How often do you check the financial health of your business? One of the most effective ways to assess your business’s financial health is to calculate its total assets. Every valuable asset the company owns falls under the company’s asset category. Not just cash or inventory; it includes high-value physical equipment and intangible property rights.

So, if we strip away all the jargon, the real question is: how do you calculate your business’s total assets?

In this blog, we will explore everything, starting with how to calculate total assets, the total assets formula, and why calculating total assets is important.

Let’s get started…

📌 Key Takeaways

- Everything the company owns that has an economic value can be called a company asset.

- A company’s total assets can be calculated by gathering all assets, assigning values to each, and summing them.

- To find out the true profit after tax deductions, calculate the Return on Assets (ROA), which compares net earnings with total resources available.

- Calculating total assets regularly helps you assess your financial position, secure loans, and make better investment decisions.

What Are Total Assets? (Total Assets Meaning)

Total assets are the complete value of everything a business owns that has measurable economic value. Total assets of a business include cash, bank balances, investments, equipment, inventory, owned property, and intangible assets such as software licenses or trademarks. Simply put, total assets reflect the business’s overall financial strength at a given point in time.

Total assets include all financial rights and resources that can generate future income or be converted into cash. Office computers, long-term investments, and delivery vehicles can all be considered while calculating total assets.

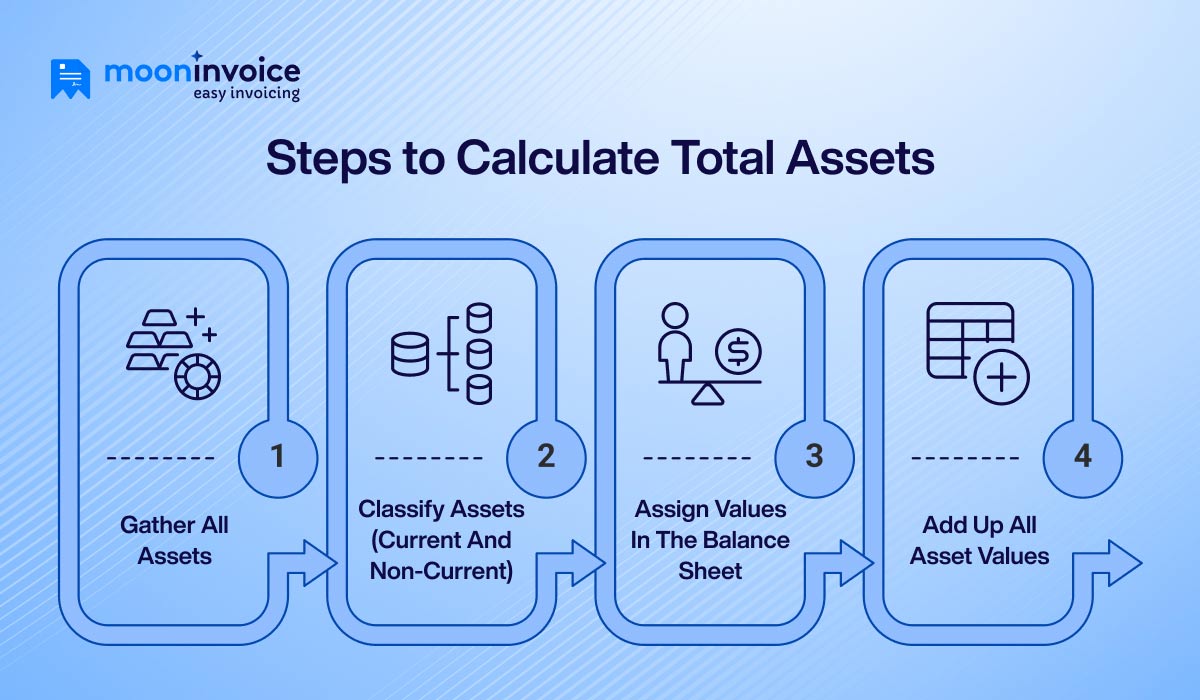

4 Easy Steps on How to Calculate Total Assets

To calculate your business’s total assets, you must follow a structured approach that avoids errors. The steps below clearly show how to calculate your business’s total assets.

Step 1: Gather All Assets

List out everything the company owns that has financial value; small or large, it needs to be listed first before calculating total assets. Gather bank statements, office equipment, vehicles, investments, property details, and any other tangible items such as software, licenses, or trademarks. Any item that can generate income or be capable of having monetary value in the future should be part of this list.

In this step, make sure nothing is overlooked or missed out, as accuracy is highly important. Verify every financial record, invoice, and asset register entry to ensure the list is detailed and organized.

Step 2: Classify Assets (Current and Non-Current)

After listing all assets, the next step is to categorize them by how quickly they can be converted into cash or used by the business. Classifying assets helps create a structured balance sheet and provides greater clarity into the finances.

Assets that are expected to be used, sold, or converted into cash within one accounting year are classified as current assets. It includes cash balances, accounts receivable, inventory, and short-term investments.

On the other hand, assets that provide long-term value and support business operations over multiple years are classified as non-current assets. It includes property, machinery, vehicles, long-term investments, and intangible assets. Proper classification ensures accurate reporting and simplifies further financial analysis.

Is Manual Expense Logging Slowing You Down?

Simplify your financial workflow by creating expenses on the go. With Moon Invoice, manage your expenditures and see how they impact your total assets.

Step 3: Assign Values in the Balance Sheet

After classifying assets into current and non-current categories, the next step is to record them in the balance sheet with accurate values. Each asset should be entered based on reliable financial records such as invoices, bank statements, purchase agreements, or valuation reports.

Short-term assets like cash, receivables, and inventory should be recorded at their realizable or book value. Long-term resources, including vehicles, buildings, and equipment, are recorded as fixed assets at purchase cost and adjusted over time through depreciation.

The key here is to apply realistic, up-to-date values so the balance sheet reflects the company’s true financial position.

Step 4: Add Up All Asset Values

Once assigning values to each asset is complete, the next step is to add up all those numbers into a single total. Everything you have listed on the balance sheet so far, starting from cash, inventory, long-term investments, and other assets, is calculated.

The final number after adding all these figures is the total assets of your company. It gives you clarity on your financial strength and the changes, improvements, or innovations you should make to grow further.

The fundamental total assets formula is:

Where,

- Current Assets: Cash, inventory, receivables

- Non-current Assets: Property, equipment, long-term investments

Here’s an example of total asset calculation:

Suppose a company has current assets:

- Cash in Bank = $25,000

- Accounts Receivable = $18,000

- Inventory = $12,000

Non-current assets:

- Office Equipment = $20,000

- Company’s Vehicle = $30,000

- Intangible Assets = $35,000

Now, the total assets will be (adding up all current and non-current assets):

Total Assets = Current Assets + Non-Current Assets

- Total Assets = $25,000 + $18,000 + $12,000 + $20,000 + $30,000 + $35,000 = $140,000

As per this example, the business owns assets worth $140,000.

How to Calculate Return on Assets?

Once your total assets are clear, you can move on to Return on Assets (ROA). It helps evaluate how well net profit is generated using the resources the business owns.

ROA can be either good or bad; it largely depends on the industry and how well the research is done.

ROA of a business can be calculated in two ways:

- Return on Assets = Net Profit Margin x Asset Turnover

- Return on Assets = Net Income / Average Total Assets

Now, lets undertand how ROA can be calculated using both these formulas in the examples below.

1. Calculating ROA Using the First Method

Let’s assume a company has:

- Net Income: $90,000

- Total Revenue: $900,000

- Average Total Assets: $450,000

Now, calculate the net profit margin:

Next, calculate the asset turnover:

So, ROA will be:

It means the business generates $0.20 in profit for every $1 invested in assets.

2. Calculating ROA Using the Second Method

Let’s assume a company has:

- Net Income: $90,000

- Total Assets at the Beginning of the Year: $420,000

- Total Assets at the End of the Year: $480,000

Here, Average Total Assets will be:

So, the ROA will be:

Why Should You Calculate Your Total Assets?

Understanding your total asset value gives you a clearer picture of how business resources are being used. With accurate figures in place, it becomes easier to evaluate operational efficiency, support growth plans, and improve profitability.

Below are some of the key reasons why you should calculate total assets:

1. Determine Financial Position

Your total assets provide a clearer picture of your business’s financial position. Consider your business’s total assets to assess stability, liquidity, and overall financial strength at a specific point in time.

2. Secure Loans Faster

Lenders, banks, and financial institutions review asset values to assess a borrower’s ability to repay. For loans and credit claims, maintaining accurate asset records improves overall credibility and helps keep a healthy asset ratio.

3. Help with Tax Filing and Audits

Well-maintained documentation makes the tax filing process easier and reduces errors during audits. Also, for depreciation claims, clear asset records are essential to ensure compliance.

4. Make Better Investment Decisions

Once you know the value of your total assets, you can better plan whether to reinvest, save, or use them for new opportunities. For example, underperforming machinery can be removed or replaced with more capable machines.

5. Reduce Financial Risk

Regularly calculating total assets helps you address inconsistencies, overvaluation, or financial pressure on borrowed funds. In critical cases, such as managing cash flow or planning a business expansion, ignoring asset accuracy can increase financial risk.

How Moon Invoice Helps You Calculate Total Assets?

Searching through a pile of paperwork or registers manually is not only time-consuming but error-prone, too. There is a higher risk of calculation errors when a business’s total assets are calculated manually. This is the primary reason why using software such as Moon Invoice is always most recommended.

They help you keep your asset reports accurate and well-categorized.

In Moon Invoice, you can record any business asset as an expense entry, which makes asset tracking simple and organized. For example, a startup’s assets, such as laptops, machinery, and vehicles, can be added under different expense categories, with the flexibility to create custom categories for less common assets.

Beyond manual entries, Moon Invoice uses AI-powered automation to reduce repetitive work by automatically categorizing expenses and identifying patterns from past records. Once expenses are captured, the platform allows you to generate detailed reports, such as purchase by product reports, purchase by task reports, and payment made reports. The dashboard then presents a clear, real-time expense summary for each business asset, helping businesses make more informed financial decisions.

Beyond expenses, below are some of the other features that make Moon Invoice a solid choice for your business:

- AI-powered Quick Scan: Convert any paper-based expense receipts into digital documents with the help of AI-backed scanning.

- Easy Integration: Sync and fetch data automatically once you integrate Moon Invoice with your existing system.

- Recurring Expense: Any expense that is purchased monthly or on a subscription basis can be set up as a recurring expense.

- Financial Reports: Create error-free financial reports such as P&L statements, balance sheets, tax reports, etc.

In Short

Assets play a vital role in keeping business operations stable. However, many small and medium-sized businesses fail to calculate total assets regularly, which leads to gaps in financial records and limited visibility into overall financial health.

Calculating a business’s total assets could take days if done manually. What’s the solution, then?

The answer is to introduce software like Moon Invoice into your business workflow. It helps you calculate the expenses for every business asset and categorize them correctly, without errors.

Explore Moon Invoice by starting your free trial today!