An invoice is a formal request for payment for products or services provided by a vendor. It incorporates the price of whatever the customer has bought or been charged for. Suppose an invoice includes the seller’s and buyer’s names, the item’s description and price, and the payment conditions. Possible use as evidence in court if that’s the case. How do we then enter these invoices into accounting?

A new account payable and a new purchases account receivable are created every time an invoice is traded. Accounting for invoices and payments must be recorded so that the company’s books and financial statements are accurate.

Then if you’re a complete accounting novice and have no idea how to enter invoices, you can feel completely overwhelmed. We have developed this blog to demonstrate the examples and explore the features of invoice accounts and accounts payable systems.

So, let’s not waste more time and get down to business.

Accounts Payable Vs Accounts Receivable

Accounts payable and accounts receivable are two separate financial ledgers for invoicing recording, and knowing the difference between accounts payable and accounts receivable is essential to comprehending the invoicing process.

Therefore, let’s separate the two and understand how journal entry for an invoice happens.

| Accounts Payable | Accounts Receivable |

|---|---|

| Simply put, your accounts payable are the sums you owe to suppliers as payment for the items and services you have received from them. To rephrase, “accounts payable” equals “payments made in settlement of bills due to vendors.”. Since paying off your debts increases your company’s credit balance, you might classify accounts payable as a liability. | Accounts receivable, on the other hand, is the money your customers owe you for the goods and services they have received from you. Your invoice should be for this whole amount. Since accounts receivable represent future cash inflows, they are considered current assets. |

| Debtor receivables are included as current assets on a company’s balance sheet. | On the balance sheet, outstanding vendor payments are categorised as current liabilities. |

| This account is being opened because of the need to do business. | This account’s opening results from using credit to acquire the assets shown here. |

| The responsibility is with the borrowers. | The company itself bears responsibility. |

| It is a Cash Inflow. | It is a Cash Outflow. |

Businesses may utilize the accrual or cash basis regarding how accounts payable journal entries are recorded.

All accrued expenses are recorded by the finance department in an accrual accounting period and serve as stand-ins for cash events. Consider the hypothetical situation whereby a shoe manufacturer chooses to make a new $15,000 purchase from XYZ Inc. and agrees to pay half of the advance and the other half upon delivery. Inventory goods incur costs only when they are goods sold to a buyer. When an invoice is received, the whole thing usually gets written off as a cost immediately (assuming the goods or services have been provided).

Expenses are only recognized when cash is dispersed, as in the credit cash-basis accounting technique. When placing the order, the Shoe manufacturer would put a $7500 deposit on the Shoes. When the Shoes arrived, the remaining $7500 would be recorded.

The received paper invoice journal entry is recorded in the general ledger as a current asset in an accrual accounting system. Finance will record the payment of bills by making a credit to the corresponding liability account and a debit to the accounts receivable account. Accounts receivable would also include any applicable late fees.

How to Record Invoice in Journal Entry? (With Examples)

Because every enterprise has unique challenges, every enterprise requires journal entries while learning how to record paper invoices in accounting. As a result, every company has its unique system for keeping track of vendor invoices and payments tailored to the individual demands of the company. This can also get to know how much your company owes and the company’s finances by recording invoices. By keeping records of invoices you will not lose track of the financial data that the company receives.

However, there are several categories of income statement journal entries that may be seen as stand-ins. For a startup, this should be sufficient.

In that case, let’s take a quick look at some journal entries for the invoice.

Instances of Journal Entries for Expenses

1. The accounts payable journal entry

Accounts payable are credited while the asset or cost used to fund the purchase is deducted. If cash is credited, then an account payable is debited for the goods and services the company sells.

2. Logging of Small-Sum Money

When the petty cash box needs replenishing, the financial transactions to do so is recorded as a credit to the cash account. A debit entry is made in the expenditures to be charged to the accounts receivable account in the total amount of money used to replenish the petty cash account.

3. Keeping track of payroll

Wages and payroll tax charges/expenses are debited, and the cash account is credited during processing payroll. Additional credits for deductions must be provided from benefit expenditure accounts if an employee has authorized a deduction from pay or salary for benefits.

4. Keeping track of accrued costs

The debit entry for an item that has been incurred should be made in the appropriate expense account, and the credit should be recorded in the accumulated expenses account. Afterwards, this item is often flipped automatically.

5. Keeping track of depreciation

To properly account for depreciation costs, a debit must be recorded against the outlay and a credit against the cumulative amount of depreciation. These categories might be subdivided further according to the recorded fixed assets.

Journal Entries for a Revenue Example (Invoicing Recording)

a. Recording a provision for doubtful accounts

To create or modify a bad debt reserve, debit accounts receivable are moved from the bad debt expense account to the allowance for doubtful accounts. Then, after the precise debts are calculated, credit receivable accounts and debit allowance for doubtful accounts.

b. Record Transactions in Sales

Sales are credited, while Accounts Receivable are debited when products or services are sold on credit (an accounting journal process known as “accrual”). However, if the transaction was settled in cash, outstanding invoices, the cash received would be deducted from the books instead of the accounts receivable while invoicing.

Account Payable Process

Every organization has an accounts payable department, albeit its organization will change as the company grows. The accounts payable division is built up based on the likely number of vendors & service providers, the amount of the payments that would be handled for some time, and the sort of reports the management would need.

For example, a small firm with a low number of buy transactions would need a rudimentary account payable procedure while accounting for invoices.

Whereas the accounts payable department of a medium/large firm would have a series of processes to be followed before processing the vendor payments. Set standards here are vital because of the value and number of transactions at any time. The steps are as follows:

1. Receiving the Bill

In the case of products, the bill/invoice aids in tracking the number/quantity of items received. The valid bill’s period might also be determined when the vendor invoice is received on time.

2. Examining the Invoice in Minute Detail

You may check the vendor’s name, authorizations, invoice date, and any special requests based on the purchase order while invoicing recording.

3. Receiving Bills and Keeping Current Records

Ledger accounts relating to the bills received need to be updated. In such a case, it is customary to practice recording an outgoing expenditure in the ledger and company records.

When using an accounting program, getting clearance from higher may be necessary before entering some expenditures. The total bill amount will be used to make the decision. Large corporations often use the ‘maker and checker’ model for posting as a safety measure while invoicing recording and journal entries for the invoice. Understanding journal entries is an important aspect of accounts receivable account.

4. Remitting Funds on Time

Payments must be made on or before the agreed-upon due dates with each vendor, supplier, or creditor. Here, you’ll need to gather and double-check the necessary paperwork while invoicing recording. The information on the cheque, the vendor’s bank account, the payment vouchers, the original invoice, the purchase order/agreement, etc., must be double-checked.

The official’s signature is often necessary. The ledger account for vendors/suppliers/creditors must be closed in the books of account after the payments have been paid. The risk established before will be mitigated.

Bonus Tips: What are Accounts Payable Metrics?

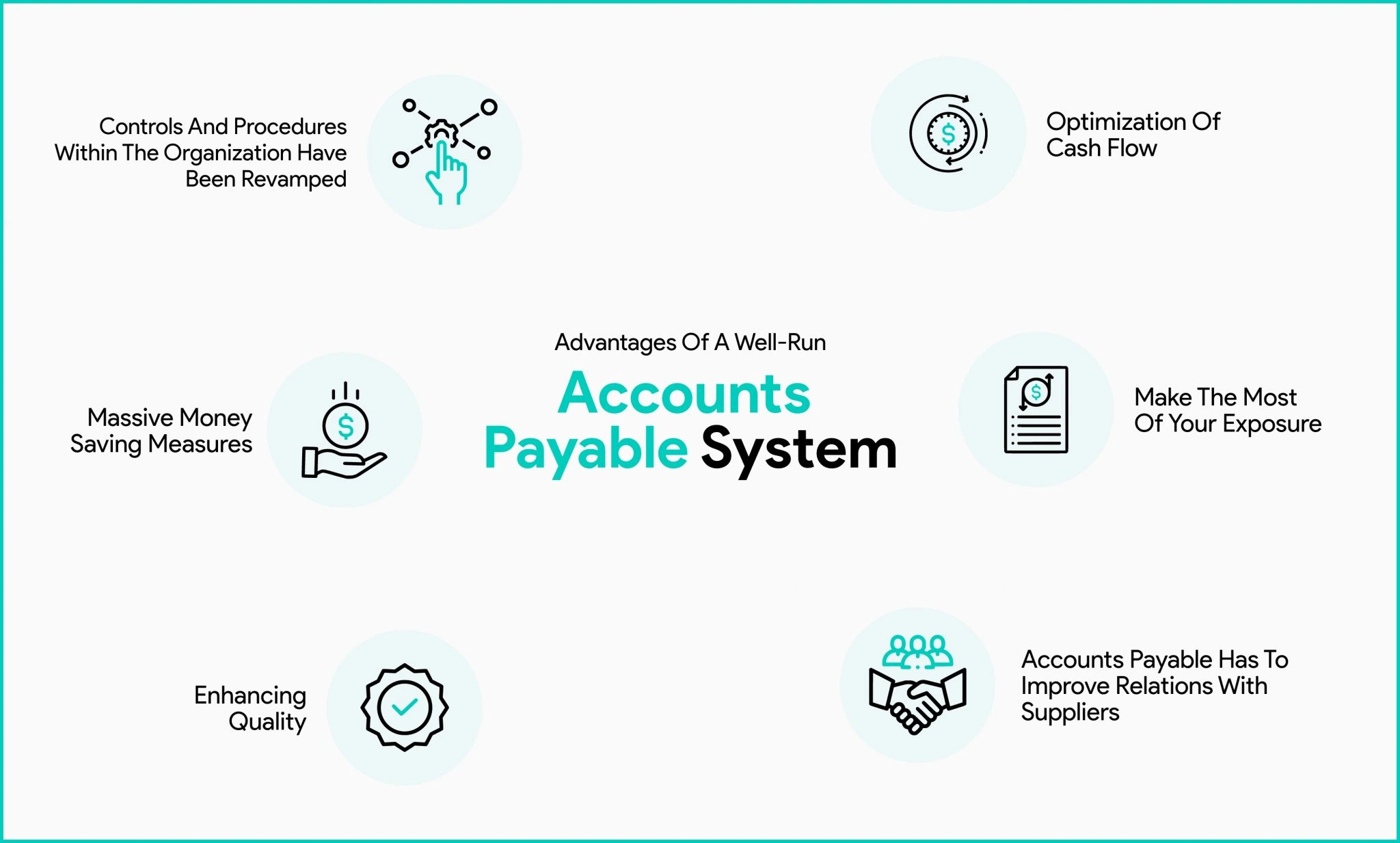

Advantages of a Well-run Accounts Payable System

While every business has its answer to how to record legitimate invoices in accounting -There are many benefits to organizations of automating proper accounts payable and decreasing the amount of human data input.

Here are the main benefits of AP automation accounting software that we believe may assist any company:

1. Optimization of Cash Flow

Accurate financial records and cash-flow forecasting is made possible by automating the accounts payable process and reducing the number of manual operations.

Accounts payable benefit from process visibility because they may direct their efforts toward the most critical tasks that affect cash flow. Payment reductions offered by dynamic cash discounting may provide considerable yearly returns and ensure that all bills are paid on time. It also alerts about unpaid invoices. Automation is crucial for dynamic cash discounting even to be a possibility.

2. Make the Most of Your Exposure

Centralizing the inbound invoicing process (reception, capturing, extract, verification, and forwarding) improves payables posting accuracy. A full audit trail is constructed to double-check the steps and the workers that performed them.

Likewise, management may deal with problems as they arise. With self-service access to invoice and payment records, there is no need for workers, financial management teams, or suppliers to contact one another with questions or requests for invoice information.

3. Controls and Procedures Within the Organization Have Been Revamped

Increasing adherence to internal controls to avoid fraud and preserve the integrity of financial results is crucial as the globe shifts to electronic invoices in response to new regulations. Because of this, the role of accounts payable has become more complex.

Manually enforcing such safeguards is very unlikely to succeed in practice. To maintain compliance, small businesses that still use manual AP procedures must incur additional prepaid expenses for audits. Accounts payable may lessen the regulatory compliance load, save money, and save time by incorporating regulations into the automated systems process.

4. Massive Money-Saving Measures

Spending may be reduced in every department thanks to AP automation. Self-service portals for suppliers, a decline in duplicate invoices (and duplicate payments), a rise in cash discount advantages (e.g., payment terms like early payment discounts and fees for late payments), and the removal of later date penalties owing to late payment are just a few of how businesses may save money with invoice automation.

5. Enhancing Quality

Mistakes (including data revenue journal entry and human error), delays, and excessive expenses may be avoided using an automated process with high-quality invoice total data and credit amounts. Instead of having a separate exception procedure, they are handled inside the workflow itself. Such distinct procedures are cumbersome, costly, and risky since they are seldom monitored or evaluated.

Accounts payable operations need to be adaptable enough to accommodate changes in corporate strategy. Because of expansion or mergers, the number of transactions may rise. Compared to rising labour expenses in a primarily manual and non-standardized operation, the cost of “switching up” in an automated process is far lower.

Outsourcing is facilitated by automation as well. In the case of a merger or acquisition, the process may be readily scaled up, delivering high efficiency at a cheap cost.

6. Accounts Payable has to Improve Relations with Suppliers

The manual procedure sends forms back and forth by mail and email, where they are easily misunderstood. Processing vendor inquiries, open items, and approvals are streamlined thanks to automation.

The protocols are compatible with PCs, tablets, and smartphones and follow established business security guidelines. A company’s ability to thrive relies on its connections with its suppliers; therefore, acting and communicating quickly with them is crucial.

Conclusion

These are the key takeaways about the accounts receivable account. Recording invoices in accounting shall always stay enviable for business owners and freelancers as it helps them get paid faster. Professional electronic invoices make a different yet appealing impression, for which recording invoices using the correct invoicing software stands crucial. So, choose the ideal online invoicing software to continue creating and sharing professional invoices.