Accounting Cycle Definition

The accounting cycle is a systematic process of identifying, recording, and processing financial transactions to prepare financial statements.

How do you manage the accounting part of your business? Is it tricky? Let’s decode it.

When you are running a business, the standard procedure to maintain financial records is to reflect on every financial activity that occurred during one specific accounting period before the books are closed. This is where the accounting cycle comes in.

This cycle provides a systematic roadmap for accountants and bookkeepers to keep finances organized and comply with regulations.

In this blog, we will explore what an accounting cycle means, the eight steps it involves, along with its purpose, and what benefits it has when paired with an automated system.

Let’s dive in..

📌 Key Takeaways

- The accounting cycle refers to a systematic process to maintain records and create financial statements of a business.

- The accounting cycle consists of 8 different steps, from identifying transactions to closing the books.

- Financial accuracy and compliance support are two of the key benefits of the accounting cycle.

- The accounting cycle focuses on past data, while the budget cycle focuses on business forecasts.

- Use accounting or invoicing software in your workflow to easily handle the time-consuming processes of the accounting cycle.

What is the Accounting Cycle?

The accounting cycle definition is the systematic process a business uses to maintain records, analyze entries, and summarize its financial transactions during one specific period (monthly, quarterly, or annually). This cycle confirms that every financial activity, starting from sales to payments, is properly documented and organized in clear financial statements.

Here, financial statements could be balance sheets, income statements, cash flow statements, or statements of changes in equity.

In simple terms, it can be said as the step-by-step process that converts raw financial data into meaningful reports. These reports highlight the company’s true financial health. When a transaction is initiated, this cycle starts, and once the financial statements are finalized and the books are closed, the cycle ends.

The purpose of the accounting cycle is to maximize consistency and reduce accounting errors in financial recordkeeping. This is key in preparing accurate reports for audits.

Struggling to Keep Your Accounting Books Accurate?

Manual entries, missed transactions, and messy records can throw your accounting cycle off track. With Moon Invoice, keep your financial statements accurate and error-free!

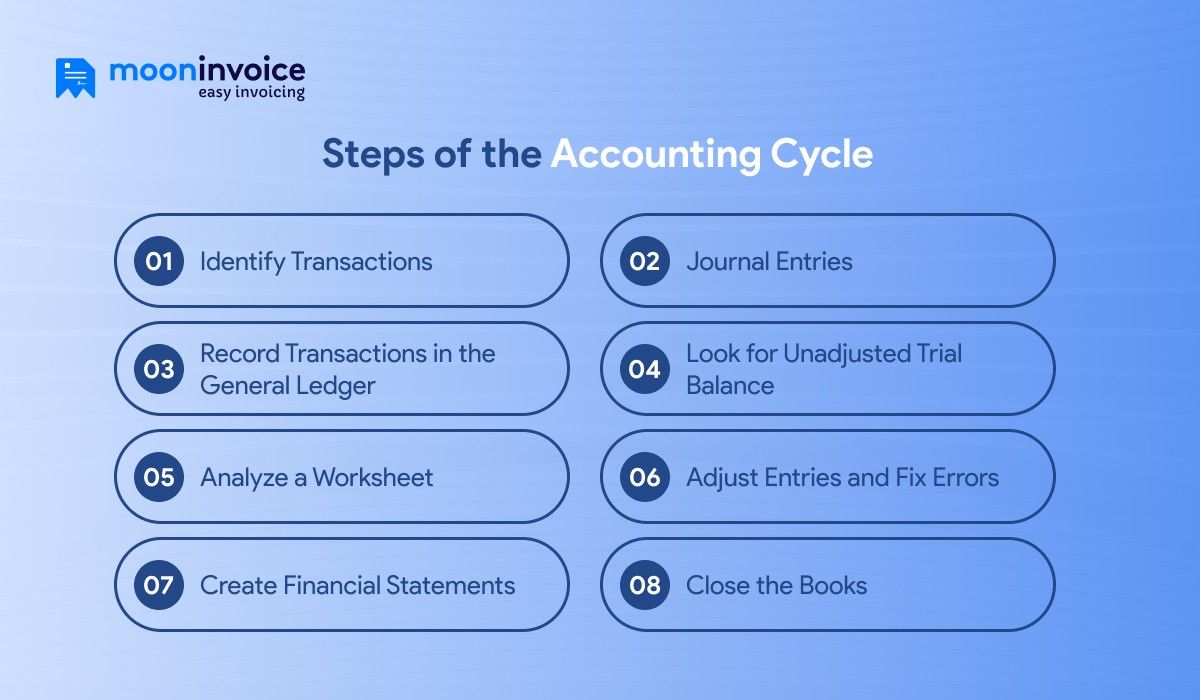

8 Steps of the Accounting Cycle

The accounting cycle steps explain how every financial data goes through different phases to prepare statements.

Here are the 8 steps of the accounting cycle:

1. Identify Transactions

The first step in the accounting cycle is to identify and analyze financial transactions. This step includes every money-related activity, such as sales, purchases, payments, or expenses. The transactions that can be measured in monetary terms are only recorded.

Gathering supporting documents like invoices, receipts, or bank statements is key here to ensure every transaction is valid and correct.

2. Journal Entries

After validating every transaction, the next step is to record it as a journal entry. Here, the double-entry system is used, which means both debit and credit accounts are recorded.

Suppose a business makes a sale, then accounts receivable is debited, and sales revenue is credited. Both these entries are recorded to maintain clarity and balance in the company’s financial records.

3. Record Transactions in the General Ledger

After recording journal entries, the next step is to record all transactions in the general ledger. It acts as a central record for all financial accounts, such as sales, cash, expenses, and even liabilities.

The journal entry is sent to its respective ledger account to determine how each category is affected over time. In this step, every transaction is organized in one place, which makes preparing reports later easier.

4. Look for Unadjusted Trial Balance

After the ledger part is over, the unadjusted trial balance is prepared. In this step, the unadjusted trial balance lists both debit and credit balances to keep the books balanced; i.e., total debits equals total credits.

If the debit and credit balances don’t match, there is an error in the records that needs correction before moving on to the next step.

5. Analyze a Worksheet

If there is any unadjusted trial balance found after listing both debits and credits, a worksheet needs to be analyzed to identify necessary adjustments. Accounts can compare the unadjusted amount as per the financial need (discrepancy), like unpaid expenses, depreciation, or accrued income.

When you analyze the worksheet, you get to know where exactly accounts require adjusting entries.

6. Adjust Entries and Fix Errors

In this stage, accountants fix errors and adjust every amount before preparing financial statements. These adjustments indicate that revenues and expenses are recorded in the right accounting period. Common adjustments include prepaid expenses, depreciation, and outstanding bills.

This step helps correct errors and ensures books accurately showcase the company’s financial position.

7. Create Financial Statements

Once all adjustments are complete, accountants prepare financial statements. These statements include everything, from the income statement, balance sheet, to the cash flow statement. Generating financial statements or reports helps determine the performance and financial health for that specific period.

Later, this financial reporting plays a large role in evaluating profit margin, assets, liabilities, and overall business stability.

💡Need to know:

8. Close the Books

The final step of the accounting cycle is to close the books, which ends the accounting period. Closing the books means every account is closed, be it revenues or expenses, which is a complete reset (starts from zero) for the next cycle.

Benefits of the Accounting Cycle

Effective accounting cycle management plays a major role in keeping your financial records accurate and organized. The benefits of the accounting cycle include:

- Financial Accuracy: The structured process helps businesses record every transaction correctly, which reduces the chances of errors or discrepancies in financial reports.

- Improves Decision-Making: The financial statements generated through the accounting cycle give correct information, which leads to reliable insights and better decision-making.

- Supports Compliance: Accurate financial records that are generated from the accounting cycle help meet legal and regulatory compliance.

- Simplifies Audits: Internal and external audits are completed quickly when books are closed and records are organized properly.

💡Did You Know?

According to a 2025 benchmarking report, researchers found 50% of finance teams take 6 or more business days to close the books at the end of the month.

Accounting Cycle vs Budget Cycle

In business finance, the accounting cycle and the budget cycle may seem related, but in reality, they serve different purposes.

The accounting cycle is all about tracking, recording, and creating financial statements that have occurred during a specific period. It is a primary part of the company’s accounting processes that ensures all financial data is accurate when presented in financial statements.

On the flip side, a budget cycle is all about planning and forecasting future income, expenses, and financial goals based on past performance. The budget cycle plays a key role in allocating resources and setting performance benchmarks.

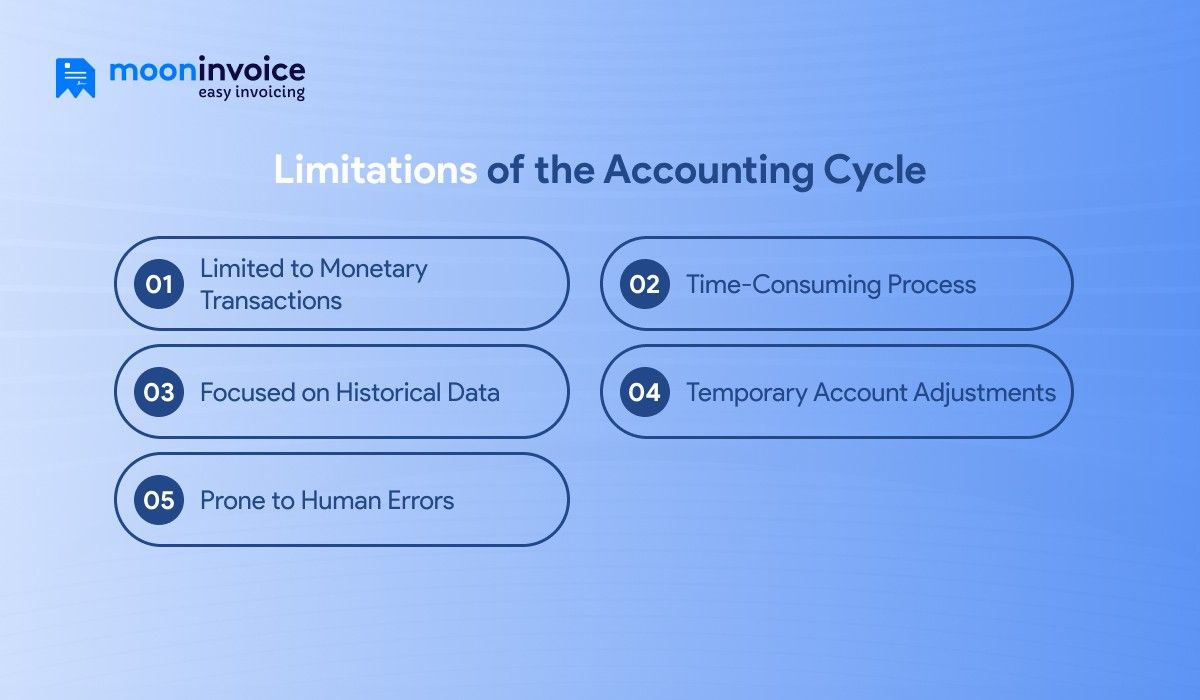

Limitations of the Accounting Cycle

The accounting cycle is a major part of your business finance, which indicates how your business is performing. But there are some limitations to it too, which require careful attention.

1. Limited to Monetary Transactions

The accounting cycle only focuses on recording transactions that are measurable in money. It doesn’t record non-financial elements like customer satisfaction or employee performance, which are key to business success.

2. Time-Consuming Process

To record financial transactions accurately and follow all steps takes a lot of time. From journal entries to closing the books, it can be lengthy, especially for small teams.

3. Focused on Historical Data

The accounting cycle is heavily dependent on past financial activities, which limits real-time insights to make strategic decisions. In case of sudden market changes, the forecast for the next accounting period is not reliable.

4. Temporary Account Adjustments

Sometimes, when you close your revenue and expense accounts at the end of each cycle, you miss long-term patterns, making it harder to analyze performance trends.

5. Prone to Human Errors

Completing every step of the accounting cycle manually can lead to calculation errors, misclassifications, or missing entries, which can affect the accuracy of financial statements.

How Moon Invoice Simplifies the Accounting Cycle?

Manually managing every step of the accounting cycle is time-consuming and error-prone. If your finance team is small, it can take up a lot of your productive time in managing the cycle.

To complete an accounting cycle, you need to use an automated accounting software or invoicing software that can reduce errors and save time. Moon Invoice is one such example. It simplifies the entire accounting process from start to finish.

Features of Moon Invoice that simplify the accounting cycle:

- AI-ready Quick Scan: You can fetch data from your paper documents and convert it into an expense, invoice, credit note, or whatever you wish.

- Payment Tracking: Easily track all incoming and outgoing payments of your business.

- Invoice Management: It synchronizes all invoice data directly into the books, reducing time spent on journal entries.

- Business Report: Helps you create over 15 high-quality reports for your business to make strategic decisions.

- Expense Management: Record your business expenses in one place, making it easier to present expense details in your books.

Using Moon Invoice in your workflow helps you easily go through all the time-consuming processes of the accounting cycle.

The Bottom Line

The accounting cycle focuses on improving the business’s financial health by creating accurate financial statements. As a business owner, skipping this step-by-step accounting process could be a mistake, as it checks every transaction and identifies errors (if any). Every financial statement generated from the accounting processes helps evaluate profit margin, assets, liabilities, and overall business stability.

So, this cycle is a must for every business, but following every step manually can be time-consuming and error-prone. This is why it is most recommended to use an automated software that can speed up the process without any errors.

You can consider using Moon Invoice in your workflow for a seamless accounting cycle. Start your free trial now!