Do you recheck the invoice properly before hitting the payment button or sending the cash? Yes, that matters a lot!

An invoice is not just a bill; it is a crucial financial document that streamlines your tax reporting, record-keeping, and legal processes. Therefore, treating & checking an invoice wisely is important.

An invoice may contain errors that can further disrupt the process. These mistakes can be in any information, including the total amount or payment terms. A single wrong payment from your end or your accounting team can lead to financial mismanagement.

That’s where it is crucial to check this payment request document. Unfortunately, many professionals don’t know how to read an invoice.

Here, we’ll share the right guide to help you unlock the right roadmap for reviewing an invoice.

📌 Key Takeaways

- The invoice number and date are essential for verification.

- The invoicing process becomes smooth when professionals know how to read invoices properly.

- Matching the invoice to the associated purchase order helps identify discrepancies.

- Verify the total payable amount and confirm it aligns with the agreed-upon terms.

- Calculating figures in an invoice is a good practice when reviewing it.

- Professionals must retain a copy of the invoice for record-keeping and audit purposes.

- Knowing what is in an invoice is essential for checking billing details and preventing payment disputes.

What Is an Invoice & Why Does it Matter?

An invoice is a financial document issued by a vendor or seller to a client, requesting payment for goods or services. In this way, the seller receives on-time payment because the client has a clear understanding of the overall billing details.

- Invoice serial number

- Invoice date

- Due date

- Currency

- Seller details

- Vendor details

- Description of delivered items/services, along with the unit cost and quantity

- Payment-related terms

- Signature

The major purpose of an invoice is to boost on-time payment. Additionally, an invoice serves as supporting documentation for legal and tax processes. It also helps the business track income and expenditures. Thus, the document is a valuable thing in the business world. It establishes clarity and transparency.

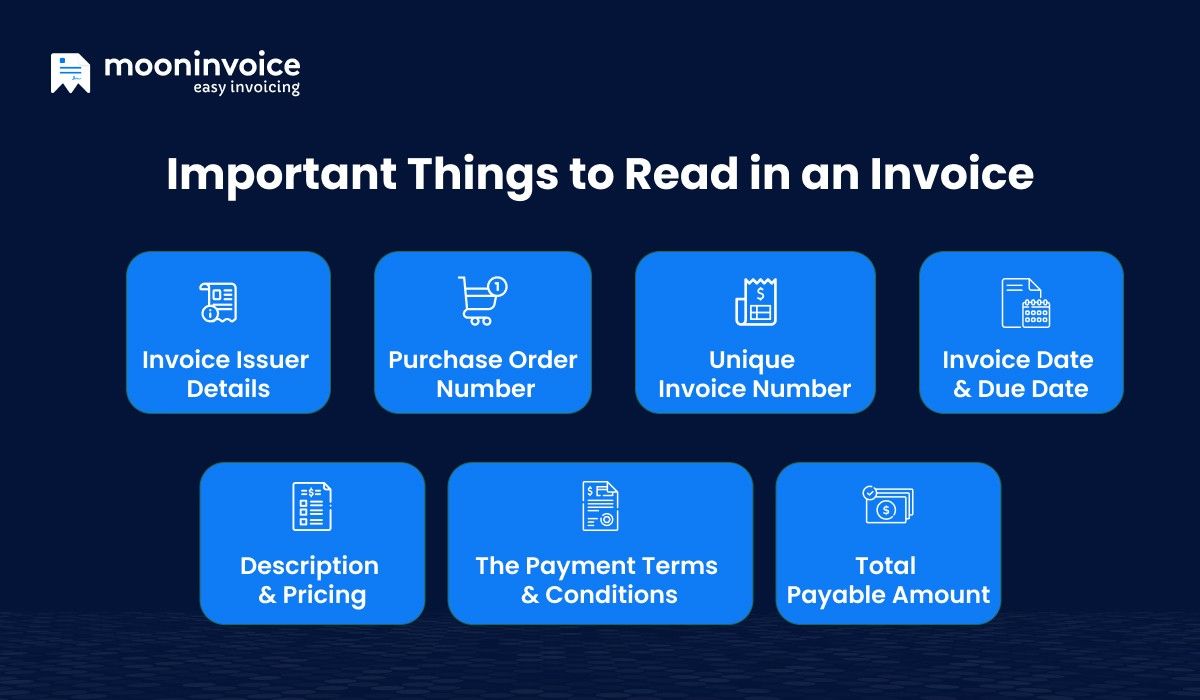

How to Read an Invoice? 7 Important Things to Check

An invoice comprises several sections, each of which contains different information. When reviewing an invoice, ensure the information is complete and accurate. Here are the complete details that you need to check one by one when receiving the first invoice:

1. Invoice Issuer Details

When reviewing an invoice, the first section to check is the issuer’s details or business details, often listed in the header. It is an initial step when considering how to read invoices. The key details to check are as follows:

- Issuer/business owner name

- Issuer address

- Company logo

- Contact information

Verifying these details ensures the invoice was issued by the correct vendor. Verify that all fields are completed, and raise a notification if any field is missing. Addressing the issue at an early stage is a good practice.

Are You Invoicing Correctly?

Ensure 100% accuracy with our customized invoice templates offering auto-calculation.

2. Purchase Order Number

The purchase order number refers to the original purchase order that your accounting department approved. This original purchase order document outlines the required product or services and the buyer’s specifications.

A clear & correct purchase order number on an invoice helps the accounting department to match the invoice with the associated PO. Thus, it simplifies the verification & assures all things are upto the mark.

It is not necessary that every invoice be accompanied by a purchase order. It works mainly for higher transactions. Many businesses have a transaction threshold before issuing a PO. If the transaction value exceeds that amount, a PO is required. This all varies from company to company.

3. Unique Invoice Number

Each invoice has a unique number that identifies it. The primary purpose of this number is to track invoices. Checking the invoice number is essential whenever you or your accounting department receives an invoice.

The invoice number is helpful for both the client and vendors. They can easily track which invoice the payment has been made for. A client can easily close the purchase order once payment is received. Vendor, on the other hand, can simply track which invoice the payment has been received for.

4. Invoice Date & Due Date

In the guide on how to read an invoice, the next step is to check the invoice date and due date. Every invoice includes an invoice date indicating when it was issued. Checking the invoice date is important because it impacts the payment timeline. Additionally, reviewing the due date is also important to ensure it aligns with agreed-upon terms.

5. Description & Pricing

This section of an invoice displays the line item for the product or service. It includes a brief description, along with quantity/hours, unit price/hourly rate, and the relevant amount. It is usually presented in an itemized format, with a cost breakdown for each line item. This helps to get insight into pricing before completing the transaction.

You must match the details with the purchase order. Ensure all products or services are identical to those specified in the purchase order or agreed upon. Once the information is correct, payment can be made.

Sometimes, requirements change mid-transaction, requiring updates to the invoice. For instance, if your company needs 15 items instead of 10, then payment can be made if the client has approved the revised line items.

A clear and correct cost breakdown helps businesses track expenses. The company can easily identify which product or service requires the most investment.

6. The Payment Terms and Conditions

Reviewing the terms and conditions is another essential step. In simple terms, payment terms are the number of days the client has to pay. Net 15, Net 30, and Net 45 are standard payment terms, meaning the client must pay in 15, 30, or 45 days, respectively.

These terms can also be stated as 2/15 Net 30, meaning a 2% discount applies when the client pays within 15 days. Additionally, it is sometimes stated as payable upon receipt.

Payment-related terms may vary by company. It is not necessary for vendors to have a payment term under any of the above terms. They might have their own defined terms for the payment. Therefore, you must review the terms carefully & clear the doubt early.

For instance, a company might have Net 60 terms, and you mark an invoice as Net 30. This creates unnecessary confusion & issues in the process. Therefore, you must have a clear understanding of clarity regarding the payment terms when dealing for the first time.

7. Total Payable Amount

The total payable amount is the amount that you need to pay to the vendor. You must verify the invoice total after properly calculating the figures. Don’t forget to consider the tax or discount if applicable. Make sure the payable amount matches your calculated amount.

How to Make a Professional Invoice for a Business?

Creating a professional invoice is not just a practice; it is a necessary part of the billing process. However, this is only possible with the right invoicing software, such as Moon Invoice.

AI-powered software is a trusted system that serves over 1.7M professionals worldwide. It not only simplifies the invoicing but also provides a complete one-to-one financial management solution. With all digital power, it improves accuracy, accelerates the process & saves professionals time.

Making a Professional Invoice

Moon Invoice offers 66+ customizable invoice templates and built-in fields. You can choose the template that best aligns with your business nature and industry. Once you select the right template, fill in the details below as follows:

- Invoice Details: Invoice serial number, invoice date, due date, and currency.

- Your/Company Details: Your or company name, business logo, address, and contact details.

- PO number: Include the PO number on the invoice if the PO has already been issued.

- Client Details: Client name, address, and contact details.

- Payment method: Specify which payment methods you accept and allow your client to pay using their preferred method.

- Line Item Details: Include all the details of the product or service delivered. Shows everything in itemized form, including quantity, unit price, and total price.

- Payment Terms: Include the payment terms or other conditions related to the transaction. Keep the language simple and easy to understand.

- Authorized Signature: Include the signature of the authorized party.

The professional invoice is ready once you fill in the required information. The templates use auto-calculation to process your entered figures and apply applicable taxes or discounts. Thus, there is no space for errors in the calculation.

With Moon Invoice, the accounting department can manage all financial activities in a single, centralized platform. Thus, it not only streamlines document management but also the auditing process.

Are You Still Processing Invoices Manually?

Upgrade to efficient invoicing with Moon Invoice, an AI-powered system.

Key Tips to Ensure Proper Invoice Checking

Always be aware of the applied VAT or sales tax. Stay up to date by reviewing the tax regulations.

- Always conduct a thorough review of an invoice.

- The accounting department should never confuse the invoice date with the due date.

- Ensure no additional charges are applied beyond those agreed upon.

- Make a habit of taking immediate action when you identify an issue.

- Automate where possible to save time and speed up workflows.

- Utilize a centralized management & process invoices in one unified system.

- Perform a factual matching – 2-way, 3-way, 4-way whenever needed to ensure high accuracy.

Last Words

You must have a deep understanding of how to read an invoice. It prevents incorrect payments, which would otherwise add unnecessary burden on the team to correct them. Whether your company underpays or overpays a vendor, it disrupts the billing cycle. Therefore, it is necessary to review the invoice carefully.