When the buyer asks you for an invoice, the first thing you do is create a hand-written invoice copy and hand it over to them. Easy, right? Maybe not, because if it were really that simple, you wouldn’t have come across this blog looking for what is electronic invoicing, would you?

A pile of paper invoices on your desk and constant payment delays would have left you with no choice but to switch to e invoicing. If that’s the case, remember you are not alone. Embracing electronic invoices to replace traditional paper-based invoicing isn’t just a smart choice, but also a worthy move to combat payment delays.

It further justifies why modern businesses have welcomed the trend of e invoicing. And because of that, the e-invoicing market is poised to be valued at USD 14,412.2 million by 2033.

Ready to join the league of modern businesses? We would love to explain to you the e-invoicing definition and e invoicing process. So, let’s begin.

What Is E-invoicing?

E-invoicing (or electronic invoicing) is a process to bill your customer in an electronic format of an invoice, which can be shared electronically on any smart device. Sending an E-invoice to the buyer is the issuer’s bid to organize accounts payable invoices efficiently and tackle late payments.

So, it’s not like you shared a photocopy of a normal invoice online and it suddenly became an e-invoice. Actually, e-invoices are created by sophisticated invoicing software and comprise online payment links so that the recipient can pay dues without switching the app.

This e-invoicing approach replaces the conventional paper-based invoices and offers a cost-effective invoicing solution for businesses. It helps them manage and track a large volume of invoices and leaves no chance of fraudulent activities.

How Does the Electronic Invoicing Process Work?

The e-invoicing process heavily relies on automation software, which reduces invoicing times from hours to minutes. It works on electronic data interchange (EDI) that only machines can understand. The process is actually divided into two phases. Let us dive into how this process works.

1. Create & Share E-Invoices

E-invoices can be generated quickly in comparison to normal invoices, as they only need a few clicks here and there. The process comprises the following steps.

- It all starts with launching the Moon Invoice web app & logging in.

- Now, the user goes to ‘Invoices’ and clicks on the “+” icon to make a new e-invoice.

- They populate the necessary business and customer details.

- Later, include invoicing details like due date, currency, & total due amount.

- Write payment terms or any instructions you want to give to the recipient.

- The entered information is reviewed once, and then the changes are saved by the user.

- Once an e-invoice is ready, the user hits the Email icon or WhatsApp icon on the top-right of the screen to send an e-invoice.

2. Track E-Invoices

Tracking e-invoices is a breeze, all thanks to the automation capabilities of Moon Invoice. The e invoicing software offers cutting-edge features to track e-invoices in a fraction of a second. Below is how the e invoice tracking process works.

- Whenever an e-invoice is generated, it is automatically stored in the cloud storage.

- So, if the user needs to track it, they head to the Moon Invoice and tap on the search icon in the ‘Invoices’ section.

- They use smart filter options such as date, name, and status to narrow down their searches.

- By doing so, they get the desired invoice and check the payment status or take other necessary actions.

Track E-Invoices Effortlessly from Your Comfort Zone

With Moon Invoice, you can track e-invoices without stepping out of your comfort zone and filter out the ones that need your attention.

E-Invoice Vs Traditional Invoice – What’s the Difference?

The conventional invoicing process and e-invoicing are like night and day. One is entirely based on the paperwork, the other relies on the electronic invoicing and accounting systems. Here are what are the major differences between e invoice and a traditional invoice.

1. Use of Paper

Traditional invoicing is all about using a pen and paper to make invoices. On the contrary, e-invoices require no paperwork as they can be created electronically using software. So, you don’t see a pile of papers on your desk when using e-invoices and can send them digitally without arranging an in-person meeting with clients.

2. Reviewing Invoices

Paper-based invoices need a dedicated accounting team to review invoices one by one. It involves manual data entry and approvals that further extend the time to review invoices. That’s not the case with e-invoices, as they can be reviewed quickly using an invoicing app on your fingertips. Consequently, you no longer need to waste time reviewing e-invoices via manual processes.

3. Record-keeping

Businesses need shoeboxes to maintain invoice hard copies and further require physical expansion of the business infrastructure. Contrariwise, e-invoices can be stored digitally in e invoicing software as they have no physical form. So, you neither need archive boxes nor physical infrastructure expansion to store them.

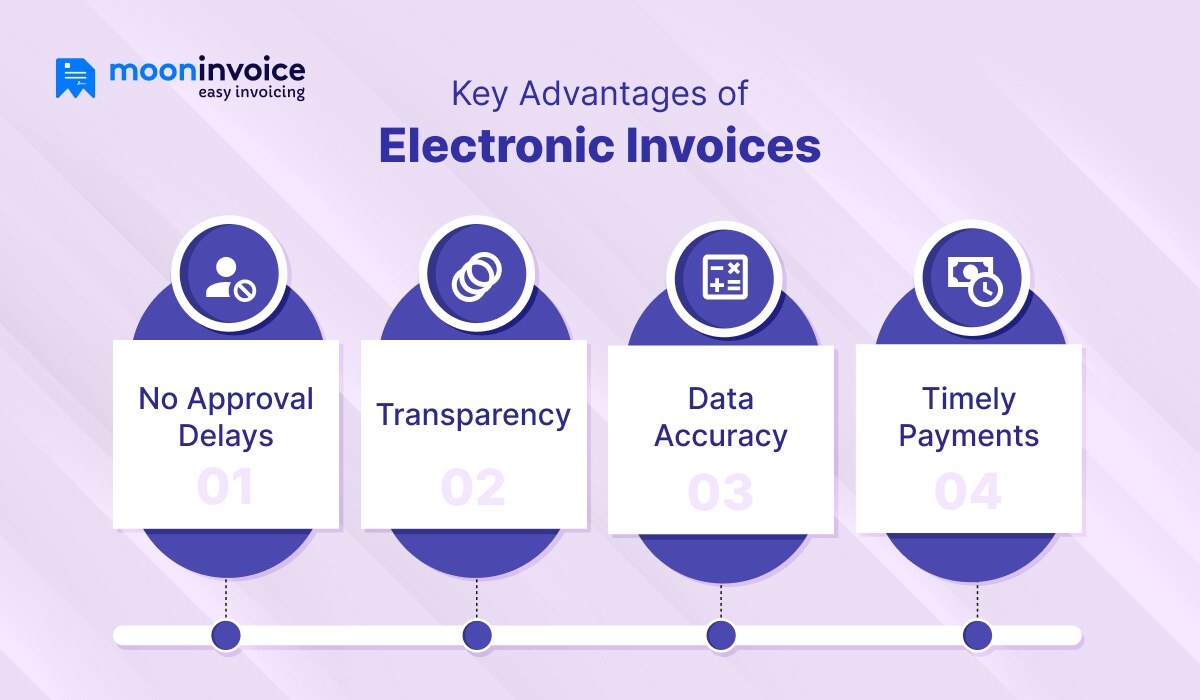

What are the Key Advantages of Electronic Invoices in 2026?

Here are the attractive benefits of e invoicing for your business.

1. No Approval Delays

One of the sought-after perks offered by e-invoices is that your accounts payable team can quickly scan the document and approve or reject the invoice. Nobody needs to compare the data manually or maintain the spreadsheets. Plus, crystal clear invoicing details on e-invoices help the AP team speed up the work.

2. Transparency

Unlike traditional invoices, electronic invoices can be easily stored and accessed by your team, even if they are far apart. Your team doesn’t need to carry physical copies in their pocket. As soon as an e-invoice is generated, it will be visible to all team members, helping you centralize the invoicing data under one roof.

3. Data Accuracy

The inaccuracy in invoicing data no longer exists since the introduction of e-invoices. There’s nothing like doing rough work on a piece of paper, and as a result, you don’t see human errors. E-invoices comprise accurate invoicing data that further leaves no chance of back-and-forth.

4. Timely Payments

An E-invoice helps the buyer understand exactly what they need to pay, so that there is no confusion afterward. This means the buyer can learn about pending dues quickly and initiate the payment process without any further delays. That’s why electronic invoice processing has an edge over manual invoice processing.

What are Mandatory Compliance Guidelines for E-invoicing?

Currently, the United States does not have any mandate for e-invoicing. That’s right, the US neither has mandatory compliance guidelines at the federal level nor at the state level for e-invoicing.

Notably, federal government-affiliated enterprises, barring some agencies, prefer e-invoicing over traditional methods for their accounting practices. In fact, many government departments encourage businesses to submit e-invoices in a bid to improve approval efficiency and slash costs.

Upon receiving their service, they ask vendors to login into a specific portal to send an e-invoice. This way they scrutinize the incoming invoices and dispatch payments for approved invoices in less time, keeping track of business transaction data.

But, as mentioned above, there aren’t compliance guidelines in the US despite other countries implementing mandatory e-invoicing laws.

How Does the Best Electronic Invoicing Solution Help Your Business?

Advanced electronic invoicing solutions like Moon Invoice are in-demand due to their cutting-edge invoicing features. It helps businesses overcome payment delays in a way that they can deliver an outstanding customer experience and concentrate more on their core business tasks.

It frees you up from boring manual invoicing process and automates important tasks to save your time and improve cash flow. So, you no longer need to hire a dedicated accountant to take care of the company’s finances or conduct manual checkups.

With an invoicing solution like Moon Invoice, you can come out on top of the invoicing and payments hassles.

Here’s what Moon Invoice, as a prominent invoicing solution, can do for your business.

👉Automate invoicing in order to decrease the time taken for approvals and payments.

👉Customizable invoice templates to make professional invoices without extra effort.

👉Enable businesses track and organize unlimited invoices in a cloud-enabled platform.

👉Auto-fetch invoicing details from paper invoices via quick scan (AI-powered invoicing).

👉A dedicated vendor portal to manage suppliers and vendors’ invoices.

👉 System-generated reports for tax compliance and performance insights.

👉20+ payment gateways to collect money from the buyers in a cashless way.

Reduce Invoice Time by 70% & Save $$$

Get a sophisticated e-invoicing solution to create and send e-invoices professionally within minutes. Start saving thousands every month!

What’s the Future of Digital Invoicing?

The future of digital invoicing seems promising for growth-oriented businesses, as it offers amazing benefits and opportunities to scale businesses quickly. On the other hand, customers have also backed the trend of e-invoicing because they find it easier to dispatch payments conveniently.

Besides, the increasing risk of fraudulent activities and the complex auditing process have prompted companies to look for a long-term solution. As a result, e-invoicing solution demands are rising day by day, shaping the future of digital invoicing.

If you want to hop on the trend and transform your business, we recommend getting Moon Invoice to kick off the e-invoicing process right away.

![How to Send an Invoice Via Email [Steps & Best Practices]](https://mi-blogs.s3.amazonaws.com/mi-live/blog/wp-content/uploads/2022/12/13105719/send-an-invoice-blog-final.jpeg)