Tax filing is easier said than done because there are multiple tax forms that you need to fill out carefully. While some form names themselves suggest what they are used for, others, with alphanumeric names, often create confusion. The two popular IRS forms W-2 and W-9 may have somewhat similar names, but they are used for completely different purposes.

If you are at the helm of a small or large organization, you must have heard about W-2 and W-9 forms whenever the tax season approaches. Like others, you too would have asked yourself who is required to fill out a W9? What is a W9 used for? Or Is a W9 the same as a W2?

But, not anymore. Here we will walk you through what is a W9 form and a W2 form, including their differences, in our comprehensive guide on W9 vs W2.

W2 vs W9: What is Form W2?

The IRS Form W-2 is a tax document that reports how much is the annual income of an employee and the amount of taxes withheld from their paycheck by the employer. Besides wages, Form W2 also consists of a Social Security Number (SSN) or a Taxpayer Identification Number (TIN).

It plays a role in informing the IRS how much an individual earns from their current employer. Therefore, it is essential to fill in the correct information and review it carefully.

As per IRS guidelines, employers in the US are required to submit a Form W2 for every employee earning more than $600. Plus, the employer also needs to describe whether they have withheld any income from employees.

If you are filling in Form W2 for the first time, here are things to be taken care of:

-

- The employer’s name and Employer Identification Number (EIN)

- Employee’s compensation and paid wages

- Income tax withholdings (both Federal and state)

- Any medicare contributions

- Once filed, keep a copy for the company’s records

- Send another copy to the employee

Pull the Stress Out of Tax Filing

Automate generating tax reports with Moon Invoice and easily file taxes within a few minutes.

When to Use a Form W-2?

Form W-2 (Wage and Tax Statement) can be used while filing an income tax return. If you are a full-time employee, then you can derive the information from the Form W2 and let the tax authority know your income status as well as the amount withheld.

However, this IRS form will be filled out earlier by your employer before the tax year ends, i.e., January 31 of the following year. They will later send you a copy of Form W2, which you can use or attach while filing the income tax return.

In short, employers file Form W-2 with the IRS, whereas employees use only the information from it in order to complete their own tax returns (Form 1040).

💡Recommended Read:

W2 Vs W9: What is a W9 Form?

The Form W9 refers to the tax document that states how much money is received by the independent contractors or freelancers during a fiscal year. The employer issues it to request individuals’ tax details, such as legal name, Taxpayer Identification Number (TIN), and certification. With Form W9, basically, the employer can track the paid money.

The Form W9 should be filled out by the independent contractor, freelancers, or anyone who is self-employed in order to reveal how much they were paid within a year. This tax form can also be utilized for reporting IRS contributions or mortgage interest.

However, you don’t see any tax withholding information in the Form W9 because self-employed individuals are themselves responsible for filing their own taxes.

When to Use a W-9?

Form W9 can be used to submit the requested details like certifications, TIN, or any other details to your employer. Self-employed individuals are the ones who fill in the tax information using W9 Form and submit it to the employer and not directly to the IRS.

In the US, employers use the Form W9 while preparing the contract for self-employed individuals in order to prepare 1099-NEC at the end of the year.

Most businesses have made completing Form W9 a part of their onboarding process. So, whenever they hire a contractor or a freelancer, they provide Form W9 and ask them to revert back with proper details.

Once they receive the Form W9 back, they keep it in their financial records, so they can quickly fill in Form 1099 for hired contractors.

Say Goodbye to Painful Tax Filing

Use Moon Invoice to organize your tax documents under one roof and file your tax return on time.

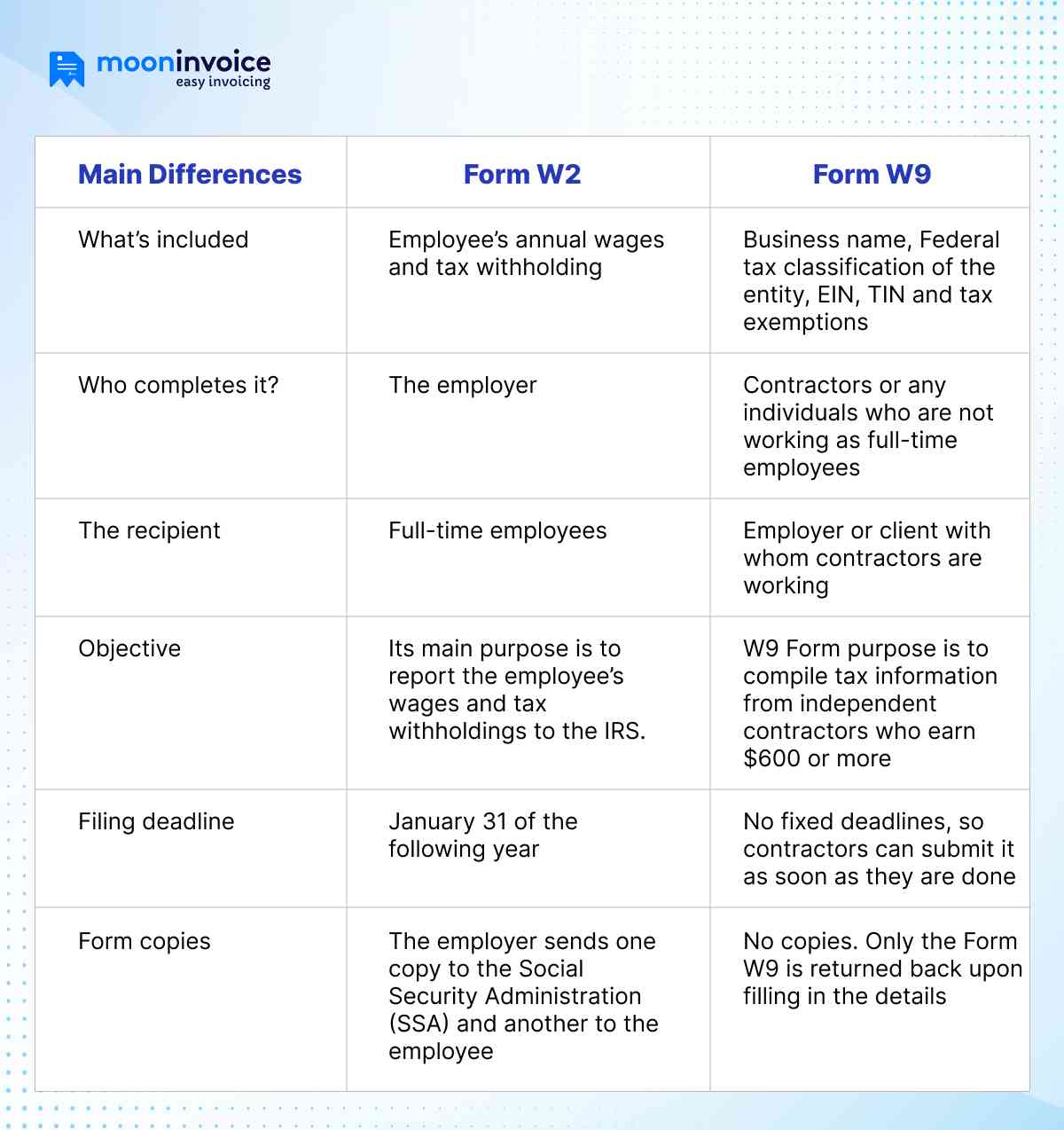

W-2 Vs W-9: What’s the Difference

Here’s the basic difference between W2 and W9 IRS forms.

Form W9 Vs W2: Key Takeaways

Whether it’s Form W-9 or W-2, filing tax forms is a cumbersome task, because what you really do is spend more time gathering the right information and the rest of the time reviewing the filled-in details

Referring to the aforesaid meaning and differences between Form W2 and W9, our takeaways are: Form W2 is to report the employee’s wages and withholdings to the tax authorities, whereas contractors or freelancers fill out Form W9 in order to submit their tax information to their employers.

In case filing taxes buys you more in collecting different tax data, we recommend trying Moon Invoice to manage your tax details and tax reports.

Avail a 7-day free trial to check out how it works.