The paperwork you must maintain to ensure a seamless delivery of your shipment to its global destination is often unclear. The Commercial Invoice is one such crucial record used in international trade.

A commercial invoice is described as a document that acts as official proof of a transaction. It is primarily used for customs clearance purposes and assists the customs authorities in calculating and assessing the number of duties and taxes that must be paid. Customs uses the breakdown of expenses on a commercial invoice to determine and assess the duties and taxes that are owed for the shipment.

Additionally, a commercial invoice serves as documentation of the delivery of the products. There wouldn’t be any fabricated claims on the part of the customer with the commercial invoice.

A comprehensive commercial invoice is required by law. Failure to do can cause issues, including protracted customs delays. Moreover, inaccurate information on a customs invoice may result in underpayment of duties and taxes, which may have legal ramifications.

In this post, we will outline what is a commercial invoice, explore why you might need one, and see if the show uses a template to make one.

A Step-by-Step Guide for Making a Commercial Invoice

A commercial invoice is an essential document that contains various detailed business information. Your export can be terminated if even one piece of information is missed. So, before creating a commercial invoice, you must be aware of the information needed.

Here is a detailed guide to creating a commercial invoice.

1. Download a Sample Commercial Invoice Template

You need to first download and customize an appropriate commercial invoice template for your business. A global invoice template can make it simpler to produce invoices.

2. Fill out the Seller’s Data Accurately

Include any reachable information about your firm, such as the name and final destination, phone number, and email address.

3. Enter the Information for the Customers

Identifying how to complete a commercial invoice is the next action to take. By providing the right information for the customer or business that is using your service, it is made feasible. The information must be provided for the contact name, final destination, and shipping address, if different from the billing address. The official address or location of the customs is also available to you.

4. Add the Unique Invoice Number

All of your bills need to be uniquely identified by invoice numbers, harmonized tariff codes, or both. Sequential identification is the ideal method for numbering a bill. The first invoice in the series should have the number 001, and so on.

5. Add a Reference Number for the Client

On a commercial invoice, the buyer reference number is given so that you may identify the client with whom you are working in the event of a complaint or if the buyer or business needs to get in touch with you.

6. Add Your Terms and Conditions for the Sale

Any information about the risk and expense you and the buyer are assuming while engaging in business is included in the sale conditions. Because the seller’s information was disclosed in advance, the first agreement on conditions of sale will be used as legal proof if the buyer complains about a transaction. However, you must also include it in the templates for business billing.

7. Specify Your Payment Terms

Make sure the consumer is aware of your rules and terms of payment in the invoice to prevent payment complications. Your payment conditions on the commercial invoice samples will act as a reminder and can be mentioned on the purchase order, relevant taxes, customs charges, and total value.

8. Include the Currency

Make sure the recipient is aware of the invoice’s purpose and the currency you desire to receive payment in for the entire amount. To avoid misunderstanding or payment delays, it should have been agreed upon before engaging in business with the buyer.

9. Mention the Delivery Mode

Your commercial invoices must specify how you are delivering the goods to your client, such as land shipment, air delivery, or ocean delivery.

10. Note the Amount

Your business invoices should include information on the product, such as the amount purchased, the cost per unit, and the gross weight of the shipment.

11. Clearly State Your Products

The invoicing document that is being utilized must have a thorough description of every item that has been sent. This invoice should list the objects’ proper dimensions and names, the kinds of packaging they’ll be transported in, the kinds of containers they’ll be placed in if necessary, as well as their gross weight, unit price, and quantity.

12. Add the Measuring Unit

The weight of each component as well as the total net weight should all be reported in the same unit of measurement.

13. Add the Cost and the Value

Both the overall selling price of all the items sold in the shipment and the cost per commercial unit should be recorded.

14. Note Container Markings

The business invoice form should include a remark about any markings or symbols on the shipping information. If there are several boxes or shipments, you can give them names and labels to make sense to the client.

15. Add on Extra Expenses

Include a packing list and explicit descriptions of any additional charges in the invoice form just in case.

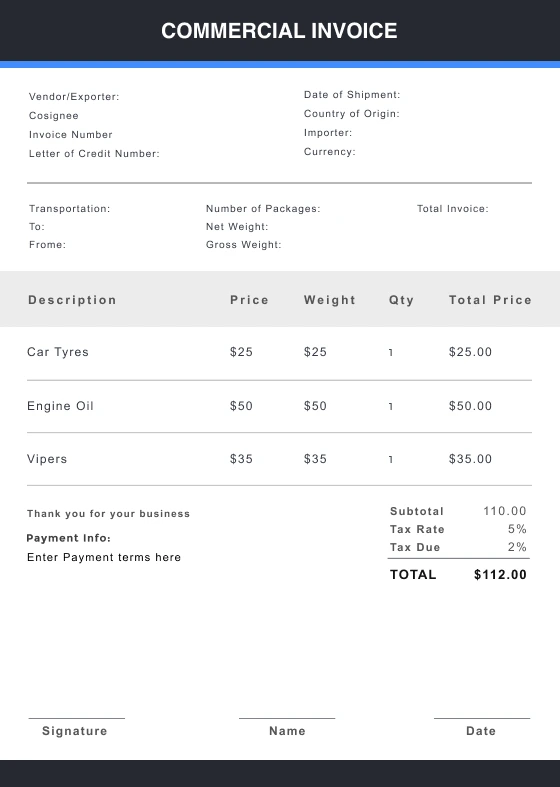

Example of a Commercial Invoice

Header containing Buyer and Seller Data: Each invoice’s header, which contains the buyer (importer) and seller’s contact details, is the document’s initial section (exporter).

Billing ID and Billing Date: To prevent double payments and maintain proper document organization, each invoice is tracked by a distinct invoice number. You may choose how this invoice number is created, however sequential generation is the most popular choice among businesses. The payment deadline must then be included, which may have been established in advance with the customer or noted in the proforma invoice.

Product and Delivery Information: The itemized list of goods you’re sending is one of the most important pieces of data on a commercial invoice. This data provides the customs division with a list of all the items in the package, together with their pricing.

Codified Harmonized System: A Harmonized System (HS) code must be included with every item you ship. Based on the product’s kind, function, and nature, the HS code divides it into categories. In this way, it is simple for customs officials to determine whether taxes, tariffs, and other excise fees apply to each product line.

Country of origin: The country of origin of your items is another data you must disclose. It is the place where your products were created. In some circumstances, you’ll need to provide a supplementary Certificate of Origin, which customs will evaluate to determine if your products are allowed for import and/or whether they will be subject to any additional duties.

Payment and Sale Conditions: The conditions of sale sometimes referred to as the Incoterms, are generally accepted business regulations. These words make it easier for buyers and sellers to convey the terms of their contracts and prevent any misunderstandings surrounding transportation management. The customs costs, postal service costs, customs duties, import duties, etc. are also mentioned by shipping authorities.

Stop Wasting Your Time Creating Manual Commercial Invoices!

Moon Invoice makes international trading easy by helping you create commercial invoices with tailor-made templates suitable for your business.

When Is a Commercial Invoice Issued?

A commercial invoice is a legally binding record that verifies a transaction that took place during international commerce between a buyer and a seller.

It is usually issued to mark the following:

1. International Sales

When conducting business across International borders between two countries, a commercial invoice is required to list all the transaction details between the two parties.

2. Exporting Goods

If you are operating an international business, you must create a commercial invoice while exporting your products. Don’t forget to look at the details about the products being shipped.

3. Customs Clearance

Customer authorities must ensure that appropriate taxes and duties are late upon the products exported between countries. To ensure this is appropriate, cross-border transaction commercial invoices for custom clearance are needed.

4. Legal Documentation

A commercial invoice is a legal document, proving a transaction has occurred.

5. Payment Transactions

Creating a commercial invoice also acts as a billing document containing a detailed list of the number of items and the related payment. This will be used to track payments.

What is a Commercial Invoice for Shipping?

International shipment mostly involves a lot of paperwork. Almost every level of sale requires documents for verification and clearance. Commercial invoices must be generated when sending products to customers abroad.

A shipping commercial invoice is an export document that serves as formal documentation of a sale transaction between the customer and seller. It is generally utilized for customs clearance and assists in identifying and analyzing the number of duties that must be paid. It contains a complete record of the things sold, as well as their amounts and agreed-upon pricing.

Commercial invoices give a thorough description of the items sold as well as the cash owed to the firm and act as a binding legal contract between the seller and the customer.

Read also about what a shipping invoice is.

What is the Purpose of Commercial Invoices?

Commercial invoices are necessary since no exporter or merchant may conduct business without the required documentation of the items. Maintaining records is a crucial component of a commercial invoice.

It not only assists with proper record keeping but also with estimating your stock level at any given time. Commercial invoices can also be used as sales documentation and legal documentation to make a payment demand.

Commercial invoices help safeguard businesses from being exploited because of their detailed character, which helps expose dishonest buyers or sellers who try to take advantage of the other side.

These important documents are also used in cases of insurance claims by the parties involved. As a result, a consumer is less likely to reject a transaction.

It is also necessary if you have to provide evidence in court to support your position. It unequivocally demonstrates a buyer’s acceptance of the products sold.

Here are some benefits listed below:

1. Payment Assurance

A commercial invoice serves an important function in payment assurance even if it is not a payment instrument since it serves as legal proof that the transaction occurred.

2. Accuracy Check

One of a business invoice’s most significant benefits is that it provides the importer with the data they need to confirm the correctness of orders and receipts.

3. Due Payment Notice

An invoice may be used as a reminder. Additionally, using an invoice as a payment notice promotes on-time payments.

How to Add the Commercial Invoice to Your Shipment?

A commercial invoice is truly a crucial document required for international shipments. It is important to know how to send an invoice and receive payment on time.

You must print three copies of the completed commercial invoice after downloading it:

- One for the country from which you are currently exporting.

- One for the nation where the shipment will be imported.

- The final one is for the purchaser.

The last one should then be placed inside the package so the customer can view it.

Using Moon Invoice can simplify the creation of commercial invoices. It not only provides templates to create invoices, but it also gives you the choice to quickly and conveniently send an electronic copy of your invoices. You can also directly print copies to package and ship with your shipments.

Commercial Invoicing Made Easy for your Business!

Compile critical business data automatically for your commercial invoices without repetitive manual work and successfully scale your international business with Moon Invoice.

What If a Commercial Invoice Is Rejected During International Shipping?

Here are some common reasons for rejection and offer guidance on addressing issues to ensure a smooth flow of goods and payments.

- Identify Reasons: Try to understand why your invoice was rejected and if it had any compliance issues.

- Communicate Promptly: If there is any chance of corrections, contact the customs departments to convey the same about your customs invoice.

- Review and Amend: Carefully review the invoice and make corrections if required. Understand what is a commercial invoice and how to make one correctly.

- Consult Experts: You can contact custom brokers or trade experts to help you by addressing specific issues and creating customs invoices as required.

- Resubmit Corrected Invoice: Submit the corrected invoice along with any requested documentation to prove the details on your invoice.

- Monitor Progress: Track the progress of international shipping and communicate with customs authorities.

- Maintain Communication: Keep the buyer informed about the situation, actions taken, and potential delays.

- Learn and Document: You can document lessons for future transactions.

Conclusion

For any overseas shipment with any commercial value, a commercial invoice is required to satisfy export-import regulations in various nations’ customs agencies.

Using digital invoicing solutions, you can easily store and update accounting records when you create the invoice. You can set up reminders and alerts to notify you when clients make payments or are past due. Sending invoices overseas, receiving payments, preparing personalized templates, and auto payment is made simple with Moon Invoice.

Hopefully, this blog has finally cleared your doubts about what is a commercial invoice. But if you have more questions arising, check out our FAQ section to read more about this special export document.