Paying taxes has already been painful, and now the phantom tax adds to the misery. Imagine owing hefty taxes on money you never actually received.

That’s scary, but when the IRS comes knocking, you have no choice but to face it. Failing to address such tax liabilities will invite unwanted consequences.

Here, we will help you know what does phantom tax mean, its importance, and ways to reduce it. This will further aid you in proper tax planning and avoiding the IRS’s attention(hopefully).

Let’s begin with the definition of phantom tax.

What Is a Phantom Tax? (Phantom Tax Meaning)

It is an accounting term referring to the scenario where an individual owes taxes on money that they never received physically. It indicates the tax liability, which is generated directly from the phantom income.

This could be so annoying for any individual because they are getting taxed on income, which is only on paper. Even if the money hasn’t arrived in your pocket, it’s still the real income in the eyes of the IRS, giving it the name ‘phantom’.

Following the phantom tax definition, let’s uncover how phantom tax is different from other taxes.

Phantom Tax Vs Other Types of Taxes

| Differences | Phantom Tax | Other Taxes |

|---|---|---|

💡Also Read:

What Is Phantom Tax Example?

Let us take a couple of examples to learn about some real-life scenarios when phantom tax comes into effect.

Example 1: Mutual Funds

If you own shares in a mutual fund but never plan to sell them, remember that you owe taxes.

Suppose your portion of capital gains is $400, then it’s a phantom income in the eyes of the IRS.

Here, the capital gains on funds equate to real money, as per the IRS, and therefore, you end up paying $400 phantom tax. That’s how phantom income is generated, even though it’s still the number on paper and no cash has been paid out.

Example 2: Zero-coupon Bonds

Another best phantom tax example is a zero-coupon bond, which is sold at a discount, but only pays the full value once it matures. Let’s say you buy a bond for $11,000, which will be $15,000 at maturity. Then, the $4000 difference becomes a phantom income, no matter how far is the maturity date.

This is because the IRS assumes you already earned $4000 from the difference between the lower and higher purchase values. Hence, the phantom tax is applied, which ultimately increases the taxes you owe.

Feeling Uneasy About Tax Audits?

Start managing tax data with Moon Invoice and stay ahead of phantom taxes, relieving audit stress that keeps you up at night.

How Does Phantom Tax Work?

Still confused about what is phantom income? Let us break it down by explaining how it works so that you get tax-ready while approaching the tax season.

1. Recognizing Income

Phantom tax comes into effect the moment gains are recorded, regardless of how soon you will receive the cash. When you file a tax return, the tax authorities also keep a tab on the profits, even if the money is somewhere else. This way, they lay the foundation for phantom income by recognizing how much profit you have earned.

2. Tax Liability

When the authorities consider paper gains as real income, tax liability triggers. It is then added to your gross income for a specific fiscal year, increasing your overall taxable income. The tax department will send a notification about your tax obligations, along with what they have considered as your net income. Thereafter, they expect you to pay taxes at the earliest.

3. No-cash Payment

Next, it’s you who needs to complete the tax payment even though you haven’t received cash in hand. At this point, you may need to arrange funds in order to pay the tax bill. This is because tax bodies think like these are real money and therefore, you are the one who is responsible for paying the said taxes.

💡Recommended Read:

Why Is It So Important for Your Businesses?

Here are some reasons why you should never skip calculating the phantom taxes, especially when the tax season is just around the corner.

1. Cash Flow Issues

A phantom income can lead to potential disruption in your cash flow management if it catches you off guard. Therefore, taxpayers need to address them by borrowing funds or selling the assets that are not in use. Because if you fail to cover phantom tax bills, the increasing cash flow problems may hamper your business operations after some time.

2. Investment-related Decisions

Phantom income also holds significance when it comes to making investment decisions because the cash it generates ultimately comes as taxable income. Taxpayers need to keep in mind that investments may increase value on paper, but they may not receive funds until a specified date. For that, you need to consider phantom taxes while doing investment planning. Or else, you are likely to get unwanted surprises.

3. Financial Planning

Since phantom tax considers paper gains as earned money, you need to establish a financial plan in a way that has funds to cover the taxes, even if the money isn’t landed in your account. You can also plan for keeping emergency funds or choosing tax-friendly accounts while bidding to avoid financial burden following the tax season. Hence, phantom awareness is a must when developing a new financial plan.

4. Reporting & Compliance

Phantom tax also matters as far as financial reporting and compliance are concerned. So, you need to consider it when disclosing your business income to the IRS while filing tax returns. Remember to report paper gains, such as vested stock or accrued interest, in such a way that complies with the tax laws. However, if you missed disclosing these earnings, you may face penalties that will further worsen your financial woes.

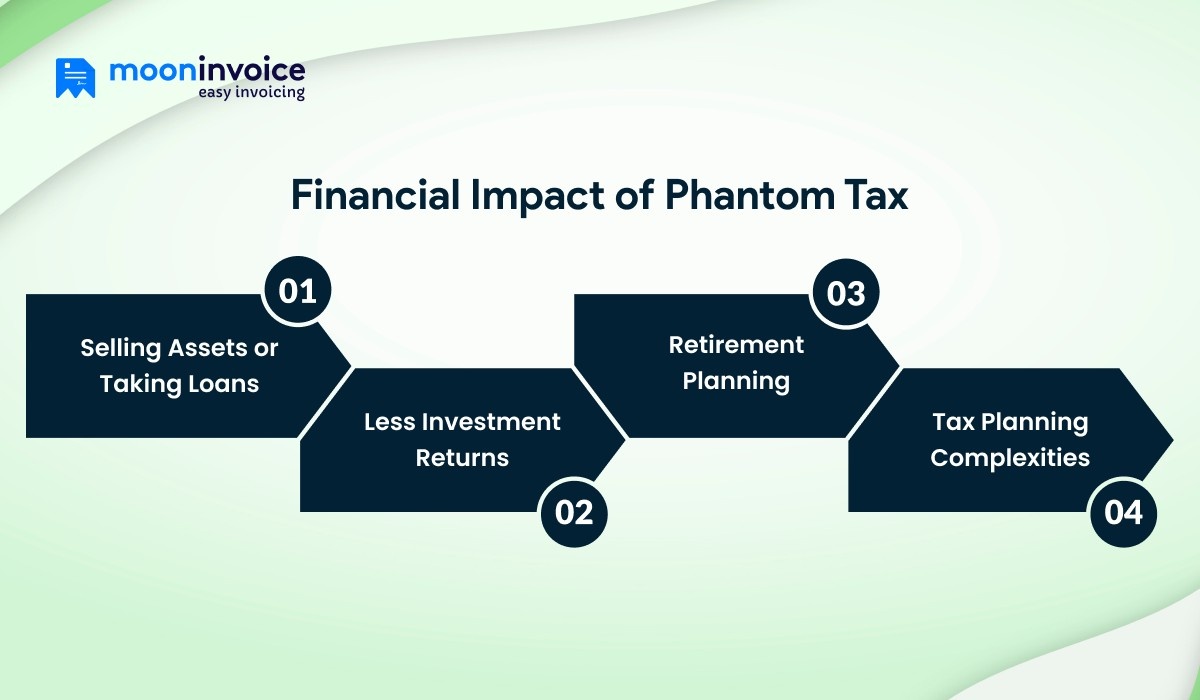

Financial Impact of Phantom Tax

Since the phantom tax is owed prior to the cash actually coming into the account, an individual may face below implications.

1. Selling Assets or Taking Loans

When a phantom tax is applied, it means you haven’t received cash in hand, and yet you are expected to clear the tax bills. In this scenario, you need to sell your assets or borrow bank loans because of no real money available to pay taxes. The latter will also incur additional costs due to the higher interest rates.

2. Less Investment Returns

The addition of a phantom tax will also hurt your earnings from small or large investments. This is because you have to pay some portion of your earnings as taxes. Therefore, an individual can’t expect larger returns on bonds or stocks that increase their value at maturity. As a result, you settle for less profits from investments.

3. Retirement Planning

Phantom tax also leads to disrupting your retirement planning, as you might need to borrow real money from retirement funds to pay taxes. This means you will have less money kept as retirement funds in 401(k)s or IRAs. So, you also deal with retirement planning pressure while keeping one eye on phantom taxes.

4. Tax Planning Complexities

With phantom taxes, you not only have difficulties in retirement planning but also in tax planning. If you fail to report other income sources, it will invite penalties from the IRS. Therefore, you have to carefully organize your taxes and make sure you report them on time. If not, you are likely to pay more taxes, which might take a toll on your business efficiency.

4 Ways to Minimize Phantom Tax For SME Businesses

Are you among the SME businesses dealing with phantom taxes? Let us help you with effective ways to minimize phantom tax.

1. Preserve Emergency Funds

To combat phantom taxes, make sure you keep adequate funds in your savings account. Preserving funds for emergency purposes can aid you in performing your tax duties on time and avoid penalties. This way, you can meet your tax obligations without halting your business operations.

2. Recognize Phantom Income

Sometimes businesses fail to realize all sources of phantom income and fall prey to surprise tax liabilities. That’s why recognizing phantom income early can help in managing finances to cover unexpected tax bills. For example, if you have invested in mutual funds, don’t forget to count them in your tax planning.

3. Review Financial Statement

Remember to take a closer look at your financial statement in a bid to reduce your phantom taxes. By doing so, you will quickly identify your phantom income sources and arrange extra funds to pay taxes in a timely manner. This is how you can avert unexpected tax burdens caused by phantom tax.

4. Consult Experts

Business professionals can seek advice from tax professionals or someone who is an expert in tax planning. They can help you lessen phantom taxes by sharing insights on tax rules and their experiences over the years. Hence, taking an expert’s advice can not only help you make informed decisions but also protect you from surprises.

How can Moon Invoice Help?

Moon Invoice, an AI-powered invoicing software, can help you centralize your financial data in a way that you get clear visibility of cash flow movements. Plus, you get high-quality financial reports that provide insights into revenue streams, sales patterns, and new customer trends.

But why only Moon Invoice?

Taxes like phantom tax can hurt your savings and slow down your business if you rely on spreadsheets or other traditional software. Moon Invoice is built differently, with AI-assisted features to make sure you never get caught off guard.

It is like having an accounting companion in your pocket, who organizes taxes and finances while you drive business growth.

Here are a few more reasons to use Moon Invoice and overcome the stressful tax seasons.

- AI-driven receipt scanner: Utilize an AI-ready receipt generator to make new receipts and later convert them to expenses, invoices, or credit notes.

- Tax reports: Explore accurate tax reports in a single tap instead of juggling lengthy paperwork or gazing at spreadsheets for hours.

- Expense management: Oversee business expenses under one roof and get insights into your ever-changing spending patterns.

- Financial statements: Create error-free financial statements in one go and set yourself free from crunching numbers manually.

Key Takeaways

Phantom income tax is invisible, but its impact can badly hurt your bottom line. It’s you who needs to clear the tax dues without receiving the cash in the account. For that, you may need to sell your assets or apply for a bank loan, putting immense financial pressure on your business.

Therefore, it’s recommended to organize taxes meticulously using advanced software like Moon Invoice. With Moon Invoice covering your back, you will neither fall short of tax obligations nor settle for unwanted surprises. As a result, you spend less time handling tax hassles and more on fueling business growth.

Don’t just take our word, try it free for 7 consecutive days and explore what’s more in store.