Collecting rent is a routine part of life for landlords. However, it is necessary to confirm that the payment has been received whenever a tenant completes a transaction. To do that, a landlord must send rent receipts to tenants. A receipt protects the interests of both parties, helps you avoid confusion, minimizes disputes, and ensures you are ready for tax time or record checks.

As a landlord, it is your duty to send rent receipts to the tenant after receiving the rent money. The rent receipt is evidence that the rent has been paid on time.

So, now the question is: how to fill out a rent receipt or create one? Are there any step-by-step methods?

In this blog, we will explore what a rent receipt is, how to fill out rent receipts, its benefits for both tenants and landlords, how rent payment records should be maintained, and how to send a rent receipt.

Let’s dive in…

📌 Key Takeaways

- When the rent payment is made and the landlord provides a receipt, it is called a rent receipt.

- A rent receipt is mandatory for tenants to claim HRA benefits; without it, HRA can’t be claimed.

- For landlords, a rent receipt is proof that the tenant has paid, which eases record-keeping.

- To create a rent receipt, you can consider using a rent receipt template online.

- When creating a rent receipt, common mistakes to avoid include incomplete information, incorrect dates, and an unstructured format.

What is a Rent Receipt?

A rent receipt is a written or digital document that confirms a tenant has paid rent to the landlord. It acts as a proof of transaction, which includes important details such as the amount paid, payment date, property address, and mode of payment. Many often consider it a simple payment slip, but in reality, it carries significant value for both tenants and landlords.

In many countries, providing rent receipts is not a formality but a legal requirement. It serves as an admissible document in case of disputes between landlords and tenants.

Landlords or the property management company generally provide a rent receipt once the payment is successful. Tenants, on the other hand, require rent receipts to have proof that the payment has been made. Rent receipts also play a large role in claiming HRA (House Rent Allowance).

Manage Sales Receipts and Invoices in One Place!

Yes, you read that right! With Moon Invoice, you can create rent receipts and manage all of your invoices in one place. Quick, Simple, and Stress-free Solution to your finances!

Components of a Rent Receipt

A rent receipt is valid if it includes all the necessary details. You can create a rent receipt using a rent receipt template, but it must carry all the details.

Below are the essential components of a rent receipt you need to consider:

- Payment Date: The receipt must clearly specify the exact payment date to maintain transparency.

- Tenant’s Details: Full name of the tenant, along with their phone number, needs to be specified in the receipt to avoid confusion.

- Receipt Number: Adding a unique receipt number is always recommended, as it helps in tracking and organizing records seamlessly.

- Landlord/Property Manager’s Details: Full name and contact information of the landlord or property manager must be specified in the receipt.

- Rental Property Address: The complete address of the rented property must be mentioned in the receipt.

- Amount Paid: Clearly specify the rent amount received, both in numbers and words, to avoid manipulation. In the event of late fees or other charges, these should also be noted.

- Payment Period Covered: The receipt must clearly indicate whether the payment is for the current month, the previous month, multiple months, or an advance.

- Mode of Payment: The method of payment must be specified, providing extra clarity. It can be any mode — cash, cheque, bank transfer, digital wallet, credit card, or debit card.

- Signature of Landlord: A handwritten or digital signature validates the receipt legally. Without a signature, the document loses its value.

How to Fill Out Rent Receipt: 5 Easy Steps

Although manual receipts (paper documents) still carry weight, digital receipts are safer and easier to create. Manual rent receipts are error-prone and appear unprofessional, making it a headache to store them in a box or locker.

On the other hand, digital receipts are faster, more accurate, and easier to manage. You can consider using a rent receipt template to create quick and ready-to-use templates.

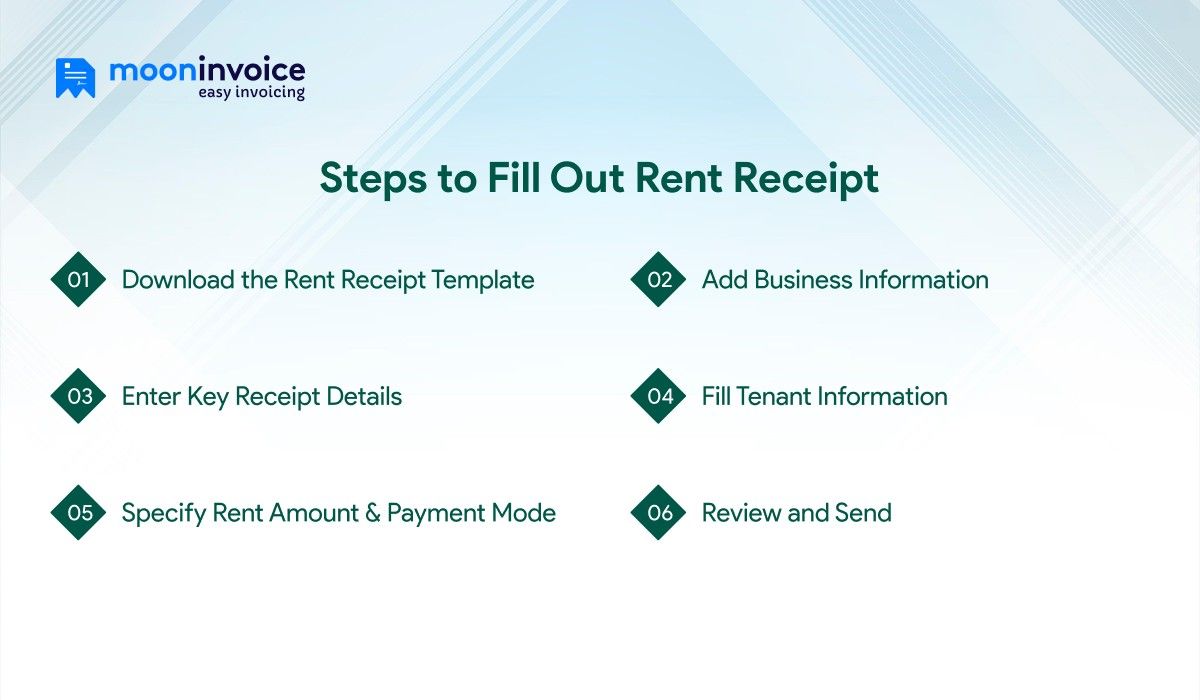

If you are wondering how to fill out money rent receipt template and its creation process, you can consider the following steps:

Step 1: Download the Rent Receipt Template

You can choose from various rent receipt template providers on the internet, such as Moon Invoice. Select the ready-made template in your desired format (Word, Excel, Google Docs, or PDF), then download the rent receipt template and start editing.

Step 2: Add Business Information

Enter every detail of your business, starting from the name, address, and contact information. This is important to ensure professionalism in your receipt.

Step 3: Enter Key Receipt Details

Fill in the receipt number, currency, and date of payment. These details are necessary to track receipts and maintain records.

Step 4: Fill Tenant Information

Add the tenant name, address, and all other relevant details. Not just the name, but all other fields here ensure the receipt represents the correct tenant and property.

Step 5: Specify Rent Amount & Payment Mode

In this step, you need to list the rent amount. The amount should be both in numerical and word form to avoid any kind of infringement. Plus, one more key detail you need to add here is the payment mode. Mentioning the payment mode confirms the method of payment, such as cash, bank transfer, digital wallets, or UPI. You can add applicable taxes as per the law.

Later, you need to mention terms & conditions, and include any special notes, such as penalties or late fees.

Step 6: Review and Send

After filling in all these details, do a final review, check every detail, save the receipt, and share it instantly with your tenant via email or PDF.

💡Also Read:

How to Maintain Rent Payment Records?

Maintaining rent payment records is crucial for both landlords and tenants. For tenants, it is a reliable document that is useful for tax and legal purposes. For landlords, a well-organized rent payment receipt saves time when it comes to tracking monthly transactions.

Instead of selecting the manual method, which includes paper files and is often time-consuming, you should use a tool that is quick, efficient, and reliable to create rent receipts and store them in the cloud.

Cloud storage is more beneficial as it reduces the risk of loss or damage compared to storing data physically in a locker. There are four ways to manage rent payments. Let’s explore them all.

1. Automated Software

It is one of the most convenient ways to maintain rent payment records for landlords. The automated software makes it easy to track payments and manage expenses with minimal effort. For small businesses, automated software might be an expensive option, and for them, a rent receipt template is a handy option to consider.

There is no upfront cost; simply visit the rent receipt template website, download the template, and edit it as needed.

2. A Receipt Book

It is a manual method for keeping track of rent receipt records. In the receipt book, major details, such as rent amount, payment date, and mode of payment, are recorded. This is a simple method, but it is done manually.

3. Rent Ledger

A ledger is known as a second book of entries where multiple receipts are listed and maintained. It is a traditional method used to keep finances moving. However, as it is an old-fashioned method, it comes with lots of drawbacks, such as confusion in accurate payment tracking, mixing up two receipts, and the inability to retrieve a specific receipt when needed.

As a landlord, keeping a record of rental payments (such as a rent receipt filled out or a bank deposit slip), whether manual or automated, helps you calculate your profit and loss for the month. Later, you can overlook the profit and loss statement and plan for the growth/expansion of your rental business.

Importance of Rent Receipts

A rent receipt is not just a normal document. It can help you in many ways. The points below are some of the most important reasons why you should always keep rent receipts:

- Acts as Proof of Payment: When landlords write a rent receipt, it becomes official evidence that the tenant has cleared their dues.

- Tax Benefits: For tenants, rent receipts help claim HRA, and for landlords, they help accurately showcase rental income in tax filings.

- Legal Protection: In the event of disputes, rent receipts can help resolve the matter and complement the rental agreement.

- Record Keeping: Maintaining receipts in the right order helps in transparent and trackable transactions.

- Professionalism & Trust: Providing a rent receipt for every month builds trust between landlords and tenants.

💡Did You Know?

In 2022, every household in the United States spent nearly $1.3K per month or 31.7% of their income on house rent.

How to Send a Rent Receipt?

Once the rent is paid by the tenant, it is the landlord’s responsibility to ensure the tenant has received the rental receipt. There are multiple options to send a receipt to tenants.

1. Printed Receipts

For every completed payment, landlords can provide a printed receipt immediately to the tenant. This is the traditional method and works well for quick, in-person transactions. However, one downside is that both parties need to keep physical copies for future use.

2. Email Receipts

Email is another option to consider for sending receipts to tenants. It is fast, reliable, and the biggest advantage is that both landlord and tenant will have a digital record. If tenants are making transactions with partial payments, email receipts are very useful.

3. Invoicing Software

This is the best method. It keeps your records up to date, simplifies financial tasks, and ensures professionalism. You can consider using an invoicing software that makes sending receipts effortless. Once the receipt is created, it can be shared with the tenant instantly via email, WhatsApp, or other channels, all within one application.

Common Mistakes to Avoid When Creating a Rent Receipt

In the juggle-muddle of how to fill a rent receipt, you must avoid some of the common mistakes. Receipt creation may seem like a simple process, but there are many key factors to consider carefully. Making these small mistakes could lead to disputes or legal troubles.

1. Incomplete Information

Landlords often overlook key information, such as additional applicable charges beyond the rent amount, rental period, and address. Do add them to keep the receipt valid.

2. Incorrect Date or No Signature

Specifying the payment date is a must, and missing this can cause a lot of confusion. Sometimes, due to a heavy workload, landlords forget to add their signature to the receipt, which makes the receipt invalid.

3. Unstructured Format

The format must be correct and readable. A receipt can’t be like a rough document where you write the name, amount, signature, and send it. A professional receipt helps for legal and tax purposes. Don’t miss important fields, such as receipt number, payment method, addresses, and outstanding dues.

4. Not Specifying Payment Methods

Landlords often make the mistake of not specifying the mode of payment, such as cheque or bank transfer, on the receipt, which leads to a lack of clarity in record-keeping.

Conclusion

Every rent receipt needs to be created with careful attention. Error-free and professional receipts benefit both landlords and tenants. However, creating receipts can become tricky when dealing with multiple tenants and manually generating them. There is a chance that you may miss important details, which could invite legal consequences.

This is the reason why you should consider a high-performance invoicing software that can handle both receipt creation and invoicing. Within one software, you can access every finance essential, such as invoices, sales receipts, purchase orders, credit notes, debit notes, expense tracking, and many more.

Sign up today and start your free trial with Moon Invoice now!