoicing system. This will let them know their balance has been updated and help maintain transparency.

Part 2: How to Record a Credit Note?

Creating the credit note is only half the job. To keep your financial records accurate, you also need to record them properly in your accounting system.

Step 1: Enter the Credit Note into Your Accounting Software

Most cloud-based accounting platforms have a section for adding credit notes. If you create a credit note within the system, it’s often recorded automatically.

If you’re doing it manually, make sure to:

- Link it to the correct customer

- Apply it against the original invoice or leave it as credit on the customer’s account.

Step 2: Adjust Accounts Receivable

Once the credit note is applied, the total amount the customer owes you should decrease. This means your accounts receivable balance will drop accordingly. This is especially important if you’re tracking unpaid invoices.

Step 3: Reflect the Adjustment in Sales and Tax Records

Credit notes reduce your income and possibly your tax liability, so be sure they’re:

- Reflected in your sales reports

- Included in tax calculations (especially if VAT/GST is involved)

Your accounting software usually handles this automatically, but if you do it manually, you’ll need to adjust your ledgers accordingly.

Step 4: Reconcile During End-of-Month Reporting

At the end of the month (or accounting period), make sure your credit notes are:

- Matched to the correct invoices

- Accounted for in your financial statements

This helps ensure that your income, taxes, and customer balances are accurate. You need to look for the best AR automation software to tackle accounts receivable issues easily.

Best Practices for Managing Credit Notes

Issuing credit notes isn’t just about fixing invoice mistakes — it’s about keeping your business processes clean, professional, and stress-free. To make sure your credit notes work for you (and not against you), here are three best practices to follow:

1. Keep a Clear and Consistent System

Credit notes should be numbered, dated, and consistently linked to their corresponding invoices. Whether you’re using accounting software or handling them manually, develop a simple naming and filing system so you can quickly trace each credit note back to the original transaction. This saves time during audits, customer queries, or internal reviews.

2. Always Document the Reason

Whenever you issue a credit note, make a brief note explaining why.

- Was it a product return?

- A pricing error?

- A late discount?

Having this context not only adds transparency for your customers but also helps you spot patterns over time, like recurring issues with a particular product or client.

3. Don’t Delay in Issuing or Recording

Treat credit notes like any other financial document — handle them promptly. Waiting too long can lead to accounting document errors, tax mismatches, or customer confusion. Aim to issue and record credit notes as soon as you identify the need, preferably within the same accounting period as the original invoice.

Make Your Accounting Smarter.

With Moon Invoice, you can manage credit notes, invoices, and payments — all in one.

Wrapping Up!

Manually adjusting your accounts after issuing credit notes can be tedious and error-prone, especially without a dedicated accounting team.

Even if you try to handle it efficiently, manual work often leads to unnecessary stress and a higher risk of mistakes — mistakes that can cost your business valuable time and money.

That’s why many modern businesses rely on smart accounting software to simplify their credit note process. With a tool like Moon Invoice, you can create and manage credit notes in just a few clicks, saving time, reducing errors, and keeping your records organized.

Switch to Moon Invoice today and transform your invoicing journey for the future.