Have you ever experienced bank fraud firsthand? Well, if not, then we wish you had never been. Unauthorized access is enough to evoke tension.

Being a victim of bank fraud is a stressful experience. Unauthorized account accessing & transactions evoke tension.

Thanks to technology that enables banks to make informed investments in fraud prevention. The technique helps to overcome fraudulent actions. Deepfake technology, cyberattacks, and artificial intelligence are among the techniques used by criminals to commit financial fraud. These approaches compel banks and other financial institutions to adopt smarter solutions to analyse the fraudulent transactions.

To understand the real truth behind how banks investigate unauthorized transactions, we’ll discuss all the actions involved.

📌 Key Takeaways

- Banks use machine learning, AI techniques, and other technologies to predict & prevent unauthorized transactions.

- Banks may also utilize and refer to transaction records and other historical data during an investigation.

- Law enforcement involvement is valid for more serious fraud cases.

- Bank policies and law limit the customer’s liability for unauthorized transactions.

What Is Bank Fraud Investigation?

A bank fraud investigation refers to an analysis activity of a bank or financial institution to identify fraudulent activities within its banking operations. The investigation pertains to bank services, transactions, and customer accounts.

It employs advanced detection techniques to investigate and prevent future fraud actions. The analyzing committee may involve the police or the Federal Bureau of Investigation (FBI) for large-scale investigations.

The primary aim of bank fraud investigation is to protect the client’s assets and maintain the bank’s trustworthiness. Thus, it ensures that bank customers continue to avail themselves of safe banking services.

💡Appalling Truth

One in five or more US citizens experienced a financial scam, and total non-credit card fraud was estimated to be $84 billion in 2024.

What Are the Common Bank Frauds?

There are different types of bank fraud that criminals perform. Every type of fraud has variations from one another, but financial misconduct is a common result of all. Some usual bank frauds are as follows:

Account Takeover (ATO)

Account takeover is a type of bank fraud in which fraudsters steal the confidential information & credentials of the user. They take control of the user’s bank account. The typical methods of performing this action are malware, phishing, data breaches, and social engineering.

Wire Fraud

Wire fraud involves obtaining a customer’s personal information through an electronic means. The action can be performed by using a cell phone, computer, or any other electronic device.

Identity Theft and Synthetic Identity Theft

Scammers take control of victims’ bank accounts by stealing the bank credentials and personal information. It is similar to account takeover actions.

Credit/Debit Card Fraud

This fraud refers to the unauthorized use of credit and debit cards during the purchase. It covers card theft, phishing, and skimming. It not only brings financial loss but also impacts the cardholder’s credit health.

Say Goodbye to Fake Vendors and Fraudulent Payments — Go Automated!

Automate your invoicing and leverage the transparency on every bill. Plenty of professionals are already doing it. Do you want?

How Banks Get Notified About Fraud?

Banks always get notifications of fraudulent transactions from their customers. There are many ways to notify, including phone calls, text messages, net banking, or visiting a branch. Banks can also utilize fraud detection systems in the accounts payable process. It involves analysing unauthorized transactions and ensuring regulatory compliance.

How Do Banks Investigate Unauthorized Transactions?

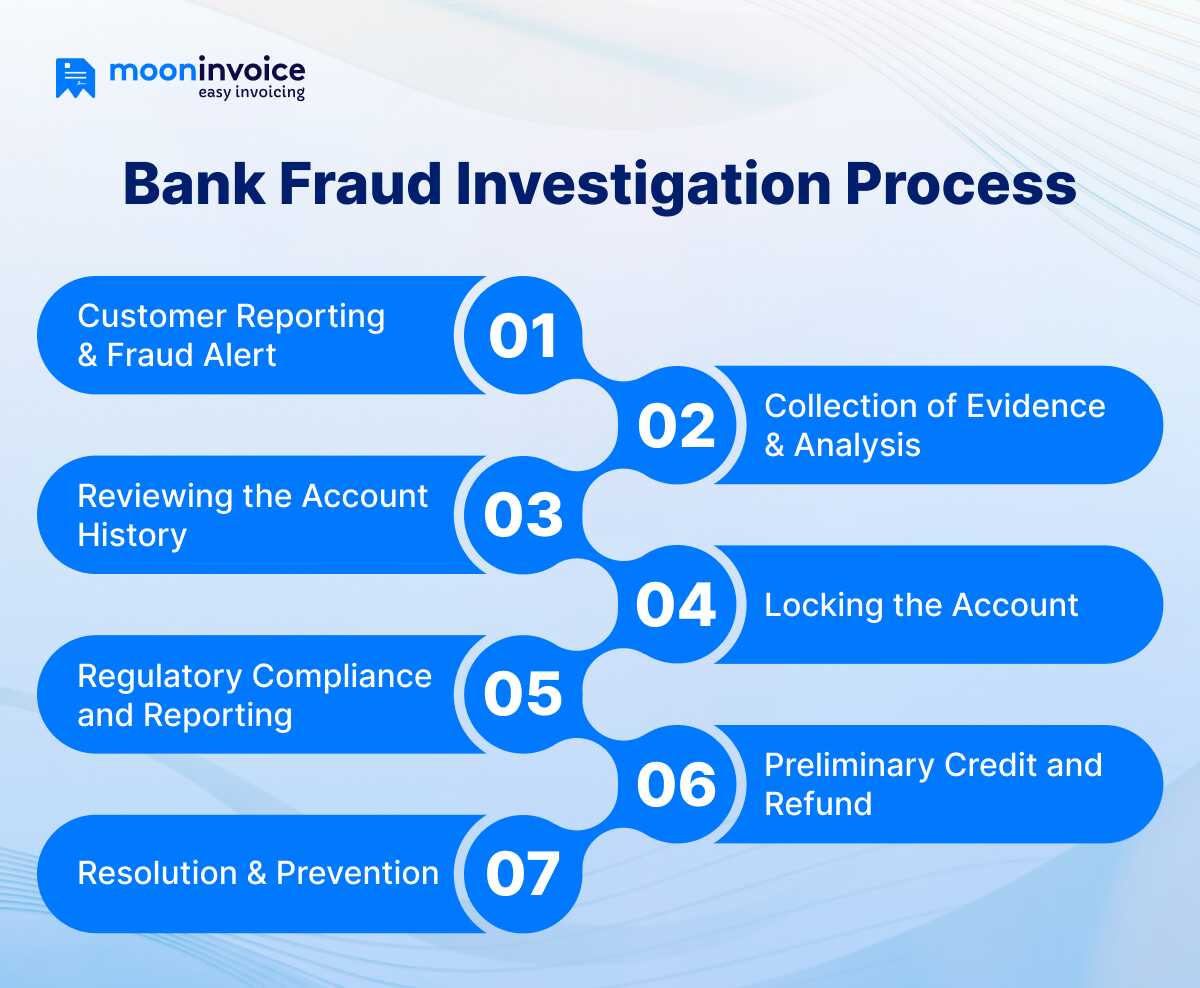

The bank fraud investigation process is a lengthy and structured one. It can be related to online banking, debit cards, and credit cards. It involves the following strategies:

1. Customer Reporting & Fraud Alert

Customers reporting an action initiate the process of investigating an unauthorized transaction. The bank initiates a fraud investigation upon receiving the customer’s complaint of fraud. Fraud detection automation plays a crucial role in this process, as it flags unusual or fraudulent activity.

2. Collection of Evidence & Analysis

Evidence is the key to resolving the banking fraud investigation into unauthorized transactions. The bank’s first action is to gather information about fraudulent activity from the customer. The details can include the amount, transaction history, IP addresses, geolocation, and device information. The bank also asks customers to submit the supporting documents to prove the transaction was unauthorized.

Once evidence is collected, the next step is to utilize machine learning algorithms and advanced data analysis techniques. This also helps to detect the method used during the fraud and take the appropriate actions to prevent it.

3. Reviewing the Account History

In the bank fraud investigation process, the team reviews the customer’s account history along with the transaction details. This kind of analysis is very helpful for banks to analyse whether the transactions are suspicious or not. If the transactions align with normal habits, they are not considered fraud.

4. Locking the Account

A temporary lockout of a customer’s account is a common measure taken when a customer reports a suspected fraudulent transaction. This prevents further fraudulent actions. All the actions, including withdrawal, net banking access, and money transfers, become inactive. In some cases, the bank also provides a new bank account number.

5. Regulatory Compliance and Reporting

The bank files Suspicious Activity Reports (SARs) with the Financial Crimes Enforcement Network (FinCEN) upon confirmation of the fraud. The bank may also collaborate with law enforcement agencies, such as the Federal Bureau of Investigation (FBI), for further investigation in complex cases. Additionally, banks may need to conduct an internal investigation.

6. Preliminary Credit and Refund

In some cases, banks temporarily credit their customers for the disputed transactions. This credit is applicable until the bank investigation is completed. The credit process can also be reversed; once the bank’s fraud investigation determines the transaction as authorized

7. Resolution & Prevention

When the fraud is confirmed, the bank reimburses the account holder or cardholder. Additionally, banks can implement financial security measures such as two-factor authentication. It may also update the passwords to prevent unauthorized access in the future.

How Long Does a Fraud Investigation Take?

“How long does a bank fraud investigation take” This is a common question among people worldwide.

The bank’s fraud investigation timeline in the USA is 10 days after the detection of fraud. Additionally, the bank must credit the client’s account if they are unable to find a resolution. The period may go higher when the investigation is in-depth.

The overall period for investigating and resolving the fraud case is 30 to 90 days. It all includes collecting evidence and understanding the user’s transaction history. Thus, the investigation period depends on the level of fraud and the collection of evidence related to the fraud.

💡Related Article:

What Factors Affect the Investigation Period?

How long do bank fraud investigations take? It all depends on several factors. The following are the factors that affect the investigation timeframe:

Complexity of the Case

The timeframe of a bank account fraud investigation depends on the complexity of the case. Simple fraud cases, such as identity theft and credit card fraud, are typically resolved more quickly. However, the complex cases take more time. International fraud involving multiple parties comes under this category.

Juridication Process

Some fraud cases, like international fraud, involve a jurisdictional process. The multi-layered operations, coordination between law enforcement and banks, and other court operations also delay the fraud detection operation.

Tech Obstacles

As fraud detection relies heavily on technology. Therefore, it is essential to integrate the latest technological advancements into the process. The lack of the latest tech can slow down the bank investigation process and increase the timeline.

Delays in Evidence Gathering

Sometimes, the investigating committee takes more time to collect the evidence. This may occur on the customer’s side if they fail to submit the supporting documents in a timely manner. This further stretches the period of investigation.

What Are Suspicious Activity Reports (SARs) & Their Role?

Suspicious Activity Reports (SARs) refer to confidential documents. Banks and financial institutions are required to submit these documents to regulatory authorities. It is also known as Suspicious Transaction Report (STR).

SARs are filed when financial institutions or banks detect any fraudulent activity by a customer. It may be related to financial crimes or money laundering.

These reports are valuable in detecting bank fraud. SAR establishes a link between financial institutions and law enforcement. Law enforcement agencies, such as the FBI, utilize SAR data to analyze patterns of fraud and identify large-scale fraud rings. The standard time for filing the SARs is within 30 days of detecting the fraudulent activity in the USA.

Liability for Debit Card, Credit Card & ACH Scam

In the guide on how banks investigate unauthorized transactions, it is also essential to understand the liability associated with such transactions. Here, we present the breakdown of debit card, credit card & ACH fraud.

Debit Card Liability

Debit card holders must report the loss or theft of their debit cards. This limits liability for any unauthorized transactions. The liability on debit cards relies on the speed of your reporting. As per the Electronic Fund Transfer Act (EFTA), the maximum liability is as follows:

| Time Period of Reporting | Liability |

|---|---|

| Immediate reporting before any unauthorized use | $0 |

| Reporting within two business days | $50 |

| Reporting after two business days but within 60 days. | $500 |

| No reporting of loss within 60 days after detection of unauthorized use within the bank statement | Unlimited |

Credit Card Liability

All bank handling disputes raised by cardholders are part of the credit card fraud investigation process. Many credit card networks, including American Express (Amex), Mastercard, and Discover, offer a zero liability policy. It means consumers do not have to pay for unauthorized transactions through prompt reporting.

In the United States, the Fair Credit Billing Act (FCBA) regulates the liability for credit card fraud. The maximum liability of the consumer for unauthorized credit card use is $50 according to this act. The submission of unauthorized transactions is 60 days after receiving the billing statement.

ACH Fraud

The Automated Clearing House (ACH) fraud involves unauthorized electronic transfers between bank accounts or through ACH invoice transactions.

The liability falls on financial institutions and merchants in the event of ACH fraud. It may also be shifted to the consumer if the report falls within the 60 days. The liability is different for businesses and consumers.

For Consumer

The Electronic Fund Transfer Act (EFTA) and Regulation E manage the automated clearing house fraud liability as:

| Time Period of Reporting | Liability |

|---|---|

| Within 2 business days of noticing the fraud | Up to $50 |

| After 2 days, but within 60 days of the statement | Up to $500 |

| After 60 days from the statement date | Unlimited – Full loss possible |

For Business

The Uniform Commercial Code (UCC) manages the liability for unauthorized ACH transactions. Businesses can easily limit their liability through robust financial security measures and multi-factor authentication. Providing employees with training on fraud prevention and detection also works. The ideal timeframe for reporting ACH fraud is 1 to 2 business days.

💡Don’t Miss:

What Is the Effect of Fraud on the Business and Customers?

How does the bank investigate an unauthorized payment? So far, we have covered sufficient information on it. We now examine the impact of potential fraud on businesses and their customers.

What is the first word that comes to your mind when you hear about fraud? Of course, it is a money loss. However, bank fraud or invoice fraud is a step further. The negative impact on banks’ reputation & customer trust is another effect that potential fraud brings.

The fraud has an impact on the business, resulting in lost customers. Hence, it impacts the business’s revenue stream. Additionally, the bank’s investigation process slows down day-to-day activities. In some cases, businesses also face fines, penalties, or legal actions, which can disrupt their normal business operations.

For the customer, fraud is the main cause of emotional distress. Furthermore, customers may experience delays in service or product delivery. Overall, a fraud brings inconvenience to the customer. Whether it is large or small, fraud has a detrimental effect on the financial stability of both businesses and individuals.

💡Good to Know

Implementing the Dual Control of Payments concept in business can prevent fraud. This involves one person initiating the payment and a second person approving the payment.

What Are Fraud Prevention Strategies?

Common people & business professionals can keep their money safe while engaging in secure transactions by adopting the following fraud prevention strategies:

Cyber Defence Policies

Making & adopting strong cybersecurity policies is a good approach for preventing unauthorized transactions. Encrypting data and using the multi-factor authentication feature are also helpful. Additionally, keeping software up to date is also a valuable approach.

Awareness Among Staff

As a business owner, you must train your employees about social engineering, invoice fraud, and phishing. The training should include general fraud awareness, as well as specialized areas such as digital forensics.

Vendor and Third-Party Risk Management

It is necessary to learn third-party risk management when businesses rely on external partners for payment, services, and operations. Weak security in third-party systems leads to fraud. Professionals can adopt a process to verify the legitimacy and reliability of third-party relationships. This lowers the risk of fraud from external sources.

Fraud Detection and Investigation

Professionals can use machine learning, data analytics, and other techniques to reduce fraud. Additionally, adapting fraud detection strategies based on emerging fraud trends is also an effective method.

How Moon Invoice Can Lower Invoice Fraud?

Moon Invoice is the ideal solution for preventing invoice fraud. The platform is not only the best invoice-making solution but also helps business professionals to avail of safe invoicing and payment.

Its key features, such as vendor verification, enable users to verify vendor details before making a payment. Additionally, it enables leveraging the advanced data protection and encryption of the information through a 256-bit SSL encryption feature.

Users can easily retrieve records & invoices by using secure cloud storage. This again helps reduce the chances of invoice fraud. Professionals can easily track real-time invoices. It’s handy to match the invoice with delivery receipts and the purchase order.

Moon Invoice offers an automated reporting and auditing feature. Thus, it helps professionals detect fraud. In the event of logins from unknown devices and locations, it alerts the user. Also, its automated invoice processing system makes a valuable contribution to reducing fraud.

Are Financial Frauds Draining Your Peace of Mind?

Moon Invoice helps to overcome it. Discover how our latest technology safeguards your business against financial fraud.

Summary Lines

Here, we are presenting our final thoughts on how banks investigate unauthorized transactions. The unauthorized transaction investigation is a crucial process for maintaining both the bank’s and the customer’s relationships. Banks and other financial institutions must adopt a more sophisticated and advanced approach to combating fraudulent activities & other financial crimes. This is the most effective way to outsmart scammers at their own game.