Marginal cost definition

Marginal cost (MC) refers to the additional cost required to complete the production of one more unit.

Offering a product that directly solves your customer’s real-life problems is already half the battle won. All that’s left is your focused effort to fulfill the desired goals.

And it starts with establishing smart pricing strategies that help you fulfill your business objectives while also delivering satisfaction to your buyers. Simultaneously, pricing strategies will also play a role in business growth, something no business owner can afford to overlook.

Why do we say? Because setting up pricing strategies is important nowadays, as consumer spending growth may weaken to 3.7% in 2025 and may also continue to decline in 2026.

Now, when we say pricing strategies, we refer to internal production cost and not the price that customers pay at the time of purchase. You might be wondering, what does marginal cost have to do with your production cost?

That’s what we will cover here. So, let’s begin with what is the best definition of marginal cost.

What is Marginal Cost?

Marginal cost refers to the ups and downs in the extra cost incurred due to the production of one more unit. It is also known as incremental cost because of the additional unit produced, which further impacts the total production cost.

Suppose your business is manufacturing 50 units of your product per month, then the cost required to generate the 51st unit will be the marginal cost or the incremental cost of the product.

Marginal costs are linked with variable costs, which often change with the increase and decrease in your business sales. Such costs have nothing to do with fixed costs that do not change, regardless of how many units you produce.

Forget the Pain of Tracking Expenses Manually

Get your financial data under one roof and generate an accurate expense report in a few taps to monitor business cash flow.

Understanding Marginal Cost in Business

Modern businesses consider marginal cost when it comes to making informed decisions in their manufacturing process. It gives a clear idea of whether they can go ahead with making one extra unit of product or not.

So, what businesses usually do is compare the marginal cost to the marginal revenue earned by selling one additional unit.

Thereafter, they check if it is really making a difference to their overall business profits. That’s how the marginal cost helps them in earning more profits as well as managing their resources.

Some businesses use marginal cost as part of their financial analysis to set effective pricing strategies. They keep a tab on the variable expense ratio to discover how much of their earned money is utilized in the variable cost.

Plus, they also consider break-even point, a moment where the business starts making a profit by covering fixed and variable expenses. Analyzing both factors, they can set the right prices.

How to Calculate Marginal Cost?

If you are unsure of how to find marginal cost, below are the simple steps to help you discover the accurate marginal cost.

1. Accumulate Required Information

Firstly, keep your accounting data ready and the number of units generated in a specific period. You will need an expense report to compute the total expenses incurred. So, keep it handy before you move forward

2. Spot the Change in Total

Notice the difference in your total cost following the production of an additional unit. For that, you can consider the previous production cost and subtract it from the production cost required for the next batch.

3. Determine the Change in Quantity

Similarly, discover the change in the quantity of units, which could usually be one unit. Therefore, subtract the previously generated units from the quantity of units generated in your recent batch.

4. Use the Marginal Cost Formula

Once you have calculated the above two details, let’s put them in the below formula to identify the marginal cost.

Marginal Cost Formula

Marginal Cost Example

Let’s illustrate this with a marginal cost example from a ceramic washbasin manufacturer. The total cost for producing 900 washbasin units is $150,000, which gives a per-unit cost of $166.67.

The manufacturer then decided to produce one more washbasin unit to cover the cost of the extra employee required to fulfill an urgent order. Now, the cost to produce the 901st unit rose to $175 is the marginal cost, taking the total production cost to $150,175.

Here’s the breakdown:

Marginal Cost = Change in Total Cost / Change in Quantity

Change in Total Cost: $150,175 – $150,000 = $175

Change in Quantity: 901 – 900 = 1 unit

Marginal Cost = $175 / 1 = $175

What is Marginal Cost Pricing?

Marginal cost pricing is basically a strategy where the company keeps the product’s price akin to its marginal cost. The price of a particular product is decided by considering the incremental cost instead of the total production cost.

The move aims to cover variable costs in a way that the business continues to operate normally. However, the business’s profitability may take a hit due to marginal cost pricing.

The Importance of Marginal Cost

Here’s why marginal cost matters the most for modern businesses like yours.

1. Optimize Production Process

Marginal cost plays a central role in optimizing your production process in such a way that you can earn maximum profit. You can identify and double down on what works for your business when producing one extra unit of goods.

2. Strategic Decisions

With marginal cost, businesses can dive deep into production insights and make strategic decisions in response to the buyer’s changing demands. That’s not all, you can develop smarter pricing strategies to unleash competitive prices to draw more customers.

3. Identifying Loopholes

Businesses can track the cost required to generate that additional unit and see whether it also increases the variable costs. Observing spikes in raw materials or extended time for labor hours, you can learn what needs to be fixed and improve overall profitability.

Slash Your Administrative Workload by 60%

Forget using Spreadsheets and adopt AI-powered invoicing software, Moon Invoice, to manage your business finances and admin-related tasks.

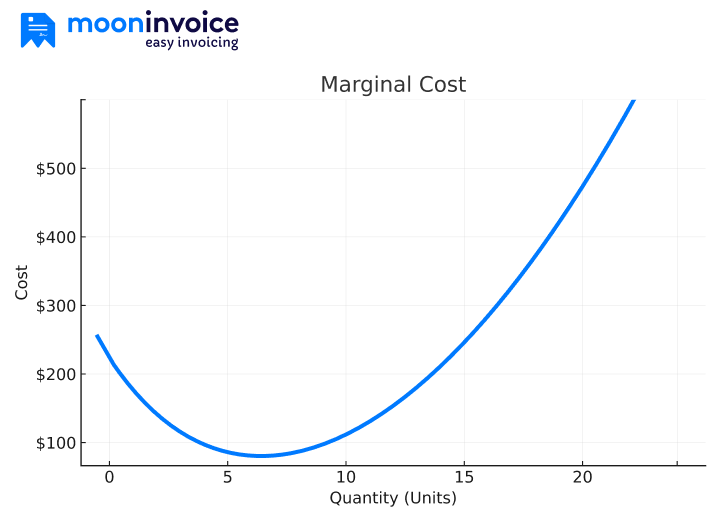

What Is the Marginal Cost Curve?

With marginal cost, your per-unit cost is also likely to grow, especially when there is a decline in business productivity. A process which is often known as the diseconomies of scale. It is where the cost initially falls and then starts going up, representing a U-shaped curve. This U-shaped curve is what we call the marginal cost curve.

For example, your local bakery making its first pancake may require extra effort to gather ingredients or heat the pan. But when you make the 6th or 7th pancake, you may require less effort because the batter is ready, and even the pan is now hot.

Later, when you make your 50th pancake, you will require immense effort because the pan will get messy, and you will probably be tired as well. So, now the effort required to make that 50th pancake is much bigger than the first pancake.

The ups and downs in the cost display the U-shaped curve, which is the marginal cost curve.

Final Say on Marginal Cost

In conclusion, not every business will benefit from using marginal cost, but what they will identify is the ability to optimize their manufacturing process. Businesses can use marginal cost to compare with the product’s selling price.

If it is really higher than the marginal cost, it would make sense to keep up with the same production rate. But if the marginal cost becomes higher, you may start losing your money. That’s when marginal cost steps in, aiding you to make big profits without overproducing goods.