Multi-currency payment is a lifeline for businesses that deal globally. It enables them to accept and process payments in various currencies, providing convenience to their clients when making payments. That’s what compels most global businesses to adopt this concept.

In the recent surveys of Grand View Research, the cross-border payment market is projected to reach USD 320.73 billion by 2030, at a CAGR of 7.1%.

The growing market is largely attributed to the various advantages of multi-currency processing. It enables professionals to reach a diverse range of global customers and boost international sales.

Not limited to this! This process has many other advantages. Yet, along with exploring those, we need to understand what multi-currency payment processing is. How does it work, and what challenges does it involve?

Luckily, the right answers are just ahead in this article. So keep your eyes active!

📌 Key Takeaways

- Multi-currency payment processes ease the sending and receiving of cross-border payments, improving business relationships.

- It supports multiple payment methods, providing greater payment flexibility.

- A multi-currency payment process enhances trust among clients by allowing them to pay in their local currency.

- It strengthens international transactions and business dealings with foreign clients.

- Business professionals gain more opportunities by adopting multi-currency payment processing in international markets.

What is Multi-Currency Payment Processing?

Multi-currency payment processing is a payment approach that enables businesses to accept & process payments in various currencies worldwide. A payment gateway or payment service provider manages the entire process. This ensures a smooth payment flow, particularly for businesses that deal with international customers.

E-commerce, travel businesses, SaaS, and other companies offering international services frequently utilize cross-currency payment processing. Thus, it becomes easy for these businesses to accept payments from clients regardless of their region. Additionally, customers can make purchases in their home currency due to dynamic currency conversion.

Multi-Currency Payments Use Case

A multi-currency payment finds its use case in the following cases:

Global SaaS Service

SaaS service providers often include customers from different parts of the world. Adopting a multi-currency payment model robustly expands the customer base while providing multi-currency payment processing.

Import & Export Businesses

Import and export businesses often require multi-currency payments due to their involvement in international trade. It eases the sending and receiving of payments for both the sender and receiver in different countries.

Traveling Businesses

A multi-currency payment includes automatic conversions. It enables hotels, travel agencies, and airlines to do automatic conversion into the preferred currency. Travelers from different countries can easily pay in their currency.

NonProfit

International donations often require multi-currency payment processing for seamless and secure donation transactions. Additionally, it offers better exchange rates compared to banks, which charge high FX fees.

Let Your Customer Pay in Any Currency!

Moon Invoice supports the multi-currency concept — convenient for your customers and beneficial for you!

How Does Multi-Currency Payment Processing Work?

Multi-currency payment processing involves a systematic approach. It includes buyers’ actions mostly. A typical workflow involves the following steps:

1. Buyer Initiates the Purchasing

Multi-currency payments work in a systematic mode. A process begins when the buyer purchases items or services directly from the seller’s website. It occurs after the customer has explored various products and services and finalized the most suitable one.

2. Selecting the Currency

Once the customer makes a purchase, the next step is to choose the right currency during checkout. This provides the buyer with full flexibility to pay in their preferred currency.

3. Currency Conversion

Next in the multi-currency payment processing comes the currency conversion. The payment processor converts the currency at the current exchange rate. Once the currency is converted, it represents the purchase amount in the chosen currency, including the necessary fees.

4. Choosing the Payment Method

To complete the payment and purchasing checkout, the buyer must select a payment method. There are ample options available for making payments, including PayPal, a digital wallet, credit card, ACH payment, and wire transfer.

5. Payment is Processed

Now, the payment is processed through a payment gateway that captures the payment details. After that, it is submitted to the processor and banks for the authorizations.

6. Settling of the Payment

Once the bank and processor authenticate the operation, the next step is to settle the payment. The payment is deducted from the buyer’s account in his chosen currency and credited to the seller’s account in the base currency. This settlement of the payment is satisfactory.

7. Confirmation

Once the payment settlement is completed, the next step is to notify both parties. This is the final step in the multi-currency payment processing. The buyer, on the other hand, receives the receipt that contains the details of the multi-currency payment.

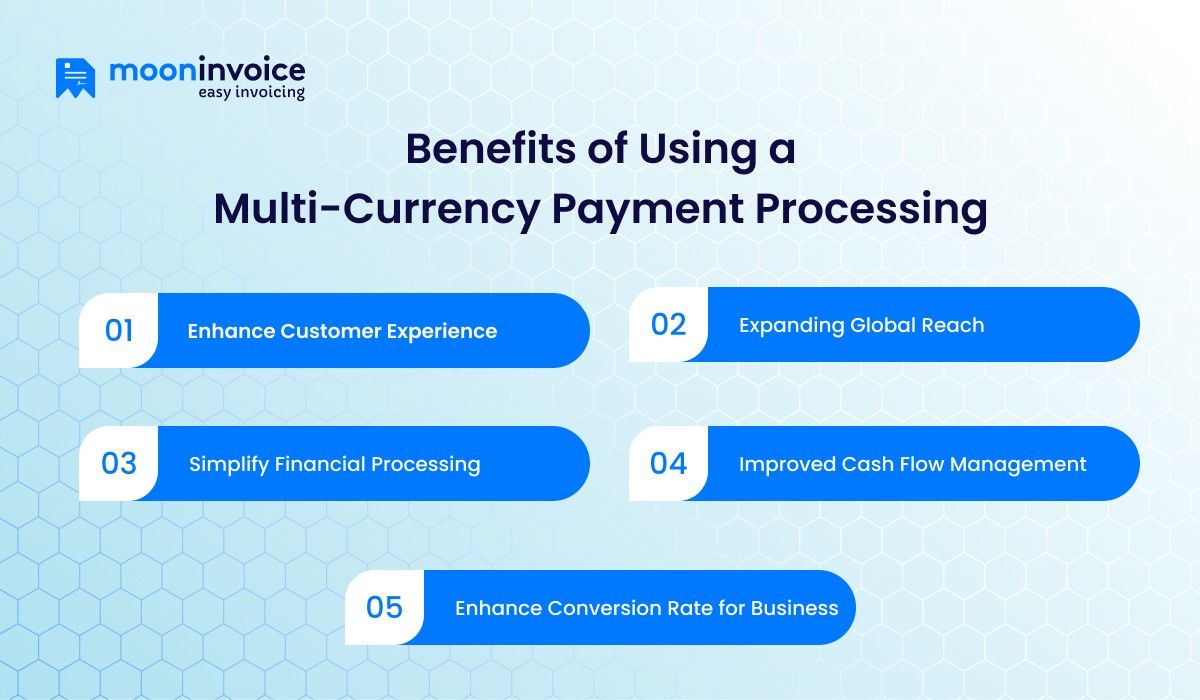

Benefits of Using a Multi-Currency Payment Processing

So far, we have unlocked the definition of multi-currency payment processing, and it works. We now look into its advantages:

Enhance Customer Experience

Customers have a convenient payment option because the system allows them to make payments in their local currency. This not only refines their experience but also makes them more familiar with the vendor’s business.

Expanding Global Reach

Due to the multi-currency payment option, business professionals can easily expand their operations globally. This enables businesses to get international clients and achieve business growth. The global reach ultimately contributes to the business’s financial health.

Simplify Financial Processing

It enables business professionals to handle their international transactions effectively when clients pay an invoice for an international deal. It eliminates the chances of errors and administrative costs during the payment process. Thus, it cost-effectively enhances financial management.

Improved Cash Flow Management

Business professionals can easily improve their incoming and outgoing payments in real time. This simplifies the reconciliation process across currencies. It facilitates the management of liquidity and helps determine the amount of cash remaining.

Enhance Conversion Rate for Business

Customers who use a multi-currency payment gateway enjoy a seamless payment experience. It enhances the checkout process and increases the chances of repeat business. Thus, a business gets overall improved conversion rates.

Key Features to Look for in a Multi-Currency Payment Gateway

When choosing a multi-currency payment processor, it should consist of the following features:

- Multi-currency Acceptance – Accepting & supporting different currencies is a necessary concept of a payment gateway.

- Currency Conversion – Automatically convert the sender’s currency payments into the merchant’s currency using real-time exchange rates.

- Secure Transactions – Encryption, PCI-DSS compliance, and fraud detection.

- Advanced Reporting & Analytics – Analyze reports using metrics such as region, currency, and payment methods.

- Supporting Subscription – Supporting global subscriptions for different currencies.

- Integration – A perfect multi-currency payment gateway provides simple & easy integration with websites and apps.

What are the Key Challenges in Foreign Exchange Payment?

An overseas payment is not always a smooth process and can involve various issues. Companies making international payments often face the following challenges:

Unexpected Fees

Foreign exchange payments typically incur bank charges, currency conversion fees, and other associated costs. Additionally, these exchange rates fluctuate at rapid rate. The result is uncertainty for the payment sender and receiver. Exchange rate volatility is a common challenge that directly impacts the cash flow.

Lack of Security

Multi-currency payment processing is vulnerable to hacking, phishing, and data breaches, making it insecure. This results in financial loss and also damages the company’s reputation. Moreover, it creates unnecessary stress for the payer.

Dealing With Other Countries’ Banks

Foreign exchange payment involves dealing with a foreign bank. Hence, it involves miscommunication and a language barrier. Additionally, it involves extra service fees on the transaction. Hence, it creates an unfamiliar & less transparent interaction for the user.

Reducing Speed & Transaction Failure

International transactions are often slower than domestic transactions. The major reasons involve multiple banks & complex processing flow. Furthermore, it is prone to transaction failure due to violating the policies or fraud risk.

Other Challenges

There could be additional challenges, such as limited foreign currency support from the payment system. Regulatory compliance could be another issue, as different countries & regions have varying rules & regulations for international transactions.

Cross-Border Payments vs Multi-Currency Payments

Often, people are confused about cross-border payments and multi-currency payments. However, these two concepts are different.

A cross-border payment involves a transaction between two parties in different countries. A multi-currency payment refers to a transaction involving different currencies, which can be within the same country or across different countries.

Hence, all cross-border payments are multi-currency, but all multi-currency transactions are cross-border transactions.

Using Moon Invoice to Streamline Multi-Currency Payments

Moon Invoice, a leading invoicing software, streamlines the multi-currency processing. It supports over 100 currencies, making it an ideal platform for global businesses involved in cross-border trade.

Additionally, the platform offers over 20 payment integrations, leading to smooth and faster transactions. The client can choose their preferred payment processor, which also helps enhance user convenience. It also contributes to strengthening the bulk payment.

Additionally, business professionals can easily generate financial reports. This simplifies their payment tracking and enables them to get insight into the real financial status of their company.

Key Features of Moon Invoice :

- Easy enabling or disabling of multi-currency

- Customized professional templates for invoice, receipt, and estimate

- Recurring invoices

- Auto-reminder for the due payment

- Expense tracking

- Support for payment integration with Stripe, PayPal, Payoneer, and more

- Multi-language supporting – 25+ language support

- Cloud-based solution enabling global access

Closing Statements

Multi-currency payment processing is a necessary part of international businesses. It streamlines cross-border payment processing, enabling businesses to enhance their financial health. Invoicing tools like Moon Invoice help business professionals streamline their international billing with robust multi-currency processing. Overall, it strengthens the overseas businesses.