Freelancing! The term sounds appealing and offers the flexibility of being your own boss. Yes, that’s 100% correct.

Working as a freelancer is a popular choice for many people today. Setting your own working hours and getting settled in your own comfort zone are the major advantages of this profession. The important thing is that you are far away from office chit-chat and politics!

Freelancers collectively earn $1.5 trillion, with a median income of $85,000, according to a Forbes report.

Thus, the freelancing profession is not underpaid. The craze for freelancing work is not hidden from anyone. Yet, the dark side of this profession is struggling with on-time payment. Like full-time employment, where fixed salaries are part of a smooth payment flow, freelancers often lack this concept and struggle to receive timely payments. Sad!

What are the freelancing tips for receiving quick payments? The answer is ahead!

Here, in this blog, we’ll share the key freelancing tips to overcome this challenge. If you have recently entered the freelancing profession or are experiencing late payments as an existing freelancer, understanding this freelancing guide will be beneficial for you. Let’s explore a guide to freelancing!

📌 Key Takeaways

- Freelancing refers to a flexible working strategy.

- On-time payment is one of the biggest challenges among freelancers.

- Requesting upfront payment, contract signing, and systematic invoicing are common ways to prevent late payment in freelancing.

- Freelancers can easily enhance their on-time payment with a free invoice generator.

- Defining the payment terms, like Net 15 or Net 30, is essential.

What Is Freelancing, and Who are Freelancers?

Freelancing is a profession under which freelancers work remotely or work independently in a fully flexible working environment. They charge an hourly rate, a fixed project fee, or a milestone-based payment. Freelancers need to source potential clients and set up their own working strategy.

Freelance professionals belong to different industries and can be any of the following:

- Software developer

- Graphic designer

- Developer providing web development and web design services

- Content writer offering content services

- Photographer

- Video editor

- Legal consultant providing legal services

- Tutor

- Other freelancers like handymen & home service providers

It means instead of working as a full-time employee who takes a monthly salary and works within fixed working hours in a year.

Why is Choosing a Freelance Career Beneficial?

- A freelance career offers flexibility that helps maintain a healthy work-life balance.

- Freelancers have unlimited earning opportunities.

- A freelance career offers the opportunity to connect with potential clients worldwide.

- Professionals working as freelancers get full exposure to diverse industries.

- Working as your own boss gives you the opportunity to build your own identity.

- There is a potential for tax deductions on the business-related expenses.

- A freelance career enables professionals to control the projects.

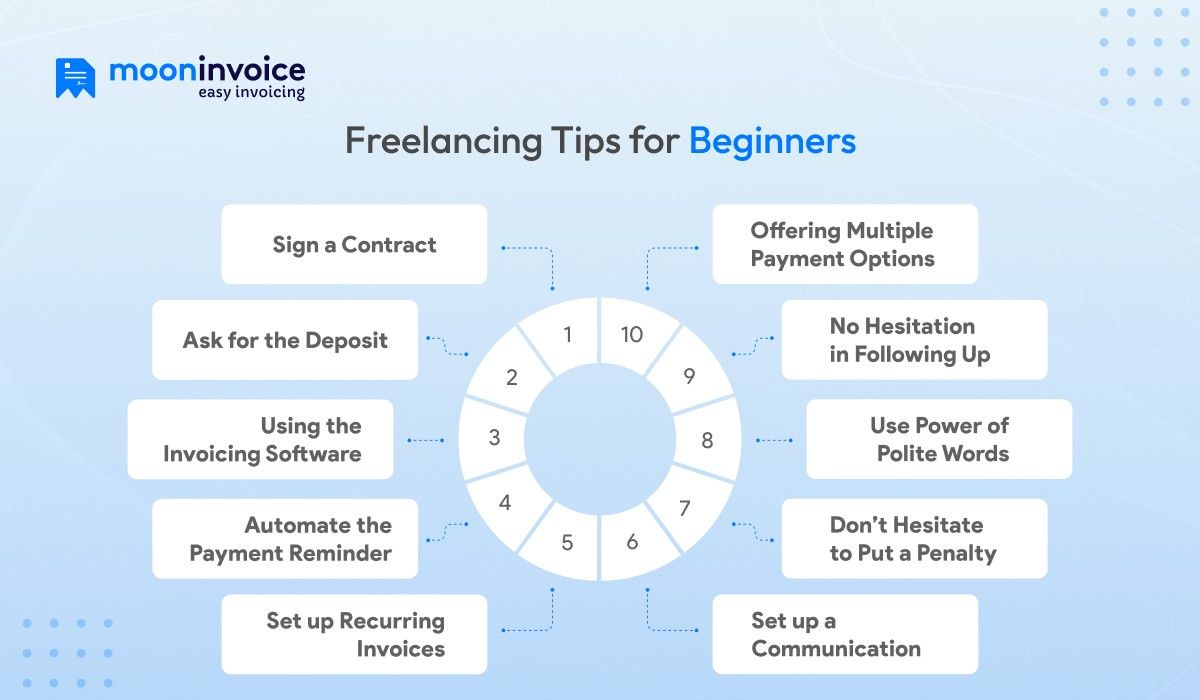

10 Popular Freelancing Tips for Beginners

1. Sign a Contract

When you work independently, one way to enhance on-time payment for your freelancing work is to sign a contract. This legal document outlines the terms and conditions under which the client is to abide. Thus, it guarantees the on-time payment. This is one of the most crucial freelancing tips for beginners. It is a good practice to follow when starting new projects.

A typical contract covers the following details:

- Project requirements

- Information on the freelance work and services that you will offer

- Timeline of the project

- The billable hours and total cost of the entire project

- The payment schedule of the projects

- Accepted mode of payment

- Ending product ownership rights

💡Pro Tip:

Don’t forget to look: What is a contractor?

2. Ask for the Deposit

Taking a deposit is a crucial strategy among the other tips for freelancing to get on-time payment.

Requesting an advance deposit is another crucial point among other freelancing tips for ensuring on-time payment. Like any other entrepreneur, freelancers can ask for upfront payment. This helps protect your finances when you secure your first client. Additionally, it alleviates your stress regarding payment. It is because something is better than nothing, and you get some portion of the payment.

Additionally, an advance payment also builds trust in your client relationship, as it demonstrates the client’s seriousness & interest in your freelancing profession. Thus, it contributes the right value in your profession.

Asking for 30% to 50% upfront amount is an ideal practice. However, for larger projects, use the milestone-based payment method.

3. Using the Invoicing Software

Invoicing software like Moon Invoice is the right weapon to enhance your on-time payment. The platform enables freelancers to abandon outdated tactics. It offers a one-to-one, on-time payment solution, helping freelancers maintain a steady cash flow.

A good invoicing tool, such as Moon Invoice, offers a customized & free freelance invoice template, accepts online payments, and sends invoices electronically. If you get paid or take a deposits, you can quickly make a professional receipt using a free deposit receipt template as well. Thus, it helps to streamline the whole process.

The professional-looking invoices created from it are another advantage to the freelancers. The templates carry an auto-calculation concept that automatically calculates the total amount. Thus, it leaves no room for errors.

On-time Payment = Successful Freelancing Job

Manage your freelancing payments with Moon Invoice. 66+ customized invoice templates for better invoicing.

4. Automate the Payment Reminder

Setting up an automated payment reminder is a good idea for ensuring you receive your due money. It is helpful for freelancers to get on-time payment. Sometimes your client forgets about the due payment. The result is you suffer with no payment for your hard freelance work.

Some best practices to follow for payment reminders:

- Schedule the reminder at a specific time

- Checking whether the invoice has been opened or not

- Customizing your messages in your own tone makes an effect

5. Set up Recurring Invoices for Ongoing Work

It is unnecessary to send the same invoice every time to a client who takes subscription services or purchases any kind of repeating service or product. Schedule repeating invoices, and your customers will receive them on time. That means you don’t need to create a new invoice every time. Set up a recurring invoice and automate your billing for all ongoing services.

6. Offering Multiple Payment Options is Good

Offering multiple payment methods is another key factor when it comes to freelancing tips for fast payment. Don’t limit the opportunity for potential clients to make a payment to you. Take full advantage of electronic payment concepts and allow your clients to make payments easily. A wide variety of payment options is available for your freelancing business.

Providing multiple payment options not only helps ensure on-time payments but also strengthens the business-client relationship. So, make it a part of your freelancing journey.

7. No Hesitation in Following Up

Following up on unpaid invoices is the next important point, among other tips for freelancers, for ensuring on-time payments.

If the invoice remains unpaid for a long time, it’s your duty & right to follow up with your client. It can be frustrating when your payment is pending on the client’s side. However, don’t be rude during the follow-up.

Just send a gentle reminder about the money in a professional message. Select the invoicing software that offers an auto-follow-up feature. That reduces the manual efforts of following up on the unpaid invoices.

Additionally, select the best expense tracking software for small businesses to help you effectively track your expenses. This is because when your client doesn’t pay on time, you have to bear the expenditure out of your own pocket.

8. Use Power of Polite Words

Polite words like ‘please’ and ‘thank you’ are also valuable contributing factors in on-time payment. These words provide a good impact on the overall payment process. It is because your client is also a human who likes friendly communication.

However, the key point here is not to use robotic or machine-oriented language. Your language flow should be natural. You must send a personalized message or follow up.

9. Don’t Hesitate to Put a Penalty

In the list of freelancing tips for beginners, there is another point to note. Charging for late payment is a common strategy employed by many business professionals. So, why can’t you impose a late payment charge as a freelancer? Many freelancers hesitate to put a penalty.

Initially, it seems strange and awkward. However, you must consider it a part of your profession and set up clear late payment charging terms.

Implement a penalty for late payments, as it encourages timely payments because no client likes to pay the late payment fee. You must consistently impose a late payment charge, but when you successfully maintain a good relationship with a client, you can consider waiving it.

10. Set up a Communication

Communication is a valuable term in any business. Like others, freelancers also maintain an active communication with their clients. Regardless of the communication platforms you choose, they should be consistent and professional in nature. It also fosters trust when you communicate with your clients.

Keep your clients aware of the project’s progress. Make it a part of your project management. Fulfill as many client expectations as possible. Showcase your work to them so that you can easily request payment. Believe it! It also matters a lot and is helpful in keeping the payment flow active while making a good impression.

💡Continue Exploring:

What Are the Pricing Models of Freelancers?

Freelance professionals adopt different pricing models, which are as follows:

Retainer Fee

The freelancer and the client agreed on a monthly fee. It also includes an upfront payment that the client makes to the freelancer to secure their services for a specific period. The retainer fee model offers a consistent income for the freelancer and is ongoing.

Project-based Fee

In the project-based fee model, freelance professionals charge a fixed amount to the client for a specific project or task. The rate is based on the time and effort required to complete the project in accordance with the client’s expectations. In this case, using project management tools is highly beneficial for freelancers.

Commission

Freelancers get a percentage of the revenue generated by the work. For instance, a client pays a commission to the client on sales. Thus, the earnings will be high if the performance is up to the mark and of high-quality work.

Per-word or per-page rate

This is very common among writers and editors. They charge a rate per word or per page. The longer the content, the more money it will cost. Thus, writers need to look for a project that contains a substantial amount of content. Additionally, one thing matters a lot, and that’s speed.

Hourly Rate

In this model, the client pays the freelancers based on the number of hours they spend on the project. It is one of the most common payment models. It doesn’t include the fixed project fee and the freelancer’s invoice for hours worked.

Value-based Pricing

From the name itself, we can predict it’s all about value. Freelancers are given prices based on the freelance work that offers value to the client. For instance, if a task is complex and requires hiring specialized freelancers to resolve it, then it will be value-based pricing.

Freelance Freedom Get Valuable With Smart & Flawless Invoice

Want to experience it practically? Utilize invoice templates and leverage the automation capabilities of Moon Invoice. How?

What are the Payment Methods Available for Freelancers?

Numerous freelance payment methods simplify the payment process for beginners performing freelance jobs. These platforms facilitate fast transactions, enabling your freelancing profession to maintain a regular payment flow.

Direct Bank Transfers

In this, the client directly transfers the payment into the freelancer’s bank account. Here, freelancers need to share their bank details with the client. It doesn’t include third-party involvement during the transaction. However, it may take a longer time.

PayPal

The most popular payment method is beneficial for freelancers to receive payments. It even helps professionals receive payments across borders. It offers user-friendly checkout options. It gives rise to quick transactions.

Stripe

What is Stripe Payment? Many freelancers still lack clarity over it. Stripe is a cloud-based payment processing platform that is another popular option for accepting international payments. Freelancers can easily accept payment via credit card or debit card directly through the invoice or website by using this platform.

Freelance Platforms (Escrow Payments)

Escrow payments are a secure method of handling money between potential clients and freelancers. In this, a third-party agent holds the money. The funds are released to freelancers when the work is completed and approved by the client. This is especially for project-based work.

Ending Words

We are ending with a freelancer guide for beginners to get timely payment. The above freelancing tips are effective in ensuring on-time payment. Whether you work as a designer, marketer, or legal consultant, you must follow a proper strategy to avail of a smooth cash flow. Additionally, you must also know how to keep track of business expenses effectively.

By incorporating a contract, establishing clear payment terms, and investing in the right tools, such as Moon Invoice, you can secure payment and build a good reputation.