Invoice Payment Definition

Payment terms are the binding terms and conditions under which the seller must make the payment. They specify how and when the buyer must pay for the goods and services purchased.

Just like an expense sheet is incomplete without itemized costs, an invoice is incomplete without clear payment terms. Whether you create an invoice online or on paper, it’s essential to include payment terms.

This is especially crucial for businesses looking to combat payment delays. Sending an invoice along with clear payment terms helps your clients learn their payment responsibilities and encourages them to complete the payment.

Highlighting payment terms on invoices also helps businesses settle false claims made by customers and improve their cash flow. Plus, you have fewer unpaid invoices to deal with, allowing you to concentrate on forming business strategies and delivering your services on time.

In this guide, we’ll explain invoice payment terms, their types, and examples of payment terms. Ready? Let’s find out.

Key Takeaways

- Payment terms are a necessary part of the invoice.

- Due dates, preferred payment methods, and late payment fees are the common details of payment terms.

- Payment terms on invoices are always in line with industry norms.

- Net 15, Net 30, and Net 60 are some payment terms.

- Professionals should always keep the language of the terms easy and clear.

- For international shipping, additional terms or payment methods may be required and should be mentioned in the payment terms.

Do You Know?

64.4% of owners of small to mid-size businesses simplify their bookkeeping through software. 👨💻

What are Invoice Payment Terms?

Invoice payment terms refer to specifications for when and how the client should make the payment. The terms also clarify acceptable payment methods, the due date, and any applicable late fees that may occur after the due date has passed.

Such payment terms are included on an invoice to minimize late payments. They help the recipient know how soon they need to clear their dues to avoid late payment fees, encouraging them to process the payment as quickly as possible.

Create an Invoice That Gets Paid Faster

Use a pre-designed invoice template from Moon Invoice to make a professional invoice and get paid instantly.

What Is the Meaning of Net Days in the Payment Terms?

Net Days is a payment terms terminology that refers to the period during which a client can make a payment. The common net days are Net 10, Net 15, Net 30, Net 60, and Net 90, with Net 30 being the standard payment term of 30 days. Here is a tabular form of various payment terms with their meaning:

| Payment Terms | Meaning |

|---|---|

| Net 7 | Payment is due seven days after the invoice date |

| Net 10 | Payment is due ten days after the invoice date |

| Net 30 | Payment is due thirty days after the invoice date |

| Net 60 | Payment is due sixty days after the invoice date |

| Net 90 | Payment is due ninety days after the invoice date |

| 21 MFI | 21st of the month following the date of the invoice |

Different Types of Payment Terms

Here are common invoice payment terms used by businesses to let their buyers know how quickly they need to complete the payment.

1. CIA (Cash in Advance)

It is a payment term that requires the client to pay in advance rather than make a payment after receiving the goods. Sellers often adopt this approach to eliminate the risk of non-payment. CIA terms are commonly utilized in industries like logistics and transportation, where upfront

payment ensures financial security.

2. CBS (Cash Before Shipment)

CBS payment terms are quite similar to CIA, where the buyer needs to complete the payment before the seller dispatches the goods. The buyer doesn’t need to pay the money before the production starts, but only before the product is ready for shipment. So, unlike the CIA, it offers buyers more time, as they can process the payment at any time before the shipment is sent.

3. CND (Cash Next Delivery)

It is usually used when there are more deliveries. If a CND is mentioned as a payment term, the buyer must pay for the delivered goods before the next delivery is made. CND payment terms offer some flexibility as payments aren’t made upfront.

4. COD (Cash on Delivery)

Cash on Delivery (COD) specifies that full payment must be made at the time of delivery of the products or services. Under this payment term, the buyer is obligated to pay the amount immediately upon receiving the goods. COD ensures that the seller is paid promptly, while the buyer can verify the delivery before making the payment.

5. CWO (Cash With Order)

Whenever Cash With Order (CWO) is written as a payment term, the buyer is required to send the money when placing the order. CWO ensures that the seller gets paid before production or delivery starts. Such payment terms are used by those who accept bulk orders.

6. EOM (End of Month)

EOM means that the payment due date will be a certain number of days after the end of the month in which the invoice was issued. In this case, the client must pay their dues within the month the invoice was received. This payment term sets the due date based on when the invoice is received rather than the delivery date of the product or service.

7. PIA (Payment in Advance)

PIA refers to a portion of the payment made in advance to cover material costs. This payment term requires the buyer to pay before the work begins. The seller may also include PIA in collecting the full payment upfront.

8. PPD (Prompt Payment Discount)

The seller uses this type of payment term to encourage clients to make early payments and take advantage of the discounts. If the client pays the due amount promptly, they are eligible to receive a discount on the total outstanding amount. This ensures payments are made quickly, nullifying the risk of late payments.

9. CAD (Cash Against Documents)

Often used for international transactions, this payment term informs that the recipient must make the payment before receiving the shipping documents. Once the payment is made, the seller will hand over the shipping documents, which will then allow them to import the goods. CAD makes sure that the seller receives the payment before the buyer collects the goods.

10. MFI (Month Following Invoice)

MFI requires the client to make payment within a month, starting from the date the invoice is received. Therefore, whenever MFI is mentioned as a payment term, the client must clear the dues by the 30th of the month. However, if the due date is missed, the client may incur additional charges, such as penalties.

11. Net 30/60/90

These are some common terms for invoice payments. Net payment terms, such as net 30, 60, or 90, clarify how much time the client has to make the payment. Depending on the payment terms, clients need to pay their dues before or on the due date. For example, net 30 payment terms allow clients to make payments within 30 days. Following the due date, the seller may impose applicable penalties.

12. 2/10 Net 30

It is part of the net 30 payment terms, where the seller offers a 2% discount if the buyer makes the payment within the first 10 days after the invoice is issued. The buyer can still pay the money at any time during the 30 days, but they won’t receive discounts on the total amount. This way, 2/10 net 30 accelerates the payment process.

13. Early Payment

The seller adds this type of payment term to inspire the buyer to pay the pending amount as soon as possible. This term doesn’t guarantee early discounts, but it informs the buyer about the urgency of the payment, helping the seller to collect the money as soon as possible.

14. Contra Payment

Contra payment comes into effect when both parties owe money. In this case, the buyer will provide the necessary supplies for services or products they receive. So, the amount is offset against, simplifying the payment collection process.

15. Terms of Sale

These are conditions that help the buyer understand their responsibility to settle the pending dues once the product delivery is completed. The seller mentions these payment terms to clarify the payment deadlines and potential penalties in case of any delay.

16. Payment Plan Details

Payment plan details consist of when and how much payment should be made over a specified period. The client is required to send payment either weekly or monthly, as described in the invoice. Payment plan details are often required when an upfront payment is not needed.

17. Short Payment Periods

The short payment periods are payment terms that inform clients that the seller has reduced the time frame for completing payments. With this term, the seller notifies the client about the change in payment conditions. For example, the seller might initially offer a net 90 term but later revise it to a net 60 term.

18. Overdue Fees

When the client fails to pay the total due amount by the due date mentioned on an invoice, it is considered overdue. Overdue fees may be charged as a flat daily rate or as a percentage of the total amount.

19. Line of Credit

The client can utilize their line of credit to make purchases on credit. The balance is later paid as per the payment schedule. Offering a line of credit can be risky for companies unless they have full trust in the customer, but it’s a flexible approach.

20. Due Upon Receipt

This term requires the client to pay immediately after receiving the invoice. This clearly means that sellers do not want any delay in payment and expect it to be made immediately. This type of payment term is the best way for a smooth cash flow. Additionally, business professionals do not have to invest time in follow-ups.

21. Open Account

An open account is one of the common payment terms used in international import and export business. In this approach, the importer receives the goods before making payment to the exporter, but payment must be made within 30, 60, or 90 days, depending on the contract or agreement between the two parties.

22. 25/25/50

This payment term refers to the different portions due on an invoice in the following ways:

- 25% at the time of order

- 25% at the time of shipping

- 50% at the time of delivery

23. 50/40/10

Two different meanings are associated with the 50/40/10 invoice payment terms, specifically in reference to the due portion of the invoice.

- 50% at the time of purchase, 40% at shipping, and 10% at delivery.

- 50% at the time of purchase, 40% 2 weeks before delivery, and the remaining balance is due under Net 10 payment terms.

24. EOAP (End of Accumulation Period)

There is an accumulation period in EOAP where invoices are accumulated for a specific period and then paid all at once at the end of the period. For instance, if there is a 30-day Net 30 EOAP, with an invoice date of May 5th, then the 30-day countdown will start from May 30th, and the payment will be due by June 30th.

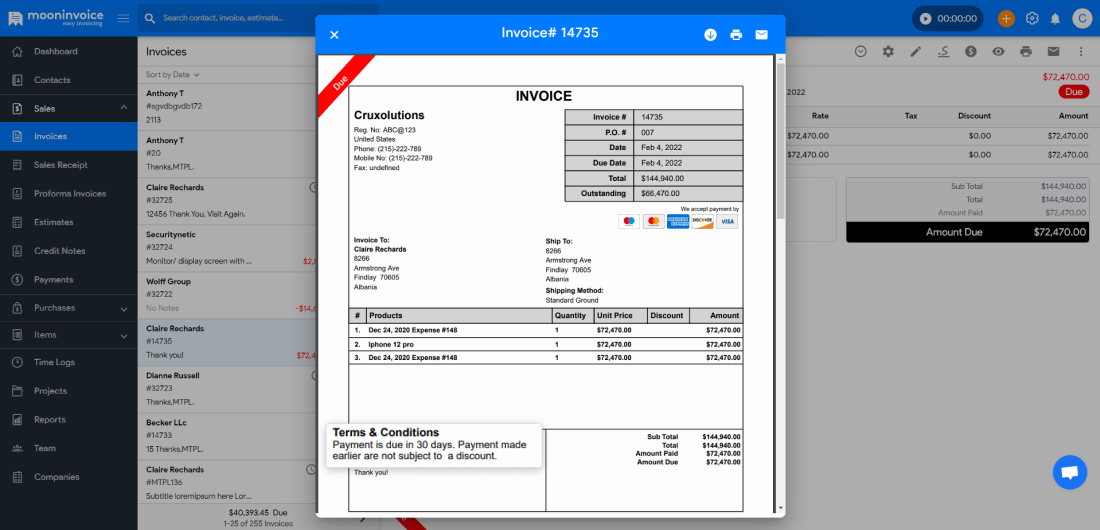

Example of Payment Terms on an Invoice

Here is an example of a payment term that showcases how terms and conditions should be written on an invoice. This example shows how keeping payment terms short and easy to understand leads to faster payments. Refer to the payment terms example below.

Fact File

In 2024, a digital wallet 🤳🏽was the most popular online payment method worldwide, according to a report by Statista.

How to Use Payment Terms?

As a business owner, you can add payment terms while preparing a new invoice or contract. When you clearly highlight payment terms and conditions, they leave no room for miscommunication and inspire clients to opt for early payments.

Also, you can utilize automation tools like Moon Invoice to enhance the readability of your payment terms and improve invoice quality. Using such an automated process will ensure your clients understand the payment terms and complete the payment in a timely manner.

Apart from focusing on how to use payment terms, you should also give equal importance to choosing the right invoice terms and conditions. So, let’s find out.

How to Choose Invoice Terms and Conditions

If you’re wondering which payment terms to include in an invoice, here are a few points to consider.

-

- Consider a Business Type

It goes without saying that different businesses need different payment terms. Based on your business type, you need to select a payment term that aligns with your business offerings and allows clients to make prompt payments. For example, if you perform product deliveries, you might need payment terms like CWO, PIA, or COD. - Assess Client History

Check the client’s history before mentioning the payment terms. If the buyer is delinquent and often pays late, then you need to describe strict payment terms along with hefty penalties. However, if the person is found making timely payments, then you can offer flexible payment terms like 2/10 net 30. - Include Industry Norms

The inclusion of payment terms also relies on which industry you serve. Therefore, consider your industry norms before adding payment terms and conditions. After all, you need to ensure that the described payment terms don’t go unnoticed and that payments are made quickly.

- Consider a Business Type

Utilize Moon Invoice for Quicker Payments

Experiencing payment delays? Switch to Moon Invoice for unmatched automation that not only facilitates the invoicing process but also gets you paid faster.

Best Practices for Invoice Payment Terms

Utilize these practices while invoicing your clients to make sure your clients don’t take too long to make payments.

1. Adopt Right Invoicing Software

Invoices created through online software offer a clearer idea of payment terms compared to paper-based invoices. Therefore, investing in reliable invoicing software can make a difference in terms of payment terms for invoices. You can create an invoice that clearly outlines payment terms, making it easier for clients to read and prompting faster payments.

2. Discounts on Early Payment

Consider offering discounts to those who pay early. It is a modern invoicing practice that businesses use to receive payments on time and simultaneously drive customer loyalty. It will also inspire delinquent clients to pay early and take advantage of discounts on their invoices.

3. Payment Flexibility

Not all of your clients will pay in cash. Some prefer to pay online via net banking or e-wallets. When you create an invoice, attach a payment link or other online payment methods if clients prefer to pay remotely. This will significantly reduce unpaid invoices, allowing you to clear business expenses in a timely manner and focus on business activities.

4. Short Payment Terms

Always add your payment terms using short one-liners to make it easier for clients to understand how soon you expect payment. If you include late payment fees in an invoice, make them bold or use a contrasting font to capture the client’s attention. By doing so, you won’t have any back-and-forth once an invoice is issued.

5. Follow Up

Always follow up on the invoice to obtain the one-time payment from the client. The frequency of sending payment reminders depends on the client’s payment history.

6. Simplify the Payment Process for the Customer

Always offer your customers the easiest payment approach. Best practices include offering multiple payment methods, clearly highlighting the due date, and stating the total amount to be paid. Also, remember to include your contact information to bridge the gap between you and the client in case of an emergency.

7. Keep the Language Simple

Always utilize simple language while showcasing your payment terms. This approach enhances the client’s understanding and indirectly boosts on-time payment. Additionally, avoiding complex technical terms and abbreviations is another consideration.

💡Pro Tip:

Adopting automation in accounting is very fruitful for businesses. A study says that about 95% of companies increase their accuracy and efficiency when fully automating their AP process.

What are Standard Payment Terms?

Standard payment terms are pre-defined limits within which customers are required to pay their dues. While invoicing terms may offer short or long payment periods, standard payment terms have only one specified payment period. Depending on your industry, standard payment terms typically range from 15 to 30 days, during which customers are expected to make the payment.

Using standard payment terms is a traditional way to provide time to make payments. However, as modern businesses allow more flexible payment terms, standard payment terms have now been largely replaced by invoicing terms.

How Does Moon Invoice Help You Avoid Late Payments?

A sophisticated invoicing software, Moon Invoice helps you create professional and accurate invoices that encourage clients to pay faster. It ensures that no revisions can be made once an invoice is created and helps clients understand the payment terms.

It requires a minute or less to generate a nice-looking invoice and enables clients to pay conveniently using online payment methods, helping you get paid in a timely manner.

This automated invoicing process neither leaves room for errors nor deteriorates the quality of an invoice. That’s how you can get rid of late payments and cultivate business growth.

Here are some of Moon Invoice’s features designed to facilitate your invoicing process.

- Readymade invoice templates

- Invoice tracking

- Send an invoice via WhatsApp or Email

- Thermal print

- Sales reports

- 20+ payment integrations

- Cloud storage

- Offline sync

Overcome Late Payments With Moon Invoice

Get Moon Invoice to generate nice-looking and easy-to-read invoices that leave no room for late payments.

Conclusion

Whether you process customer transactions or deal with vendors, invoice payment terms are essential to maintain clear communication and avoid payment delays. By now, you should have a better idea of which payment terms work best for your needs.

As discussed, payment terms are easier to understand when clearly highlighted on a digital invoice rather than on a poorly written one. Invoicing software like Moon Invoice is perfect for creating online invoices that minimize delays and help you receive payments faster. Start using it for free today!