Electronic payments are now part of the daily life routine for every third person. Most individuals and professionals prefer electronic transactions due to their security and speed.

The Electronic Funds Transfer Market is expected to reach USD 174.34 billion by 2032, with a projected CAGR of 9.90%.

A wide variety of electronic payment options are available, and it is essential to understand their differences. Typically, people are confused about EFT vs ACH and often consider the two terms as interchangeable.

However, understanding the difference between EFT and ACH is crucial. The clarity over it is helpful in making the correct decision on which payment method is most appropriate for their business. This enhances efficiency and also refines the financial management.

Let’s find out more interesting information to enhance your knowledge and understanding of ACH vs EFT. Keep reading our words with active eyes!

📌 Key Takeaways

- EFT is a broad term for digital & electronic payment transactions, and ACH is one of its parts.

- All ACH payments are EFTs, but not all EFTs are ACH payment transfers.

- Both ACH and EFT refer to modern & digital payment methods that are secure and convenient.

- EFT methods are fast, while ACH transfers typically take 1 to 3 business days.

- Processing speed, cost, and usage are the primary comparison points between ACH payments and EFTs.

- These digital payments contribute to smooth payment tracking and overall financial management for the accounts receivable (AR) department.

What Is EFT?

EFT stands for Electronic Funds Transfer, which encompasses a wide range of methods for transferring funds digitally from one bank account to another. The bank could be the same or a different one. It is an umbrella term that covers Wire transfers, ACH transfers, debit, electronic bank transfers, and credit card payments.

The fund transfer among financial institutions is quick and secure due to various security measures, such as encryption. EFTs are commonly used in transferring funds, making payments to vendors, and paying other bills online.

Types of EFT Payments

- ACH payments

- ATM transactions

- Credit card transactions

- Debit card payments

- eChecks

- Direct deposit

- In-app purchases

- Phone-based payments

- Peer-to-peer transfers

Benefits of EFT

- EFT allows for quick transfer of funds.

- Electronic funds transfer gives a convenient approach to transferring funds.

- With EFT, professionals can easily track their payments.

- Electronic fund transfer payment methods are quicker than paper checks.

- EFTs are also useful for cross-border transactions while supporting multiple currencies.

- It gives better cash flow management.

What Is ACH?

ACH stands for Automated Clearing House. It is a U.S.-based digital payment network that transfers electronic funds between bank accounts and credit unions through the Automated Clearing House Network. It is one of the various payment options available through Electronic Funds Transfer.

In ACH transactions, funds are transferred through a batch processing system. ACH methods offer quick fund transfer. NACHA (National Automated Clearing House Association) is a governing body that manages the ACH network.

Benefits of ACH

- ACH offers a cost-effective solution for fund transfers.

- Automated Clearing House eliminates manual processing.

- NACHA manages ACH, which provides an encryption network.

- The chances of failure and fraud are low in ACH compared to other payment methods.

- ACH transactions are well-suited for recurring payments, including utility bills, subscriptions, and payroll.

Hassle-Free Digital Payment Acceptance Is Here

Choose the Moon Invoice that offers 20+ payment options to enhance your invoice payment experience.

EFT vs ACH: What Is the Difference Between ACH and EFT?

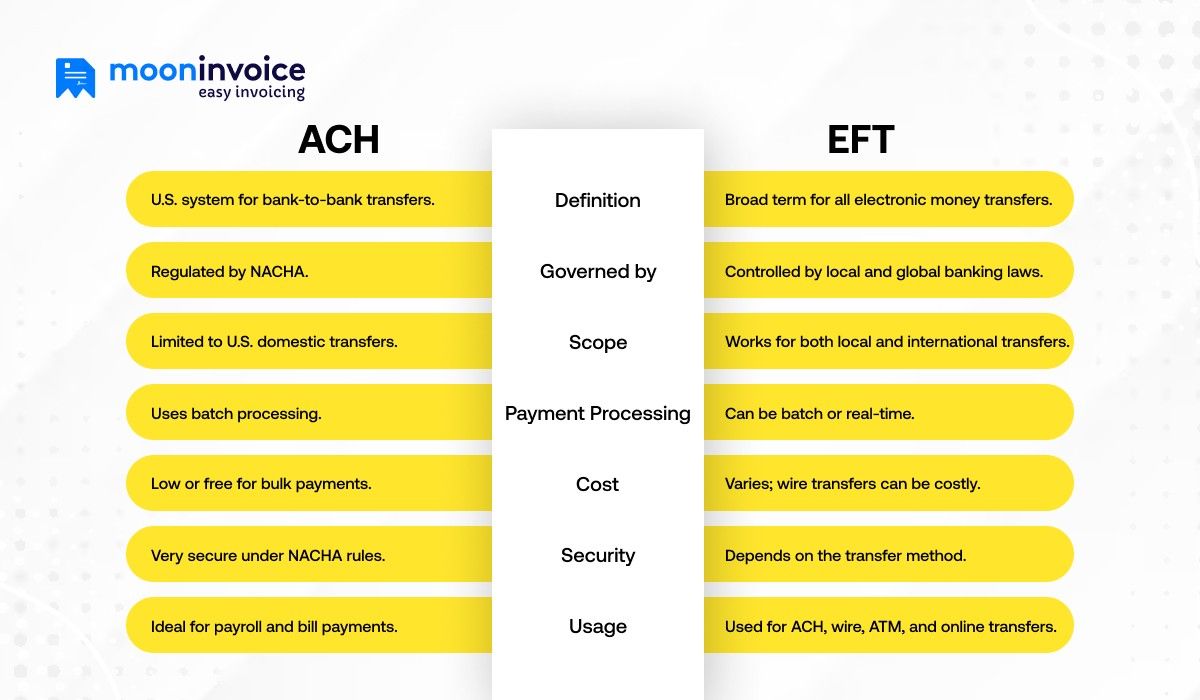

In ACH payment vs EFT, the major comparison terms are transaction speed, scope, usage & cost. For instance, ACH is primarily used for domestic transactions, while EFT can be used for both domestic and international payment transactions, depending on the payment method it includes. When it comes to what the difference is between ACH and EFT, here are the key differences:

| Points | ACH | EFT |

|---|---|---|

ACH vs. EFT vs. Wire Transfers

So far, we have covered the information on ACH vs EFT payments. We now compare ACH, EFT, and wire transfers.

| Points | ACH | EFT | Wire Transfer |

|---|---|---|---|

How to Choose the Right Payment Type for Your Business?

It is also essential to determine which payment method best suits your business with a clear understanding of EFT versus ACH. Every payment type has its own value and attributes. However, one needs to choose the appropriate payment type for the business, especially when integrating it with accounting software.

Here are the key factors to consider for justifying the right payment type for the business:

4 Factors to Consider When Choosing the Payment Type

1. Security

Different payment methods provide different security features. One should always look for encryption and fraud prevention features. Payment methods that comply with PCI DSS or NACHA are most suitable for the business.

2. Transaction Speed

Transaction speed is an important factor for businesses. However, it varies depending on the payment methods. So one should choose the method according to the business nature and other requirements.

3. Cost

ACH payment methods are low-cost, while wire transfers have higher transaction fees. Business professionals need to consider which payment method fits best for their business in terms of payment.

4. Geographic Reach

Some electronic payment methods, like ACH, are limited to local or domestic transactions. However, some methods, such as wire transfers, are ideal for international transactions. Therefore, business professionals should always focus on the geographic reach.

Closing Remarks

Understanding the differences between EFT and ACH is crucial for business professionals. These two are crucial payment methods, and one should always choose the appropriate method according to business needs. The key knowledge on EFT vs ACH is beneficial for the business, and tools like Moon Invoice make it easier to handle such transactions efficiently. Get the free trial to explore its features.