Invoicing can be a time-consuming and tedious task for businesses of all sizes. Especially when dealing with multiple customers or clients, managing invoices can be overwhelming. That’s where consolidated invoicing comes in.

Consolidated invoicing is a process that combines multiple invoices into a single, easy-to-understand document. It can turn out to be a blessing for accountants managing a large number of invoices and payments.

In this blog, let’s explore what invoice consolidation is.

What is Consolidated Invoicing?

Invoice consolidation refers to a billing procedure that merges various invoices intended for one customer or client into one comprehensive document. It provides a summary of all separate invoices, including the amount due, date, invoice number, and all the necessary information.

This process is often used by companies that have many recurring transactions with the same customers or clients, such as telecommunications, utilities, or rental services. Customers can review all their outstanding invoices and make a single payment instead of having to pay each separate invoice.

By consolidating a number of invoices into a single document, you can simplify their billing procedure and focus on more critical tasks that will help your business grow.

How to Create a Consolidated Invoice?

When creating the consolidated invoice, it’s essential to make sure that all the information on every separate invoice is accurate and up-to-date. Double-check that the total amount due is calculated correctly and all the invoices are included in the consolidated invoice.

Creating consolidated invoices is relatively easy. It involves combining multiple invoices for the same customer or client into a single document. Here are the steps to consolidate invoicing and how to generate one:

- To consolidate invoices, you need to collect all the invoices that are due and require compensation from the specific customer or client you are targeting. Make sure to gather all the invoices for that particular customer or client.

- Determine the period that the invoice should cover. This will depend on the billing cycle and how often you issue invoices.

- Create a summary of all the separate invoices in a single document. This summary should include details such as the date, invoice number, amount due, and any other relevant information for each invoice.

- Add up the total amount due for all the respective invoices that the customer receives, and include it on this invoice. This total amount due should include all outstanding amounts for the customer or client.

- Include any other relevant information too. For example, you may want to include the payment due date or any late payment fees that may apply.

- Send it to the customer or client. You can send it via email or mail, depending on the customer’s or client’s preference.

You can also use invoicing software like Moon Invoice to make the process of creating invoices more efficient and streamlined.

Looking for an Efficient and User-Friendly Invoicing Solution?

With its intuitive interface and comprehensive features, Moon Invoice can streamline your billing and accounting procedures, improve your customer experience, and help you avoid late payment fees.

How to Use Consolidated Invoices?

When you consolidate invoices you can simplify the billing process for both you and your clients. Customers can review all their outstanding invoices and make a single invoice amount instead of having to deliver each invoice separately. For a business, it can help streamline billing services, reduce administrative tasks, and generate improved cash flow.

Here are some tips on how to use consolidated invoices:

- Review carefully: When you receive a consolidated invoice, take the time to review it carefully. Verify that the information presented in the invoice is precise and corresponds with the details of the respective invoices being summarized.

- Avoid delayed payments: As with any invoice, it’s important to make payments on time to avoid late payment fees and potential service disruptions. Pay the total amount due on the invoice by the payment due date specified.

- Keep track of payments: When you make a payment for a consolidated invoice, make sure to keep a record of it. This will help you keep track of your payments, avoid missed payments, and ensure that you have paid all outstanding amounts.

- Use consolidated invoices for budgeting: Consolidated invoices can be useful for budgeting purposes, especially if you receive invoices from the same vendor regularly. Use consolidated invoices to track your expenses and adjust your budget as needed.

- Communicate with the vendor: In case you have any queries or apprehensions regarding the consolidated invoice, you can contact the vendor.

Example of a Consolidated Invoice

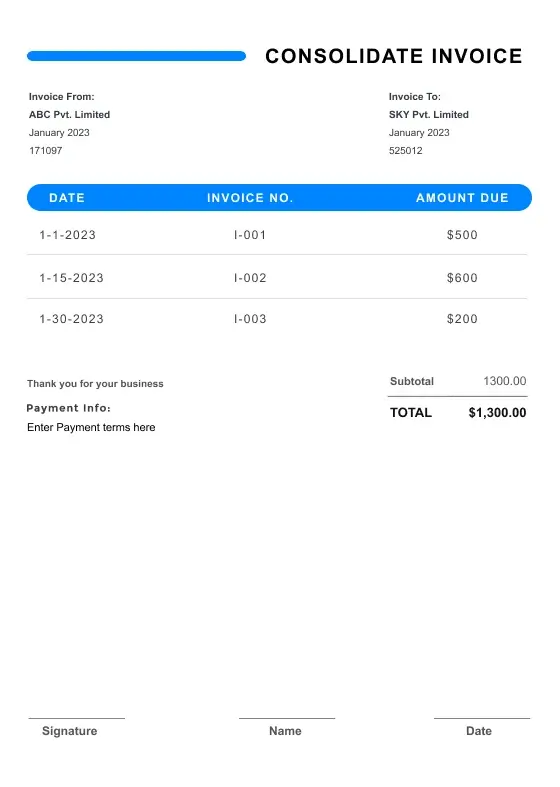

Here’s an example of a consolidated invoice with line items for a client who has multiple outstanding invoices with a vendor:

Consolidated invoices provide a convenient way for the client to pay all outstanding amounts in a single charge instead of having to deliver compensation for each invoice separately. The client can use the invoice number to identify the particular invoices that the invoice is summarizing, which can help with record-keeping and tracking of payments.

Benefits of Consolidated Invoicing

Consolidated invoicing combines benefits for companies and customers, including simplifying the billing procedure. Here is a list of the top benefits:

1. Saves Time and Effort

Creating separate invoices and processing them is time-consuming. Consolidating many invoices into a single document can improve efficiency and effort for both the vendor and the customer. Instead of creating individual invoices and paying several invoices separately, the customer can make a single payment for all the outstanding amounts.

2. Simplifies Billing and Accounting

For your business, consolidated invoicing can streamline billing and accounting procedures. By consolidating invoices into a single document, companies can reduce the number of invoices they have to manage and keep track of.

3. Reduces the Chances of Errors

By consolidating too many invoices into one invoice document, your business can reduce the likelihood of errors such as duplicate payments or missed payments. This can help to avoid unnecessary complications and disputes.

4. Improves Cash Flow

Consolidated invoicing can help improve revenue for companies by ensuring that they receive payments for outstanding amounts in a shorter period of time. By consolidating numerous invoices into a single document, you can make it easier for customers to make timely payments.

5. Enhances Customer Experience

By simplifying your billing, consolidated invoicing can enhance the customer experience, making it easier for customers to manage their payments. This, in turn, can help you facilitate timely payments from customers and reduce the occurrence of late payment fees.

Conclusion

Consolidated invoicing is a practical solution for you that need to manage many invoices for the same customer or client. By creating a single document that summarizes all individual invoices, your business can simplify the invoicing process and improve revenue. Consolidated invoicing can also benefit customers by reducing the number of invoices they need to review and pay, saving time and reducing errors. By using consolidated invoicing, you can focus on more critical tasks that will help your business grow.

Overall, using consolidated invoices can simplify the accounting process and make it easier to manage numerous invoices. By reviewing the invoice carefully, making payments within the required time period, and keeping track of payments, you can effectively manage your finances and avoid any potential issues.