Sending a payment is equally important for the business as receiving money. Sometimes, it is also necessary to make multiple payments to several recipients simultaneously. Sounds tough?

Yes! It may seem daunting, but it ultimately leads to saving time & streamlining the payment process. Certain processes, such as payroll, supplier payments, and issuing refunds, require a streamlined system for disbursing funds to multiple parties, commonly referred to as bulk payments.

Moving further, you will find the real meaning of bulk payment, along with its advantages and common challenges associated with it. We’ll discuss many more things, so keep your eyes active.

📌 Key Takeaways

- Bulk payments reduce manual transactions and streamline multiple payments.

- It is beneficial for improving cash flow management.

- Businesses can easily handle multiple bills with mass payment.

- It reduces the unnecessary burden associated with single transactions.

- The bulk payment system provides comprehensive reporting and analytics.

- Bulk payments always handle sensitive financial information efficiently.

What Is a Bulk Payment?

A bulk payment refers to a financial transaction in which multiple payments are made simultaneously to different recipients at the same time. It is also useful to pay multiple vendor invoices simultaneously. Thus, it eliminates the individual transaction approach, leading to a smoother transaction/payment process. Other names for bulk payments include mass payments, batch payments, and payouts.

Bulk payments are widely used in businesses, e-commerce platforms, government agencies, NGOs, freelancers, some small businesses, and other large enterprises. The money is sent through digital financial transactions, such as ACH, using credit or debit cards, PayPal, or other financial institutions. The most usual method for sending a bulk payment is a bank wire transfer. Approximately 71% of financial institutions prefer this method for transferring large amounts in B2B transactions.

How Are Bulk Lists Different from Bulk Payment?

Bulk lists and bulk payments differ in terms of functionality. A bulk list is a collection of beneficiary details and payment instructions, but bulk payment is the actual transaction. Therefore, one needs to create a bulk list first before initiating bulk payment.

Therefore, it is impossible to make a bulk payment without a bulk list. There are usually two types of bulk payments and bulk lists:

Standard Domestic Bulk Payment

In this type of transaction, a standard domestic bulk payment is made for multiple recipients through the single debit system within the same country. This type of transaction is commonly useful for transferring employees’ salaries & payments to vendors and suppliers.

Bulk Inter Account Transfer (IAT)

Bulk inter-account transfer is primarily useful for transferring funds on an international level. Thus, it is often used for businesses that involve overseas financial transactions. However, it is also useful for domestic transactions. It facilitates a faster and more reliable transfer of funds.

Powerful Recurring Invoice = Smooth Payment Flow

Moon Invoice can streamline your recurring invoicing process. Experience the magic of automation.

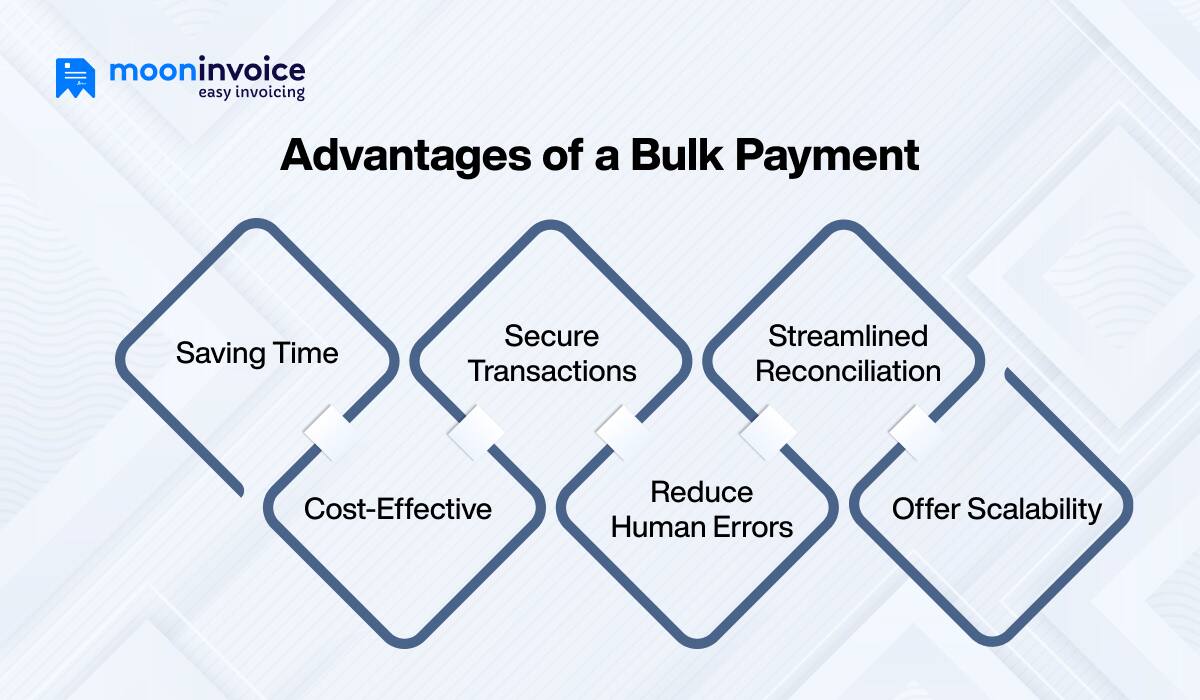

What are the Advantages of a Bulk Payment?

While adopting a mass payment method, business professionals can experience certain benefits in their process. Check out its key benefits and how it is helpful for the business:

Saving Time

Business professionals can save their precious time through bulk payment. It’s because it reduces the one-by-one transaction concept and provides a unified system of processing multiple payments. It’s quite easy & quick to pay multiple recipients in a second.

Cost-Effective

A bulk payment offers cost-saving transactions because you only need to pay a single processing fee, rather than multiple fees for individual transactions. Additionally, due to fewer error chances, it reduces administrative costs and the time spent correcting those errors.

Secure Transactions

Bulk payments are done through a digital mode that involves techniques such as Secure Sockets Layer (SSL). This encrypts all sensitive information, reducing the likelihood of information leakage. Thus, it leads to a secure transaction. Thus, business professionals can leverage a secure transaction once they integrate bulk payments.

Reduce Human Errors

Bulk payment transactions are less prone to human errors due to automation. Additionally, it involves verifying and confirming the details before final payment is made. The validation checks verify vendor information and payment details. Professionals just need to set up the payment, and the amount will be automatically sent to the desired recipient. It reduces human errors in the financial operations.

Streamlined Reconciliation

Incorporating mass payment results in a smooth reconciliation because the payment is sent in a single transaction batch. Thus, it eliminates the unnecessary burden on the accounting team that handles the invoice reconciliation process. With the manual approach, the finance team needs to ensure that every transaction detail is accurately recorded in the accounting system. However, it got automated with bulk transactions.

Offer Scalability

The payment volume increases with the business growth. The manual process requires additional manpower, which increases the cost. However, with the bulk payment system, this can be handled carefully. It is because the system is scalable and can be utilized efficiently as the business expands.

Common Challenges & Their Solution Using Bulk Payments

No doubt, bulk payments offer numerous benefits, but they are also prone to some issues that you must be aware of. Let’s have a look at the challenges with their solutions below:

Transaction Fees

No doubt, a bulk payment solution is a cost-effective approach; however, transaction fees still apply to bulk payments. Hence, you can’t escape from this and take advantage of a 100% fee-free transaction.

Solution

Exploring lower-cost alternatives, such as ACH, and negotiating volume discounts may be more effective.

Payment Failures

Bulk payments are also prone to errors, such as insufficient funds, invalid account numbers, or bounced checks, which can cause delays in the process. Additionally, it also damages the payee’s trust.

Solution

One can avoid it by implementing data validation before submission. Additionally, maintaining a sufficient balance is crucial for a successful transaction.

File Format Issues

CSV, XML & Excel are different file formats available for bulk payment services. The specific file format support varies from bank to bank or platform to platform. Incorrect file formats can lead to payment delays or failures.

Solution

Always ensure the correct file format before initiating. Have a clear understanding of which file format the platform & banks support.

Wrong Setups

Whenever a business professional chooses a different system, it is natural to encounter some issues at the initial stage. It is also common to have an incorrect setup of the bulk payment solution. As a result, it negatively affects the transaction.

Solution

Always read the user manual and understand the product’s functionality. Additionally, you can contact the customer support team for a more comprehensive understanding.

Foreign Currency Transfer

A different fee applies when sending bulk payments to multiple countries. Additionally, it also incurs a currency conversion fee. This adds extra cost to the transaction process. Hence, it doesn’t provide a cost-effective solution.

Solution

Always look for the platform that offers mid-market exchange rates with full transparency.

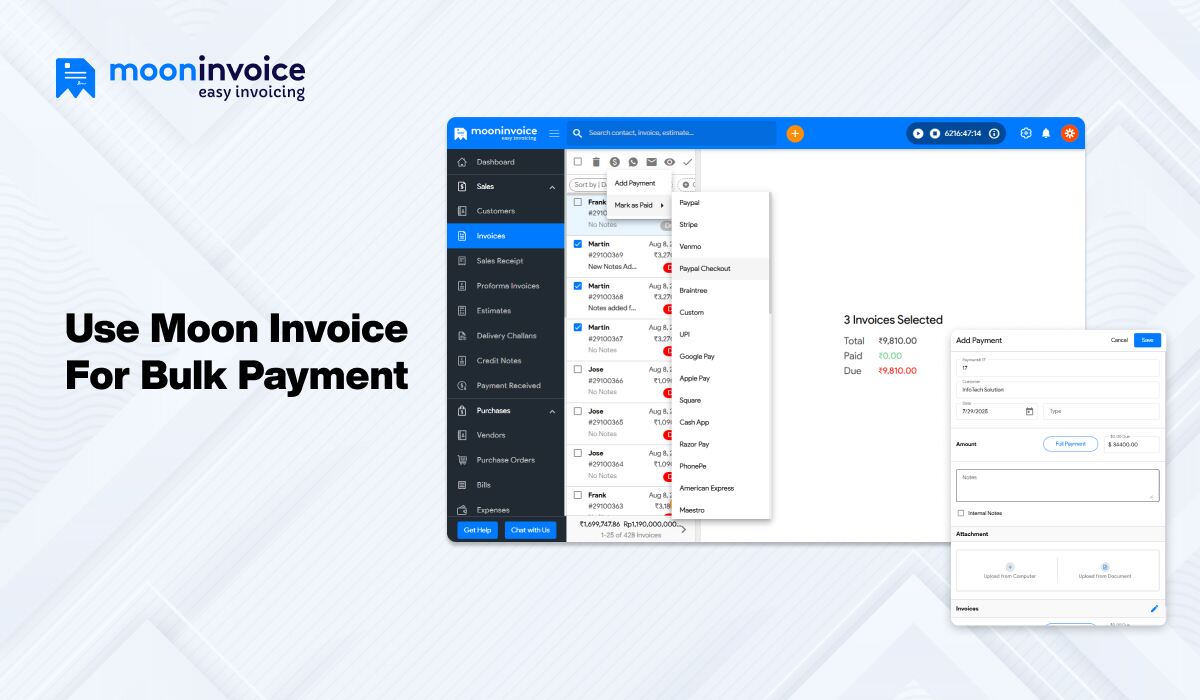

Use Moon Invoice For Bulk Payment

Moon Invoice, one of the popular invoicing software, helps businesses to streamline their bulk payment. Its advanced features streamline the bulk payment process by automating the process while eliminating manual efforts. As a result, save time and effort!

One of its most helpful features is bulk invoice generation, which helps professionals to generate and send bulk invoices simultaneously. Professionals can easily send these invoices to a single person or a group of people. Hence, professionals can easily accelerate the bulk payment processing for businesses with a high volume of transactions.

Bulk invoicing is also beneficial for recurring billing, making the process more streamlined and efficient. Professionals can easily send multiple invoices to multiple clients in bulk by selecting the right invoices and sending them to clients through email.

Other features of Moon Invoice that streamline bulk payment:

Payment Gateway Integration – The software seamlessly integrates with other popular payment gateways, including PayPal, Razorpay, and Stripe. These platforms facilitate the batch payment process.

Reporting – Professionals can easily generate reports on bulk payments. This helps to get a better insight into the financial budgeting.

Grouping Clients and Vendors – Professionals can easily group clients or vendors to streamline bulk transactions. This smooths the bulk payment processing.

Automated Reconciliation – The payment status is automatically matched to invoices and their corresponding purchase orders when the bulk payments are made. Therefore, it reduces the manual efforts and speeds up the work.

Bulk Payment in the Future

The changing landscape of technologies and the market also impacts the bulk payment system. With the increasing demand for a safe and secure payment scenario, professionals are increasingly focusing on advanced payment systems.

In the near future, technologies such as Artificial Intelligence (AI) and blockchain will play a significant role in bulk payments. This will offer the next level of automation and transaction security.

Want to Streamline Your Bulk Payment? Here Is the Solution

Level up your bulk payment processing with all the innovative features of Moon Invoice.

Last Word

Bulk payment is a crucial aspect for businesses, especially those with a growth and expansion vision. It facilitates a large transaction volume, resulting in smooth financial operations. Therefore, one should be well aware of its advantages & challenges to utilize it in the right way. Additionally, using the right accounting software, such as Moon Invoice, is another crucial step in the process.