Invoice and receipt are two common terms you may have heard when dining out, shopping, or managing business payments. “I didn’t receive an invoice”, “I paid, give me a receipt” are some common things that business owners encounter on a daily basis. An invoice and a receipt differ from each other, but both are important not only for filing tax returns but also to keep you on top of your financial management.

No matter how many invoices and receipts you generate, you need to keep all of them in your financial records. Invoices help you track payments, while receipts show the bigger picture of the business’s financial health. If you are unsure when to use a receipt or invoice, here we have a complete guide on the difference between invoice and receipt. Also, understand how Moon Invoice can play a pivotal role in creating paperless invoices or receipts quickly.

Key Takeaways:

- Invoices and receipts aren’t the same. An invoice is sent before payment to request money. A receipt is given after payment to confirm it’s done.

- You need to save every invoice and receipt for smooth bookkeeping, tax filing, and tracking your business’s cash flow.

- Sending invoices right after delivering a product or service helps ensure faster payments and reduces unpaid bills.

- Receipts act as proof of payment. Once a client pays, issuing a receipt confirms the transaction and can help avoid future disputes.

- Invoicing software like Moon Invoice makes life easier—you can create, send, and store both invoices and receipts digitally, no more paperwork or manual tracking.

What’s the Difference Between Invoice and Receipt?

An invoice and a receipt not only serve different purposes, but also their generation times are completely different. Let’s explore the differences between an invoice and a receipt to understand them in detail.

The time of payment

An invoice is created to request payment, which means it will be issued after the payment is made. In contrast, a receipt is issued only after the customer has completed the payment and there are no outstanding dues. An invoice can be sent to the buyer to demand payment for the goods delivered. So, the buyer is yet to make the payment when an invoice is issued. On the contrary, a receipt is made when the customer pays the total amount mentioned on an invoice.

Purpose

An invoice is used to help customers know the money they owe you. On the other hand, a receipt is created when you get paid. Invoices can be used to track the status of the payment. Unlike invoices, receipts can’t be used to track the payments, but they help you revise business strategies and ultimately, improve the cash flow.

Create Invoices That Get Paid Faster

Let Moon Invoice generate paperless invoices with readymade invoice templates and help you get paid 2x quicker.

What is an Invoice?

An invoice is a formal document that demands payment for goods or services you have already provided to the buyer. It includes important details such as the pending amount, due date, or any other payment instructions. An invoice helps your customers know how much money they owe you.

Once you share an invoice, the buyer needs to complete a payment within the given timeline. If they fail to pay on time, you can add late fees to the total amount outstanding on an invoice. You need to save every invoice copy in a way that allows you to easily track payments.

Read Also: How Do Invoices Work?

How to Write an Invoice Professionally

The best way to write a professional Invoice is by using the powerful invoicing software, Moon Invoice, rather than generating hand-written invoices. The software makes sure you prepare an attention-grabbing invoice in less time. Let’s understand how to do that.

- Log in to the Moon Invoice or sign up for free and start creating an invoice from the “Invoices” tab.

- Now, fill in the customer details, such as full name, billing address, contact number, or email. These details will be automatically saved for future purposes.

- Then, enter the invoicing details, such as the invoice number, currency, issue date, due date, and select your preferred payment method.

- Next, you can add product details, including their rates and quantities. For service-based businesses, you can add multiple tasks.

- Include discounts or select taxes if applicable, and it will automatically adjust the total outstanding amount.

- Later, you can mention additional notes, attach files if required, or highlight payment terms and conditions.

- Then, click the ‘Save and Preview’ button to save your changes and review the invoice. Open a preview and check if everything is correctly mentioned.

- Send an invoice directly via Email or WhatsApp. If needed, you can also take a normal print or a thermal print.

Here’s a perfect invoice example

What is a Receipt?

A receipt is a formal document that acknowledges payment has been made and that there are no outstanding dues. It usually works as payment evidence to confirm that payment has been made. It consists of the product’s quantity, including its rates and the payment method. Businesses can only issue a receipt once they have received the payment.

Just like invoices, receipts should be stored in handy tools for analyzing the cash flow and adjusting the pricing strategies. Businesses can use receipts to settle disputes, while clients can utilize receipts to meet their tax obligations.

How to Write a Receipt?

With technological advancement, software like Moon Invoice has made receipt generation simple and easy. You can generate accurate receipts quickly. Follow the steps below to create a receipt.

- Open the Moon Invoice app using your credentials or sign up for free on the web app. Find ‘Sales Receipts’ in the menu options on your left side.

- Enter customer details, such as full name, delivery address, contact number, or email address. Details once entered will remain saved on the Moon Invoice.

- Thereafter, enter invoicing details such as currency, payment date, and the payment method used by your client.

- Next, include product details, delivery address, delivery time, and tasks completed, along with their brief descriptions.

- Specify the product or service cost, the discount offered, or the taxes applied, and let Moon Invoice calculate the total paid amount automatically.

- You can also add additional notes if needed or highlight your company’s refund policy.

- Save changes and tap on the ‘preview’ button to see how it will look. Thoroughly check the details on the receipt.

- Once the receipt is generated, you can send it digitally to clients via WhatsApp or Email.

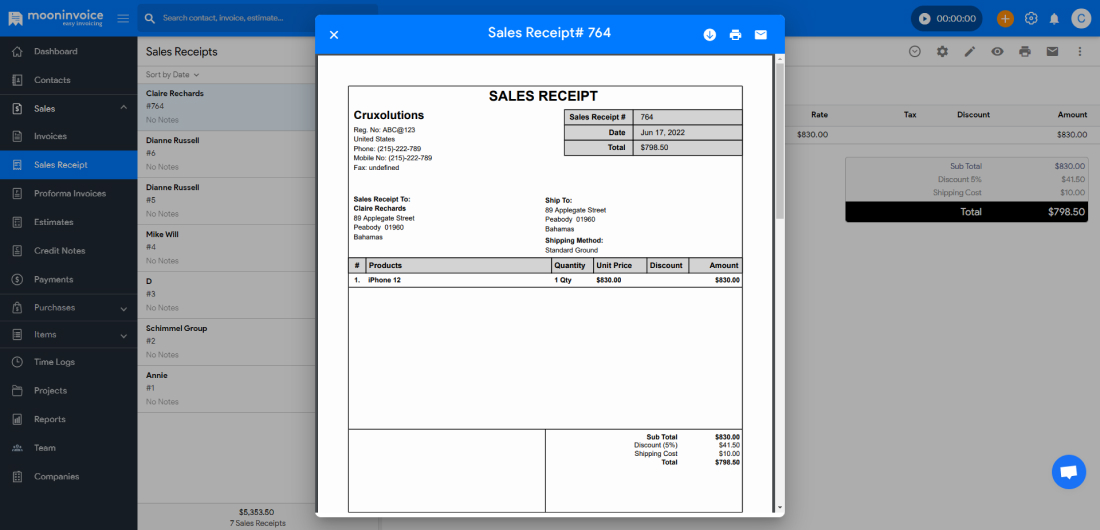

Refer to the receipt example below for more clarity.

Importance of Invoices and Receipts in Business

Issuing invoices and receipts is important for both service-based businesses and those that sell products. Let’s find out why they are so vital.

1. Financial Records

Your financial records are nothing without invoices and receipts. Whether you issue an invoice or generate a receipt, you need to store each one properly. Otherwise, you can simply hand them over to the accounting team so they can update the accounts receivable and accounts payable sheets. Maintaining financial records, including invoices and receipts, means you can monitor incoming cash flow and analyze business profits.

2. Tax Obligations

Surviving tax season is another reason to save an invoice or receipt. If not saved, you may need to collect each of them from every corner, consuming a lot of time just filing your tax returns. Therefore, it is better to store invoices and receipts in a cloud-based invoicing software to file returns quickly using accurate data. A minute or two is what the right invoicing software takes to generate tax reports if you store invoices and receipts digitally.

3. Claim Deductions

With invoices and receipts stored in handy tools, you can easily figure out whether you can claim deductions. Invoices and receipts help you prepare a tax report and can be used as supporting documents while submitting the claim to the IRS. This way, you can save hefty money by submitting receipts that prove the money was used for business operations and not for any other purpose.

When to Use Invoices and Receipts?

As soon as you deliver a product to the customer’s location or complete the service, create and share an invoice. Sending an invoice after delivery or service is the right time to request payment from customers. It shows how professionally you provide services and handle the invoicing process. Issuing an invoice in a timely manner could also attract payment quickly, reducing the number of unpaid invoices. Hence, remember to always share an invoice before making a payment.

Receipts should only be generated if you have received the payment. Therefore, once the customer pays the due amount, you need to make a fresh receipt. Ensure you include the paid amount, the correct date, and the payment method when you create a receipt. Later, hand it over to the customer. The given receipt will serve as proof of payment. This is how the receipt is used: only after payment is collected.

Is an Invoice and a Receipt the Same?

No, an invoice and a receipt can never be the same. A business owner issues an invoice for whatever they delivered either goods or services. Whereas receipt is only provided if the customer has successfully paid their dues.

An invoice outlines the cost incurred and how much money the customer owes to the company. On the other hand, the receipt is sent to confirm the payment is made.

Therefore, there are no similarities between an invoice and a receipt, both are distinct from each other.

💡Pro Tip:

Always match refunds or cancellations with the original invoice or receipt.

Whether it’s full or partial, link the credit note or refund receipt to the initial document for a complete understanding. This makes things way easier during tax time or audits, and saves you from having to dig through old records.

How to Handle Cancellations or Refunds?

Mistakes happen, orders change, or sometimes customers simply change their minds. Whatever the reason, knowing how to properly handle cancellations or refunds, both for invoices and receipts, is essential for maintaining clear records and good customer relationships.

1. If the Invoice Is Issued but the Order Is Canceled

Scenario: You’ve already sent an invoice, but the customer cancels the order before making a payment.

What to do:

- Void the Invoice: Instead of deleting it, mark it as “void” in your invoicing software. This keeps your records clean without removing the original document.

- Send a Cancellation Note: Email the client to let them know that the invoice has been voided and the order is canceled.

- Update Your Accounting: Ensure the canceled invoice is reflected correctly in your accounts receivable so it doesn’t appear as unpaid.

2. If Payment Has Already Been Made and a Refund Is Needed

Scenario: A customer paid, but due to product return, service dissatisfaction, or other reasons, a refund is issued.

What to do:

- Issue a Credit Note: Instead of editing the original invoice, create a credit note referencing the original invoice. This officially adjusts your accounts.

- Process the Refund: Refund the amount using the same payment method originally used (e.g., bank transfer, card, UPI).

- Generate a Refund Receipt: This is similar to a regular receipt, but it shows the refunded amount. Include details like:

- Original payment date

- Reason for refund

- Refund amount

- Payment method

- Notify the Customer: Share the credit note and refund receipt with the customer for their records.

3. Handling Partial Refunds or Order Adjustments

Scenario: The client only cancels part of an order or requests changes after the invoice has been paid.

What to do:

- Issue a Partial Credit Note: Mention which items or services are being refunded.

- Update the Invoice (if not paid yet): If payment hasn’t been made, simply update the original invoice to reflect the change.

- Communicate Clearly: Let the customer know exactly what’s being refunded and how it will be handled.

Manage Invoices and Receipts From Anywhere With Moon Invoice

Moon Invoice, an online invoicing software, has made it easier to manage your business finances. Whether it is an invoice or a receipt, you can store unlimited copies in the software. Interestingly, it provides ready-to-use invoice and receipt templates that need no extra work. You can pick a template in any format, enter details, and save changes to create a professional invoice or receipt instantly, rather than making hand-written receipts on paper.

Here’s how you can transform your business using Moon Invoice.

✅Impress clients with attention-grabbing invoices

✅Manage business finances efficiently

✅Scan financial reports on the go

✅Store receipts in the cloud storage

✅Track business expenses seamlessly

✅20+ payment integrations to help you get paid

Manage Business Finances Without Lifting a Finger

Get Moon Invoice to keep your finances well organized and stay on top of your financial management.

Conclusion

Receipt vs invoice, in a nutshell, are quite different from each other as both serve different purposes. But they are crucial as long as you want to operate your business legally and deliver invoices professionally. Apart from the invoicing process, they make it easier to track payments and make important financial decisions.

Since you know the difference between an invoice and a receipt, you can easily create one using the steps mentioned above. In conclusion, we recommend trying Moon Invoice to manage invoices and receipts efficiently on a cloud platform, rather than doing tedious paperwork.