TL;DR

In this guide, we emphasize what is a chart of accounts (COA), along with a chart of accounts examples. COA is a well-structured list of business finances, offering a magnified view of where the money is going. It is important to prepare as long as you want to survive the tax season and check your business’s financial health. Assets, liabilities, equity, revenue, and expenses are necessary components to be included in the COA.

“A budget is telling your money where to go instead of wondering where it went.”

– John C. Maxwell

The famous saying by the American author reflects the purpose of the chart of accounts. It helps you categorize every dollar in a way that you no longer need to guess where your money has suddenly disappeared. Just like you can’t reach an unknown destination without a map, managing business expenses without a chart of accounts is next to impossible.

However, the chart length also grows with the business expansion, which can increase the number of accounts, which can increase the number of accounts. So, that’s right, whether you like it or not, the larger your company, the more difficult it becomes to manage.

Well, we can’t create a basic chart of accounts for your company, but we can certainly guide you on what is a COA, why it matters, and what to include while preparing a simple chart of accounts.

Ready? Let’s start with the basics first.

Chart of Accounts Definition: What is COA?

A Chart of Accounts (COA) refers to an organized list of your business’s finances, indicating both incoming and outgoing funds, so that you can keep track of every dollar. In other words, it is a summary of financial transactions in a general ledger, allowing you to see a 360-degree view of the business finances.

Since you have every detail posted in the chart, it would be easier to find the scope of improvement and map out an effective business strategy. COA represents every account tied directly to your business’s core operations. It also offers flexibility to businesses to add or remove accounts as per their requirements.

Now that you already know what is a chart of accounts, it’s time to uncover what does a chart of accounts look like.

Chart of Accounts Example

One of the best chart of accounts examples is a dashboard of your existing software. Let’s say your accounting team is using Tally accounting software. Opening that you can see the bank balance, accounts payable, stock summary, and much more in its dashboard. Isn’t it?

Similarly, it works as your dashboard, which gives a comprehensive view of your business finances. The only difference you may find is that some businesses have more accounts, while others have less accounts, depending on the business’s size and growth.

Sample Chart of Accounts for a Small Business

Here is an example of chart of accounts to clear your doubts and help you understand what it looks like.

| Account Type | Account Number | Account Name | Description | Balance ($) |

|---|---|---|---|---|

| Assets | 1000 | Cash | Funds held | 25,000.00 |

| Assets | 1010 | Receivables | Customer dues | 12,500.00 |

| Assets | 1500 | Land | Property owned | 100,000.00 |

| Liabilities | 2000 | Payables | Amounts owed | 8,000.00 |

| Liabilities | 2500 | Bank Loan | Debt to bank | 150,000.00 |

| Equity | 3000 | Capital | Initial investment | 100,000.00 |

| Revenue | 4000 | Sales Income | Product earnings | 60,000.00 |

| Expenses | 5000 | Wages | Employee pay | 10,000.00 |

| Expenses | 5010 | Rent | Lease cost | 2,000.00 |

Hate Manual Entries in Accounting? Us too.

Get Moon Invoice and make the most of no-sweat accounting to simplify preparing COA and expense tracking.

Why is the COA Important?

Below are a few reasons why you should prepare a chart of accounts list for your company and how it helps accelerate business growth.

1. Ease of Reporting

When you prepare a COA, you categorize your business finances in a way that makes it easier for you to create reports or financial statements. You can not only make reports quickly but also impress investors or lenders and eventually secure funding.

2. Insights on Financial Health

It goes without saying that you get enhanced visibility into your company’s financial health once you have a COA ready. So, you can learn the unnecessary costs and take the required steps to reduce them. This way, you can maintain a profitable business.

3. Aids in Surviving Tax Season

A detailed COA can aid you in tax preparation, helping you file tax returns on time and avoid possible penalties. With COA, your accounting data is centralized in one place, which provides great help in fulfilling your tax obligations in a timely manner.

💡Also Read:

Key accounts receivable metrics to consider for your business

Chart of Accounts: The Working Process

Coming to this point, now you would be familiar with basic COA meaning and why it is important, but one question may still come to mind: ‘How does it work?’ – Let’s find out.

It works like your own financial system that keeps every type of financial transaction well organized. Be it income, expenses, assets, liabilities, or equity accounts, the COA breaks down each category into accounts. That’s where it allows you to take a closer look at incoming and outgoing money.

Now, referring to the chart, you can learn about where exactly your money is moving. Suppose you have many accounts like office rent, utilities, and employees’ salaries in the business expense category, then you can easily identify how much you paid for rent or utility bills and salary proceeds for employees.

This means whenever you record a transaction (i.e., making a sale or paying a bill), it goes straight to the appropriate account. As a result, you can keep a tab on every financial move.

💡You May Also Like:

What’s included in the Charts of Accounts?

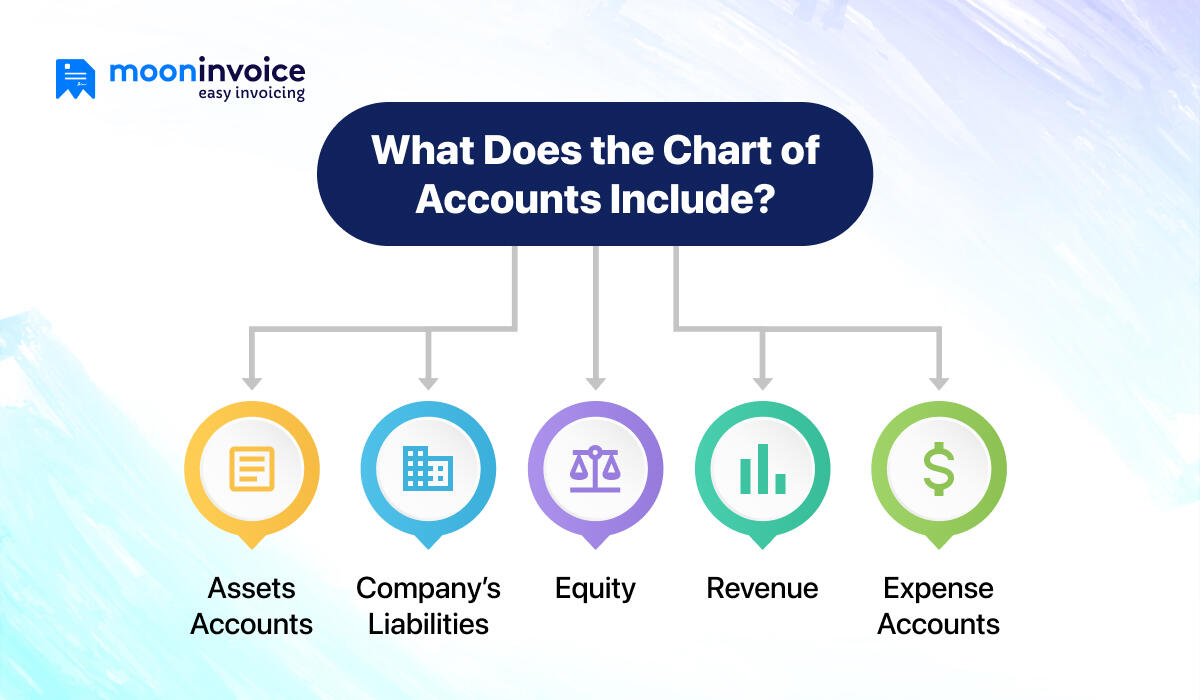

Below are a few necessary things that need to be included while preparing the company chart of accounts.

1. Assets Accounts

They are resources owned by your company that hold monetary value. The company’s vehicles, equipment, and inventory are classified as the company’s assets and are listed in the COA for business to assess how they are being used. The cash you have available in your bank account goes to asset accounts.

2. Company’s Liabilities

They indicate how much you owe to others, including business loans, unpaid bills, or any other short-term financial debts. Thus, you need to include liability accounts in the COA. This will further assist you in managing repayments.

3. Equity

The owner’s share, once the liabilities are taken off from the assets, also needs to be included in the chart. Therefore, one can include retained earnings and the owner’s capital. By doing so, it helps you see what’s actually owned by your business.

4. Revenue

Including operating revenue in the COA is as important as establishing your sales strategies. Because without revenue, you may not track the business income. The revenue account not only gives you an idea of sales performance but also identifies the top-selling products.

5. Expense Accounts

Lastly, include the business expense accounts, i.e., fixed or variable expenses like utility bills, office supplies, or staff salaries. Including expenses can aid you in keeping track of business expenses and determining your business’s profitability.

7 Best Practices to Prepare the COA Structure

Read out the best practices to follow while preparing the chart from scratch.

1. Prioritize a Simple Structure

Refrain from overdoing the details and keep a simple accounts structure whenever you prepare the accounts’ chart. It reduces confusion and helps you see the financial data more clearly. Therefore, make a simplified chart so that you can easily navigate the details.

2. Categorize Accounts

Start organizing your accounts in a way that you can see where your funds are coming from and where they are going. By categorizing them into assets, liabilities, and other key groups, you can assess whether your business is performing up to expectations.

3. Avoid Discrepancy

While you make a new COA for your company, always take care of possible discrepancies in accounts. If not addressed, they may lead to costly reporting errors and also contribute to financial inconsistencies. So, focus on accuracy in the accounts’ chart.

4. Consider Your Business’s Future

Keep your business growth in mind when creating a COA, so you can add new accounts that you might require as soon as your business starts growing. In short, you need to remember what lies ahead and prepare the chart that aligns with your future needs.

5. Limit User Access

Restrict who can access the accounts’ chart to accounting professionals so that only authorized users can access or edit the details. Once there is no unauthorized user access, you ultimately have less duplicate data and accounting errors.

6. Update the Chart Periodically

Ask your accounting team to review and update the chart quarterly or yearly. There would be outdated or unused sections that need to be deleted in order to align with the current financial data. Hence, develop a habit of updating the chart in a periodic manner.

7. Adhere to FASB and GAAP Guidelines

Don’t forget to stick to the financial reporting standards like FASB and GAAP so that your reports are compliant and credible as well. Following these guidelines is so important because it offers transparency when conducting the audit process or dealing with investors.

Final Words on COA

To sum it up, we explored the chart of accounts definition, its importance, and an example of chart of accounts. Now, one thing is clear that a COA is way more important than what we often think. Usually, the financial details are matched with the balance sheet to make sure the entered data is accurate.

Moreover, it also enables investors or lenders to evaluate the company’s performance and eventually help you in securing funding. Now that you know the best practices to make a COA, you can create a well-structured COA and maintain consistency.

However, if preparing a COA is taking longer than usual, you can adopt modern accounting or invoicing tools like Moon Invoice to keep financial data under one roof.

On that note, we recommend trying Moon Invoice free for 7 days and exploring its cutting-edge features.

![Chart of Accounts 101 for Small Businesses [Definition & Chart of Accounts Example]](https://mi-blogs.s3.amazonaws.com/mi-live/blog/wp-content/uploads/2025/06/09100111/Chart-of-Accounts-101-for-Small-Businesses-Definition-Chart-of-Accounts-Example.jpg)