TL;DR

International billing refers to invoicing an overseas client for purchases made abroad. Proper invoicing to foreign clients includes the agreed currency, correct tax, & correct payment terms. One can streamline overseas billing with an invoicing app that offers advanced features.

It’s exciting to serve international clients and receive payment from them. However, before that, you need to share an overseas invoice. Many professionals experience forehead tension lines while sharing this kind of invoice.

This could be high, especially for small businesses or those who are invoicing for the first time to an international client.

But honestly, with the right approach & proper understanding of a few things, it can be stress-free and simple. To understand the major concept, read this article till the end. Here we will introduce you to the guide on how to invoice international clients.

Additionally, you’ll learn how to create international invoices, things to consider when invoicing, and key tips to follow.

📌 Key Takeaways

- E-invoicing can improve accuracy and boost on-time payment.

- Invoicing in the client’s currency is convenient for them and helps improve on-time payment for you.

- Translating the invoice in clients language reduces confusion.

- Always use a multi-currency invoicing system/software when invoicing a foreign client.

- Careful handling of foreign currency is required when paying invoices in a foreign currency.

- Incorporating automation simplifies operations, making them quick and accurate.

The e-Invoicing Market is expected to reach USD 22.90 billion by 2035, and North America accounts for a 34% share of this market.

What is International Invoicing?

International invoicing involves sending professional invoices to clients in foreign countries. This kind of invoicing is quite common among businesses that provide services or sell products to foreign countries.

Unlike a domestic/regular invoice, an international invoice is more detailed. It includes currency, currency exchange rate, payment methods & correct international tax treatment. It also covers country-specific compliance requirements and international banking information.

How Can I Make an International Invoice?

When you think about how to invoice international clients, it is crucial to understand how to issue an international invoice.

You need to follow the right approach to make an international invoice. The traditional pen-and-paper concept also works for creating an invoice. However, it is time-consuming and error-prone.

In contrast, trusted invoicing software like Moon Invoice makes it easy to create an E-invoice with its 66+ customizable invoice templates. You can choose any format from Word, Excel, Sheets, Docs, or PDF. Let’s understand the proper steps as follows:

1. Choose the Template

From the wide variety of ready-made samples, choose the template that best meets your needs. Moon Invoice offers customizable templates so you can set it up according to your priorities. Make sure your invoice looks professional whenever you invoice a cross-border client.

2. Fill in the Details

Once you finalize the template, it’s time to fill in the required details accurately. The following is the major information you need to fill in:

- Seller information: Seller name/company name, address & contact information.

- Client information: Client name, address & contact information.

- Payment method: Set up a payment method to ensure your payment is processed smoothly.

- Invoice details: Invoice number, invoice date & due date.

- Currency: Include the correct currency after a clear discussion with the client.

- Line item description: Description of the sold service or the product, in itemized form, along with unit price and rate.

- Tax & discount: Mention the tax with a proper understanding of tax. Similarly, mention the discount if it is applicable.

- Total amount: Include the total payable amount.

- Payment terms: Details of the payment terms, like mode of payment, due date, and applicable penalty after the due date.

- Additional notes: Include any additional notes, such as a thank-you note or a support contact.

- Signature: Mention the signature of the authorized person.

The invoicing templates of Moon Invoice offer auto calculation. It automatically computes the total amount, including tax and discount. This reduces the errors and commits 100% accuracy.

3. Cross-Check Invoice

Once the invoice is ready, you must review it well. Cross-check every detail carefully to ensure correctness. If there is any shortcoming, fix it on the spot. This approach prevents further disputes and issues arising from incorrect information.

Simplify Your International Invoicing with Moon Invoice.

Discover 100+ currencies and ease your international transactions on every deal.

What Are the Important Things to Consider When Invoicing International Clients?

It is important to consider certain factors when you are deciding how to invoice international clients. These factors affect the payment flow and the overall invoicing process. Some of them are as follows:

Payment Methods

The speed of your on-time payment depends on the type of payment method you choose. The commonly available methods in international invoicing are as follows:

- Bank transfer

- Direct debit

- Wire transfers

- Debit/Credit card

- Check

- Digital wallet

International Taxes

This is somewhat complex, yet the most important factor to understand. Whenever you are billing an international client, it is important to focus on taxes. Different regions/countries have different tax systems, so you need to tax accordingly. If you are operating a business in the USA, it is important to register for foreign VAT and understand the treaty benefits.

Here are the key tax considerations when you have a USA-based business:

- Withholding Tax (WHT): Foreign countries often impose WHT on service fees or royalties.

- Self-employment Tax: A U.S. resident living abroad must pay self-employment tax. However, it applies when net income is > $400.

- Tax Treaties: Bilateral agreements between the United States and other countries to prevent tax evasion and double taxation. The U.S. has treaties with over 60 countries.

- Documentation: International invoices must contain the Tax Identification Number (GST & VAT) and other legal disclosures.

Saving the Records

It is a good practice to keep records of all international transactions. It helps to file tax refunds and credits easily. It also reduces disputes and confusion. A well-recorded international taxation system streamlines audits and related processes. Thus, it saves time.

Currency

One of the most crucial things in an international transaction is currency. Some currencies, such as the US dollar and the euro, are among the most dominant in international transactions. The main reasons are their stable performance and high liquidity. Choosing and handling the right currency helps boost on-time payments. It is also important because exchange rate fluctuations affect your net profit.

💡Pro Tip:

Many clients prefer their own currency. It is always better to clearly communicate with your client before issuing an invoice.

Best Payment Methods for International Clients

There are various kinds of payment methods that you can consider for international billing:

Opening up a Foreign Bank Account

You can open a foreign bank account if you receive most of your income from a single country. One of the major advantages of this approach is a reduction in transaction fees, which is often associated with popular payment methods like wire transfers.

Third-party Payment Processing

There are many international payment processors available to ease your international billing. It includes PayPal, Stripe, or Square. The major benefit is that there is no need to set up a dedicated merchant account.

Wire Transfers/Bank Account

It is another payment method you can use for international payments. You only need to share the details, such as the Swift code, routing number, or IBAN, with the invoice. It enables your client to make the due payment easily, regardless of borders.

Accepting Credit Card Payment

You can offer credit card payment as an option for your international clients. However, it covers foreign exchange rate charges typically ranging from 2% to 5%. Visa, American Express, and Mastercard are popular, globally accepted card brands.

Tips to Get Paid Faster by International Clients

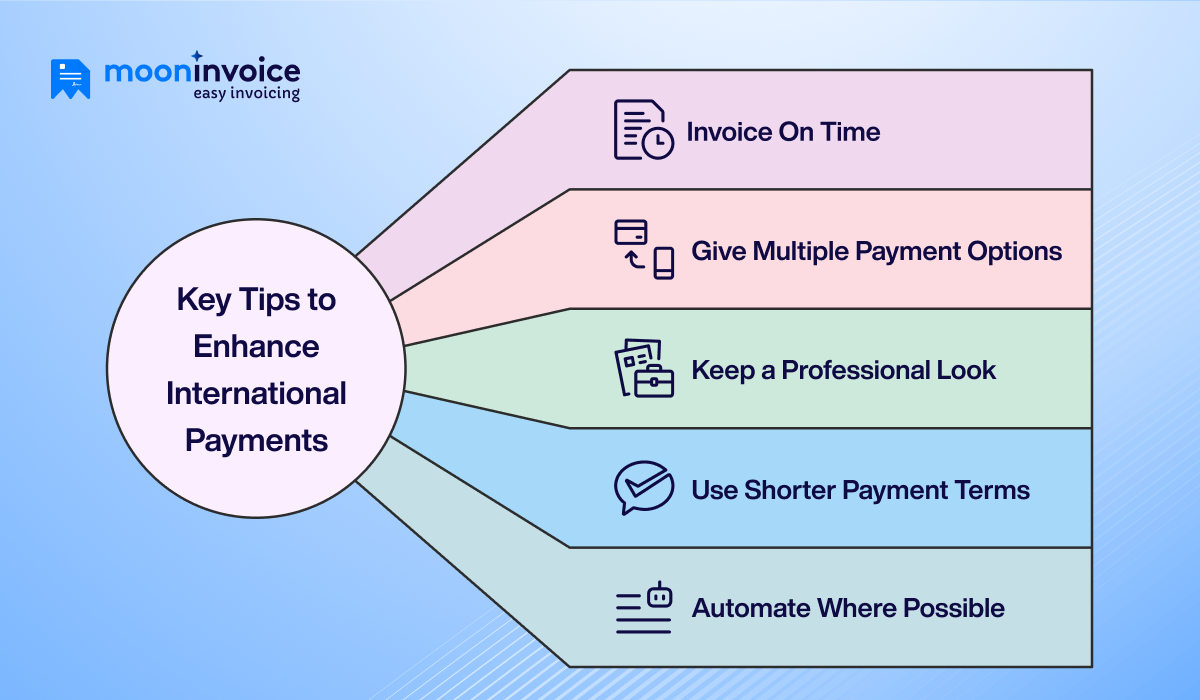

On-time payment applies to both domestic and international clients. Here are the key tips to follow for getting paid quicker:

Invoice on Time

Always send an invoice on time; the longer you delay, the longer you have to wait for payment. This is a major reason for payment delays in many cases. It is better to invoice promptly while considering the payment terms.

Multiple Payment Options

Instead of relying on a single payment option, it is better to offer multiple. The chances of on-time payment are high when the client finds such convenience. It is because they get an easy way to make payments using their preferred payment methods.

Keep a Professional Look

Keep the invoice format quite professional and clear-looking. This is again the major factor in on-time payment. It enhances the client’s understanding and leaves a lasting impression, strengthening the business relationship.

Use Shorter Payment Terms

Using short payment terms can enhance on-time payment. It is another trick you can use to ensure on-time international payments. It’s because shorter payment terms force customers to act more quickly.

Automate Where Possible

Automation is another catalyst to boost your international payments. For instance, you can set up recurring invoicing or automate payment reminders with Moon Invoice. This reduces effort and helps you get on-time payments. However, to incorporate automation, you need to adopt reputable accounting software.

Looking for the Right Solution to Smarten Your Overseas Billing?

Join AI-powered Moon Invoice, trusted by over 1.7M users professionals in the world.

Final Statements

So, how to invoice international clients? We hope you have gained sufficient knowledge on it. An international invoice looks similar to a regular invoice, but behind the scenes, the two documents work differently. It’s nothing major, but you need to keep a few things in mind, such as currency, taxes, and payment methods.

Additionally, by choosing the right invoicing system and template, you win the game of invoicing. Your true destination for this is Moon Invoice. Curious to know how? Try it now with a 7-day free trial.

![How to Send an Invoice Via Email [Steps & Best Practices]](https://mi-blogs.s3.amazonaws.com/mi-live/blog/wp-content/uploads/2022/12/13105719/send-an-invoice-blog-final.jpeg)