Expense Recognition Principle Definition

An expense recognition principle is an accounting rule according to which expenses should be recorded in the same period in which corresponding revenues are earned.

How would you ensure that your company is gaining a sufficient level of Return on Investment (ROI)? Also, are the financial statements of your business accurate & credible? As a business owner, this matters significantly for your company.

One key concept is the expense recognition principle. This accounting principle helps determine expenses and the revenue associated with them. Furthermore, experts record the expenditure and the corresponding revenue for the same period. As a result, it leads to accurate financial reporting.

Well, the story doesn’t end here! Our words will help you further explore this concept. So you understand it’s working & value to the business. Explore the expense recognition principle example for better understanding.

📌 Key Takeaways

- The expense recognition principle relates to recording expenses and revenue in the same accounting period, which helps generate revenue.

- It is also known as the ‘Matching Principle’.

- Expenses are recorded only when they generate revenue, not when they generate cash.

- It applies to various items, such as salaries, COGS, depreciation & prepaid expenses.

- Businesses can easily avoid understating or overstating income in the given period.

- It improves decision-making by revealing the true cost of generating revenue.

What Is Expense Recognition Principle?

The expense recognition principle is an accounting rule that requires businesses to record expenses in the same period as the revenue they help generate. It is regardless of whether the cash is paid or received.

This principle is also known as the matching principle because businesses need to match expenses with their corresponding revenue.

Expenses such as salaries and utilities, often referred to as accrued expenses, are included under this principle. The business incurs these accrued expenses but has not yet paid them.

This concept enables you to maintain strong transparency in the financial reporting when matching expenses to sales revenue. This is a core concept within Generally Accepted Accounting Principles (GAAP) and also an essential element of accrual accounting.

Track Every $ Spent With Moon Invoice

Digitalize your expense management & ensure 100% clarity & accuracy on your business expenditure.

How Does the Expense Recognition Principle Work?

The expense recognition principle requires that expenses be recognized in the same accounting period as the revenue to which they relate. The core point is that financial statements reflect the true cost of generating revenue regardless of cash flow. Here are the key steps:

1. Identifying the Expense

Initially, business professionals need to identify the expenses. Accounting professionals need to list all expenditures on the financial statements that the company incurred to generate revenue. The recording should be for those expenses that have not been paid.

2. Identifying the Revenue Earned

The next step is to determine the revenue the company earned during the specified period. The accountant needs to consider all the revenue generated by the business after investments. It means they consider revenue with corresponding expenses.

3. Matching the Expenses to the Revenue

Match & record all the expenditures that directly or indirectly help in generating the revenue in the same period. For example, marketing costs should be linked to and matched with the revenue the company generated from advertising costs.

You need to properly include the prepaid & deferred expenses. For unpaid expenses, such as utility bills, record them as accrued expenses. For prepaid expenses, you need to recognize the expenditure based on the benefit availed over the consumption period.

Expense Recognition vs Revenue Recognition

Expense recognition and revenue recognition are two crucial aspects of accurate financial reporting. However, they are different.

The expense recognition principle relates to costs incurred by the business, regardless of when they are paid. Whereas, under revenue recognition, revenue is recorded when it is earned.

The core purpose of expense recognition is to ensure costs are reported in the same period in which the business uses the resources. Whereas, the core purpose of revenue recognition is to ensure income in the same period when the business delivers the goods or services.

Accrual vs Cash Accounting

For a better understanding of the expense recognition principle definition, let’s get a key insight into accrual vs cash accounting below:

| Aspect | Accrual Accounting | Cash Accounting |

|---|---|---|

💡You Might Be Surprised to Know!

According to Market Growth Reports, with the incorporation of automated workflow, organizations experience a 72% reduction in manual data entry time and a 48% drop in policy violations.

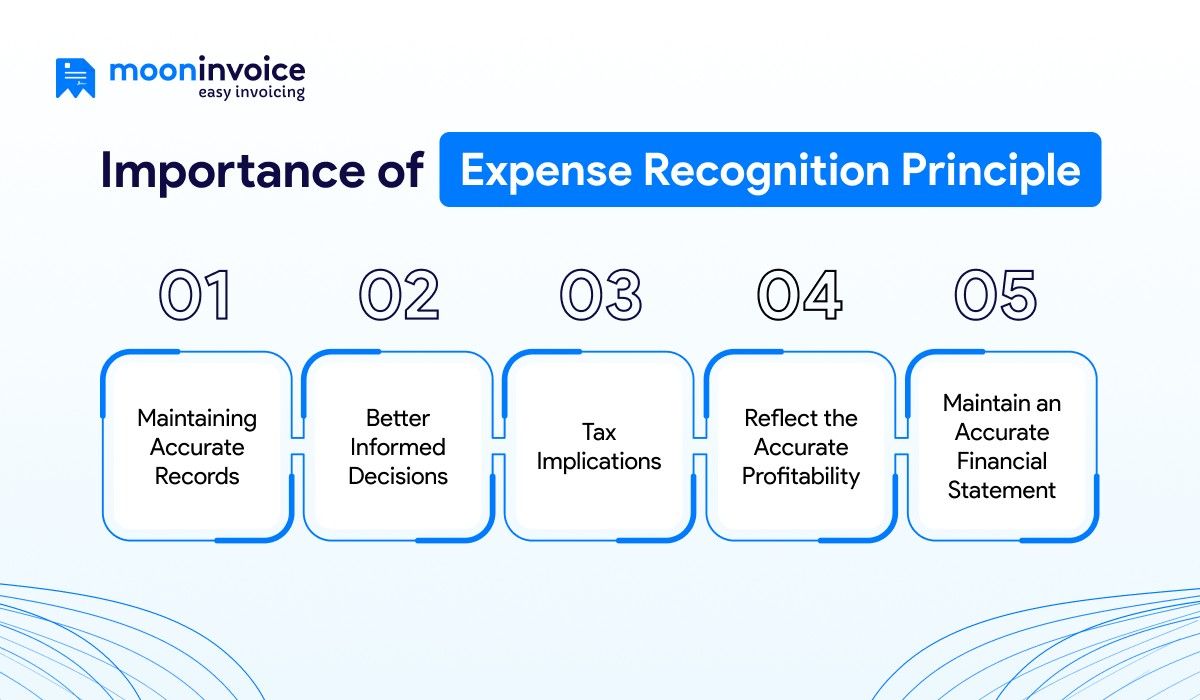

Why Is the Expense Recognition Principle Important?

Does the expense recognition principle really matter for your business? The straightforward answer is, of course. Here are the key points showcasing its values:

Maintaining Accurate Records

Matching expenses to revenue in the same accounting period directly affects the accuracy of the financial statements. Professionals get a clear picture of the company’s profitability. Similarly, it establishes transparency for investors and stakeholders, and ultimately, the company gains their trust by showing correct financial health.

Better Informed Decisions

The faulty data brings the opposite and leads to wrong decisions. But you will make better decisions when you have clear financial statements. You’ll learn how to control costs, budget, and adjust the pricing strategy.

Tax Implications

Business professionals can ensure that taxable income is calculated accurately when the expenses are recorded in the correct period. It keeps unnecessary penalties at bay by preventing incorrect expenses from triggering additional tax.

Reflect the Accurate Profitability

Business professionals get a realistic view of the company’s profitability. It is because expenses & relevant revenue are recorded accurately for the same period. This reflects the correct business’s profitability related to the business operations.

Maintain an Accurate Financial Statement

Recognizing expenses in the wrong period can misstate the net income & cash flow. This also disrupts the spend management procedure. Therefore, with the help of the matching principle, companies can overcome this kind of issue.

Examples of Expense Recognition

After understanding what the expense recognition principle is? We now understand it through practical examples in real-life scenarios.

Employees Salaries & Wages

Every organization incurs salaries and wages as a major expense. However, under the matching principle, this type of expense is recognized when employees contribute to the work in exchange for their salary. For instance, if an employee worked in March and the salary was paid in April, the salary expense will be recorded in March.

Rent Expenditure

Another expense recognition principle example is rental expenditure. Suppose you paid the office rent for May in June. The expenditure will be recorded in May because the space utilization was for that month, when you used the rental space. If there is an advance rent payment, expense recognition will be done monthly.

Utilities

When you make a payment for the utility bill of your office, the spending will be considered for the month in which you used the utilities. For instance, if you paid the utility bill in March for February, the expense will be recorded for February.

Cost of Goods Sold (COGS)

Cost of goods sold of any company refers to the expenses the company directly incurred in producing the goods sold. The COGS is recorded only when the related goods are sold and produce revenue. Let’s say a company purchases the raw material in June; this cost will not be treated as an expense. Now, when your company sells the goods it created in August and generates revenue, the expense and revenue will be recognized in that month.

Challenges and Common Mistakes in Expense Recognition

Your finance teams can face some challenges in the expense recognition process, which are as follows:

Variation in Currency Exchange Rate

Variation in the exchange rate affects the recognition of expenses, especially for businesses involved in foreign trade. The actual recognition of the expense will be based on the exchange rate. As a result, it leads to incorrect financial statements.

Not Distinguishing Prepaid and Deferred Expenses

Often, business professionals fail to classify prepaid expenses and deferred expenses. Professionals record prepaid expenses as an immediate expense rather than systematically expensing them over time. This leads to an uneven situation: understated in one month and overstated in another.

Tracking Future-Based Expenses

Determining the future-oriented expense amount poses another significant challenge in expense & revenue matching. These expenditures are not fixed and often result in financial statement inaccuracies due to early recognition.

Unable to Follow GAAP/IFRS Rules

Due to a lack of proper accounting knowledge, professionals often fail to comply with GAAP/IFRS requirements. This gives rise to legal & financial work issues that affect business.

Poor Expense Categorization

When professionals put incorrect expense categories, it becomes difficult to track accurate spending patterns. Also, it reflects the wrong operating cost. On the other hand, professionals struggle to match expenses and revenue accurately.

Best Practices for Expense Recognition Principle

To improve the expense recognition principle, one must follow the practices below:

Keep Yourself Updated

To better identify expenses, professionals must remain up to date with the latest accounting standards and regulations. To this end, continue reviewing the Financial Accounting Standards Board (FASB) or the American Institute of Certified Public Accountants (AICPA). It helps to maintain compliance.

Give Training to Your Team

Keep your team well-informed about the latest accounting standards. They must be sufficiently expert to manage accounting & expenses wisely. Additionally, they must be sufficiently knowledgeable to accurately match expenses and revenue. You can make it possible by providing regular & ongoing training to your team members.

Categorize Expenses

The matching principle requires proper expense categorization. This simplifies matching, tracking & reporting. Always categorize your business expenses properly. Rent, utilities, wages, and COGS are the key expense categories.

Using Accounting Software

By using accounting software, professionals can streamline their expense management. Actions like real-time expense tracking, integration with other accounting platforms & generating accurate reports help simplify expense recognition.

💡Pro Tip:

A thorough review of accrued, prepaid, and deferred expensesbefore the end of each reporting period helps ensure accurate financial statements.

How Moon Invoice Expense Management Simplifies Expense Reporting?

Moon Invoice is a fully digitized, automated software ideal for all kinds of businesses to simplify expense management. It caters to the needs of managing expenses at the top level for businesses of all sizes & types.

Here are key points that justify choosing this platform.

Real-time Tracking

You can easily track your business spending in real time in a digital format. This helps professionals obtain an accurate picture, thereby enhancing the accuracy of expense recognition principles.

Expense Categorization

Professionals can easily categorize their business expenses. The categorization can be based on project, client, department, or expense type. This categorization makes expense management more manageable and clearer.

Centralized Expense Management

Professionals can easily manage all their expenditures in a centralized location. This prevents unsystematic handling of expenses while keeping all involved parties on a single dashboard. Ultimately, enhance the process.

Supporting Multi-Currency & Tax Rules

Business professionals can easily manage their expenses across multiple currencies, as the system supports them. Also, it supports complex tax structures, such as tax on tax, thereby simplifying the tax process.

Automation

The platform offers automation that further enhances the expense management process. Its automation concept automatically calculates the total, including shipping costs and applicable taxes. This commits accuracy while reducing manual efforts.

Third Party Integration

Moon Invoice offers a seamless third-party integration. Professionals can easily integrate with other systems for payment, Gmail, and data transfers & migration. This directly enhances productivity.

AI-Powered Quick Scan

This is the greatest feature that lets the user generate expense receipts with all the AI power. The system captures details as it scans the uploaded receipt image. This offers intelligent expense scanning.

Real-Time Reporting

Business professionals can easily grab the real-time reporting with Moon Invoice. Utilize the smart filters to generate customized financial reports in a minute.

Last Remarks

Hopefully, you got the right knowledge on the expense recognition principle. Make sure to manage it wisely, as it reflects true profitability & prevents misleading financials. Additionally, it improves budgeting & forecasting and ensures your business complies with accounting standards.