You served clients, you got payment, and checked off all reporting tasks. We guess you had a quite busy quarter, and now, finally, the accounting books are closed. But, before you move on to the next quarter, one thing really needs your attention is the income statement. A crucial report, which lies at the heart of your business finances.

For most business professionals, generating an income statement requires a lot of manual hassles and accurate accounting data. But if you figure out how to prepare an income statement using an invoicing or accounting tool, it isn’t that difficult.

That’s exactly what we will discuss in this comprehensive guide. We will walk you through how to prepare an income statement, along with an income statement example.

💡Did You Know👉

Meeting sustainability reporting standards is one of the top challenges for accountants in 2025.

What Is an Income Statement?

An income statement is a financial report that showcases a company’s net income and expenditures throughout the fiscal year. It throws light on how well a company performed and what are the areas that need your attention. Basically, it provides a clear picture of the financial activities by breaking down the costs incurred by the company.

This information presented on the income statement is later examined by investors and lenders. By doing so, they can learn about the company’s revenue and how it turned into net profit. Based on that, they can decide whether it’s worth an investment.

Income Statement Example

To ensure you get a clear idea about what is statement of income, we tried generating an income statement of Tesla using Moon Invoice. If you take a closer look at this income statement example, you can see the breakdown of the company’s expenses and revenue.

Check out the example of income statement to know what Tesla’s net income was for Q1 of 2026.

Tesla Income Statement (Q1 FY25)

| Revenue | |

| Automotive sales | $15,560 |

| Services & other | $5,212 |

| Cost of Goods Sold | |

| Labor & manufacturing | $10,900 |

| Vehicle warranty expenses | $1,400 |

| Operating Expense | |

| General & administrative | $2750 |

| Marketing | $1900 |

| Income | |

| Profit | $8,472 |

| Total net income | $3,822 |

Forget the Pain of Deriving Data Manually

Centralize your accounting data in one cloud-enabled software, Moon Invoice and pull out the accurate details in a fraction of a second.

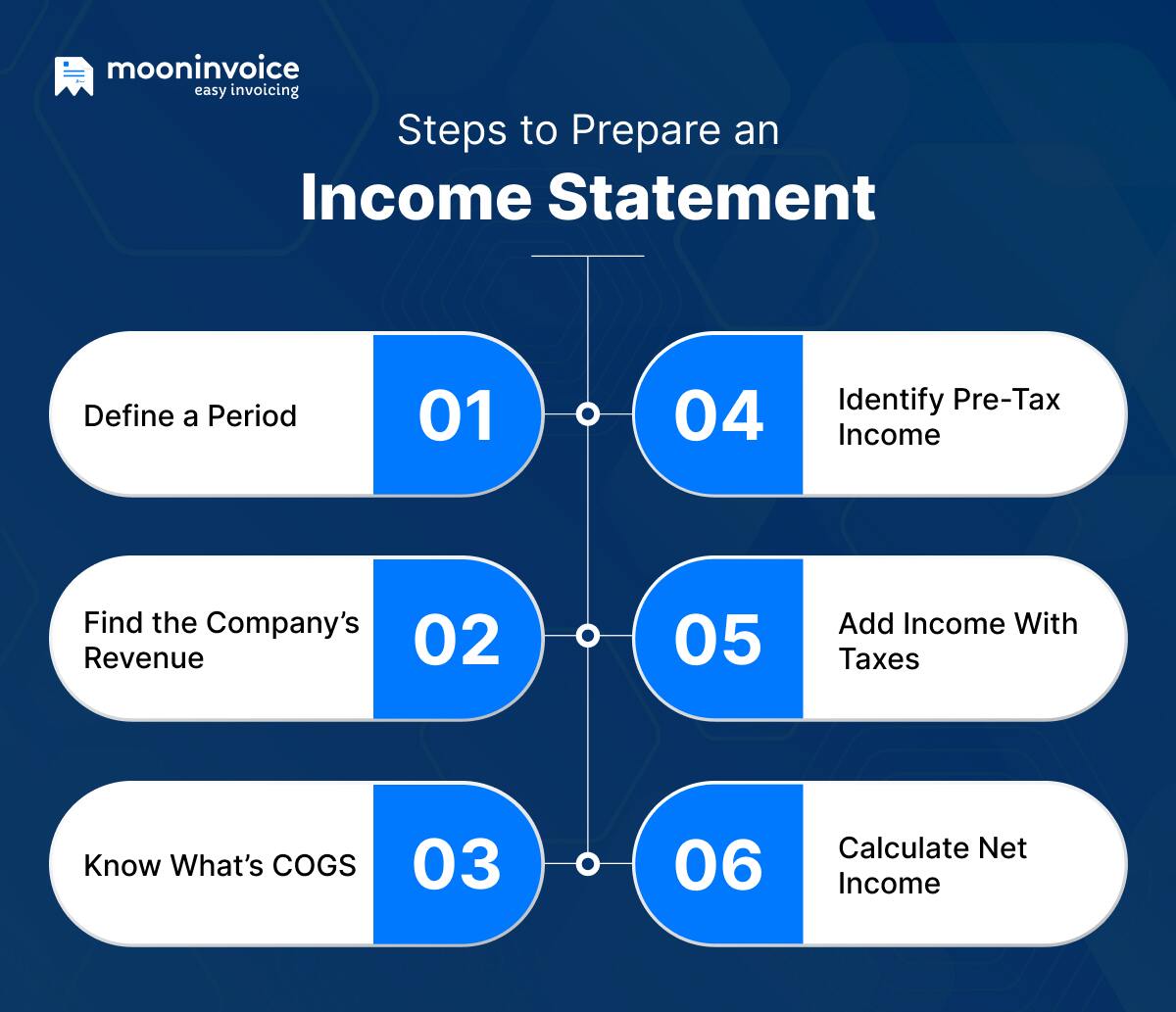

How to Prepare an Income Statement

Preparing income statements may sound like a complex process, but it’s actually not. To create an income statement, you need to pull out the required data from the company’s general ledger because there is no income statement formula. Or if you have managed data somewhere else on spreadsheets, keep it handy before you start following the steps below.

1. Define a Period

Whenever you start creating an income statement, always pick a reporting period such as quarterly, monthly, or annually. If you own a small business, you will need a P&L (Profit and Loss) statement on an annual basis. But if you operate a large-size business, you will need a statement quarterly or monthly.

So, depending on your requirement, choose the reporting period. You will later be required to mention the same on the income statement.

2. Find the Company’s Revenue

Alright, now discover what is your company’s revenue (both operating and non-operating revenue) for a reporting period that you finalized earlier. You need to calculate the money you earned by providing services or selling products within the defined reporting period.

Remember, if there are pending dues, you should refrain from including them in a revenue column. Because you are yet to earn that money from customers. If you are unsure how to calculate revenue, you can utilize online tools to get an accurate revenue figure.

3. Know What’s COGS

The next thing you will need to prepare an income statement is the cost of goods sold (COGS). So, in case you operate a service-oriented business, you must find the labor charges, material costs, and production costs first in order to calculate COGS.

The COGS formula is simple:

Beginning Inventory + Purchases Made During the Period − Ending Inventory

On your income statement, mention COGS right after the company’s revenue section. Make sure you have accurate COGS. This is because it affects the gross margin as well as the company’s profitability, which you displayed on the income statement.

💡You May Also Learn:

4. Identify Pre-Tax Income

Now, at this stage, you need to get the actual earnings before taxes, i.e., pre-tax income. This process involves summing the total profit after taking off COGS and operating expenses. For example, you may have earned revenue of $2,000,000 in a year, comprising the COGS of $300,000 and the operating expenses of $150,000.

The amount you get as pre-tax income will be noted in the bottom section of the income statement. Once you are done, move on to the next step.

5. Add Income With Taxes

Coming to this step, you will now be required to calculate the income, inclusive of taxes. For that, you can use the pre-tax income amount, which you figured out previously. Then, multiply the taxes by pre-tax income, and you will get the income with taxes. It is one of the key metrics to gauge the profitability without any impact of taxes.

For example, if your company pays 11% of the income tax to the IRS and 5% tax to the state government, then mention it all in the statement.

6. Calculate Net Income

Lastly, calculate net income before you take the final look at the income statement. Here, you can minus both interest and taxes from the pre-tax income. Now, the resulting amount is the available reserve funds that can be used for different business purposes.

Once added, you can start reviewing the statement. Ensure you have added the header part, highlighting the reporting period and necessary business details. Since your income statement is now ready, it will provide a snapshot of your company’s financial health.

💡Also Read:

What are the uses of income statements?

The income statement is not just an ordinary document for individuals running their own business. Here are the uses of the income statement.

Founders/CEOs

Business founders check the income statement quarterly or yearly to analyze business performance. In fact, they look at the income statement when it comes to making important financial decisions. In many companies, the final decisions come from the CEOs, and hence, the income statement is passed to the CEO’s desk once it is prepared. They dive deep to learn about the revenue and expenses before coming to the final decision.

Lenders

Lenders also use the income statement for a very important reason: they want their money back after some days. So, they go through the income statement carefully and decide whether to offer financial aid to the borrower. Assessing the income statement allows them to identify if the company can really pay its debts. As per their observations from the statement, they decide what to do.

Investors

The income statement pulls the local and foreign investors as well. They take a keen interest in exploring the company’s financial ability to earn profits through various revenue streams. They go through each row in the statement when deciding whether to invest in the company. After all, they want your company to make more profits, regardless of the seasonal trends and customer demands.

💡Read at Your Leisure:

Copy-pasting Accounting Data? Not Anymore

Stop copy-pasting data from spreadsheets and start using Moon Invoice to create high-quality income statements that dazzle your investors.

What’s Included in the Income Statement?

Professionals can decide what to include in the income statement based on what your business is all about. Say, if you are running a consulting business, you are likely to include more information on service revenue.

Likewise, if you are a retail business owner, you will specify details about line items in the statement.

Let us check what are necessary things usually included in the income statement.

| Aspects | Descriptions |

|---|---|

Conclusion

Income statements are easy to prepare when you have accurate accounting details handy. We hope you now have a clear understanding of how to fill out an income statement. You need to calculate many things, such as COGS, expenses, EBIT, income, TIE Ratio and other details, before putting them in the income statement.

However, you don’t have to waste time in manual calculations if you get the right invoicing or accounting software. Just a few clicks here and there, and you will get your income statement ready. That said, wouldn’t you like to try it by yourself? Sign up with Moon Invoice now.