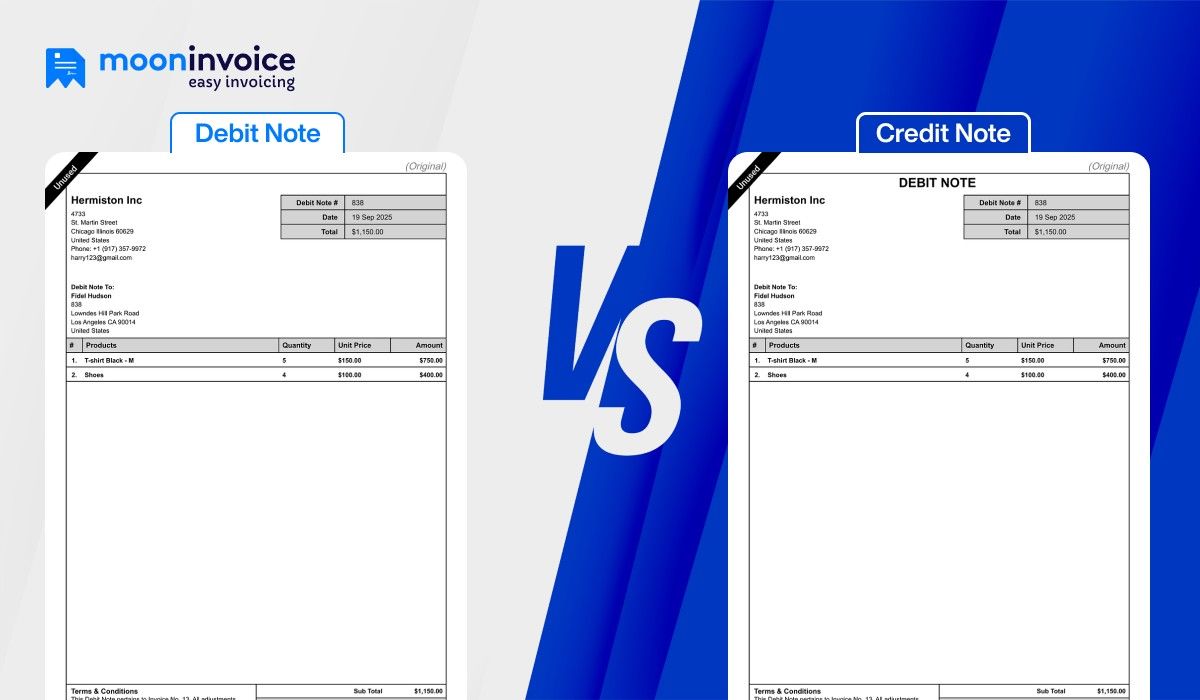

Debit notes and credit notes are two different documents that play a vital role in financial accounting. Using these documents, business professionals can streamline their payment due, shipment tracking, and maintain transparency in financial transactions.

Unfortunately, many times, business professionals are often confused over the difference between a debit note and a credit note. This misunderstanding and confusion lead to improper bookkeeping, financial errors & other compliance issues.

Therefore, it’s essential to have clarity on debit note vs credit note. Right? Luckily, our words have the correct guidance. Your reading journey will help you find the true definitions of debit notes, credit notes, their purposes, and key differences.

📌 Key Takeaways

- A debit note is issued by the buyer to the seller, whereas the seller issues a credit note to the buyer.

- Both documents are crucial in accounting for accurate recording and maintaining transparency during purchase and sale transactions.

- A debit note initiates the adjustment, whereas a credit note finalizes the statement.

- Debit notes and credit notes are essential for recording and reporting purposes under the tax system, ensuring compliance with tax regulations.

- A clear understanding of the debit note vs the credit note helps in building business client relationships.

- Professionals should manage credit notes and debit notes efficiently along with electronic invoicing.

Before delving into the topic of credit notes vs. debit notes, we first need to understand the meaning of both documents with an example.

💡Do You Know?

The U.S. goods and services trade deficit increased in July of this year, according to the U.S. Bureau of Economic Analysis. The goods deficit increased $18.2 billion in July to $103.9 billion. The services surplus decreased $1.1 billion in July to $25.6 billion.

What Is a Debit Note?

A debit note is a financial document that the buyer issues to the vendor for the current debit obligation. It is sent to the vendor in the event of a return of goods or an overcharged price, which is a common scenario in the business-to-consumer (B2C) transaction model. However, it is also useful in business-to-business (B2B) transaction models.

The meaning of a debit note refers to a formal acknowledgement for returned items, along with their values and the reason for the return. A debit note reflects the sum debited from the seller’s account. Hence, it decreases the seller’s debt.

The seller can also issue a debit note to the buyer in the event of an undercharged invoice. It also serves as a payment reminder, allowing the seller to receive the due payment on time.

Is a Debit Note the Same as an Invoice?

The next perplexing question! Often, workers understand a debit note as a type of invoice. However, these two are different from each other. The buyer issues a debit note, and the seller then issues an invoice in response.

An invoice is the main billing document that requests payment from the client. Instead, the debit note is an adjustment document that requests a correction to the main invoice due to an error or a return of a product.

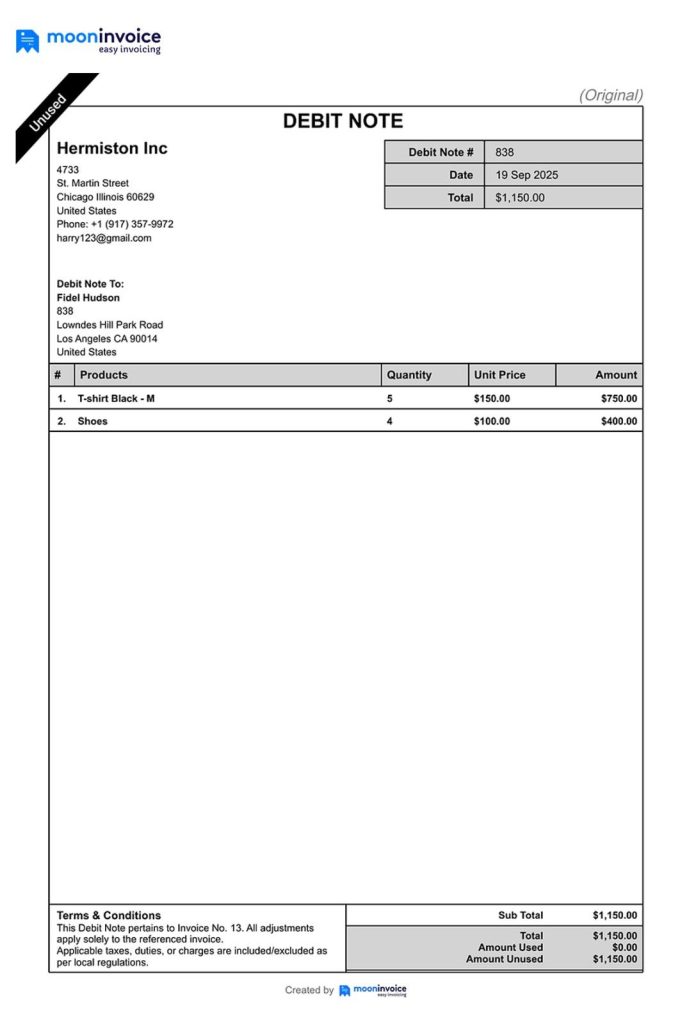

Elements Included in Debit Note

Now that we have defined what a debit note is, we will examine the important details it should comprise. A debit note comprises the following elements.

- Vendor Details – Name, address, and contact details.

- Buyer Details: Name, Address, and Contact Information.

- Debit Note Details – Debit note number and date of issuing debit note.

- Line Item Details – Description of product or service, along with the quantity, unit price, and applicable tax or discount.

- Terms and Notes – Cover the terms and notes relevant to the debit note process and your business policies.

- Reason – Description reflecting the reason for issuing the debit note.

- Debited Amount – The total amount to be debited.

- Signature – Signature of the customer or any authorized person issuing the debit note.

💡Also Read:

Debit Note Example

After defining the meaning of the debit note, let’s examine its structure. A typical debit note looks like this:

When a Debit Note Is Used and How Does it Work?

A debit note is useful when there is any shortcoming in the received product or errors in the pricing. The other scenario includes the omission of the applicable tax charges. The seller issues the debit note in case of undercharging for the product or service sold.

The workflow of a debit card includes the communication between the buyer and the seller. The process begins when the buyer purchases the product or service, and the seller creates & issues an invoice using professional invoice templates. When the buyer finds underbilling or other issues in an invoice, he creates a debit note & shares it with the seller in cases where a financial adjustment is required.

Once the seller receives the debit note, they review the document and verify all the details. When finding it upto the mark, the seller records the debit note in their accounts and revises the amount. He can also issue a new & updated invoice or make corrections to the existing one.

Boost Debit Note Flow 5 Times with Moon Invoice

Select our ready-to-use debit note format to streamline your workflow. Easy to fill out and simple to send!

What Is a Credit Note?

A credit note is a document that the seller issues to the buyer when there is a need to reduce the amount of an invoice. In other words, the credit note definition also refers to the formal acknowledgement from the seller to the buyer, indicating the credit of the buyer’s account. The term credit note is often interchangeable with ‘credit memos’.

Is a Credit Note equal to a Refund?

Often, professionals and everyday people use the terms “credit note” and “refund” interchangeably. However, the actual scenario is different! A credit note acts as a voucher that a store issues to the buyer, which they can use for future purchases. It doesn’t refer to the cash return from the seller to the buyer. On the other hand, a refund refers to the actual cash return to the customer.

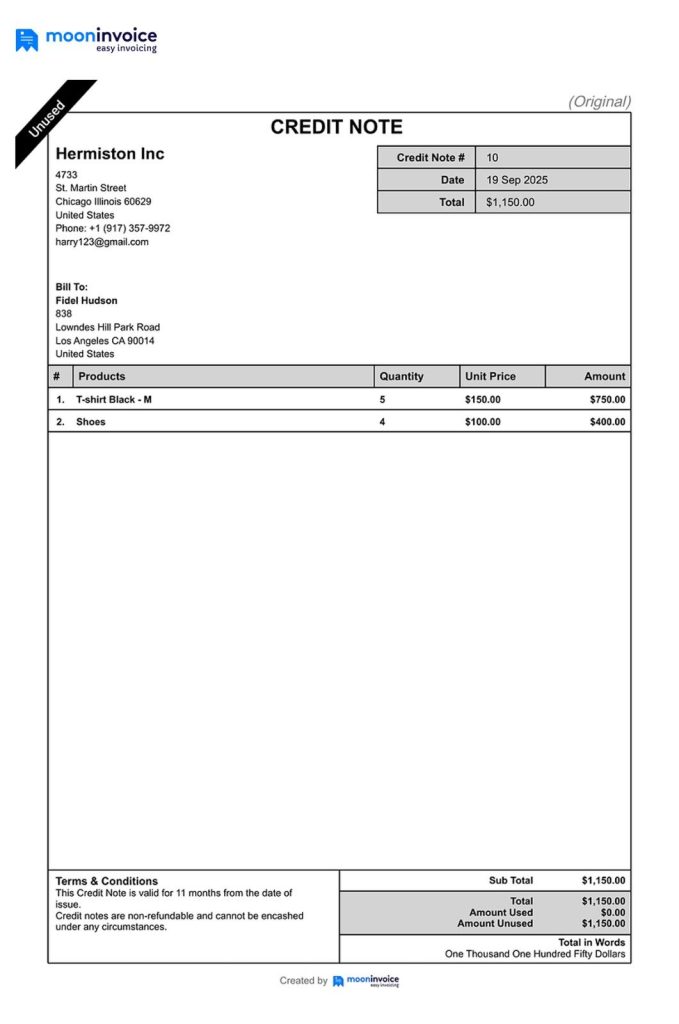

Elements Included in Credit Note

After understanding the meaning of a credit note, we can identify the key elements that are important in this document. A credit note comprises the following elements.

- Vendor Details – Name, address, and contact details.

- Buyer Details: Name, address, and contact information.

- Credit Note Details – Credit note number and date of issuing the credit note.

- Line Item Details – Description of product or service, along with the quantity, unit price, and applicable tax.

- Terms and Notes – Cover the terms and notes relevant to the credit note process and your business policies.

- Reason – Description reflecting the reason for issuing the credit note.

- Credited Amount – The total amount to be credited.

- Signature – Signature of the customer or any authorized person issuing the credit note.

💡Continue Reading:

Credit Note Example

After defining the meaning of the credit note, let’s examine its structure. A typical credit note looks like this:

When a Credit Note Is Used and How Does it Work?

A credit note is typically used when a customer receives an overcharged invoice or the buyer requests a refund due to a product return.

The journey of a credit note begins when the seller issues an invoice to the customer, and the customer returns the product or finds errors in the bill. Once the customer/ buyer returns the goods, the vendor or seller verifies the details.

Once the verification is done and everything is in order, the vendor creates a credit note using the credit note software and issues it to the client, reflecting the price reduction. The buyer then either pays the reduced amount or uses the credits in a future purchase.

Debit Note vs Credit Note: Key Comparison

Debit notes & credit notes are two different financial documents that serve different purposes during a business transaction. These are commonly used when a product is returned to the seller or supplier by the customer.

The major difference between a debit note and a credit note lies in their purpose. The debit note increases the accounts payable for the buyer and accounts receivable for the seller. On the other hand, a credit note decreases the accounts payable for the buyer and accounts receivable for the seller.

Here is a tabular form of debit note vs credit note, presenting the key differences:

| Features | Debit Note | Credit Note |

|---|---|---|

How to Generate a Debit Note and a Credit Note?

In today’s digital era, online accounting software like Moon Invoice eases the creation of credit and debit notes.

By providing ready-made samples, it not only saves time but also ensures the creation of a professional debit note or credit note. Additionally, the templates ensure accuracy by providing the auto-calculation concept.

Professionals can easily send debit notes and credit notes via WhatsApp or Email. Users can easily customize the PDF and print settings to suit their preferences. Professionals can review every action performed through the activity log.

In short, Moon Invoice provides a one-to-one solution for debit and credit notes. From creation to the final online submission of the documents, it offers everything.

Save Time and Avoid Errors with Our Credit Note Template

Use the ready-made credit note sample of Moon Invoice and boost your process 5 times.

Final Remarks

Summarizing at the final, a debit note is issued by the buyer to indicate the correction, while the seller issues a credit note to reduce the amount owed by the buyer. Professionals should always have a clear understanding of debit note vs credit note. It leads to accurate financial records.

Whether it is a debit note or a credit note, business professionals should manage them wisely by utilizing the right invoicing tool, such as Moon Invoice. Schedule your demo!