Pro Rata Definition

Pro Rata is a Latin word that refers to “in proportion” and is used to divide assets into equal portions. The division is based on time, usage, quantity, or contribution.

Are you allocating the shares fairly among shareholders? Or does your employee receive fair wages for the work performed? Sounds perplexing! But you can determine the straightforward answer by understanding the meaning of pro rata.

A Latin phrase that simply refers to dividing the allocation proportionally instead of equally. The allocation is based on the quantity, time, and ownership percentage. Thus, the primary purpose of the concept is to allocate costs, shares, and assets fairly based on the contributions or time involved.

We’ll go deeper to uncover insights beyond this pro rata definition. In this article, you will learn the formula, calculation, and practical example.

📌 Key Takeaways

- Pro rata meaning refers to the fair allocation of the amount in proportion to usage and time. Pro rata translates to “in proportion”.

- Pro rata calculated using the simple proportion formula.

- Business professionals can use the pro rata method to allocate assets among shareholders in proportion to their ownership.

- Calculating pro rata shares is useful in many areas, including determining dividend payments or cash payments.

- The concept can set transparency in business finance.

- Pro rata is widely used in payroll processes, business partnership income allocations, insurance, and rent calculations.

- It makes two fractions equal when they have different denominators.

What is Pro Rata?

Pro Rata is a Latin term that simply means “in proportion.” A professional uses it when an amount is calculated or divided fairly in a proportion. Another meaning of pro rata is according to the rate.

It is also known by many other names, such as:

- Pro rate

- Respectively

- Prorated

- Proportionately

- In Proportion

- According to the calculated share

- Ad Valorem

- Fair share

Understanding the pro rata definition is crucial for business professionals, insurance professionals, HR departments, and many others.

How Pro Rata Works in Different Contexts?

Pro rata is useful in many circumstances where the primary objective is fair distribution. Here are the real-life scenarios where it is used:

1. Salary & Payroll

The human resource department uses pro rata calculation in the payroll process. The primary purpose is to provide part time workers with a fair salary based on their working days or working hours of employees in their job. The concept is particularly useful when an employee joins mid-month or leaves before the month ends. The concept is also useful in determining the part-time employees’ salaries.

2. Share Distribution

Pro rata is useful in allocating business partnership income. This allocation is made in proportion to each partner’s contribution. Thus, a fair distribution is based on ownership percentages & proportionate allocation. Shareholders gain appropriate portions.

3. Invoicing & Billing

Businesses use pro rata billing when a client uses the service for a specific period. It means the client is charged only for the period he used the service, rather than the full charge. Thus, a pro rata cash payment allows consumers to pay fairly based on usage.

4. Rent Payment

Property owners can use the pro rata method to charge the tenant based on the tenant’s use of the property. It means the tenant pays only for the days he occupies the space, rather than the full monthly rent.

5. Insurance Premium Payment

A pro rata insurance calculator is useful when a policy begins or ends midyear. According to it, an insurance company applies pro rata premiums based on the actual policy coverage rather than the annual premium for the entire year. That means the policyholder receives partial coverage as per the partial policy term.

Leverage the Fast & Accurate Billing

Enhance your invoicing with our 66+ customized invoice templates of Moon Invoice.

Pro Rata Formula & Calculation

Along with understanding the pro rata meaning, it is compulsory to know that the standard pro rata formula is as follows:

Additionally, we can include further formulas in the modified form based on time, hours, and total amount:

On the Basis of Time

On the Basis of Hours

On the Basis of Annual Amounts

On the Basis of the Share

The pro rata calculation is performed using the formula above. You need to calculate the whole amount, individual share/time used, and total share/time-period work. It is also known as prorating.

Steps to Calculate Pro Rata

- Identify Total Amount: First, determine the total amount, which includes the total monthly salary, total premium, & total invoice value.

- Determine Total Period or Total Share: This refers to the total number of days in a month, the total number of months in a year, or the ownership of an individual.

- Calculate the Portion Used: Identify the total time the employee worked, or the unit consumed by the user, or the ownership percentage.

Once you have identified all the above values, straightforwardly apply them to the pro rata formula. The result is the final pro rata amount.

Examples of Pro Rata

Let’s understand the pro rata calculation through the practical examples below:

Payroll-Based Example

Suppose an employee joins the company on the 10th of the 30th day of the month. The total salary of an employee is $50,000. However, as he joins the company on the 10th, his employment period is 20 days. Now, calculating the pro rata cash payment.

50,000 x (20 / 30)

50,000 x 0.1 = 33,333

Thus, the employee will receive a total salary of $33,333 instead of the given whole salary.

Insurance-Based Example

Suppose an individual holds a $10,000 insurance policy. The policy remains active for 6 months rather than 12. So, as per the pro rata:

10,000 x (6/12)

10,000 x 0.5 = 5,000

Now, $5,000 is the premium the policyholder must pay.

Rent-Based Example

Suppose a property owner rented the house for $15,000 per month. However, the tenant vacated the rental space on the 20th day of the month’s 30-day period. Calculating the pro rata as:

15,000 x (20/30)

15,000 x 0.6 = 9,000

The tenant pays $9,000 in rent.

Besides that you should also know how to fill out rent receipt to eliminate any queries arising.

Benefits of Using Pro Rata

Pro rata offers several benefits to human resources departments & business professionals. Here are several merits of using pro rata in multiple circumstances:

Set Transparency

Using the pro rata method, one can set transparency among the parties involved. They have a clear understanding of how the amount is calculated. As a result, it also enhances credibility. There is no space for the inflated or unclear costs.

Ensure Fairness in Distribution

Pro rata distribution is fair and based on valid consumption or work time. Whether it is paying salaries or rent, amounts are always aligned with the work performed. Thus, understanding the meaning of pro rata is beneficial.

Supporting the Flexible Billing

Pro rata enhances billing flexibility by eliminating the dependency on rigid flat pricing. You can bill either at the midpoint of the month or based on short-term usage.

Reduce Confusion Chances

Pro rata cash payment helps reduce the risk of confusion by increasing clarity & transparency. Involved parties have a clear set of payments because the calculation is straightforward and requires no guesswork.

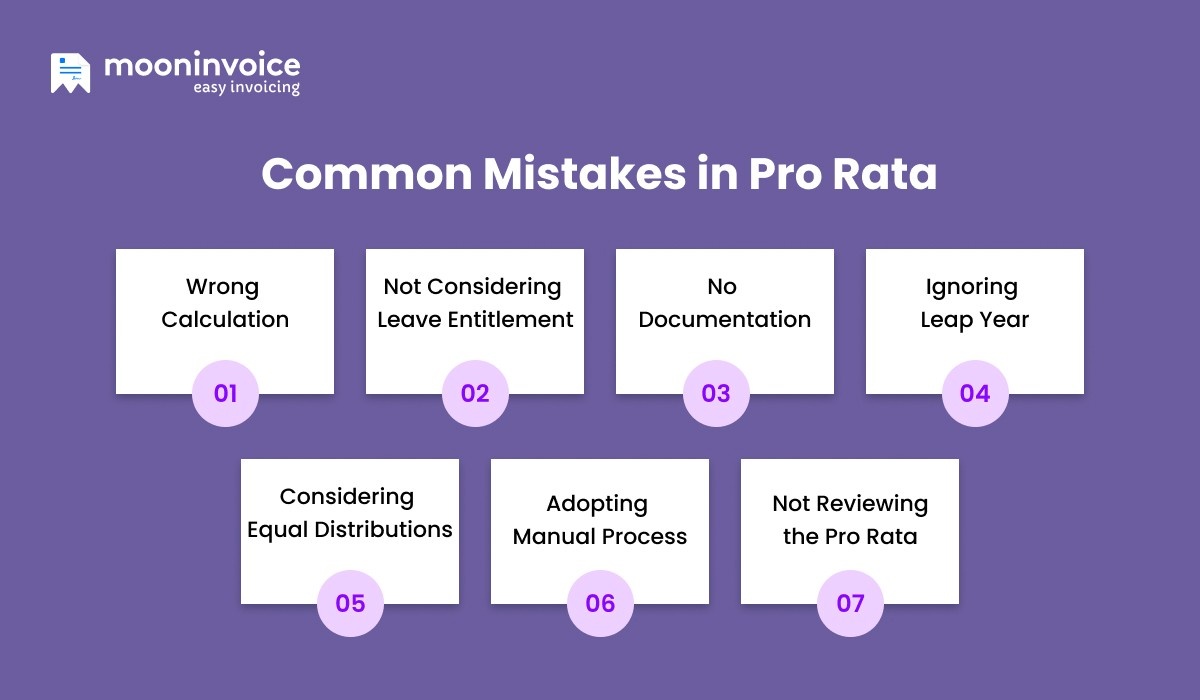

What Are the Common Mistakes Involved in Pro Rata?

Professionals often make mistakes when determining the pro rata. Here are the common faults you must avoid during the pro rata:

1. Wrong Calculation

Ensure that full-time hours worked are calculated accurately. It is necessary for the accurate calculation of the final payable amount. An incorrect calculation yields an incorrect result.

2. Not Considering Leave Entitlement

In the payroll process of employment, the human resource department ignores leave entitlements. Employee leaves, such as sick or casual leave, should be calculated proportionally to the time the employee worked (e.g., days or hours).

3. No Documentation

Professionals often fail to maintain proper records of calculations. In the pro rata, it is necessary to streamline the audit process. It also sets transparency while eliminating confusion.

4. Ignoring Leap Year

When determining the pro rata, professionals often forget to account for leap years. In such a case, they use 365 days instead of 366, which directly affects the calculation and results in an incorrect outcome.

5. Considering Equal Distributions

It is a common misconception that pro rata refers to dividing in equal portions. Instead, the allocation is in the same proportion and is based on usage, time, or ownership, reflecting the actual allocation.

6. Adopting Manual Process

Many businesses use the manual method to calculate pro rata. It leads to human error and delays. Instead, using the software is beneficial, as it not only boosts workflow but also keeps it on track.

7. Not Reviewing the Pro Rata

Companies often forget to review & update the pro rata. The result is that it doesn’t comply with evolving laws and regulations. Thus, companies should always review it, especially when it concerns payroll and employment.

How to Manage Pro Rata Efficiently?

You need to be careful about the following things for efficient pro rata management:

- Always pay attention to month lengths, leap years, & overlapping billing periods.

- Use invoicing software like Moon Invoice to automate processes and manage accounting efficiently.

- Keep standardization in the time calculation.

- Maintains clear records, which are essential for correct & compliant calculation.

- Always round the final amount to ensure accuracy.

- Showcase the details in a clear breakdown form for transparency.

Upgrade Your Billing to a Smarter System

Simplify your billing & control your finances digitally with Moon Invoice. Trusted by 1.7M users.

Final Remarks

Pro rata is far more than just a term. It is an important metric, and you must understand how it works if you are managing the business. A fair allocation is essential in payroll and asset distribution, and it’s only possible when you understand the concept of pro rata calculation. It helps establish transparency and build trust with your client or employee.

![How to Calculate Net Sales [Net Sales Formula]](https://mi-blogs.s3.amazonaws.com/mi-live/blog/wp-content/uploads/2024/04/25100739/How-to-Calculate-Net-Sales-Updated-Guide-2024.jpg)